Isuzu 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ISUZU MOTORS LIMITED ANNUAL REPORT 2002

4

(8) Engineering Efficiency Improvement

Isuzu will bol-

ster the efficiency of development programs and systems

by integrating its seven current platforms into three “core

platforms.” This will be achieved alongside the introduc-

tion of new models.

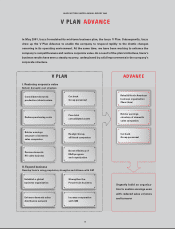

At the end of the first half of the fiscal year under

review, Isuzu devised the Isuzu V Plan Advance, as a

means of front-loading execution of key measures, with

a focus on North American operations. This approach rec-

ognized the criticality of the immediate restoration of

North American business to Isuzu Group’s reconstruction.

In line with this move, Isuzu will define its business

domains and review the North American operating struc-

ture and reduce structural costs. The Isuzu V Plan Advance

has been incorporated into the original Isuzu V Plan. The

operating structure reforms planned for the current fiscal

year have been largely completed.

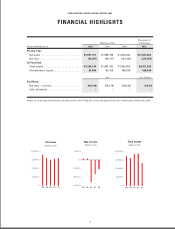

RESULTS FOR THE YEAR ENDED MARCH 31, 2002 Con-

solidated net sales for the year ended March 31, 2002

increased 1.8% year on year to ¥1,597,701 million, as grow-

ing sales of engine components more than offset the lower

vehicle sales volume.

The company reported operating income of ¥15,134

million, reversing an operating loss of ¥27,316 million in

the previous fiscal year. This dramatic improvement was

partly due to reductions in materials and operating costs,

and a weaker yen. The net loss narrowed by ¥23,795 mil-

lion to around ¥42,991 million. Principal factors affecting

the bottom line were an ¥18,609 million gain on sales of

property, plant and equipment and investment securities,

a ¥9,452 million unrealized holding loss on securities and

a ¥14,475 million expense for early retirement incentive

packages. As a result, the cumulative deficit carried for-

ward was ¥213,562 million.

Consolidated shareholders’ equity declined by ¥33,024

million to ¥61,084 million. As a result, the shareholders’

equity ratio decreased from 5.0% to 4.6%. Meanwhile, total

assets stood at ¥1,324,144 million as of March 31, 2002, a

reduction of ¥567,347 million compared to the previous

fiscal year-end.

Domestic sales volume declined 17.7% compared to

the previous fiscal year to 64,139 units while overseas

sales volume decreased 11.8% to 244,298 units. As a result,

total sales volume was 308,437 units, a drop of 13.1%

against the previous fiscal year. In other product areas,

sales of automotive components for overseas production

declined by 37.5% to ¥46,741 million. Engine component

sales, however, surged 39.6% to ¥225,582 million, owing

to higher production at Isuzu’s engine plant in Poland

(ISPOL) and to the start of mass production at a joint ven-

ture (DMAX) between Isuzu and GM.

With regret, Isuzu suspended dividend payments, as

we did last year, due to weak earnings.

OUTLOOK FOR THE YEAR ENDING MARCH 31, 2003

While the Japanese economy has started showing signs

of bottoming out, it must overcome several hurdles,