Invacare 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Invacare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

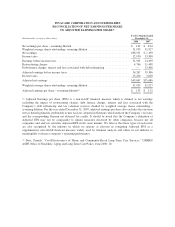

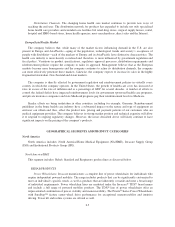

INVACARE CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NET EARNINGS PER SHARE

TO ADJUSTED EARNINGS PER SHARE(1)

(In thousands, except per share data)

Twelve Months Ended

December 31,

2008 2007

Net earnings per share – assuming dilution ....................................... $ 1.21 $ 0.04

Weighted average shares outstanding- assuming dilution ............................ 31,953 31,927

Net earnings ................................................................ $38,551 $ 1,190

Income taxes ............................................................... 12,950 13,300

Earnings before income taxes .................................................. 51,501 14,490

Restructuring charges ........................................................ 4,766 11,408

Debt finance charges, interest and fees associated with debt refinancing ................ — 13,408

Adjusted earnings before income taxes ........................................... 56,267 39,306

Income taxes ............................................................... 13,200 3,620

Adjusted net earnings ........................................................ $43,067 $35,686

Weighted average shares outstanding- assuming dilution ............................ 31,953 31,927

Adjusted earnings per share – assuming dilution(1) .................................. $ 1.35 $ 1.12

(1) Adjusted Earnings per share (EPS) is a non-GAAP financial measure which is defined as net earnings

excluding the impact of restructuring charges, debt finance charges, interest and fees associated with the

Company’s debt refinancing and tax valuation reserves divided by weighted average shares outstanding –

assuming dilution. For the year ended December 31, 2007, adjusted earnings per share also excludes the one-time

net tax benefit primarily attributable to new tax laws adopted in Germany which reduced the Company’s tax rates

and the corresponding German net deferred tax credits. It should be noted that the Company’s definition of

Adjusted EPS may not be comparable to similar measures disclosed by other companies because not all

companies and analysts calculate Adjusted EPS in the same manner. We believe that these types of exclusions

are also recognized by the industry in which we operate as relevant in computing Adjusted EPS as a

supplementary non-GAAP financial measure widely used by financial analysts and others in our industry to

meaningfully evaluate a company’s operating performance.

(2) Doty, Pamela. “Cost-Effectiveness of Home and Community-Based Long-Term Care Services.” USHHS/

ASPE Office of Disability, Aging and Long-Term Care Policy. June 2000: 10.