Harris Teeter 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

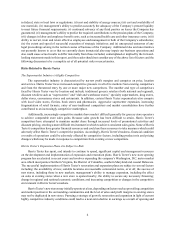

Fiscal 2007 Fiscal 2006 Fiscal 2005 % Inc. (Dec. )

% to

Sales

% to

Sales

% to

Sales

07 vs

06

06 vs

05

Operating Profit (Loss)

Harris Teeter . . . . . . . . . 154,083 4.23 127,637 3.91 113,580 3.83 20.7 12.4

American & Efird . . . . . 1,424 0.04 1,579 0.05 9,010 0.30 (9.8 ) (82.5 )

Corporate . . . . . . . . . . . . (7,333 ) (0.20 ) (6,147 ) (0.19 ) (7,330 ) (0.25 ) 19.3 (16.1 )

Total . . . . . . . . . . . . . 148,174 4.07 123,069 3.77 115,260 3.88 20.4 6.8

Other Expense, net . . . . . . . 17,683 0.48 9,672 0.30 7,702 0.26 82.8 25.6

Income Tax Expense . . . . . . 49,803 1.37 41,061 1.26 38,960 1.31 21.3 5.4

Net Income . . . . . . . . . . . . . $ 80,688 2.22 $ 72,336 2.21 $ 68,598 2.31 11.5 5.4

Consolidated net sales increased 11.4% in fiscal 2007 and 10.2% in fiscal 2006 when compared to prior

years as a result of strong sales gains at Harris Teeter. The fiscal 2007 increase was partially offset by a sales

decline at A&E. Over the past several years, A&E has pursued a global expansion strategy along with the

diversification of their product lines. These actions have resulted in an increase in foreign sales; however, the

percentage of foreign sales to consolidated net sales has declined during these periods as a result of the sales

mix between the operating subsidiaries. Foreign sales for fiscal 2007 represented 5.1% of the consolidated sales

of the Company, compared to 5.4% for fiscal 2006 and 5.7% for fiscal 2005. Refer to the discussion of segment

operations under the captions “Harris Teeter, Retail Grocery Segment” and “American & Efird, Industrial

Thread Segment” for a further analysis of the segment operating results.

The increase in gross profit as a percent to sales for fiscal 2007 resulted primarily from improved gross

profit margins at Harris Teeter, although A&E also realized improved gross profit as a percent to its sales for

fiscal 2007. The gross profit margin increase for fiscal 2006 was driven by a gross profit margin improvement

at Harris Teeter that was offset, in part, by a gross profit margin decline at A&E from fiscal 2005 to fiscal 2006.

Refer to the discussion of segment operations under the captions “Harris Teeter, Retail Grocery Segment” and

“American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

Selling, general & administrative (“SG&A”) expenses as a percent to sales increased in fiscal 2007

and fiscal 2006 as a result of increased operating costs at both subsidiaries. The increased operating costs at

the subsidiaries in fiscal 2006 were offset, in part, by lower operating expenses at Corporate. As previously

disclosed, Corporate SG&A expenses for fiscal 2006 included income of $2.2 million for life insurance proceeds

and a pre-tax charge of $1.5 million related to new Supplemental Executive Retirement Plans. Refer to the

discussion of segment operations under the caption “Harris Teeter, Retail Grocery Segment” and “American &

Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

Other expense, net includes interest expense, interest income, investment gains and losses, and minority

interest. Net interest expense (interest expense less interest income) increased $3.9 million in fiscal 2007 over

fiscal 2006 and $3.4 million in fiscal 2006 over fiscal 2005. The increase for both periods resulted from increased

borrowings under the Company’s credit facility, and lower interest income due to the utilization of the Company’s

temporary investment portfolio during fiscal 2006. Fiscal 2006 and fiscal 2005 include investment gains of $4.0

million and $2.2 million, respectively related to the sale of real estate investments held by Corporate.

The effective consolidated income tax rate for fiscal 2007 was 38.2% as compared to 36.2% for fiscal 2006

and fiscal 2005. The effective tax rates for fiscal 2006 and fiscal 2005 were lower primarily due to tax savings

associated with non-taxable life insurance proceeds.

Net income after income taxes in fiscal 2007 was $80.7 million, or $1.68 per diluted share, as compared

to $72.3 million, or $1.52 per diluted share in fiscal 2006 and $68.6 million, or $1.44 per diluted share in fiscal

2005.