HR Block 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 ANNUAL REPORT >>> 2005 PROXY STATEM ENT

Table of contents

-

Page 1

2005 A NNUA L REPORT >>> 2005 PROXY STATEM ENT -

Page 2

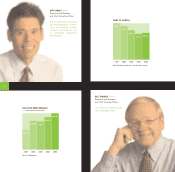

CONSOLIDATED REVENUES > > > (IN M ILLIONS) EARNINGS PER SHARE > > > PER DILUTED SHARE CONSOLIDATED NET INCOM E > > > (IN M ILLIONS) 2005 2004 $4,420.0 2005 $1.88 $709.2 $635.9 $4,247.9 2004 $1.96 $477.6 $441.3 2003 2002 $3,731.1 $3,311.9 2003 $1.30 2002 2001 $1.17 $282.6 $2,982.2 2001... -

Page 3

... CONTENTS Select ed Financial Highlight s Chairman's Let t er t o Shareholders H&R Block Branded Businesses RSM M cGladrey Business Services Opt ion One M ort gage Five Years in Review Proxy St at ement (green band) Form 10-K (black band) 2 3 8 14 18 23 Board of Direct ors and Execut ive Off icers... -

Page 4

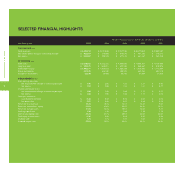

... Amounts in thousands, except per share amounts and number of shareholders Year Ended April 30 2005 2004 2003 2002 2001 FOR THE YEAR > > > Select ed Financial Highlight s Total revenues Net income before change in accounting principle Net income $ 4,420,019 $ 635,857 $ 635,857 $ 4,247,880... -

Page 5

... advisors businesses, which offset a 4 percent reduction in shares outstanding. However, we ended the year in a strong financial position with modest debt and solid capital levels. M ARK ERNST >>> H&R Block Chairman, President and Chief Executive Officer 3 Our approach to running the company... -

Page 6

... Executive Vice President and Chief Operating Officer " We are continually enhancing our value proposition to better serve an increasing number of clients and build our level of sust ainable compet it ive differentiation." DEBT TO CAPITAL* 44.0% 40.3% 35.6% 31.1% 32.4% 2001 2002 2003 2004 2005... -

Page 7

... H&R Block has shown over its 50-year history. During the past tax season, we opened more than 600 new companyowned offices, approximately 450 new co-locations with partners such as Wal-Mart and Sears, and supported our franchise community in opening about 150 new offices. importantly, they helped... -

Page 8

... in the number of account executives and support staff, which allowed more clients to access Option One's industry-leading mortgage service quality. In the process, we increased loan production more than 33 percent to $31 billion. At the same time, we were highly focused on cost management, reducing... -

Page 9

..., will enable our shareholders to realize the financial rewards of this emerging leader in the tax, accounting and business services market. A Proud History and a Bright Future For some companies, 50 years represents success. For H&R Block, it represents a beginning. Our success, our heritage, the... -

Page 10

..., H&R Block Tax Services, Inc. " What makes H&R Block distinctive is its mission to act as an advocate for our clients, giving them confidence that they have a strong partner, w hether in maximizing their personal tax situation, developing a longerterm financial plan, or buying a home." 9,339... -

Page 11

... Shareholders H&R Block A Convenience is a key factor for our clients. They want to find an office convenient to their home or work that provides quick, efficient and accurate service. That's why we opened more than 1,200 new locations this tax season, including company-owned and franchised offices... -

Page 12

... example, we provide a convenient and easy savings tool with our Express IRA product. Clients can use part or all of their tax refund to open an IRA right in our office. We help our clients develop a long-term approach to their financial security that can fund their children's education or provide... -

Page 13

... Operating Officer, Option One M ortgage " H&R Block M ortgage's total loan origination volume increased 30 percent in fiscal year 2005 to $4 billion." M ORTGAGE LOANS M ADE TO H&R BLOCK TAX CLIENTS 2005 10,386 2004 8,905 11 H&R Block CANDY WEDLOW > > > She believed she couldn't aff ord a home... -

Page 14

...Block Financial Advisors " We opened more than 18,000 new f inancial account s t his year as a result of client referrals from H&R Block tax professionals." H&R BLOCK FINANCIAL ADVISORS AND TAX CLIENT ASSETS 2005 $3.7 billion 2004 $2.9 billion 2003 $2.1 billion Represents H&R Block Financial... -

Page 15

... ood A We're using a mix of training, technology and relationship-building programs to continue to increase the percentage of tax clients who have access to our mortgage services. Our loan consultants work closely with tax professionals to best meet our clients' overall financial needs, and they... -

Page 16

... ith RSM M cGladrey as a provider that can serve a broad range of their business service needs, making this our most successful year ever." Chargeable Hours Per Person 1,388 1,414 Net Billed Rat e Per Hour $133 $120 $124 Average M argin Per Person $97,117 $102,496 $112,573 2003 2004 2005 -

Page 17

...Q Your core tax and accounting services grew double digits this year. What's driving this? A Our focus on middle-market clients is paying off. With the industry-wide demand for services related to the Sarbanes-Oxley Act of 2002 (SOX), many middle-market businesses are looking for a firm that will be... -

Page 18

... for business advisory and consulting services. Not only has SOX resulted in more risk management work, most of our SOX projects during the past year were for first-time clients who more closely match our targeted client profile. 16 Q Your industry is experiencing a shortage of accountants, with... -

