Harley Davidson 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

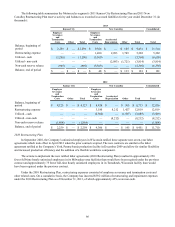

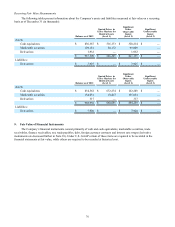

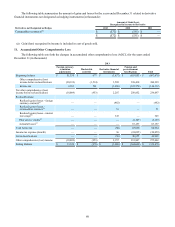

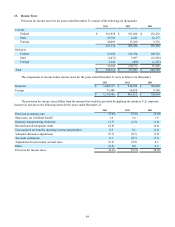

Recurring Fair Value Measurements

The following tables present information about the Company’s assets and liabilities measured at fair value on a recurring

basis as of December 31 (in thousands):

Balance as of 2013

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $ 836,387 $ 516,173 $ 320,214 $ —

Marketable securities 129,181 30,172 99,009 —

Derivatives 1,932 — 1,932 —

$ 967,500 $ 546,345 $ 421,155 $ —

Liabilities:

Derivatives $ 3,925 $ — $ 3,925 $ —

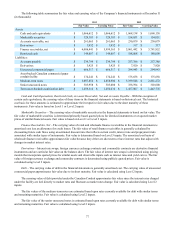

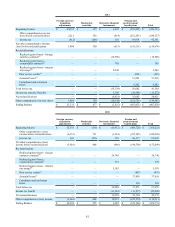

Balance as of 2012

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $ 834,562 $ 672,274 $ 162,288 $ —

Marketable securities 154,051 18,417 135,634 —

Derivatives 317 — 317 —

$ 988,930 $ 690,691 $ 298,239 $ —

Liabilities:

Derivatives $ 7,920 $ — $ 7,920 $ —

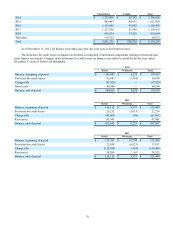

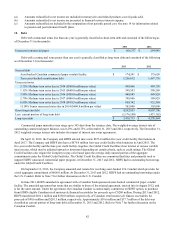

9. Fair Value of Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, marketable securities, trade

receivables, finance receivables, net, trade payables, debt, foreign currency contracts and interest rate swaps (derivative

instruments are discussed further in Note 10). Under U.S. GAAP certain of these items are required to be recorded in the

financial statements at fair value, while others are required to be recorded at historical cost.