Hertz 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

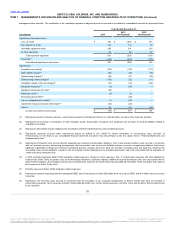

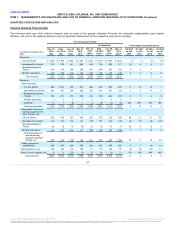

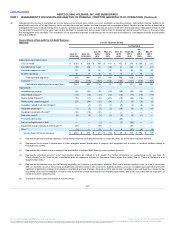

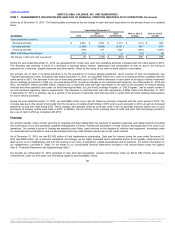

Transaction days (in thousands) 10,734

14,695

12,096

9,395

10,473

14,278

11,261

9,006

Average fleet 156,700

196,900

172,300

141,400

155,700

188,700

163,500

137,500

Number of days in period 92

92

91

90

92

92

91

90

Average fleet multiplied by number of

days in period (in thousands) 14,416

18,115

15,679

12,726

14,324

17,360

14,879

12,375

Fleet efficiency 74%

81%

77%

74%

73%

82%

76%

73%

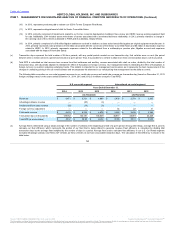

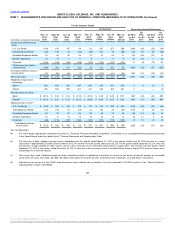

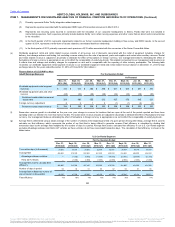

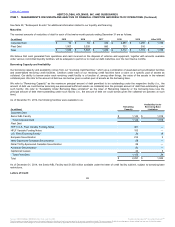

(h) Net depreciation per unit per month is a non-GAAP measure that is calculated by dividing depreciation of revenue earning equipment and lease charges, net by the

average fleet in each period and then dividing by the number of months in the period reported, with all periods adjusted to eliminate the effect of fluctuations in foreign

currency. Our management believes eliminating the effect of fluctuations in foreign currency is useful in analyzing underlying trends. Average fleet used to calculate

net depreciation per unit per month in our U.S. Car Rental segment includes Advantage sublease and Hertz 24/7 vehicles as these vehicles have associated lease

charges. Net depreciation per unit per month represents the amount of average depreciation expense and lease charges, net per vehicle per month. The table below

reconciles this non-GAAP measure to its most comparable GAAP measure, which is depreciation of revenue earning equipment and lease charges, net, (based on

December 31, 2013 foreign exchange rates) for the periods shown:

Depreciation of revenue earning

equipment and lease charges, net (in

millions) $ 533

$ 409

$ 391

$ 424

$ 337

$ 337

$ 323

$ 285

Average Fleet 486,900

515,300

502,500

491,500

490,200

516,800

499,000

454,000

Depreciation of revenue earning

equipment and lease charges, net

divided by average fleet $ 1,095

$ 794

$ 778

$ 863

$ 687

$ 652

$ 647

$ 628

Number of months in period 3

3

3

3

3

3

3

3

Net depreciation per unit per month $ 365

$ 265

$ 259

$ 288

$ 229

$ 217

$ 216

$ 209

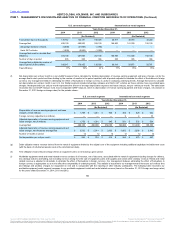

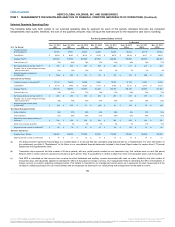

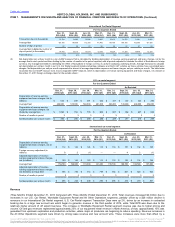

Depreciation of revenue earning

equipment and lease charges, net (in

millions) $ 112

$ 143

$ 124

$ 113

$ 119

$ 151

$ 132

$ 125

Foreign currency adjustment (in

millions) 8

2

(1)

—

—

4

2

(1)

Adjusted depreciation of revenue

earning equipment and lease charges,

net (in millions) $ 120

$ 145

$ 123

$ 113

$ 119

$ 155

$ 134

$ 124

Average Fleet 156,700

196,900

172,300

141,400

155,700

188,700

163,500

137,500

Adjusted depreciation of revenue

earning equipment and lease charges,

net divided by average fleet $ 766

$ 736

$ 714

$ 799

$ 764

$ 821

$ 820

$ 902

Number of months in period 3

3

3

3

3

3

3

3

Net depreciation per unit per month $ 255

$ 245

$ 238

$ 266

$ 255

$ 274

$ 273

$ 301

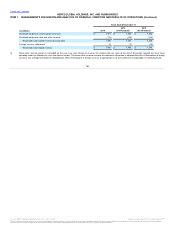

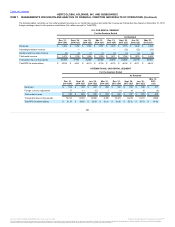

Total revenues increased $4 million due to

increases in our U.S. Car Rental, Worldwide Equipment Rental and All Other Operations segments, partially offset by a $26 million decline in

revenues in our International Car Rental segment. U.S. Car Rental segment Transaction Days were up 2%, driven by an increase in contracted

booking due to a large new account win which began to generate revenue in the third quarter of 2014, while Total RPD was down due to the

relatively higher amount of off airport business. The increase in Worldwide Equipment Rental segment revenue was due to higher pricing and

volume. Oil and gas revenues represented approximately 25% of our equipment rental revenue in North America, of that, approximately 15% was

generated from upstream exploration and production activities, where major oil producers are beginning to reduce spending. Revenue increases in

the All Other Operations segment were driven by strong lease revenue and new account wins. These increases were more than offset by a

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.