Page 19

... >>> Chief Operating Officer, Emerging Businesses, RSM M cGladrey " Our emerging businesses are important building blocks in enabling RSM M cGladrey to become the premier provider of financially focused business services to midsized companies." FINANCIAL PROCESS OUTSOURCING Auto Parts Stores - No... -

Page 20

... Providing Superior Service. Opt ion One M ORTGAGE LOANS FUNDED 2005 195,392 18 2004 2003 2002 155,339 115,841 89,333 BOB DUBRISH >>> President and Chief Executive Officer, Option One M ortgage " 2005 w as a competitive year in t he mort gage business. Our strategy of differentiating Option One... -

Page 21

... is low, our sales force builds on that knowledge each year, maintaining our high levels of service even as we add new sales associates. Q Why did you increase the number of active mortgage brokers licensed to work with Option One? A In the wholesale business, mortgage brokers are our customers. By... -

Page 22

...balance sheet. So our financial risk becomes limited to that extent. Investors know our servicing team is one of the industry's best, which is a key reason why they often put a premium on our loans. This division is very focused on working with borrowers to find solutions to keep them in their homes... -

Page 23

...Option One customer Irvine, California >>> RUTHE M ONTGOM ERY >>> Because she's worked in the customer service indust ry 25 years, Ruthe Montgomery knows good service. When Opt ion One began servicing Rut he's home loan, t he company had t o live up t o pret t y high st andards. Rut he's assessment... -

Page 24

..., Option One M ortgage Corp. STEVEN TAIT >>> President, RSM M cGladrey Business Services Inc. JOAN COHEN >>> Executive Vice President, H&R Block Financial Advisors Inc. BRAD C. IVERSEN >>> Senior Vice President and Chief M arketing Officer TAM M Y S. SERATI >>> Senior Vice President, Human Resources... -

Page 25

... Year Ended April 30 2005 2004 2003 2002 2001 FEE AND CLIENT DATA > > > Tax preparation and related fees: United States Canada Australia Other Clients served: United States (1) Canada Australia NUM BER OF TAX OFFICES > > > By country: United States Canada Australia Other By type: Company... -

Page 26

-

Page 27

... ï¬xed the close of business on July 5, 2005 as the record date for determining shareholders of the Company entitled to notice of and to vote at the meeting. By Order of the Board of Directors BRET G. WILSON Secretary Kansas City, Missouri August 12, 2005 A proxy for the annual meeting is enclosed... -

Page 28

-

Page 29

...Main Street), Kansas City, Missouri. This Proxy Statement contains information about the matters to be voted on at the meeting and the voting process, as well as information about our directors and executive ofï¬cers. H&R BLOCK 2005 Proxy Statement WHY DID I RECEIVE THIS PROXY STATEMENT? The Board... -

Page 30

...Mellon Investor Services'') you are considered, with respect to those shares, the ''shareholder of record.'' The proxy statement, annual report and proxy card have been made available directly to shareholders of record by the Company. If your shares are held in a stock brokerage account or by a bank... -

Page 31

... are a beneï¬cial owner, please refer to the information provided by your broker, bank or nominee for instructions on how to access future proxy statements and annual reports on the Internet. HOW MUCH DID THIS PROXY SOLICITATION COST? The Company has retained Mellon Investor Services to assist in... -

Page 32

... careers, Mr. Bloch had a 19-year career with the H&R Block organization, resigning as President and Chief Executive Ofï¬cer of the Company in 1995. Mr. Bloch graduated from Claremont McKenna College in Claremont, California in 1976. He is a member of the Finance Committee of the Board of Directors... -

Page 33

... Chief Executive Ofï¬cer of BATUS, Inc., where he was responsible for the company's extensive U.S. holdings in retailing, ï¬nancial services, tobacco and paper. His previous business experience covers a variety of operating, management and board positions with companies such as Masco Corporation... -

Page 34

... Austin in 1974 and attended the University of Pittsburgh's Management Program for Executives in October 1987. Mr. Wilkins is a member of the Audit, Finance and Governance and Nominating Committees of the Board of Directors. H&R BLOCK 2005 Proxy Statement Louis W. Smith Director since 1998 Age 62... -

Page 35

... Committee Report on Executive available in print to shareholders upon written request to: Compensation'' beginning on page 13. Corporate Secretary, H&R Block, Inc., 4400 Main St., Kansas City, The Finance Committee, whose members are Mr. Frigon Missouri 64111. Set forth below is a description of... -

Page 36

...-employee directors free income tax return preparation services at an H&R Block ofï¬ce of their choice, a ï¬fty percent discount on tax preparation services from RSM McGladrey, Inc. and free business travel insurance in connection with Company-related travel. CORPORATE GOVERNANCE ϾϾϾ Our Board... -

Page 37

...with an individual Board member concerning the Company may do so by writing to the Board, to the non-management directors, or to the particular Board member, and mailing to the correspondence to: Ofï¬ce of the Chief Legal Ofï¬cer, H&R Block, Inc., 4400 Main Street, Kansas City, Missouri 64111. The... -

Page 38

... revenues, (c) sales of shareholders of the corporation must approve the material terms products, services or accounts, (d) numbers of income tax of the performance goals under which such compensation is to be returns prepared, (e) margins, (f) earnings per share, (g) return paid. The Plan satisfies... -

