Hess 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Hess annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Review of 2002

During 2002 we achieved a number of important successes:

•We met our goal of delivering results on exploration opportunities

in Equatorial Guinea obtained in the Triton acquisition. We discov-

ered the Ebano, Akom and Abang Fields, and made a potentially

significant discovery with the G-13 well, all of which will be further

appraised. We discovered the Elon Field, which will be developed.

•We were successful in the deep-water Gulf of Mexico where the

Shenzi Field was discovered and the Llano Field was successfully

appraised. Appraisal of the Shenzi discovery is planned for the

second quarter of 2003. Resources discovered in 2002 in the Gulf

of Mexico and Equatorial Guinea will begin to be added to our

proved reserve base when development plans are finalized.

•We submitted development plans for the Okume, Oveng and

Elon Fields to the Government of Equatorial Guinea and expect

approval in the second quarter of 2003. Development of the Llano

Field has begun.

•We continued to upgrade our portfolio of assets. We sold

exploration and production assets for $268 million, including our

United Kingdom energy marketing business for $165 million and

smaller properties in the United States, United Kingdom and

Azerbaijan. We also sold our U.S. flag vessels for $140 million.

•We agreed to exchange our equity interest in Premier Oil plc for a

23% interest in the Natuna A Field in Indonesia, adding low cost,

long life reserves.

•The HOVENSA refinery joint venture completed construction of

a 58,000 barrel per day coking unit, allowing the refinery to

process lower cost, heavy Venezuelan crude oil, thereby enhancing

profit margins.

•We reduced debt by $673 million, exceeding our $600 million debt

reduction target.

We also experienced some disappointments:

•Production averaged 451,000 barrels of oil equivalent per day, the

highest in the Corporation’s history, but below our target of 475,000.

This shortfall was caused primarily by natural declines from mature

fields in the United States and the United Kingdom and reduced

production from the Ceiba Field in Equatorial Guinea.

•We took a $530 million after-tax impairment charge on the Ceiba

Field reflecting an extended production profile and a reduction in

probable reserves and a $256 million after-tax impairment charge

to reduce the carrying value of several Gulf of Mexico fields,

reflecting reduced reserves.

•Total proved reserves on a barrel of oil equivalent basis declined

to 1.2 billion barrels from 1.4 billion barrels at year-end 2001.

The decline was caused by negative revisions, reductions in entitle-

ment reserves covered by production sharing contracts due to

high year-end commodity prices and asset sales.

•Refining and marketing earnings declined to $40 million in 2002

from $235 million in 2001, due to poor refining margins, a warm

winter and narrow retail gasoline margins.

Results of Operations

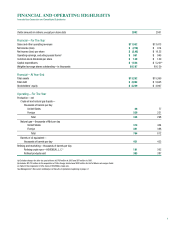

Amerada Hess reported a net loss of $218 million for 2002, including

after-tax charges of $769 million for special items. Operating income

was $551 million for 2002, versus $945 million in 2001. Details appear

under Management’s Discussion and Analysis of Results of Operations

and Financial Condition beginning on page 14.

Strategic Plan

Our long-term strategic plan is focused on reshaping our portfolio of

assets to enhance financial performance and provide long-term

profitable growth. Exploration and production will be the engine of future

income and growth, currently representing more than 72% of our capi-

tal employed and over 90% of our average annual capital expenditures.

John B. Hess

Chairman of the Board and Chief Executive Officer

TO OUR STOCKHOLDERS:

“Our long-term strategic plan is focused on reshaping our

portfolio of assets to enhance financial performance and

provide long-term profitable growth.”