Huntington National Bank 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

03008AR

HUNTINGTON 2007 ANNUAL REPORT

Table of contents

-

Page 1

HUNTINGTON 2007 ANNUAL REPORT -

Page 2

... Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. Founded in 1866, Huntington serves its customers as the "local bank with national resources." Nearly 12,000 associates provide consumer and commercial banking, mortgage banking, automobile ï¬nancing, equipment leasing, investment... -

Page 3

..., PRESIDENT, AND CHIEF EXECUTIVE OFFICER TO OUR SHAREHOLDERS AND FRIENDS: For Huntington and the entire banking industry, 2007 was a year like no other in modern history. We began the year with cautious optimism, expecting modest growth in core earnings per share and a relatively stable credit... -

Page 4

...of 2007 occurred with the $424 million pre-tax earnings charge we took in the fourth quarter associated with our credit exposure to Franklin Credit Management Corporation. Sky Financial had a successful 17-year relationship with Franklin, which was in the business of acquiring/originating, servicing... -

Page 5

... to Huntington, and we are proud to have been ranked #1 in Ohio and West Virginia in SBA lending, with Greenwich recognizing us for our "excellence" in overall small business customer satisfaction, cash management services, online banking, and branch services. Our retail online banking offering... -

Page 6

... to have a successful year and have set earnings guidance of $1.57-$1.62 per share, excluding the last remaining merger costs. Our business model of local bankers making local decisions to serve local customers, supported by great "national" resources, is working well. And our value proposition of... -

Page 7

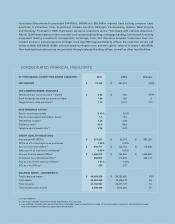

NET INCOME (MILLIONS) $461 $372 $399 $412 DILUTED EARNINGS PER SHARE $1.92 $1.61 $1.71 $1.77 $75 $.25 03 04 05 06 07 03 04 05 06 07 RETURN ON AVERAGE EQUITY 17.0% 16.8% CASH DIVIDENDS DECLARED $1.06 16.0% 15.7% $.845 $.75 $.67 $1.00 1.6% 03 04 05 06 07 03 04 05 06 07 5 -

Page 8

... OF DIRECTORS Raymond J. Biggs (1)(2) David P. Lauer (3) Private Investor; Retired Chairman and Chief Executive Ofï¬cer, Huntington Bancshares Michigan, Inc. Joined Board: 2002 Don M. Casto III (1)(4)(5)(6) Certiï¬ed Public Accountant; Retired Managing Partner, Deloitte & Touche LLP Joined Board... -

Page 9

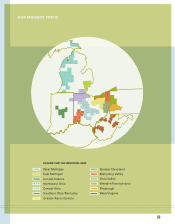

OUR MIDWEST FOCUS LEGEND FOR THE REGIONAL MAP West Michigan East Michigan Central Indiana Northwest Ohio Central Ohio Southern Ohio/Kentucky Greater Akron/Canton Greater Cleveland Mahoning Valley Ohio Valley Western Pennsylvania Pittsburgh West Virginia 7 -

Page 10

... ACTION BY BOARD OF DIRECTORS. COMMON STOCK PRICE 2007 2006 2005 2004 2003 2002 High Low Close $ 24.14 13.50 14.76 $ 24.97 22.56 23.75 $ 25.41 20.97 23.75 $ 25.38 20.89 24.74 $ 22.55 17.78 22.50 $ 21.77 16.00 18.71 20-YEAR DIVIDEND HISTORY CASH DIVIDENDS DECLARED(1) STOCK DIVIDEND... -

Page 11

... of Operations Reports of Management Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements... -

Page 12

... Critical Accounting Policies and Use of Signiï¬cant Estimates Total Allowances for Credit Losses Fair Value Measurements Goodwill Mortgage Servicing Rights (MSRs) Trading Securities and Securities Available-for-sale Derivatives Loans Held-for-sale Other Investments - Equity Investments Income... -

Page 13

... Value Analysis Mortgage Servicing Rights (MSRs) Price Risk Equity Investment Portfolios Liquidity Risk Sources of Liquidity Parent Company Liquidity Credit Ratings Off-Balance Sheet Arrangements Operational Risk Capital LINES OF BUSINESS DISCUSSION Acquisition of Sky Financial Funds Transfer... -