Page 39

...cer, Option One Mortgage Corporation Jeffery W. Yabuki, Executive Vice President and Chief Operating Ofï¬cer Steven Tait President, RSM McGladrey Business Services, Inc. Nicholas J. Spaeth Senior Vice President and Chief Legal Ofï¬cer All Executive Ofï¬cers Award H&R BLOCK 2005 Proxy Statement... -

Page 40

... ABSENCE OF questions and will have an opportunity to make a statement if he INSTRUCTIONS TO THE CONTRARY. or she so desires. For additional information regarding the Company's relationship with KPMG LLP, please refer to the ''Audit Committee Report'' below. H&R BLOCK 2005 Proxy Statement 12 AUDIT... -

Page 41

... the Company's ï¬nancial statements or that are traditionally performed by the independent auditor. Tax Fees consist of fees for the preparation of original and amended tax returns, claims for refunds and tax paymentplanning services for tax compliance, tax planning, tax consultation and tax advice... -

Page 42

... in most cases in ï¬scal year 2005) is placed upon the Financial STI Component, which speciï¬cally relates executive pay to Company performance. Under the STI Program, the Committee reviews and the Board approves ï¬nancial-performance goals and individual target bonus awards. Short-term incentive... -

Page 43

... of the Company's shareholders. Under the Company's 2003 Long-Term Executive Compensation Plan, option exercise prices are set at 100% of the fair market value of the stock on the date of grant and the options expire after ten years. Options granted to executive ofï¬cers in ï¬scal year 2005 become... -

Page 44

... Section 162(m) of the Internal Revenue Code limits to $1 million the Company's federal income tax deduction for compensation paid to any one executive ofï¬cer named in the Summary Compensation Table of the Company's proxy statement, subject to certain transition rules and exceptions for speciï¬ed... -

Page 45

... Executive Ofï¬cer, Option One Mortgage Corporation Jeffery W. Yabuki, Executive Vice President and Chief Operating Ofï¬cer Steven Tait President, RSM McGladrey Business Services, Inc. Nicholas J. Spaeth Senior Vice President and Chief Legal Ofï¬cer Fiscal Year 2005 2004 2003 2005 2004 2003 2005... -

Page 46

...year 2005. Options were granted under the 2003 Long-Term Executive Compensation Plan. The exercise price for each option is the fair market value of a share of Common Stock on the date of grant. Options granted to the Named Ofï¬cers become exercisable one year after the date of grant, at which time... -

Page 47

... unexercised options as of such date for the Named Ofï¬cers. The information provided does not reï¬,ect the two-for-one stock split effective August 22, 2005. The value of unexercised in-the-money options at ï¬scal year-end is calculated by determining the difference between the fair market value... -

Page 48

... $100 was invested at the market close on April 30, 2000 and that dividends were reinvested. The data for the graph was furnished by Research Data Group, Inc. 300 250 H&R BLOCK 2005 Proxy Statement D 200 O L 150 L A R 100 S 50 H&R BLOCK, INC. S & P 500 S & P DIVERSIFIED COMMERCIAL SERVICES 20... -

Page 49

... 22, 2005. The Company currently has four stock-based compensation plans: the 2003 Long-Term Executive Compensation Plan, the 1989 Stock Option Plan for Outside Directors, the 1999 Stock Option Plan for Seasonal Employees, and the 2000 Employee Stock Purchase Plan. The shareholders have approved all... -

Page 50

... either on the effective date of the Agreement or on Mr. Tait's last day of employment. As of the effective date, the Severance Plan provides maximum compensation of 18 months of salary and one twelfth of the target payout under the STI Program multiplied by Mr. Tait's years of service, as well as... -

Page 51

... shareholders of a liquidation or dissolution of the Company. Brian L. Nygaard, H&R Block, Inc., and H&R Block Financial Advisors, Inc. (''HRBFA'') entered into a Termination Agreement INFORMATION REGARDING SECURITY HOLDERS SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT ϾϾϾ dated January 7, 2005... -

Page 52

... H&R BLOCK 2005 Proxy Statement 24 Less than 1% Includes shares that on June 1, 2005 the speciï¬ed person had the right to purchase as of June 30, 2005 pursuant to options granted in connection with the Company's 1989 Stock Option Plan for Outside Directors or the Company's Long-Term Executive... -

Page 53

... Main Street, Kansas City, Missouri 64111, Attention: Corporate Secretary, on or before March 31, 2006. Applicable Securities and Exchange Commission rules and regulations govern the submission of shareholder proposals and our consideration of them for inclusion in next year's proxy statement and... -

Page 54

... request to: H&R Block, Inc., 4400 Main Street, Kansas City, Missouri 64111, Attention: Corporate Secretary. The Chairman of the meeting may exclude matters that are not properly presented in accordance with the foregoing requirements. H&R BLOCK 2005 Proxy Statement The Board of Directors knows of... -

Page 55

...any time during the three years immediately preceding the date of determination, the director (or any of the director's immediate family) received more than $100,000 per year in direct compensation from the Company other than (i) director or committee fees (including fees for service on the board of... -

Page 56

H&R BLOCK 2005 Proxy Statement A-2 (This page intentionally left blank) -

Page 57

... Targets established by the Committee each year shall be based of one or more of the following business criteria: (a) earnings, (b) revenues, (c) sales of products, services or accounts, (d) numbers of income tax returns prepared, (e) margins, (f) earnings per share, (g) return on equity, (h) return... -

