General Dynamics 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 General Dynamics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Jay L. Johnson

Chairman and

Chief Executive Officer

General D y nam i cs Annual Repor t 2 0112

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

For General Dynamics, 2011 was a year of continued

focus on operating performance, excellent cash

generation and accelerating Aerospace growth.

Our company’s success is anchored by a strong

foundation of relevant products and services, a

commitment to continuous improvement, and an

innovative workforce.

As economic headwinds impact U.S. defense

spending, the strength of General Dynamics’ portfolio

is ever more apparent. Our Aerospace segment,

driven by market leader Gulfstream, is preparing to

deliver two new aircraft to the world, the G650 and

G280. These aircraft highlight the importance of our

sustained investment in new products and are at

the forefront of technological development among

business aircraft.

Following a decade of growth, we are now in a

new era where defense spending is declining. Despite

this reality, our diverse defense businesses remain

resilient and valuable assets and we continue to

feel confident about the relevance of our portfolio.

Our facilities are key parts of the defense industrial

base which must be maintained. We have solid

incumbency in the Army and Navy force structures.

We can leverage our incumbency, innovation and

experience both to bid as a prime competitor for new

development programs, and to provide our customer

with steady and dependable proven solutions.

As of this writing in early 2012, the defense

market is shrouded by the uncertainty of

sequestration which could impose $500 billion

of additional defense spending cuts over the next

nine years if the Congress does not act. If enacted,

sequestration would place extreme fiscal pressures

on our customers, with wide-ranging effects on our

industry and the security of our nation. However

sequestration is resolved, it is clear that defense

spending will continue to be a part of addressing our

nation’s economic problems.

Amidst a backdrop of continued deficit focus

and political divide, we were pleased by the support

our programs received in the fiscal year 2012

defense budget. For fiscal year 2013, the President

has requested Defense Department base-budget

funding of $525 billion, including $168 billion for

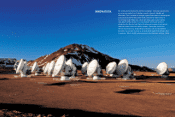

investment accounts. Our core shipbuilding and

tactical communications programs fared well in the

proposed budget. Conversely, funding for our primary

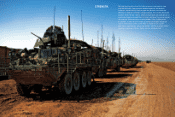

U.S. vehicle programs, Stryker and Abrams, declined

significantly. These funding levels reflect lower

Army investment spending as the Pentagon shifts

priorities. We will work with all of our stakeholders

to ensure they understand the industrial base

implications of significant funding reductions.

As we confront a fast-changing business

environment, we continue to focus on maximizing

profitability. Over the past few years, we have cut

overhead costs, improved manufacturing processes,

divested certain non-core assets, and right-sized

businesses to better position ourselves for the future.

These actions will enhance the affordability of our

products for our customers, improve the profitability

of our business for our shareholders and strengthen

our competitive positioning for the long-term benefit

of our company and our employees.

Report on Operations

Company revenues were $32.7 billion in 2011, a mod-

est increase from 2010, as initial deliveries of the

G650 drove double-digit volume growth in our

General Dynamics A nnual Report 2011 3