Page 14

... Net income per common share - diluted Cash dividends declared per common share Balance sheet highlights Total assets (period end) Total long-term debt (period end)(3) Total shareholders' equity (period end) Average long-term debt(3) Average shareholders' equity Average total assets Key ratios... -

Page 15

... located in Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. Selected financial service activities are also conducted in other states including: Dealer Sales offices in Arizona, Florida, Georgia, Nevada, New Jersey, New York, North Carolina, South Carolina, and Tennessee; Private... -

Page 16

... Based on the balances at December 31, 2007, a 10 basis point increase in this ratio to 1.71% would require $40.0 million in additional reserves (funded by additional provision for credit losses), which would have negatively impacted 2007 net income by approximately $26.0 million, or $0.09 per share... -

Page 17

... 31, 2007. For additional information regarding goodwill and the carrying values by lines of business, please refer to Note 8 of the Notes to the Consolidated Financial Statements. Mortgage Servicing Rights (MSRs) MSRs and certain other servicing rights do not trade in an active, open market with... -

Page 18

... investments through investments in equity funds (holding both private and publicly traded equity securities), directly in companies as a minority interest investor, and directly in companies in conjunction with our mezzanine lending activities. We measure these equity investments at fair value... -

Page 19

... mergers used to determine "merger-related" impacts. Balance Sheet Items Sky Financial For average loans and leases, as well as total average deposits, Sky Financial's balances as of June 30, 2007, adjusted for purchase accounting adjustments, and transfers of loans to loans held-for-sale, were used... -

Page 20

...Unizan's actual full year 2005 results were used for pro-rating the impact on post-merger periods. For example, to estimate the 2006 first quarter impact of the merger on personnel costs, one-twelfth of Unizan's full-year 2005 personnel costs was used. Full quarter and year-to-date estimated impacts... -

Page 21

... losses Net interest income after provision for credit losses Service charges on deposit accounts Trust services Brokerage and insurance income Other service charges and fees Bank owned life insurance income Mortgage banking Securities (losses) gains Automobile operating lease income Other Total... -

Page 22

.... The current year included six months of net interest income attributable to the acquisition of Sky Financial, which added $13.3 billion of loans and $12.9 billion of deposits at July 1, 2007. As stated earlier, we saw good non-merger-related growth in total average commercial loans. However, total... -

Page 23

... (2) changes in an accounting principle; (3) one-time tax assessments/refunds; (4) a large gain/loss on the sale of an asset; (5) outsized commercial loan net charge-offs related to fraud; etc. In addition, for the periods covered by this report, the impact of the Franklin restructuring is deemed to... -

Page 24

... programming services related to systems conversions, and marketing expenses related to customer retention initiatives. These net merger costs were $85.1 million in 2007. This included $13.4 million severance expense relating to the retirement of Sky Financial's former chairman, president, and chief... -

Page 25

...of FHLB funding and the sale of mortgage loans resulted in total charges of $4.4 million, resulting in total balance sheet restructuring costs of $77.5 million ($0.21 per common share). 5. MORTGAGE SERVICING RIGHTS (MSRS) AND RELATED HEDGING. - Included in net market-related losses are net losses or... -

Page 26

... from other net market-related losses: Securities gains/ (losses) $(30,486) (55) 715 Public equity investments $(20,009) 7,436 - Loss on loans held-for-sale $(34,003) - - Debt extinguishment $8,058 - - Pretax income $(76,440) 7,381 715 Net income $(49,686) 4,798 465 Per common share $(0.16) 0.02... -

Page 27

... change Gain on sale of MasterCard» stock Balance sheet restructuring Huntington Foundation contribution Automobile lease residual value losses Severance and consolidation expenses Accounting adjustment for certain equity investments Adjustment to defer home equity annual fees Net impact of federal... -

Page 28

... 17.7 390.1 $285.6 Loans and direct financing leases Securities Other earning assets Total interest income from earning assets Deposits Short-term borrowings Federal Home Loan Bank advances Subordinated notes and other long-term debt, including capital securities Total interest expense of interest... -

