Invacare 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Invacare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

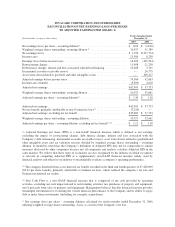

INVACARE CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NET EARNINGS (LOSS) PER SHARE

TO ADJUSTED EARNINGS PER SHARE (1)

(In thousands, except per share data)

Twelve Months Ended

December 31,

2007 2006

Net earnings (loss) per share – assuming dilution * ............................... $ 0.04 $ (10.00)

Weighted average shares outstanding- assuming dilution * ......................... 31,927 31,789

Net earnings (loss) ......................................................... $ 1,190 $(317,774)

Income taxes ............................................................. 13,300 8,250

Earnings (loss) before income taxes ........................................... 14,490 (309,524)

Restructuring charges ....................................................... 11,408 21,250

Debt finance charges, interest and fees associated with debt refinancing ............... 13,408 3,745

Incremental accounts receivable reserve ........................................ — 26,775

Asset write-down related to goodwill and other intangible assets ..................... — 300,417

Adjusted earnings before income taxes ......................................... 39,306 42,663

Income taxes (benefit) ...................................................... (3,599) 4,910

Adjusted net earnings ....................................................... $42,905 $ 37,753

Weighted average shares outstanding- assuming dilution ........................... 31,927 32,061

Adjusted earnings per share – assuming dilution(1) ................................ $ 1.34 $ 1.18

Adjusted net earnings ....................................................... $42,905 $ 37,753

Net tax benefit, primarily attributable to new German tax laws(2) ..................... (7,220) —

Adjusted net earnings, excluding net tax benefit .................................. $35,685 $ 37,753

Weighted average shares outstanding – assuming dilution .......................... 31,927 32,061

Adjusted earnings per share – assuming dilution, excluding net tax benefit(1) (2) ......... $ 1.12 $ 1.18

(1) Adjusted Earnings per share (EPS) is a non-GAAP financial measure which is defined as net earnings

excluding the impact of restructuring charges, debt finance charges, interest and fees associated with the

Company’s debt refinancing, incremental accounts receivable reserve, asset write-downs related to goodwill and

other intangible assets and tax valuation reserves divided by weighted average shares outstanding – assuming

dilution. It should be noted that the Company’s definition of Adjusted EPS may not be comparable to similar

measures disclosed by other companies because not all companies and analysts calculate Adjusted EPS in the

same manner. We believe that these types of exclusions are also recognized by the industry in which we operate

as relevant in computing Adjusted EPS as a supplementary non-GAAP financial measure widely used by

financial analysts and others in our industry to meaningfully evaluate a company’s operating performance.

(2) The company benefited from a one-time net tax benefit recorded in the third and fourth quarters of $7,220,000

($0.22 per share benefit), primarily attributable to German tax laws, which reduced the company’s tax rate and

German net deferred tax credits.

(3) Free Cash Flow is a non-GAAP financial measure that is comprised of net cash provided by operating

activities, excluding net cash impact related to restructuring activities less purchases of property and equipment,

net of proceeds from sales of property and equipment. Management believes that this financial measure provides

meaningful information for evaluating the overall financial performance of the Company and its ability to repay

debt or make future investments (including, for example, acquisitions).

* Net earnings (loss) per share – assuming dilution calculated for twelve-months ended December 31, 2006

utilizing weighted average shares outstanding – basic as a result of the Company’s net loss.