Page 58

...subject to approval by the Company's shareholders at the Company's 1996 annual meeting of shareholders, and shall remain in effect until such time as it shall be terminated by the Board of Directors of the Company. If approval of the Plan meeting the requirements of Section 162(m) of the Code is not... -

Page 59

... Regulations promulgated thereunder, notwithstanding any other provisions of the Plan to the contrary. SECTION 3.8 GOVERNING LAW ϾϾϾ The Plan and all rights and Awards hereunder shall be construed in accordance with and governed by the laws of the State of Missouri. B-3 H&R BLOCK 2005 Proxy... -

Page 60

-

Page 61

... Block, Inc. (Exact name of registrant as specified in its charter) MISSOURI (State or other jurisdiction of incorporation or organization) 44-0607856 (I.R.S. Employer Identification Number) 4400 Main Street, Kansas City, Missouri 64111 (Address of principal executive offices, including zip code... -

Page 62

H&R BLOCK 2005 FORM 10-K AND ANNUAL REPORT TABLE OF CONTENTS Introduction and Forward Looking Statements PART I Item 1. Business General Development of Business Description of the Business Tax Services Mortgage Services Business Services Investment Services Service Marks, Trademarks and Patents ... -

Page 63

... to better meet the changing financial needs of our clients. H&R Block, Inc. was organized as a corporation in 1955 under the laws of the State of Missouri, and is a holding company with within our Annual Report and mailed to shareholders in August 2005 and will also be available on our website at... -

Page 64

... the income tax return information to the IRS and the lending bank. Within a few days or less after the filing date, the client receives a check or direct deposit in the amount of the loan, less the bank's transaction fee, our tax return preparation fee and other fees for client-selected services... -

Page 65

...com. These websites allow clients to prepare their federal and state income tax returns using the Online Tax Program (''OTP''), access tax tips, advice and tax-related news and use calculators for tax planning. Beginning with the fiscal year 2003 tax season, we participated in the Free File Alliance... -

Page 66

... filed in offices, online and via our software, we are the largest company providing direct tax return preparation and electronic filing services in the U.S. We also believe we operate the largest tax return preparation businesses in Canada and Australia. The Digital Tax Solutions businesses compete... -

Page 67

... inquiries regarding the applicability of Foreign Laws may have on our segments, any particular subsidiary, or our consolidated financial statements. Statutes and regulations relating to income tax return preparers, electronic filing, franchising and other areas affecting 5 H&R BLOCK 2005 Form 10K -

Page 68

... regarding their assets, liabilities, income, credit history, employment history and personal information. We require a credit report on each applicant from an industry-recognized credit reporting company. In evaluating an applicant's credit history, we use credit bureau risk scores, generally... -

Page 69

... sectors of the residential mortgage loan market are highly competitive. The principal methods of competition are price, service and product differentiation. There are a substantial number of companies competing in the residential loan market, including mortgage banking companies, commercial banks, -

Page 70

... Our Business Services segment offers middlemarket companies accounting, tax and consulting services. We have continued to expand the services we offer our clients by adding wealth management, retirement resources, payroll services, corporate finance and financial process outsourcing. loans to... -

Page 71

...firm, provides audit and review services and other services in which M&P issues written reports on client financial statements. Through an administrative services agreement with M&P, we provide accounting, payroll, human resources and other administrative services to M&P and receive a management fee... -

Page 72

... cash management features, and a comprehensive line of insurance annuity products. Clients may also open professionally managed accounts. As previously discussed in ''Tax Services,'' we offer our tax clients the opportunity to open an Express IRA through HRBFA as a part of the tax return preparation... -

Page 73

...growth and client satisfaction. COMPETITIVE CONDITIONS ϾϾϾ HRBFA competes directly with a broad range of companies seeking to attract consumer financial assets, including full-service brokerage firms, discount and online brokerage firms, mutual fund companies, investment banking firms, commercial... -

Page 74

... our access to these funds. To meet our future financing needs, we may issue additional debt or equity securities. LITIGATION ϾϾϾ We are involved in lawsuits in the normal course of our business related to RALs, our Peace of Mind guarantee program, electronic filing of tax returns, Express IRAs... -

Page 75

... offices, online and software channels could adversely affect our current market share and limit our ability to grow our client base. See clients served statistics included in Item 7, under ''Tax Services.'' REFUND ANTICIPATION LOANS ϾϾϾ Changes in government regulation related to RALs could... -

Page 76

... Charter. If you would like a printed copy of any of these corporate governance documents, please send your request to the Office of the Secretary, H&R Block, Inc., 4400 Main Street, Kansas City, Missouri 64111. Information contained on our website does not constitute any part of this report. -

Page 77

...building will be located in downtown Kansas City, Missouri and we expect it to be completed in fiscal year 2007. All current leased and owned facilities are in good repair and adequate to meet our needs. H&R BLOCK 2005 Form 10K certification. Other cases were settled, with one settlement resulting... -

Page 78

...' claims consist of five counts relating to the POM program under which the applicable tax return preparation subsidiary assumes liability for additional tax assessments attributable to tax return preparation error. The plaintiffs allege that the sale of POM guarantees constitutes (i) statutory... -

Page 79

...Other Claims'') concerning investment products, the preparation of customers' income tax returns, the fees charged customers for various products and services, losses incurred by customers with respect to their investment accounts, relationships with franchisees, denials of mortgage loans, contested... -