Page 29

... assets reflected a change in our strategy to use trading account securities to hedge the change in fair value of our mortgage servicing rights. The $0.5 billion, or 1%, increase in total non-merger related average deposits primarily reflected a $0.6 billion, or 2%, increase in average total core... -

Page 30

...020 $28,972 Assets Interest bearing deposits in banks Trading account securities Federal funds sold and securities purchased under resale agreement Loans held for sale Investment securities: Taxable Tax-exempt Total investment securities Loans and leases:(3) Commercial: Middle market commercial and... -

Page 31

...S H A R E S I N C O R P O RAT E D Interest Income/Expense Average Rate(2) 2007 $ 12.5 37.5 29.9 20.6 221.9 43.4 265.3 614.2 117.4 318.2 435.6 256.4 1,...252.9 288.6 212.9 39.2 793.6 1,431.1 $ 2004 0.7 4.4 5.5 13.0 171.7 28.8 200.5 196.5 64.2 88.0 152.2 110.3 459.0 165.1 109.6 274.7 208.6 163.0 29.5... -

Page 32

....9) 20.6% Service charges on deposit accounts Trust services Brokerage and insurance income Other service charges and fees Bank owned life insurance income Mortgage banking Securities losses Other income Sub-total before automobile operating lease income Automobile operating lease income Total non... -

Page 33

...to the balance sheet restructuring (see "Significant Items") and 2007 losses primarily related to the securities impairment losses recognized on certain investment securities. - $20.3 million, or 9%, increase in service charges on deposit accounts, primarily reflecting higher personal and commercial... -

Page 34

... asset growth. - $7.0 million, or 16% ($1.0 million Unizan merger-related), increase in other service charges and fees, primarily reflecting a $5.3 million, or 17%, increase in fees generated by higher debit card volume. Partially offset by: - $65.1 million increase in investment securities losses... -

Page 35

..., or 4%, non-merger-related decline primarily reflected: - $26.1 million, or 84%, decline in automobile operating lease expense. - $22.1 million, or 3%, decline in personnel costs reflecting merger efficiencies including the impact of the reductions to fulltime equivalent staff during 2007. 33 -

Page 36

...$131.5 million provision in 2005. The tax benefit in 2007 was a result of lower pretax income combined with the favorable impact of tax exempt income, bank owned life insurance, asset securitization activities, and general business credits from investments in low income housing and historic property... -

Page 37

...our primary banking markets. Also, we continue to focus on expanding existing relationships with our retail customers and adding new borrowers that meet our risk profile. The checks and balances in the credit process and the independence of the credit administration and risk management functions are... -

Page 38

...Mahoning Valley Ohio Valley West Michigan East Michigan Western Pennsylvania Pittsburgh Central Indiana West Virginia Other Regional(2) Regional Banking Dealer Sales Private Financial and Capital Markets Group Treasury/Other Total loans and direct financing leases (2) 2007 includes loans to Franklin... -

Page 39

... Dealer floor plan loans Equipment direct financing leases $ 8,468 795 895 10,158 2,968 13,126 7,804 1,379 9,183 $22,309 Middle market commercial and industrial loans and leases Small business commercial and industrial loans Commercial and industrial loans and leases Middle market commercial real... -

Page 40

... Classification: Services Finance, insurance, and real estate(1) Manufacturing Retail trade Contractors and construction Transportation, communications, and utilities Wholesale trade Agriculture and forestry Energy Public administration Other Total (1) Includes commitments and loans to Franklin. 24... -

Page 41

..., and loan-to-value (LTV) ratios. We offer closed-end home equity loans with a fixed interest rate and level monthly payments and a variable-rate, interest-only home equity line of credit. At December 31, 2007, we had $3.4 billion of home equity loans and $3.9 billion of home equity lines of credit... -

Page 42

...S H A RE S I N C O R P O R AT E D have variable rates of interest and do not require payment of principal during the 10-year revolving period of the line. During 2007, we originated commitments of $1.5 billion of home equity lines with a weighted average combined LTV ratio at origination of 76% and... -

Page 43

... business commercial and industrial and commercial real estate Residential mortgage Home equity Total nonaccrual loans and leases Restructured loans, accruing Other real estate, net: Residential(1) Commercial Total other real estate, net Impaired loans held-for-sale(2) Other nonperforming assets... -

