Hasbro 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

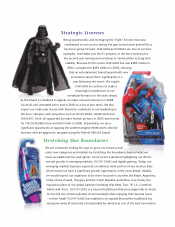

Strategic Licenses

Being opportunistic and leveraging the “right” licenses have also

contributed to our success during the past several years and will be a

key focus going forward. STAR WARS and MARVEL are two of our best

examples. STAR WARS was the #1 property in the boys' business for

the second year running and continues to demonstrate its long term

viability. Revenue for the entire STAR WARS line was $285 million in

2006, compared to $494 million in 2005, showing

that an entertainment brand layered with new

innovation can perform signifi cantly in a

year following the movie. We expect

STAR WARS to continue to make a

meaningful contribution to our

overall performance in the years ahead,

as the brand is scheduled to appear on major network television in 2008

via an all-new animated series and in 2009 as a live-action series. We also

expect our multi-year license with Marvel to contribute to our leadership in

the boys’ category with properties such as GHOST RIDER, SPIDER-MAN and

FANTASTIC FOUR, all supported by major motion pictures in 2007, and movies

for THE INCREDIBLE HULK and IRON MAN in 2008. Importantly, we see a

signifi cant opportunity in tapping the underleveraged SPIDER-MAN collector

business with an aggressive program using the Marvel ORIGINS brand.

Stretching Our Boundaries

We are constantly looking for ways to grow our business and

enter new categories and markets by stretching the boundaries beyond what we

know as traditional toys and games. Some recent examples highlighting our efforts

include growth in emerging markets, TOOTH TUNES and digital gaming. Today, our

emerging markets business represents a relatively small portion of our revenue base

which means we have a signifi cant growth opportunity in the years ahead. Initially,

we would expect our expansion to be more focused in countries like Brazil, Argentina,

India, China, Poland, Hungary and the Czech Republic and follow very closely the

expansion plans of our global partners including Wal-Mart, Toys “R” Us, Carrefour,

Metro and Tesco. TOOTH TUNES is a musical toothbrush that encourages kids to brush

for the full two minutes (dentist recommended) while enjoying their favorite music

– in their head! TOOTH TUNES has enabled us to expand beyond the traditional toy

and game aisles at retail and is being hailed by dentists as one of the best innovations