IBM 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

integration and innovation, and underpinned by a

strong financial footing, is unique

—

and why we are

strongly positioned to capture the most attractive

growth and profit opportunities in the years ahead.

Leadership Businesses and Leadership Results

Our results in 2005 were achieved through the

marketplace performance of our major businesses

—

Systems and Technology, Software, and Services.

Let me describe that performance briefly for each.

SYSTEMS AND TECHNOLOGY: Our company’s

technology strength is the result of long-term

investments we’ve made over many years, invest-

ments that are now bearing fruit. Last year, IBM’s

Systems and Technology business extended its indus-

try leadership, enhancing its competitive standing

and staking out advantageous positions in growth

markets of the future. Since 2000, IBM’s total

share of the server market has grown 9.5points in

annual revenue, according to industry analyst IDC.

Our Systems and Technology revenues in 2005

were up 5percent. In the fourth quarter, shipments

of MIPS (millions of instructions per second)

for our zSeries mainframes grew 28 percent year-

to-year

—

our largest quarter of MIPS shipments on

record, leading to our highest mainframe revenue

since the fourth quarter of 1998. pSeries UNIX

servers had a strong year, growing 15 percent, with

double-digit growth in all geographies. We believe

this was the fourth straight year of improvement in

pSeries’ market position. We expect to maintain

our leadership in the fast-growing Blade server

business, with a 2005 growth rate of 65 percent. In

addition, our system storage business was up 15 per-

cent for the year, driven by our mainstay disk

and tape products. And our emerging technologies

also gained momentum, such as storage virtualiza-

tion, which added 1,700 clients.

Led by our sweep of the three major gaming

platforms, IBM’s microelectronics business achieved

16 percent growth. Revenue from our 300-millimeter

wafer products grew strongly in 2005

—

including

more than 250 percent growth in the fourth quarter.

Engineering & Technology Services grew 39 percent

for the year. The Cell Broadband Engine, our

revolutionary microprocessor developed through

a unique technology collaboration with Sony and

Toshiba, is bringing the capabilities of supercomputer-

level simulation to multiple arenas, including con-

sumer electronics, healthcare and defense. Recently

we combined a number of these engineering and

technology operations into a new unit, Technology

Collaboration Solutions, to bring greater focus and

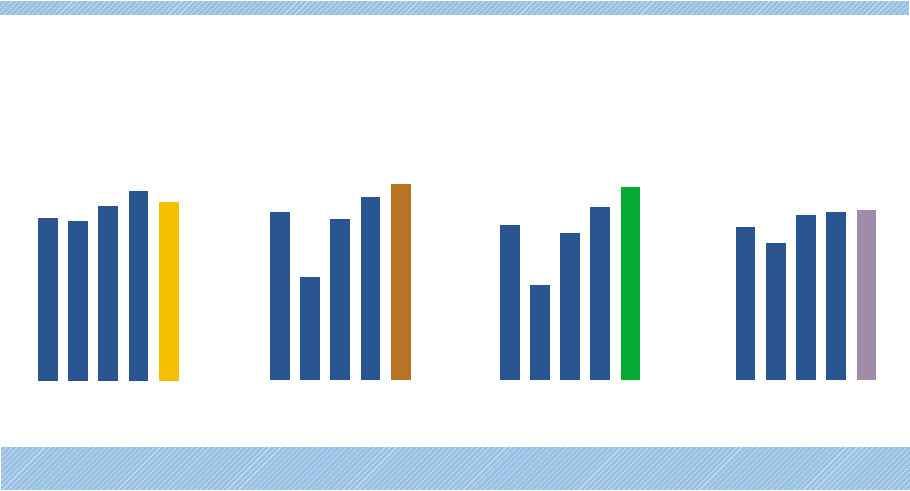

Revenue

(Dollars in billions)

Income

(Dollars in billions)

Earnings per share —

assuming dilution

(In dollars)

Net cash from operating

activities, excluding Global

Financing receivables

(Dollars in billions)

_3

2005 performance includes results from four months of the IBM PC business, which was divested on April 30, 2005.

3_

0_

6_

9_

12_

$15_

0504030201

11. 7

10.5

12.6 12.9 13.1

Results from continuing operations

1_

2_

3_

4_

$5_

0504030201

3.94

2.43

3.76

4.39

4.91

0_

2_

4_

6_

$8_

0_

0504030201

6.9

4.2

6.6

7. 5 8.0

0_

0504030201

83.1 81.2

89.1

96.3 91.1

20_

40_

60_

80_

$100_