Page 44

...) 2007 2006 2005 2004 2003 Nonperforming assets, beginning of year New nonperforming assets(1) Restructured loans, accruing(2) Acquired nonperforming assets Returns to accruing status Loan and lease losses Payments Sales Nonperforming assets, end of year (2) Restructured loans are net of loan... -

Page 45

... that this new calculation is a better measure of the macro-economic environment's impact on the credit performance of our portfolio. Given the expectation of continued stress in commercial real estate markets, as well as weak performance of the eastern Michigan and northern Ohio economies, we... -

Page 46

... estate Small business commercial and industrial and commercial real estate Total commercial Consumer: Automobile loans and leases Home equity Residential mortgage Other loans Total consumer Total allowance for loan and lease losses Allowance for unfunded loan commitments and letters of credit Total... -

Page 47

... commercial and industrial Construction Commercial Middle market commercial real estate Small business Total commercial Consumer: Automobile loans Automobile leases Automobile loans and leases Home equity Residential mortgage Other loans Total consumer Total recoveries Net loan and lease charge... -

Page 48

...leases Automobile loans and leases Home equity Residential mortgage Other loans Total consumer Total net charge-offs Net charge-offs - annualized percentages: Commercial: Middle market commercial and industrial(1) Construction Commercial Middle market commercial real estate Small business commercial... -

Page 49

... E D Total net charge-offs during 2007 were $477.6 million, or an annualized 1.44% of average related balances. After adjusting for the $308.5 million related to the Franklin restructuring, total net charge-offs during 2007 were $169.1 million, compared with $82.4 during 2006. Investment Portfolio... -

Page 50

... rate risk are employed: income simulation and economic value analysis. An income simulation analysis is used to measure the sensitivity of forecasted net interest income to changes in market rates over a one-year time horizon. Although bank owned life insurance and automobile operating lease assets... -

Page 51

...012 (in thousands of dollars) Total Shareholders' Equity Less: Goodwill Other intangible assets(1) Add: Allowance for credit losses(2) Net Equity (1) Other intangible assets are net of deferred tax. (2) Limited to 1.25% of gross risk-weighted assets. Mortgage Servicing Rights (MSRs) (This section... -

Page 52

... buy and sell publicly traded securities, investment funds that hold securities of private companies, direct equity investments in companies (public and private), and direct equity interests in private companies in connection with our mezzanine lending activities. These investments are reported as... -

Page 53

... of wholesale funding include other domestic time deposits of $100,000 or more, brokered deposits and negotiable CDs, deposits in foreign offices, short-term borrowings, Federal Home Loan Bank (FHLB) advances, other long-term debt and subordinated notes. At December 31, 2007, total wholesale funding... -

Page 54

... deposits: Commercial Personal Total core deposits By Business Segment(1) Regional Banking: Central Ohio Northwest Ohio Greater Cleveland Greater Akron/Canton Southern Ohio/Kentucky Mahoning Valley Ohio Valley West Michigan East Michigan Western Pennsylvania Pittsburgh Central Indiana West Virginia... -

Page 55

... Commercial real estate - commercial Total Variable interest rates Fixed interest rates Total Percent of total At December 31, 2007, the portfolio of investment securities totaled $4.5 billion, of which $2.3 billion was pledged to secure public and trust deposits, interest rate swap agreements... -

Page 56

... 10 years Total private label CMO Asset backed securities Under 1 year 1-5 years 6-10 years Over 10 years Total asset backed securities Other Under 1 year 1-5 years 6-10 years Over 10 years Non-marketable equity securities Marketable equity securities Total other Total investment securities $ 299... -

Page 57

...federal consolidated tax return, fees for services provided to subsidiaries, and the issuance of debt securities. At December 31, 2007, the parent company had $153.5 million in cash or cash equivalents. This declined significantly compared with the prior year-end reflecting a cash payment in 2007 of... -

Page 58

... 5 years $ - 481 29 - 1,115 1,674 160 13 Total $20,321 17,422 3,084 2,844 1,937 1,934 363 260 Deposits without a stated maturity Certificates of deposit and other time deposits Federal Home Loan Bank advances Short-term borrowings Other long-term debt Subordinated notes Operating lease obligations... -

