IBM 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

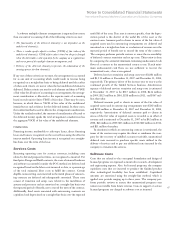

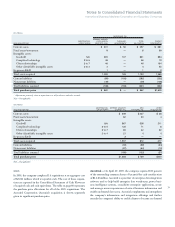

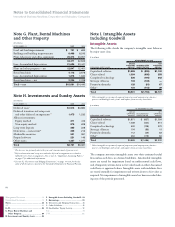

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Effective December 31, 2006, the company adopted SFAS No.

158, “Employer’s Accounting for Defined Benefit Pension and Other

Postretirement Plans, an Amendment of FASB Statements No. 87,

88, 106 and 132(R),” which requires the recognition of the funded

status of the retirement-related benefit plans in the Consolidated

Statement of Financial Position and the recognition of the changes

in that funded status in the year in which the changes occur through

Gains and (losses) not affecting retained earnings, net of applicable

tax effects. The provisions of SFAS No. 158 were adopted pursuant

to the transition provisions therein. The company measures defined

benefit plan assets and obligations as of December 31 and SFAS No.

158 did not affect the company’s existing valuation practices. The

adoption of SFAS No. 158 had no impact on the company’s existing

debt covenants, credit ratings or financial flexibility. See note U,

“Retirement-Related Benefits,” on pages 105 to 116 for additional

information, including the incremental effect of adoption on the

Consolidated Statement of Financial Position.

In September 2006, the Securities and Exchange Commission

(SEC) issued Staff Accounting Bulletin (SAB) No. 108, codified as

SAB Topic 1.N, “Considering the Effects of Prior Year Misstatements

when Quantifying Misstatements in Current Year Financial State-

ments.” SAB No. 108 describes the approach that should be used to

quantify the materiality of a misstatement and provides guidance for

correcting prior-year errors. The company early adopted SAB No. 108

in the third quarter of 2006 and accordingly, follows SAB No. 108

requirements when quantifying financial statement misstatements.

The adoption of SAB No. 108 did not require any changes to the

Consolidated Financial Statements.

In the third quarter of 2006, the company adopted FSP FIN

46(R)-6, “Determining the Variability to Be Considered in Applying

FASB Interpretation No. 46(R).” FSP FIN No. 46(R)-6 clarifies that

the variability to be considered in applying FASB Interpretation

46(R) shall be based on an analysis of the design of the variable inter-

est entity. The adoption of this FSP did not have a material effect on

the Consolidated Financial Statements.

In the first quarter of 2006, the company adopted SFAS No. 154,

“Accounting Changes and Error Corrections — a replacement of APB

Opinion No. 20 and FASB Statement No. 3.” SFAS No. 154 changed

the requirements for the accounting for and reporting of a voluntary

change in accounting principle. The adoption of this statement did not

affect the Consolidated Financial Statements in fiscal years 2007 and

2006. Its effects on future periods will depend on the nature and sig-

nificance of any future accounting changes subject to this Statement.

Beginning January 2006, the company adopted SFAS No. 151,

“Inventory Costs — an amendment of ARB No. 43, Chapter 4.” SFAS

No. 151 requires certain abnormal expenditures to be recognized as

expenses in the current period versus being capitalized in inventory.

It also requires that the amount of fixed production overhead allo-

cated to inventory be based on the normal capacity of the production

facilities. The adoption of this Statement did not have a material

effect on the Consolidated Financial Statements.

Effective January 1, 2005, the company adopted the provisions of

SFAS No. 123(R), “Share-Based Payment.” The company elected to

adopt the modified retrospective application method provided by

SFAS No. 123(R) and accordingly, financial statement amounts for

the periods presented herein reflect results as if the fair value method

of expensing had been applied from the original effective date of

SFAS No. 123. See note A, “Significant Accounting Policies,” on page

70 and note T, “Stock-Based Compensation,” on pages 102 to 105 for

additional information.

In March 2005, the FASB issued FASB Interpretation No. 47,

“Accounting for Conditional Asset Retirement Obligations, an inter-

pretation of FASB Statement No. 143” (FIN 47). FIN 47 clarifies

that conditional AROs meet the definition of liabilities and should be

recognized when incurred if their fair values can be reasonably esti-

mated. The company implemented FIN 47 at December 31, 2005

and recorded conditional AROs of approximately $85 million. These

conditional AROs relate to the company’s contractual obligations to

remove leasehold improvements in certain non-U.S. locations thereby

restoring leased space to its original condition. Upon implementation

of FIN 47, the company recorded a $36 million charge (net of income

tax benefit of $21 million) which was reported as a cumulative effect

of a change in accounting principle in the 2005 Consolidated

Statement of Earnings. The company’s accounting policy for AROs is

described in note A, “Significant Accounting Policies,” on page 69.

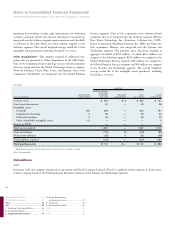

The pro forma effect of retroactively applying FIN 47 for the

year 2005 was:

($ in millions except per share amounts)

FOR THE YEAR ENDED DECEMBER 31: 2005

Pro forma amounts assuming accounting

change is applied retroactively:

Pro forma net income

$7,964

Pro forma earnings per share of common stock —

assuming dilution

$ 4.89

Pro forma earnings per share of common stock — basic $ 4.98

ARO liabilities at December 31, 2005 $ 85