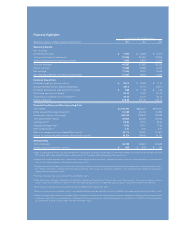

Goldman Sachs 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We see opportunity

In extending

our reach

BOVESPA HOLDING S.A.

In 2007, Goldman Sachs made a

series of significant commitments

to building our presence in Brazil.

We established a bank and

supported the management team

with important new hires and

transfers. We have built upon our

long history as one of the

country’s premier M&A advisors

to become a diversified provider

of products and services, including

Fixed Income, Currency and

Commodities, Asset Management,

Research, Principal Investing,

Corporate Finance and Equities.

In 2007, we participated as the

lead bookrunner in the country’s

largest recorded IPO for

BOVESPA Holding, which

controls the São Paulo Stock

Exchange. The IPO was the

culmination of over a year of

working as an exclusive advisor

to BOVESPA Holding during its

demutualization and preparation

to become a publicly traded entity.

In preparation for the IPO,

Goldman Sachs worked with the

BOVESPA Holding management

board to develop a profile that

would appeal to a broad base of

international investors. Key to the

success of the offering was helping

them demonstrate how their

evolving culture supported the

financial disclosure, compliance

and independent board oversight

practices expected by the global

investment community. Our

commitment throughout the

process, from the demutualization

to the pricing of the IPO, is an

important factor in our efforts to

grow our franchise in new markets

through strong client relationships

and innovative services.

11Goldman Sachs 2007 Annual Report