Page 59

... are currently 3.9 million shares remaining available. During 2007, Huntington Capital III, a trust formed by us, issued $250 million of enhanced trust preferred securities. The securities were secured by junior subordinated notes from the parent company. The enhanced trust preferred securities have... -

Page 60

... - Commercial banking - Mortgage banking Dealer Sales - Consumer auto loans and leases - Dealership inventory financing - Dealership real estate / working capital PFCMG - Asset management - Private banking - Brokerage Treasury/Other - Investment securities - Bank owned life insurance - Insurance... -

Page 61

... home equity loans and lines of credit, first mortgage loans, direct installment loans, small business loans, personal and business deposit products, as well as sales of investment and insurance services. At December 31, 2007, Retail Banking accounted for 51% and 80% of total Regional Banking loans... -

Page 62

...in fees received from the sales of private financial and capital markets products and services. These increases were partially offset by a $5.6 million decline in mortgage banking income largely due to $5.8 million of higher losses related to MSR valuation, net of hedge-related trading activity. Non... -

Page 63

... Dealer Sales line of business provides a variety of banking products and services to more than 3,700 automotive dealerships within our primary banking markets, as well as in Arizona, Florida, Georgia, Nevada, New Jersey, New York, North Carolina, South Carolina, and Tennessee. Dealer Sales finances... -

Page 64

... $16.3 billion total assets under management at December 31, 2007. The Huntington Investment Company offers brokerage and investment advisory services to both Regional Banking and PFCMG customers through a combination of licensed investment sales representatives and licensed personal bankers PFCMG... -

Page 65

... of an annual fee sharing adjustment for commercial loan swaps. These declines were partially offset by: (1) $1.5 million increase in trust services income primarily reflecting an 8.5% growth in Huntington Fund average asset balances, and (2) $0.6 billion increase in brokerage and insurance income... -

Page 66

... 31, 2007 - GAAP earnings Franklin relationship restructuring Net market-related losses Merger costs Visa» indemnification charge Increases to litigation reserves December 31, 2006 - GAAP earnings Gain on sale of MasterCard» stock Completion of balance sheet restructuring Huntington Foundation... -

Page 67

...Total commercial Automobile loans and leases Home equity Residential mortgage Other consumer Total consumer Total loans Deposits Demand deposits - non-interest bearing Demand deposits - interest bearing Money market deposits Savings and other domestic deposits Core certificates of deposit Total core... -

Page 68

... Other service charges and fees Bank owned life insurance income Mortgage banking income Securities losses Other income Sub-total before automobile operating lease income Automobile operating lease income Total non-interest income N.M., not a meaningful value. (1) Calculated as non-merger related... -

Page 69

... period + merger-related + merger-costs). The $9.3 million, or 2%, non-merger-related decline reflected: - $14.1 million, or 6%, decline in personnel expense, reflecting merger efficiencies including the impact of the reduction of 828, or 6%, full-time equivalent staff during the 2007 third quarter... -

Page 70

... an annualized 0.47%, in the year-ago quarter and an annualized 0.58% in the prior quarter. The economic weakness in our markets, most notably among our borrowers in eastern Michigan and northern Ohio, continue to impact residential mortgage and home equity net charge-offs. Nonaccrual Loans (NALs... -

Page 71

... for credit losses Service charges on deposit accounts Trust services Brokerage and insurance income Other service charges and fees Bank owned life insurance income Mortgage banking income Securities (losses) gains Other income Sub-total before operating lease income Operating lease income Total non... -

Page 72

... High (1) Low (1) Close Average closing price Dividends, per share Cash dividends declared on common stock Common shares outstanding Average - basic Average - diluted Ending Book value per share Tangible book value per share Common share repurchases Number of shares repurchased Quarterly key ratios... -

Page 73

... believes that, as of December 31, 2007, the Company's internal control over financial reporting is effective based on those criteria. Thomas E. Hoaglin Chairman, President, and Chief Executive Officer Donald R. Kimble Executive Vice President and Chief Financial Officer February 25, 2008 71 -

Page 74

... of and for the year ended December 31, 2007 of the Company and our report dated February 25, 2008 expressed an unqualified opinion on those financial statements and included an explanatory paragraph regarding the Company's adoption of new accounting standards. Columbus, Ohio February 25, 2008 72 -

