Fannie Mae 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The American

Dream Decade

2001 Annual Report

Meeting the Growing Demand for Homeownership

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Table of contents

-

Page 1

T he American Dream Decade Meeting the Growing Demand for Homeownership 2001 Annual Report 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -

Page 2

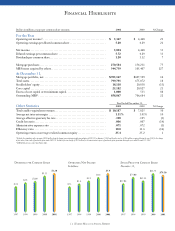

...Financial Statements and Reports 79 Glossary 80 Board of Directors and Senior Management 21 Selected Financial Information: 1999-2001 12 Leading Consumer Product 14 Leading Consumer Investment 22 Management's Discussion and Analysis of Financial Condition and Results of Operations 82 Fannie Mae... -

Page 3

... change in fair value of time value of purchased options under FAS 133. Includes after-tax charges of $383 million for the amortization expense of purchased options premiums during the year ended December 31, 2001. 2 MBS held by investors other than Fannie Mae. { 1 } Fannie Mae 2001 Annual Report -

Page 4

... per share for each of the past 15 years. Also in 2001, Fannie Mae set an important new standard for corporate best practices by implementing the strongest transparency and disclosure practices of any large financial institution in the country. At a time when the market, shareholders, policy makers... -

Page 5

...low-cost mortgage capital for home buyers to finance their homes, Fannie Mae is at the center of the housing industry, one of the strongest growth sectors in America. public companies, Fannie Mae is a model for openness, transparency, regulatory oversight, capital protections, and market discipline... -

Page 6

... the longest, strongest bull market in history, over the last 10 years, the average-priced home earned nearly twice the value of the average stock portfolio - $44,000 versus $23,000. In a recent poll, 39 percent of Americans said they believe that real estate is the best investment they can make... -

Page 7

... or underserved, Fannie Mae will continue to offer a wide range of creative and consumerfriendly mortgage options, technology, and services. Fannie Mae has developed the partnerships with lenders, mortgage products, technology, international markets, and risk management tools necessary to be... -

Page 8

... Value Timothy Howard Executive Vice President and Chief Financial Officer Timothy Howard, Executive Vice President and Chief Financial Officer, talks about Fannie Mae's stellar performance, strong growth prospects, and model safety, soundness, and transparency practices. How has Fannie Mae... -

Page 9

... double-digit growth in operating EPS, year after year, through all types of economic and financial market environments for the last 15 years. The reason is simple. At Fannie Mae, we are risk managers, not passive risk takers. In our credit guaranty business, we { 7 } Fannie Mae 2001 Annual Report -

Page 10

...loss rate of other financial institutions. With revenues over one hundred times the size of our credit losses, even a doubling in Fannie Mae's credit losses in 2002 - which we do not expect - would reduce our earnings per share growth by less than 1 percentage point. How do you manage interest rate... -

Page 11

... to regularly disclose key details about our business and risk management, including regular reports about our credit risk and interest rate risk exposure. We also began issuing subordinated debt, whose price is sensitive to how the market views our financial condition. Fannie Mae now gives more... -

Page 12

... of T he American Dream The first decade of the 21st century will be a time of unparalleled opportunity for Fannie Mae, our industry partners, and the families and communities we serve. America's housing finance system has continually evolved to meet the needs of our nation's home buyers. By helping... -

Page 13

.... Today, the financial system that provides mortgage capital to lenders throughout America - and fuels the needed production of high-quality rental housing - is strong and capable of meeting the challenges that will be placed upon it this decade. Working with our partners, Fannie Mae is prepared to... -

Page 14

... Stadium on opening day. It's the gas grill you and your son assembled out there on the deck. It's the discussion around the dinner table about that remodeling project the entire family has a say in. It's your house, and you never tire of making it your home. { 12 } Fannie Mae 2001 Annual Report -

Page 15

-

Page 16

... market, money market funds, and retirement savings, housing represents economic empowerment - their best chance to gain a foothold to a strong financial future. Now, you count yourself among those Americans who believe in the power of an investment you come home to every night. { 14 } Fannie Mae... -

Page 17

-

Page 18

...home improvement store a few miles away, like you do almost every weekend, to make your castle even more comfortable. Cans of paint, crown molding, curtains, and a new mitre saw. A call to the plumber. Jobs created, jobs to do, jobs for others. Housing. The economy's smiling face. { 16 } Fannie Mae... -

Page 19

-

Page 20

...why Fannie Mae is poised to make this the decade of the American Dream for all who aspire to own a place of their own. That means bringing low-cost capital to people and places where it hasn't yet reached...closing the racial gap in homeownership rates through strategic partnerships and new mortgage... -