Page 80

... Results of Operations reflects the investment, mortgage and business services and products. We are restatement of previously issued financial statements, as the only major company offering a full range of software, online discussed in Item 8, note 2 to our consolidated financial and in-office tax... -

Page 81

... expansion of our national accounting, tax and consulting business, add extended services to middle-market companies and enhance our client service culture. ½ Investment Services - work to align the segment's cost structure with its revenues, attract and retain productive advisors, serve the broad... -

Page 82

... is based on a discounted cash flow approach and market comparables, when available. This analysis, at the reporting unit level, requires significant management judgment with respect to revenue and expense growth rates, changes in working capital, and the selection and application of an appropriate... -

Page 83

...years 2005 or 2004. In fiscal year 2003, a goodwill impairment charge of $108.8 million was recorded in the Investment Services segment due to unsettled market conditions. Also during 2003, our annual impairment test resulted in an impairment of $13.5 million for a reporting unit within the Business... -

Page 84

...(4) Average fee per client served Company-owned offices Franchise offices RALs ϾϾϾ Company-owned offices Franchise offices Digital tax solutions: Software Online (6) (5) Tax Services - Financial Results Year ended April 30, Service revenues: Tax preparation and related fees Online tax services... -

Page 85

... from the prior year. Tax preparation and related fees increased $129.4 million, or 8.1%. This increase is primarily due to an 8.1% increase in the average fee per U.S. client served, resulting from increases in our pricing and the complexity of returns prepared. Online service revenues increased... -

Page 86

... H&R BLOCK 2005 Form 10K associated with RAL participations, which was not incurred in the prior year due to the waiver agreement. Intangible amortization increased $9.0 million from the acquisition of assets of former major franchisees. Marketing costs increased $20.7 million as a result of... -

Page 87

...non-prime and prime mortgage loans through a retail office network, the sale and securitization of mortgage loans and residual interests, and the servicing of non-prime loans. Mortgage Services - Operating Statistics Year Ended April 30, Volume of loans originated ϾϾϾ Wholesale (non-prime) Retail... -

Page 88

... Gain on sales of residual interests Impairment of residual interests H&R BLOCK 2005 Form 10K Interest income: Accretion-residual interests Other Loan-servicing revenue Other Total revenues Cost of services Cost of non-service revenues: Compensation and benefits Occupancy Other Selling, general and... -

Page 89

... income to gains on sales for fiscal year 2003. In November 2002, we completed the sale of previously securitized residual interests and recorded a gain of $93.3 million. 27 H&R BLOCK 2005 Form 10K Year Ended April 30, Average servicing portfolio: With related MSRs Without related MSRs 2005... -

Page 90

....0%, over the prior year. Compensation and benefits increased $43.6 million as a result of a 22.9% increase in the number of employees, reflecting resources needed to support higher loan production volumes. Occupancy expenses increased due to nine additional branch offices opened since October 2002... -

Page 91

... rate per hour Average margin per person 2005 2004 2003 2,898 1,430 $ 133 $ 112,573 2,598 1,414 $ 124 $ 102,496 $ $ 2,584 1,388 120 97,117 (in 000s) Business Services - Financial Results Year ended April 30, Service revenues: Accounting, tax and consulting Capital markets Payroll, benefits and... -

Page 92

... (millions) Average customer payables balances (millions) Number of advisors Included in the numbers above are the following relating to fee-based accounts: Customer accounts Average revenue per account Assets under administration (millions) Average assets per active account (1) consulting business... -

Page 93

... 2005, compared to 38.0% in the prior year. Advisor productivity averaged approximately $166,000 in the current year, essentially flat compared to the prior year. Other service revenue declined $6.4 million, or 18.0%, from the prior year due to fewer fixed income underwriting offerings and Express... -

Page 94

... business initiatives subsidiary in fiscal years 2004 and 2003. Corporate - Financial Results H&R BLOCK 2005 Form 10K Year Ended April 30, Operating revenues Eliminations Total revenues Corporate expenses: Interest expense Other Support departments: Marketing Information technology Finance Other... -

Page 95

... to fund mortgage loans. FISCAL YEAR 2006 OUTLOOK ϾϾϾ We began construction on a new world headquarters facility during fiscal year 2005. Estimated construction costs during fiscal year 2006 of $103.5 million will be financed from operating cash flows. Our Board of Directors approved an... -

Page 96

... to the segment's pretax results. Revenues related to the RAL program totaled $174.2 million for the year ended April 30, 2004, representing 4.1% of consolidated revenues. Our international operations are generally self-funded. Cash balances are held in Canada, Australia and the United Kingdom... -

Page 97

... these letters of credit at any time during fiscal year 2005 or 2004. Liquidity needs relating to client trading and margin-borrowing activities are met primarily through cash balances in client brokerage accounts and working capital. We believe these sources of funds will continue to be the primary... -

Page 98

... was 76% whole loan sales and 24% securitizations. The current year shift to whole loan sales is due to the more favorable pricing in the whole loan market. Increased whole loan sale transactions result in cash being received earlier. Additionally, whole loan sales do not add residual interests to... -

Page 99

... as a result of the proposed rules. H&R BLOCK 2005 Form 10K The following chart provides the debt ratings for Block Canada as of April 30, 2005 and 2004: Short-term DBRS Moody's R-1 (low) P2 Corporate A Trend Stable We use capital primarily to fund working capital requirements, pay dividends... -