Page 75

... Incorporated Columbus, Ohio We have audited the accompanying consolidated balance sheets of Huntington Bancshares Incorporated and subsidiaries (the "Company") as of December 31, 2007 and 2006, and the related consolidated statements of income, changes in shareholders' equity, and cash flows... -

Page 76

...funds sold and securities purchased under resale agreements Interest bearing deposits in banks Trading account securities Loans held for sale Investment securities Loans and leases: Commercial and industrial loans and leases Commercial real estate loans Automobile loans Automobile leases Home equity... -

Page 77

... Home Loan Bank advances Subordinated notes and other long-term debt Total interest expense Net interest income Provision for credit losses Net interest income after provision for credit losses Service charges on deposit accounts Trust services Brokerage and insurance income Other service charges... -

Page 78

... losses for pension and other post-retirement obligations, net of tax of ($22,710) Total comprehensive income Assignment of $0.01 par value per share for each share of common stock Cash dividends declared ($1.06 per share) Shares issued pursuant to acquisitions Recognition of the fair value of share... -

Page 79

... subordinated notes Proceeds from Federal Home Loan Bank advances Maturity/redemption of Federal Home Loan Bank advances Proceeds from issuance of long-term debt Maturity of long-term debt Dividends paid on common stock Repurchases of common stock Other, net Net cash provided by (used for) financing... -

Page 80

...insurance and financial products and services. Huntington's banking offices are located in Ohio, Michigan, West Virginia, Indiana, Kentucky and Pennsylvania. Certain activities are also conducted in other states including Arizona, Florida, Georgia, Maryland, Nevada, New Jersey, North Carolina, South... -

Page 81

...by the first policy are accounted for using the operating lease method of accounting and are recorded as operating lease assets in Huntington's consolidated balance sheet. Automobile leases originated after October 9, 2007 are not covered by a third party residual value insurance policy. The absence... -

Page 82

...year amounts generally charged off as a credit loss. - SOLD LOANS AND LEASES - Loans or direct financing leases that are sold are accounted for in accordance with Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. For loan or lease sales... -

Page 83

... value of MSRs, Huntington uses a static discounted cash flow methodology incorporating current market interest rates. A static model does not attempt to forecast or predict the future direction of interest rates; rather it estimates the amount and timing of future servicing cash flows using current... -

Page 84

... loan interest rate lock commitments and its mortgage loans held for sale. Mortgage loan sale commitments and the related interest rate lock commitments are carried at fair value on the consolidated balance sheet with changes in fair value reflected in mortgage banking revenue. Huntington also uses... -

Page 85

... Payment (Statement No. 123R), relating to its share-based compensation plans. Prior to January 1, 2006, Huntington had accounted for share-based compensation plans under the intrinsic value method promulgated by Accounting Principles Board (APB) Opinion 25, Accounting for Stock Issued to Employees... -

Page 86

... by Huntington's management reporting system, as appropriate. - STATEMENT OF CASH FLOWS - Cash and cash equivalents are defined as "Cash and due from banks" and "Federal funds sold and securities purchased under resale agreements." 2. NEW ACCOUNTING STANDARDS STANDARDS ADOPTED IN 2007: - FINANCIAL... -

Page 87

... over 330 banking offices and over 400 ATMs and served communities in Ohio, Pennsylvania, Indiana, Michigan, and West Virginia. Under the terms of the merger agreement, Sky Financial shareholders received 1.098 shares of Huntington common stock, on a tax-free basis, and a taxable cash payment of... -

Page 88

... value of the net assets acquired on July 1, 2007 related to the acquisition of Sky Financial: (in thousands) July 1, 2007 Assets Cash and due from banks Federal funds sold and securities purchased under resale agreements(1) Loans held for sale Securities and other earning assets Loans and leases... -

Page 89

...423 590,062 165,369 $4,362,924 Other securities include Federal Home Loan Bank and Federal Reserve Bank stock, corporate debt and marketable equity securities. Contractual maturities of investment securities as of December 31 were: 2007 (in thousands) 2006 Fair Value $ 104,520 89,720 188,273 3,694... -

Page 90

... R P O R AT E D At December 31, 2007, the carrying value of investment securities pledged to secure public and trust deposits, trading account liabilities, U.S. Treasury demand notes, and security repurchase agreements totaled $2.3 billion. There were no securities of a single issuer, which are not... -

