Fluor 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Fluor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FLUOR CORPORATION 2005 ANNUAL REPORT

NEW AWARDS

& BACKLOG

(dollars in billions)

■ new awards ■ backlog

6.0

4.8

3.6

2.4

1.2

0.0 2003 2004 2005

REVENUE BY SEGMENT

Oil & Gas

40%

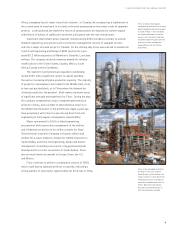

(right) ICA Fluor in Mexico is

providing engineering, procurement

and construction services for this

LNG receiving, storage and regas-

ification terminal, including the

marine berth. This facility will

receive shipments of LNG and will

gasify the LNG and place it into

the natural gas pipelines, helping

to increase the amount of natural

gas available in Mexico.

(top left and far right) A Fluor

joint venture is performing this

world class project that has a total

installed cost of approximately

$4.9 billion. This sour-gas injection

project in Kazakhstan will increase

oil production at Tengizchevroil’s

project to 550,000 barrels of oil

per day beginning in 2007.

(bottom left) Fluor managed the

design, procurement and construc-

tion of this $2.6 billion integrated

petrochemicals site in Nanjing,

the People’s Republic of China,

for BASF-YPC Company Ltd. It

is among the largest Sino-foreign

petrochemical enterprises in

China and became fully functional

in 2005.

As an industry leader, Fluor has an extensive history of

providing a full range of EPC services on a worldwide basis

to the oil and gas production and hydrocarbon processing

industries. Fluor performs projects of all sizes, yet is one

of the few companies with the global scope, experience and

program management capabilities to handle the largest,

most complex projects anywhere in the world. Depletion

of oil and gas reserves, combined with limited capacity

additions and growing demand for hydrocarbon-based

products, is driving a major cycle of capital investment

in upstream, downstream and petrochemical projects.

Operating profit for the Oil & Gas segment was outstanding, growing 50 percent in 2005 to

$242 million. New awards in 2005 were $4.4 billion, up 10 percent from 2004, continuing the

strong booking rate which began in 2003. Backlog rose 13 percent to $6.0 billion, compared

with $5.4 billion at the end of 2004.

A significant portion of new capital investments are directed at large, elaborate and

geographically challenging projects that play to Fluor’s strengths and experience. After many

years of underinvestment, major programs are proceeding at a disciplined and deliberate pace,

and as a result, it is expected that this cycle will be characterized by a relatively high and

sustained level of spending. Recent budget announcements from major multi-national and

national oil and gas companies provide further evidence of a continued and accelerated ramp-up

in capital investment.

Fluor’s strong program management skills and global experience make the company

particularly well suited to perform the role of overall program manager. In addition, Fluor often

secures the full engineering, procurement and construction (EPC) responsibility for certain process

units and the infrastructure work, or offsites and utilities, that are critical to tying the entire

project together. The company is also leveraging its strengths in key technologies, including gas

processing and sulfur removal in the upstream market, and clean fuels and oil sands in the

downstream market.

7