Page 100

... consolidated balance sheets. A summary of our commitments as of April 30, 2005, which may or may not require future payments, expire as follows: (in 000s) Total Commitments to fund mortgage loans Commitments to sell mortgage loans Pledged securities Commitment to fund M&P Franchise Equity Lines... -

Page 101

... ordinances, and/or adopted rules and regulations, regulating aspects of our business. These aspects include, but are not limited to, commercial income tax return preparers, income tax courses, the electronic filing of income tax returns, the facilitation of RALs, loan originations and assistance in... -

Page 102

... are managed at the subsidiary level. Our cash equivalents are primarily held for liquidity purposes and are comprised of high quality, short-term investments, including qualified money market funds. As of April 30, 2005, our non-restricted cash and cash equivalents had an average maturity... -

Page 103

... therefore not recorded in our financial statements. Forward loan sale commitments lock in the execution price on the loans that will ultimately be delivered into a whole loan sale. With $8.7 billion of forward loan sale commitments at April 30, 2005 (and the option to adjust the commitment amount... -

Page 104

... all employees and directors in living up to high standards of integrity. The Audit Committee of the Board of Directors, composed solely of outside and independent directors, meets periodically with management, the independent auditors and the chief internal auditor to review matters relating to... -

Page 105

... consolidated balance assessing the accounting principles used and significant sheets of H&R Block, Inc. and its subsidiaries (the Company) as estimates made by management, as well as evaluating the overall of April 30, 2005 and 2004, and the related consolidated financial statement presentation... -

Page 106

...of the Treadway Commission (''COSO''), and our report dated July 29, 2005 expressed an unqualified opinion on management's assessment of, and an adverse opinion on the effective operation of, internal control over financial reporting. Kansas City, Missouri July 29, 2005, except as to note 19, which... -

Page 107

... Organizations of the Treadway Commission (''COSO''). Kansas City, Missouri July 29, 2005 H&R BLOCK 2005 Form 10K REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ϾϾϾ To the Board of Directors and Shareholders of H&R Block, Inc.: evidence supporting the amounts and disclosures in the... -

Page 108

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in 000s, except per share amounts) Year ended April 30, REVENUES ϾϾϾ Service revenues Other revenues: Gains on sales of mortgage assets, net Product and other revenues Interest income H&R BLOCK 2005 Form 10K 2005 $ 2,920,586 ... -

Page 109

...to customers, brokers and dealers Accounts payable, accrued expenses and other Accrued salaries, wages and payroll taxes Accrued income taxes Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities COMMITMENTS AND CONTINGENCIES STOCKHOLDERS' EQUITY ϾϾϾ Common stock... -

Page 110

... customers, brokers and dealers Accounts payable, accrued expenses and other Accrued salaries, wages and payroll taxes Accrued income taxes Other, net Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES ϾϾϾ Available-for-sale securities: Purchases of available-for-sale... -

Page 111

... (6,439) 44,139 140,155 380 6,528 (530,022) (142,988) H&R BLOCK 2005 Form 10K Balances at April 30, 2002 (2) Net income (2) Unrealized translation gain Change in net unrealized gain on marketable securities (2) Shares issued for: Stock options Restricted shares ESPP Acquisition of treasury shares... -

Page 112

... mortgages; investment services through a broker-dealer; tax preparation and related software; refund anticipation loans offered by a third-party lending institution; and accounting, tax and consulting services to business clients. Tax preparation services are also provided in Canada, Australia and... -

Page 113

... the sale. The MSRs are carried at the lower of cost or fair value. Fair values of MSRs are determined based on the present value of estimated future cash flows related to servicing loans. Assumptions used in estimating the value of MSRs include market discount rates and 51 H&R BLOCK 2005 Form 10K -

Page 114

... year basis. REVENUE RECOGNITION ϾϾϾ Service revenues consist primarily of fees for preparation and filing of tax returns, both in offices and through our online programs, fees associated with our POM guarantee program, mortgage loan-servicing fees, fees for consulting services and brokerage... -

Page 115

... in which the franchise provides the service. RAL participation revenue is recorded when we purchase our participation interest in the RAL. Software revenues consist mainly of tax preparation software and other personal productivity software. Sales of software are recognized when the product is sold... -

Page 116

... result of the proposed rules. The estimated impact of these new accounting standards reflects current views. There may be material differences between these estimates and the actual impact of these standards. NOTE 2: RESTATEMENT OF PREVIOUSLY ISSUED FINANCIAL STATEMENTS On June 7, 2005, management... -

Page 117

... in fiscal year 2003. ½ Restatement adjustments pertaining to income taxes relate primarily to purchase accounting restatement adjustments described above. Notes 4, 5, 6, 7, 8, 11, 15, 16, 17, 20, 21 and 22 have been restated to reflect the above described adjustments. 55 H&R BLOCK 2005 Form 10K -

Page 118

... 30, As Previously Reported(1) Gains on sales of mortgage assets, net Interest income Total revenues Cost of service revenues Cost of other revenues Impairment of goodwill Selling, general and administrative Total operating expenses Operating income Income before taxes Income taxes Net income Basic... -

Page 119

... previously securitized residual interests Impairment of goodwill Accounts payable, accrued expenses and deposits Accrued salaries, wages and payroll taxes Accrued income taxes Net cash provided by operating activities Purchases of property and equipment, net Net cash provided by (used in) investing... -

