Fifth Third Bank 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2FIFTH THIRD BANCORP AND SUBSIDIARIES

REPORT TO SHAREHOLDERS

Dear Shareholders and Friends,

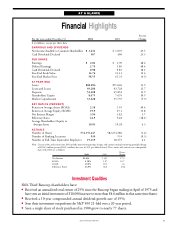

2002 was another good year for

Fifth Third. Financial results

were driven by outstanding cus-

tomer and deposit growth in all of our

markets, solid revenue growth, and

consistently strong credit quality. Net

income increased by 17 percent on a

comparable basis over 2001 and totaled

$1.63 billion for the full year. I would

like to thank all of our employees for

their hard work, both in maintaining

our high standard of customer service

and in managing the challenges that

come with growth. Some of the

highlights:

●Total revenue increased by 15 per-

cent on double-digit growth in

nearly all of our affiliate markets

despite the challenges of a difficult

year in financial services.

●Our capital ratio improved six percent

to 10.93 percent, representing an

additional $836 million in shareholder

equity and one of the best capitalized

balance sheets in the industry.

Fifth Third Bancorp President and CEO George A. Schaefer, Jr.

●Return on average assets was 2.18

percent and return on average

equity was 19.9 percent on an

expanded capital base, continuing

our long history of high returns and

once again ranking among the best

in the industry.

●Our efficiency ratio improved to

44.9 percent in 2002 from 46.6

percent on a comparable basis in

2001.

●The 2002 dividend of $.98 per

share was an 18 percent increase

over last year’s dividend and an

increase of 40 percent over the 2000

annual dividend.

●In 2002, five affiliates contributed

earnings in excess of $100 million,

with an additional six affiliates

earning more than $50 million for

the full year.

The year was highlighted by deposit

and customer growth stronger than at

any other time in our history and an

across-the-board return to traditional

Fifth Third performance metrics less

than a year after the largest acquisition

Fifth Third has ever undertaken. Our

four primary businesses – Retail and

Commercial Banking, Investment

Advisors and Electronic Payment

Processing – continued to provide

strong results in 2002 with non-

interest income up 18 percent for the

full year. Electronic Payment Proc-

essing once again led the growth with

an annual increase in revenues of 47

percent over last year, or 27 percent

excluding the incremental revenue

addition from the 2001 purchase

acquisition of Universal Companies

(USB), on the addition of several

significant new merchant and

electronic funds transfer (EFT)

customer relationships. Successful sales

of Retail and Commercial deposit

accounts fueled an annual increase in

deposit service revenues of 17 percent

over last year and provided an

important base for the sale of

additional products and services within

these business lines. Investment

Advisors revenues increased 10 percent

on the year despite a difficult equity

market on the strength of double-digit

growth in private banking and retail

brokerage. The credit quality of our

loan portfolio remained stable at levels

among the best in the industry, an area

where some competitors experienced a

great deal of difficulty this year. We

continue to maintain our commitment

to a strong, flexible balance sheet as

evidenced by the full year 2002 capital

ratio of 10.93 percent compared to

10.28 percent in 2001. Overall, we were

extremely pleased with the quality

growth and performance in each of our

markets in 2002.

Over the years, as we have grown from

our base here in Cincinnati by

expanding into adjacent markets, we