Intel 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

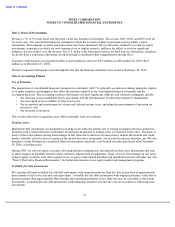

Contractual obligations that are contingent upon the achievement of certain milestones are not included in the table above.

These obligations include contingent funding/payment obligations and milestone-based equity investment funding. These

arrangements are not considered contractual obligations until the milestone is met by the third party. Assuming that all future

milestones are met, additional required payments related to these obligations were not significant as of December 26, 2009.

For the majority of restricted stock units granted, the number of shares issued on the date the restricted stock units vest is net

of the minimum statutory withholding requirements that we pay in cash to the appropriate taxing authorities on behalf of our

employees. The obligation to pay the relative taxing authority is not included in the table above, as the amount is contingent

upon continued employment. In addition, the amount of the obligation is unknown, as it is based in part on the market price of

our common stock when the awards vest.

We have a contractual obligation to purchase the output of IMFT in proportion to our investments, 49% as of December 26,

2009. We also have several agreements with Micron related to intellectual property rights, and R&D funding related to NAND

flash manufacturing and IMFT. The obligation to purchase our proportion of IMFT’s inventory was $100 million as of

December 26, 2009. See “Note 11: Non-Marketable Equity Investments” in Part II, Item 8 of this Form 10-K.

The expected timing of payments of the obligations above are estimates based on current information. Timing of payments and

actual amounts paid may be different, depending on the time of receipt of goods or services, or changes to

agreed-upon amounts for some obligations.

Off-Balance-Sheet Arrangements

As of December 26, 2009, with the exception of a guarantee for the repayment of $275 million in principal of the payment

obligations of Numonyx under its senior credit facility, as well as accrued unpaid interest, expenses of the lenders, and

penalties, we did not have any significant off-balance-sheet arrangements, as defined in Item 303(a)(4)(ii) of SEC Regulation

S-K. In February 2010, we signed a definitive agreement with Micron and Numonyx under which Micron agreed to acquire

Numonyx in an all

-stock transaction. The senior credit facility that is supported by Intel’

s guarantee is expected to be repaid in

full following the closing of this transaction. See “Note 11: Non-Marketable Equity Investments” in Part II, Item 8 of this

Form 10-K.

46