Page 120

... Noncompete agreements Weighted average life $ 243,246 Accounting firms Fiscal year 2003 ϾϾϾ Accounting firms 58 Goodwill Customer relationships Noncompete agreements Weighted average life During fiscal year 2005, our Business Services segment acquired six businesses. Cash payments related... -

Page 121

...603 2.02 1.98 $ Restated 2003 $ 477,615 H&R BLOCK 2005 Form 10K 359,276 8,878 1 368,155 1.33 1.30 NOTE 5: MARKETABLE SECURITIES AVAILABLE-FOR-SALE The amortized cost and market value of marketable securities classified as available-for-sale at April 30, 2005 and 2004 are summarized below: (in 000s... -

Page 122

... loans are sold in whole loan sales, servicing released, to third-party buyers. Activity related to residual interests in securitizations consists of the following: (in 000s) H&R BLOCK 2005 Form 10K April 30, Balance, beginning of year Additions (resulting from NIM transactions) Cash received Cash... -

Page 123

... Discount rate - MSRs Variable returns to third-party beneficial interest holders 2005 2004 H&R BLOCK 2005 Form 10K 3.03% 4.16% 21.01% 19.09% 12.80% 12.80% LIBOR forward curve at valuation date We originate both adjustable and fixed rate mortgage loans. A key assumption used to estimate the cash... -

Page 124

...158) (10,023) (9,991) (20,700) Not applicable Not applicable $ (2,175) (4,301) $ $ 62 $ (36,552) (73,646) Not applicable Not applicable Mortgage loans which have been securitized at April 30, 2005 and 2004, past due sixty days or more and the related net credit losses are presented below: (in... -

Page 125

...year 2003. Also during 2003, our annual impairment test resulted in an impairment of $13.5 million for a reporting unit within the Business Services segment. No other impairments were identified. The goodwill and intangible assets previously included in Corporate... H&R BLOCK 2005 Form 10K Accumulated ... -

Page 126

... fiscal year 2004, we recognized $6.5 million of revenues related to this instrument. The final settlement in accordance with this agreement was received in January 2004. None of our derivative instruments qualify for hedge accounting treatment as of April 30, 2005 and 2004. H&R BLOCK 2005 Form 10K -

Page 127

... shares, 0.6 million shares have been designated as Participating Preferred Stock in connection with our shareholder rights plan. short-term borrowings that initially funded the acquisition of OLDE Financial Corporation and Financial Marketing Services, Inc. On October 21, 1997, we issued $250... -

Page 128

...the 1989 Stock Option Plan following three years. In addition, certain option grants have for Outside Directors, the 1999 Stock Option Plan for Seasonal accelerated vesting provisions based on our stock price reaching Employees, and the 2000 ESPP. The shareholders have approved specified levels. all... -

Page 129

... ESPP provides the option to purchase shares of our Common Stock through payroll deductions to a majority of the employees of our subsidiaries. The purchase price of the stock is 90% of the lower of either the fair market value of our Common Stock on the first trading day within the Option Period or... -

Page 130

....4 million, $28.9 million and $20.7 million for fiscal years 2005, 2004 and 2003, respectively. H&R BLOCK 2005 Form 10K 68 NOTE 14: SHAREHOLDER RIGHTS PLAN On July 25, 1998, the rights under a shareholder rights plan, adopted by our Board of Directors on March 25, 1998, became effective. The 1998... -

Page 131

... Other Total income tax expense Effective tax rate 2005 $ 356,200 Restated 2004 $ 407,041 Restated 2003 $ 299,447 H&R BLOCK 2005 Form 10K Deferred income tax provisions (benefits) reflect the future tax consequences attributable to differences between the financial statement carrying amounts... -

Page 132

... an annual facility fee of twelve basis points per annum. Among other provisions, the credit agreement limits our indebtedness. We maintain a revolving credit facility in an amount not to exceed $125.0 million (Canadian) in Canada to support a commercial paper program with varying borrowing levels -

Page 133

... per client limit of $5,000, attributable to tax return preparation error for which we are responsible. We defer all revenues and direct costs associated with these guarantees, recognizing these amounts over the term of the guarantee based upon historic and actual payment of claims. The related... -

Page 134

... 30, 2005. We are self-insured for certain risks, including certain employee health and benefit, workers' compensation, property and general liability claims, and claims related to our POM program. We issued three standby letters of credit to servicers paying claims related to our POM, errors and... -

Page 135

... market and competition. H&R BLOCK 2005 Form 10K As a result of the May 26, 2005 court ruling to deny the settlement offer, we reversed our legal reserves to amounts representing our assessment of our probable loss. We are also parties to claims and lawsuits pertaining to our electronic tax return... -

Page 136

... Block Financial Advisors branch offices. CORPORATE ϾϾϾ This segment consists primarily of corporate support departments that provide services to our operating segments. These support departments consist of marketing, information technology, facilities, human resources, executive, legal, finance... -

Page 137

...of our previously issued financial statements. (in 000s) Year Ended April 30, REVENUES ϾϾϾ Tax Services Mortgage Services Business Services Investment Services Corporate INCOME (LOSS) BEFORE TAXES ϾϾϾ Tax Services Mortgage Services Business Services Investment Services Corporate 2005 $ 2,358... -

