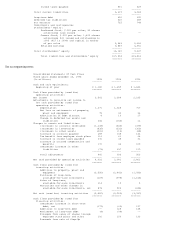

Intel 1995 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1995 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.See accompanying notes.

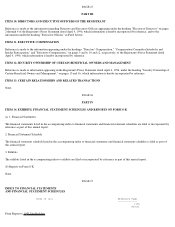

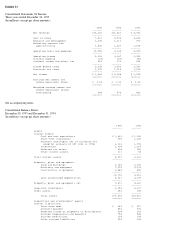

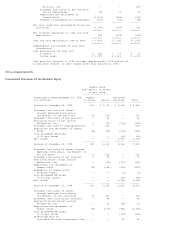

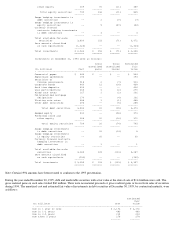

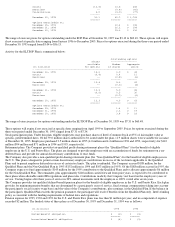

Income taxes payable 801 429

------- -------

Total current liabilities 3,619 3,024

------- -------

Long-term debt 400 392

Deferred tax liabilities 620 389

Put warrants 725 744

Commitments and contingencies

Stockholders' equity:

Preferred Stock, $.001 par value, 50 shares

authorized; none issued -- --

Common Stock, $.001 par value, 1,400 shares

authorized; 821 issued and outstanding in

1995 (827 in 1994) and capital in excess

of par value 2,583 2,306

Retained earnings 9,557 6,961

------- -------

Total stockholders' equity 12,140 9,267

------- -------

Total liabilities and stockholders' equity $17,504 $13,816

======= =======

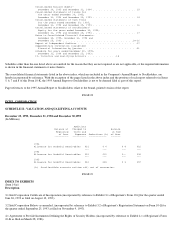

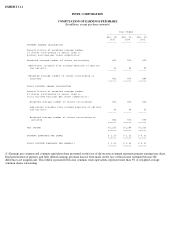

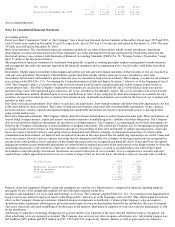

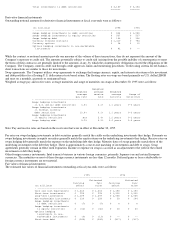

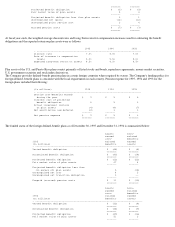

Consolidated Statements Of Cash Flows

Three years ended December 30, 1995

(In millions) 1995 1994 1993

------- ------- -------

Cash and cash equivalents,

beginning of year $ 1,180 $ 1,659 $ 1,843

======= ======= =======

Cash flows provided by (used for)

operating activities:

Net income 3,566 2,288 2,295

Adjustments to reconcile net income to

net cash provided by (used for)

operating activities:

Depreciation 1,371 1,028 717

Net loss on retirements of property,

plant and equipment 75 42 36

Amortization of debt discount 8 19 17

Change in deferred tax assets and

liabilities 346 (150) 12

Changes in assets and liabilities:

(Increase) in accounts receivable (1,138) (530) (379)

(Increase) in inventories (835) (331) (303)

(Increase) in other assets (241) (13) (68)

Increase in accounts payable 289 148 146

Tax benefit from employee stock plans 116 61 68

Increase in income taxes payable 372 38 32

Increase in accrued compensation and

benefits 170 44 109

(Decrease) increase in other

liabilities (73) 337 119

------- ------- -------

Total adjustments 460 693 506

------- ------- -------

Net cash provided by operating activities 4,026 2,981 2,801

======= ======= =======

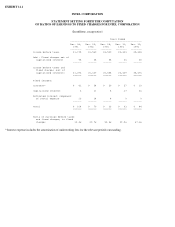

Cash flows provided by (used for)

investing activities:

Additions to property, plant and

equipment (3,550) (2,441) (1,933)

Purchases of long-term,

available-for-sale investments (129) (975) (1,165)

Sales of long-term,

available-for-sale investments 114 10 5

Maturities and other changes in

available-for-sale investments, net 878 503 (244)

------- ------- -------

Net cash (used for) investing activities (2,687) (2,903) (3,337)

======= ======= =======

Cash flows provided by (used for)

financing activities:

(Decrease) increase in short-term

debt, net (179) (63) 197

Additions to long-term debt -- 128 148

Retirement of long-term debt (4) (98) --

Proceeds from sales of shares through

employee stock plans and other 192 150 133

Proceeds from sale of Step-Up