Isuzu 2016 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2016 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

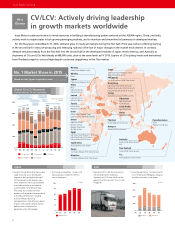

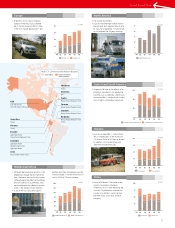

No. 1 Market Share in 2015

(Based on sales figures compiled by Isuzu) Source: Isuzu Motors

Buses

Ireland

Light Duty

Trucks

(GVW 3.5-9.9 ton)

Tunisia

Pickup Trucks

(Payload 1 ton & over)

Malta

MCV

Light Duty

Trucks

(GVW 3.5-8 ton)

Cyprus

Pickup Trucks (Payload 1 ton)

Norway

Pickup Trucks (Payload 1 ton)

Light Duty Trucks (Payload 1 ton & over)

Light Duty Buses (15-38 seats)

Pickup Trucks (GVW 2-4 ton)

Egypt

Pickup Trucks (Payload 1 ton)

Light Duty Trucks (GVW 6.1-9.5 ton)

Israel

Thailand

Trucks (Payload 2 ton & over)

Australia

Trucks (GVW 4.5 ton & over)

PPV

Papua New Guinea

Trucks

(Payload 1 ton & over)

Light Duty Trucks (Payload 2-3 ton)

Buses (Heavy Duty Buses)

Japan

Light Duty Trucks (GVW 3.5-9 ton)

Medium Duty Trucks (GVW 10-16 ton)

Heavy Duty Trucks (GVW 24-30 ton)

Hong Kong

South Africa

Trucks (GVW 3.5 ton & over)

Kenya

CV (Trucks & Buses GVW 3.5 ton & over)

Mauritius

CV (Trucks & Buses GVW 3 ton & over)

Gabon

Malaysia

Trucks (GVW 3 ton & over)

New Zealand

Trucks (GVW 3.5 ton & over)

Fiji

Trucks (Payload 1.5 ton & over)

Oman

Light Duty

Trucks

Saudi Arabia

Light Duty

Trucks

Uzbekistan

Light Duty

Trucks

(GVW 5-8 ton)

Turkey

Medium Duty Trucks (GVW 6.5-16 ton)

CV (Trucks & Buses GVW 3 ton & over)

Philippines

Chile

Ukraine

Light Duty Trucks

(GVW 3.5-9 ton)

Medium Duty Trucks

(GVW 9-16 ton)

At a

Glance

Isuzu Motors continues its drive to invest resources in building a manufacturing system centered on the ASEAN region, China, and India,

actively work to expand sales in fast-growing emerging markets, and to maintain and streamline its businesses in developed markets.

For the fiscal year ended March 31, 2016, demand grew in nearly all markets during the first half of the year, before softening starting

in the second half in resource-producing and emerging nations in the face of major changes in the market environment. In contrast,

demand remained steady from the first half into the second half in the developed markets of Japan, North America, and Australia as

shipments of CVs and LCVs held steady at 668,000 units, close to the same levels as FY 2015. Exports of LCVs (pickup trucks and derivatives)

from Thailand surged to a record high despite continued sluggishness in the Thai market.

CV/LCV: Actively driving leadership

in growth markets worldwide

●

Despite firming demand for heavy-duty

cargo trucks for use in distribution,

shipments declined slightly during FY

2015 compared to the previous year,

when shipments from Isuzu exceeded

actual demand due to the need to

accommodate rising demand levels.

The Group has actively launched

products with exceptional environmental

and safety performance, including

trucks and buses featuring

next-generation, high-efficiency diesel

engines with excellent environmental

performance and world-class

preventive safety technologies.

●

The Group achieved No. 1 share in the

heavy-duty bus market for the first

time in three years.

●

Shipments of CVs fell due primarily to

shrinking demand in Indonesia.

Shipments of LCVs rose thanks to the

popularity of the new SUV mu-X in the

Philippines.

●

Isuzu retained the No. 1 market share for

CVs in Thailand, the Philippines, Malaysia,

and other countries in the region.

AsiaJapan

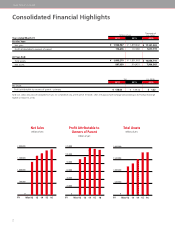

Global CV/LCV Shipments

Finished vehicles, KD sets, and others

CV domestic

FY

(K-units)

0

200

400

600

800

99

148

53

193

126

96

170

45

188

144

73

203

50

153

161

54

194

51

123

132

42

619

(520)

643

(547)

640

(567)

427

(386)

568

(509)

568

(509)

690

(628)

598

(552)

47

206

57

155

134

59

211

64

125

110

62

214

60

218

136639

(564)

75

221

42

168

133

668

(586)

248

35

132

171

( ): Overseas shipments

83

1311 12 14 15

668

(587)

238

36

130

183

81

16

06 07 08 09 10

554

(500)

CV overseas LCV others

LCV Thailand LCV export

127

42

118

99

• Enhancement of overseas

business structures

• Development of new markets

• Inventory

optimization

• Global recession

• The Great East

Japan Earthquake

• Thailand

floods

(K-units)

FY

0

20

40

60

100

80

81

(K-units)

0

100

200

300

48

177

67

268

FY

400

60

204

60

174

54

177

Domestic CV Asia CV Asia LCV

62

75

59

83

12 13 14 15 16 12 13 14 15 16

4