Page 138

...,692 .28 .27 As Restated January 31, 2005 $ 1,036,236 153,278 57,513 $ $ $ 95,765 .29 .29 H&R BLOCK 2005 Form 10K Fiscal Year 2005 Quarter Ended Revenues Income before taxes Income taxes Net income Basic earnings per share Diluted earnings per share As Reported October 31, 2004 $ 539,255 (85,924... -

Page 139

...for a detailed description of each Fiscal Year 2005 Quarter Ended Impact on Purchase accounting Sales of previously securitized residual interests Lease accounting Incentive compensation accrual Improper capitalization Income tax (benefit) Net income January 31, 2005 Revenues Pretax Income $ - 4,229... -

Page 140

Fiscal Year 2004 Quarter Ended Impact on Purchase accounting Sales of previously securitized residual interests Lease accounting Incentive compensation accrual Improper capitalization Income tax (benefit) Net income October 31, 2003 Revenues Pretax Income $ - 4,395 - - - $ (1,831) 4,395 (216) (3,... -

Page 141

...635,857 H&R BLOCK 2005 Form 10K Operating income Interest expense Other income, net Income before taxes Income taxes Net income - - 1,017,715 1,017,715 381,858 $ 635,857 Year Ended April 30, 2004 (as restated) Revenues Expenses: Cost of service revenues Cost of other revenues Selling, general and... -

Page 142

... $ 477,615 Operating income Interest expense H&R BLOCK 2005 Form 10K Other income, net Income before taxes Income taxes Net income - - 855,564 855,564 377,949 $477,615 CONDENSED CONSOLIDATING BALANCE SHEETS (in 000s) 80 April 30, 2005 Cash & cash equivalents Cash & cash equivalents - restricted... -

Page 143

...214,872) H&R BLOCK 2005 Form 10K $4,214,534 $ 2,208,973 $(4,214,872) CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS (in 000s) Year Ended April 30, 2005 Net cash provided by operating activities: Cash flows from investing activities: Cash received on residual interests Purchases of property... -

Page 144

... investing activities: Cash received on residual interests Sales of residual interests in securitizations Purchases of property & equipment, net Payments made for business acquisitions Net intercompany advances Other, net Net cash provided by (used in) investing activities Cash flows from financing... -

Page 145

... our assessment, management determined that a material weakness existed in the Company's internal controls over accounting for income taxes as of April 30, 2005. Specifically, the Company did not maintain sufficient resources in the corporate tax function to accurately identify, evaluate and report... -

Page 146

... all tax related financial statement account balances as of this Form 10-K filing date. The Company believes it has established appropriate controls and procedures and created the appropriate tax account analysis and support subsequent to April 30, 2005. In addition to the above actions, management... -

Page 147

... Catamount Marketing in 2002; Executive Vice President and Director of Marketing at Bank One Corporation from 1997 to 2002. Vice President, Communications since July 1999. H&R BLOCK 2005 Form 10K William L. Trubeck, age 58 Executive Vice President and Chief Financial Officer Jeffery W. Yabuki... -

Page 148

... in our Form 8-K dated July 5, 2005, Melanie K. Coleman resigned as Vice President and Corporate Controller of the Company, effective July 31, 2005. H&R BLOCK 2005 Form 10K ITEM 11. EXECUTIVE COMPENSATION The information called for by this item is contained in our definitive proxy statement filed... -

Page 149

...the related Reports of Independent Registered Public Accounting Firms. These will be filed with the SEC but will not be included in the printed version of the Annual Report to Shareholders. 3. Exhibits: The list of exhibits in the Exhibit Index to this Report is incorporated herein by reference. The... -

Page 150

... Chairman of the Board, President and Chief Executive Officer H&R BLOCK 2005 Form 10K Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated on July... -

Page 151

... herein by reference. Form of 1989 Stock Option Plan for Outside Directors Stock Option Agreement, filed as Exhibit 10.9 to the Company's annual report on Form 10-K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. H&R BLOCK 2005 Form 10K 3.2 10.1* 3.3 10... -

Page 152

... and Restated Refund Anticipation Loan Operations Agreement dated as of June 9, 2003, between H&R Block Services, Inc., Household Tax Masters, Inc. and Beneficial Franchise Company, filed as Exhibit 10.27 to the annual report on Form 10-K for the fiscal year ended April 30, 2003, file number 1-6089... -

Page 153

... the Company's annual report on Form 10-K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. Amended and Restated Sale and Servicing Agreement dated as of March 18, 2005, among Option One Owner Trust 2002-3, Option One Loan Warehouse Corporation, Option One Mortgage... -

Page 154

... report on Form 10-K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. Sale and Servicing Agreement dated as of August 8, 2003 among Option One Owner Trust 2003-4, Option One Loan Warehouse Corporation, Option One Mortgage Corporation and Wells Fargo Bank, National... -

Page 155

...Funding Corporation, financial institutions thereto and Bank One, NA, filed as Exhibit 10.70 to the Company's annual report on Form 10K for the year ended April 30, 2005, file number 1-6089, is incorporated by reference. Amendment No. 5 to Note Purchase Agreement dated January 31, 2005, among Option... -

Page 156

... our shareholders a copy of our 2005 Form 10-K as filed with the Securities and Exchange Commission. Requests should be directed to Investor Relations, 800-869-9220, ext. 2721, or by mail to 4400 Main Street, Kansas City, Missouri 64111. Client photos and information included in this Annual Report... -

Page 157

H&R Block Inc. 4400 M ain Street Kansas City, M O 64111 816.753.6900 w w w.hrblock.com