Page 91

... non-prime loans through its wholly-owned subsidiary, Tribeca Lending Corp. and has generally held for investment the loans acquired and a significant portion of the loans originated. Tribeca currently accounts for approximately 25% of Franklin's business activities. Commercial loans to Franklin and... -

Page 92

...$193,620 $ 59,114 Commercial and industrial Commercial real estate Residential mortgage Home equity Total nonaccrual loans and leases Restructured loans Other real estate, net Impaired loans held for sale(1) Other nonperforming assets(2) Total nonperforming assets Accruing loans past due 90 days or... -

Page 93

... underlying mortgage loans by sale or securitization of the loans with servicing rights retained. MSRs are accounted for under the fair value provisions of Statement No. 156. The same risk management practices are applied to all MSRs and, accordingly, MSRs were identified as a single asset class and... -

Page 94

... of year Fair value, end of year Huntington has retained servicing responsibilities and receives annual servicing fees from 0.55% to 1.00% and other ancillary fees of approximately 0.40% to 0.60% of the outstanding loan balances. Servicing income, net of amortization of capitalized servicing assets... -

Page 95

...sale of collateral, net of costs to sell that collateral. (4) The loans to Franklin, classified as troubled debt restructuring, are included in impaired loans at the end of the year. 8. GOODWILL AND OTHER INTANGIBLE ASSETS Changes to the carrying amount of goodwill by line of business for the years... -

Page 96

..., Huntington's other intangible assets consisted of the following: Gross Carrying Amount Accumulated Amortization Net Carrying Value (in thousands) December 31, 2007 Core deposit intangible Customer relationship Other Total other intangible assets December 31, 2006 Core deposit intangible Customer... -

Page 97

... $1,065,649 3.33% $1,213,673 Average balance during the year Average interest rate during the year Maximum month-end balance during the year 11. FEDERAL HOME LOAN BANK ADVANCES Huntington's long-term advances from the Federal Home Loan Bank had weighted average interest rates of 5.11% and 5.40% at... -

Page 98

... Huntington National Bank 5.33% Securitization trust note payable due 2012(1) 5.57% Securitization trust note payable due 2018(2) 7.88% Class C preferred securities of REIT subsidiary, no maturity Total other long-term debt (1) Variable effective rate at December 31, 2007, based on one month LIBOR... -

Page 99

...the vesting period, subject to certain service restrictions. The fair value of the restricted stock unit awards is the closing market price of the Company's common stock on the date of award. Huntington uses the Black-Scholes option-pricing model to value share-based compensation expense. This model... -

Page 100

...forma expense, net of tax Pro forma net income Net income per common share: Basic, as reported Basic, pro forma Diluted, as reported Diluted, pro forma $412.1 (11.9) $400.2 $ 1.79 1.74 1.77 1.71 Huntington's stock option activity and related information for the year ended December 31, 2007, was as... -

Page 101

... Vested Forfeited Nonvested at December 31, 2007 22.74 22.74 - - In connection with the merger of Sky Financial, Huntington granted restricted stock awards of 221,569 shares of Huntington common stock. The restricted stock awards vest in equal monthly installments at the end of each calendar... -

Page 102

... the statutory rate Increases (decreases): Tax-exempt interest income Tax-exempt bank owned life insurance income Asset securitization activities Federal tax loss carryback General business credits Repatriation of foreign earnings Resolution of federal income tax audit Other, net (Benefit) provision... -

Page 103

... for credit losses Loss and other carry-forwards Fair value adjustments Partnerships investments Operating assets Accrued expense/prepaid Other Total deferred tax assets Deferred tax liabilities: Lease financing Pension and other employee benefits Purchase accounting adjustments Mortgage servicing... -

Page 104

... and losses Total changes Projected benefit obligation at end of measurement year (September 30) The investment objective of the Plan is to maximize the return on Plan assets over a long time horizon, while meeting the Plan obligations. At September 30, 2007, Plan assets were invested 75% in equity... -

Page 105

...'s policy to recognize settlement gains and losses as incurred. Management expects net periodic pension cost to approximate $16.2 million and net periodic post-retirement benefits cost to approximate $5.7 million for 2008. The estimated transition asset, prior service cost and net gain for the plans... -

