Intel 1999 Annual Report Download - page 35

Download and view the complete annual report

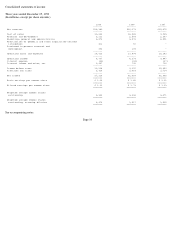

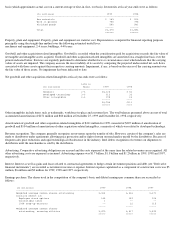

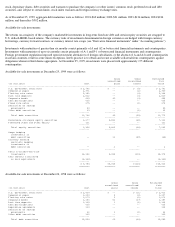

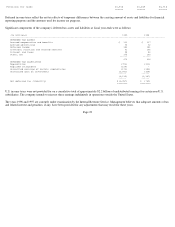

Please find page 35 of the 1999 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.basis (which approximates actual cost on a current average or first-in, first- out basis). Inventories at fiscal year-ends were as follows:

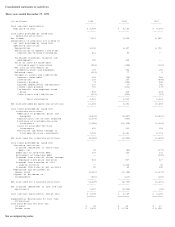

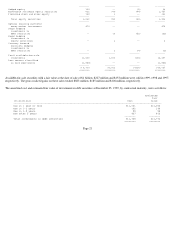

Property, plant and equipment. Property, plant and equipment are stated at cost. Depreciation is computed for financial reporting purposes

principally using the straight-line method over the following estimated useful lives:

machinery and equipment, 2-4 years; buildings, 4-40 years.

Goodwill and other acquisition-related intangibles. Goodwill is recorded when the consideration paid for acquisitions exceeds the fair value of

net tangible and intangible assets acquired. Goodwill and other acquisition-related intangibles are amortized on a straight-line basis over the

periods indicated below. Reviews are regularly performed to determine whether facts or circumstances exist which indicate that the carrying

values of assets are impaired. The company assesses the recoverability of its assets by comparing the projected undiscounted net cash flows

associated with those assets against their respective carrying amounts. Impairment, if any, is based on the excess of the carrying amount over

the fair value of those assets. No impairment has been indicated to date.

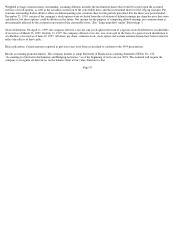

Net goodwill and other acquisition

-related intangibles at fiscal year-ends were as follows:

Other intangibles include items such as trademarks, workforce-in-place and customer lists. The total balances presented above are net of total

accumulated amortization of $471 million and $60 million at December 25, 1999 and December 26, 1998, respectively.

Amortization of goodwill and other acquisition-related intangibles of $411 million for 1999 consisted of $307 million of amortization of

goodwill and $104 million of amortization of other acquisition-related intangibles, a majority of which was related to developed technology.

Revenue recognition. The company generally recognizes net revenues upon the transfer of title. However, certain of the company's sales are

made to distributors under agreements allowing price protection and/or right of return on merchandise unsold by the distributors. Because of

frequent sales price reductions and rapid technological obsolescence in the industry, Intel defers recognition of revenues on shipments to

distributors until the merchandise is sold by the distributors.

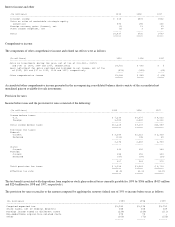

Advertising. Cooperative advertising obligations are accrued and the costs expensed at the same time the related revenues are recognized. All

other advertising costs are expensed as incurred. Advertising expense was $1.7 billion, $1.3 billion and $1.2 billion in 1999, 1998 and 1997,

respectively.

Interest. Interest as well as gains and losses related to contractual agreements to hedge certain investment positions and debt (see "Derivative

financial instruments") are recorded as net interest income or expense. Interest expense capitalized as a component of construction costs was $5

million, $6 million and $9 million for 1999, 1998 and 1997, respectively.

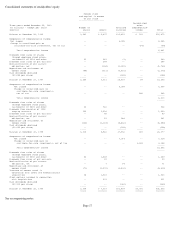

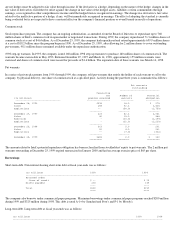

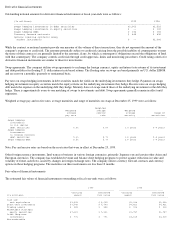

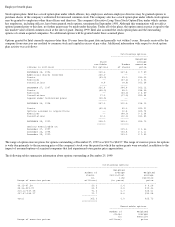

Earnings per share. The shares used in the computation of the company's basic and diluted earnings per common share are reconciled as

follows:

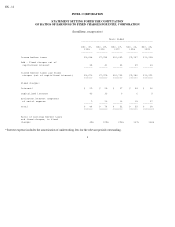

(In millions) 1999 1998

--------------------------------------------------------------------------

Raw materials $ 183 $ 206

Work in process 755 795

Finished goods 540 581

------ ------

Total $1,478 $1,582

====== ======

Life in

(In millions) Years 1999 1998

-----------------------------------------------------------------

Goodwill 2-6 $4,124 $ 52

Developed technology 3-6 612 33

Other intangibles 2-6 198 26

------ ----

$4,934 $111

====== ====

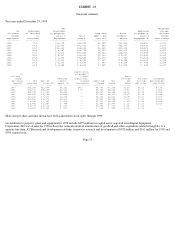

(In millions) 1999 1998 1997

--------------------------------------------------------------------------------------------------------

Weighted average common shares outstanding 3,324 3,336 3,271

Dilutive effect of:

Employee stock options 145 159 204

Convertible notes 1 -- --

1998 step-up warrants -- 22 115

----- ----- -----

Weighted average common shares

outstanding, assuming dilution 3,470 3,517 3,590

===== ===== =====