Harman Kardon 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Harman Kardon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

remains a differentiating HARMAN strength,

and we have built a robust talent bench with

which to seize future opportunities.

We continue to reach out to the communities where

we live and work through a variety of educational

and sponsorship programs focused on our passion

for education, music and the arts. We delivered on a

key environmental stewardship target by achieving

a five percent reduction in energy use and green-

house gas emissions at several key facilities during

the second half of the fiscal year, and we are

extending this program and its proven principles

to HARMAN facilities worldwide.

Beyond our steadily improving financial perform-

ance, we took several additional steps to increase

shareholder value during fiscal year 2012 – doubling

our annual dividend and launching a $200 million

share repurchase program. Two major ratings

agencies upgraded Harman’s outlook midway through

the fiscal year, and both Standard and Poor’s and

Moody’s have raised the Company’s corporate credit

rating to investment grade as this report goes

to press.

I am very proud of HARMAN’s management team

and the thousands of talented employees world-

wide who have embraced our culture of continuous

improvement. Our team is energized to carry this

performance into fiscal year 2013, and we look

forward to the continued support of our customers,

employees, and shareholders toward cementing

HARMAN’s position as the clear global leader in

audio and infotainment.

Best regards,

Dinesh C. Paliwal

Chairman, President and

Chief Executive Officer

talent PERFORMANCE

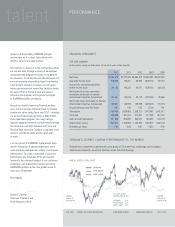

HARMAN’S JOURNEY: COMPANY PERFORMANCE VS. THE MARKET

Harman has consistently outperformed a peer group of 28 automotive, technology, and consumer

electronics companies, as well as the Dow Jones Industrial Average.

HAR VS. PEERS / DOW JONES

FEB. 2008 SEPT. 2012WORST OF GLOBAL RECESSION EUROZONE CRISIS I EUROZONE CRISIS II

2/6/2008

HAR 38.70

PEERS 57.97

9/28/2012

HAR 46.16

PEERS 44.96

TSR, FEB. 6, 2008,

ENDING SEP. 30, 2012

HARMAN 21%

PEER GROUP -31%

DOW JONES 10%

HARMAN

PEER GROUP

DOW JONES

FINANCIAL HIGHLIGHTS

FIVE YEAR SUMMARY

(In thousands, except per share data, for the fiscal years ended June 30)

2012 2011 2010 2009 2008

Net sales $4,364,078 $3,772,345 $3,364,428 $2,854,895 $4,072,359

Operating income (loss) 300,246 190,051 85,555 (503,812) 132,167

Income from continuing operations

before income taxes 261,153 160,220 49,077 (528,610) 109,209

Net income (loss) from continuing

operations attributable to Harman

International Industries, Incorporated 329,541 135,916 35,178 (422,345) 95,966

Net income (loss) attributable to Harman

International Industries, Incorporated 329,541 135,916 158,769 (431,504) 101,723

Diluted Earnings (Loss) Per Share 4.57 1.90 2.25 (7.34) 1.64

Total assets 3,169,464 3,058,495 2,556,215 2,473,497 2,802,971

Total debt 395,688 381,014 377,837 577,296 361,737

Cash and cash equivalents 617,356 603,892 645,570 586,359 223,109

Shareholders’ equity 1,529,611 1,423,658 1,134,892 1,007,918 1,382,108

Dividends per share 0.30 0.05 0.00 0.025 0.05