Page 106

... Plan assets. The Plan assets consisted of investments in a variety of Huntington mutual funds and Huntington common stock as follows: Fair Value 2007 (in thousands) 2006 % -% 73 25 2 100% Balance $ 820 % -% 69 28 3 100% Balance $ 65 Huntington funds - money market Huntington funds - equity funds... -

Page 107

... (79,883) Financial Assets: Cash and short-term assets Trading account securities Loans held for sale Investment securities Net loans and direct financing leases Derivatives Financial Liabilities: Deposits Short-term borrowings Federal Home Loan Bank advances Other long term debt Subordinated notes... -

Page 108

...of securities available for sale. - LOANS AND DIRECT FINANCING LEASES - variable-rate loans that reprice frequently are based on carrying amounts, as adjusted for estimated credit losses. The fair values for other loans and leases are estimated using discounted cash flow analyses and employ interest... -

Page 109

... D The following table presents additional information about the interest rate swaps used in Huntington's Asset and Liability Management activities at December 31, 2007: Notional Value Average Maturity (years) Fair Value Weighted-Average Rate Receive Pay (in thousands ) Liability conversion swaps... -

Page 110

... used in its mortgage banking activities: At December 31, (in thousands) 2007 2006 Derivative assets: Interest rate lock agreements Forward trades and options Total derivative assets Derivative liabilities: Interest rate lock agreements Forward trades and options Total derivative liabilities Net... -

Page 111

... loss. On February 20, 2008, a putative class action lawsuit was filed in the United States District Court for the Southern District of Ohio against the Company, the Huntington Bancshares Incorporated Pension Review Committee, the Huntington Investment and Tax Savings Plan (the Plan) Administrative... -

Page 112

... of the Employee Retirement Income Security Act (ERISA) relating to the Company's stock being offered as an investment alternative for participants in the Plan. The complaint seeks money damages and equitable relief. At this early stage of this lawsuit, it is not possible for management to assess... -

Page 113

... principal, the transfer of these balances to a subsidiary of the holding company, or through the sale of the loans to third parties. Dividends from the Bank are one of the major sources of funds for Huntington. These funds aid the parent company in the payment of dividends to shareholders, expenses... -

Page 114

...Income (in thousands) Year Ended December 31, 2007 2006 2005 Income Dividends from The Huntington National Bank Non-bank subsidiaries Interest from The Huntington National Bank Non-bank subsidiaries Management fees from subsidiaries Other Total income Expense Personnel costs Interest on borrowings... -

Page 115

... home equity loans and lines of credit, first mortgage loans, direct installment loans, small business loans, personal and business deposit products, as well as sales of investment and insurance services. At December 31, 2007, Retail Banking accounted for 51% and 80% of total Regional Banking loans... -

Page 116

.... Huntington has been in this line of business for over 50 years. Private Financial and Capital Markets Group (PFCMG): This segment provides products and services designed to meet the needs of higher net worth customers. Revenue is derived through the sale of trust, asset management, investment... -

Page 117

... E D Listed below is certain operating basis financial information reconciled to Huntington's 2007, 2006, and 2005 reported results by line of business: INCOME STATEMENTS 2007 Net interest income Provision for credit losses Non-interest income Non-interest expense Income taxes Net income 2006 Net... -

Page 118

... expense Net interest income Provision for credit losses Non-interest income Non-interest expense Income (loss) before income taxes (Provision) benefit for income taxes Net income (loss) Net income per common share - Basic Net income per common share - Diluted (in thousands, except per share data... -

Page 119

...77 South High Street, Columbus, Ohio. Information Requests: Copies of Huntington's Annual Report; Forms 10-K, 10-Q, and 8-K; Financial Code of Ethics; and quarterly earnings releases may be obtained, free of charge, by calling (888) 480-3164 or by visiting Huntington's investor relations web site at... -

Page 120

Huntington Center, 41 South High Street Columbus, Ohio 43287 (614) 480-8300 huntington.com HUNTINGTON BANCSHARES INCORPORATED and Huntington® are federally registered service marks of Huntington Bancshares Incorporated. © 2008 Huntington Bancshares Incorporated. ® 03008AR