Page 21

-

Page 22

... Board of Directors and Senior Management 49 Financial Statements and Reports 53 Notes to Financial Statements 75 Net Interest Income and Average Balances (Unaudited) 82 Fannie Mae Offices 83 Common Stock Information (Unaudited) 76 Rate/Volume Analysis (Unaudited) { 20 } Fannie Mae 2001 Annual... -

Page 23

... preferred stock, (c) paid-in capital, and (d) retained earnings. 3 Includes revenues net of operating losses and amortization expense of purchased options premiums, plus taxable-equivalent adjustments for tax-exempt income and investment tax credits using the applicable federal income tax rate... -

Page 24

... for Losses," "Balance Sheet Analysis-Mortgage Portfolio," and "Mortgage-Backed Securities." Fannie Mae also tracks performance based on operating net income and operating EPS which are adjusted for certain items related to the January 1, 2001 adoption of Financial Accounting Standard... -

Page 25

... in the income statement, but not the options in callable debt or mortgages. Prior to the adoption of FAS 133, Fannie Mae amortized premiums on purchased options into interest expense on a straight-line basis over the life of the option. Without these adjustments, net income and diluted EPS grew 33... -

Page 26

... acquisitions. Mortgage-to-debt spread is the difference between the yield on a mortgage and the cost of debt that funds mortgage purchases. The following graph compares Fannie Mae's adjusted net interest income to average mortgage rates over the past ten years. Guaranty Fee Income Guaranty fees... -

Page 27

... losses on loans that default, and • centralized foreclosure management operations at Fannie Mae's National Property Disposition Center in Dallas to achieve higher net proceeds from the sale of real estate owned and reduce property disposition costs. The reduction in credit-related expenses... -

Page 28

... Mae's effective tax rate on net income was 27 percent in 2001, compared with 26 percent in 2000. Special Contribution Special contribution expense reflects a contribution by Fannie Mae to the Fannie Mae Foundation. Extraordinary Item Fannie Mae strategically repurchases or calls debt and related... -

Page 29

... patterns through time and across different interest rate paths. To achieve the desired liability durations, Fannie Mae issues debt across a broad spectrum of final maturities. Because the durations of mortgage assets change as interest rates change, callable debt and interest rate derivatives are... -

Page 30

... while remaining within corporate risk guidelines. Fannie Mae took advantage of the opportunity to lower its debt costs by redeeming significant amounts of callable debt, particularly during the first quarter of 2001, in response to the sharp decline in short-term interest rates. These redemptions... -

Page 31

... of the guaranty fee business on a run-off basis in the net asset value sensitivity analysis but not the other interest rate risk measures. The net asset value of Fannie Mae on December 31, 2001, as presented in Table 5, is the same as that disclosed in the Notes to Financial Statements under Note... -

Page 32

... officer. Those business unit credit officers and the leaders of Fannie Mae's Credit Policy team serve on the Credit Risk Policy Committee. Three main credit risk management teams support the Chief Credit Officer and the committee: • Policy and Standards - Establishes and monitors credit policies... -

Page 33

...cost markets (for example, Alternative A loans or A minus loans) have become eligible for purchase by Fannie Mae. In many instances, sale of these loans to Fannie Mae requires payment of risk-based guaranty fees or price adjustments by lenders as additional credit risk compensation. Management plans... -

Page 34

... losses during 2000. The application of various credit risk management strategies throughout a loan's life helped reduce credit-related losses in 2001 despite deteriorating economic conditions. Fannie Mae's sensitivity of net future credit losses to an immediate 5 percent decline in home prices... -

Page 35

... risk evaluation, regular asset management of earning assets, special asset management of problem transactions, and contract compliance monitoring for structured transactions. Fannie Mae maintains rigorous loan underwriting guidelines and extensive real estate due diligence examinations for... -

Page 36

.... Fannie Mae manages credit risk throughout the life of a multifamily loan through dedicated due diligence, portfolio monitoring, and loss mitigation teams. The due diligence team specializes in assessing transactions prior to purchase or securitization, particularly with large loans or structured... -

Page 37

..., which generally includes a review of the mortgage insurer's business plan, insurance portfolio characteristics, master insurance policies, reinsurance treaties, and ratings on ability to pay claims. Fannie Mae monitors approved insurers through a reporting and analysis process performed quarterly... -

Page 38

... of Fannie Mae, mortgage servicers collect mortgage and escrow payments from borrowers, pay taxes and insurance costs from escrow accounts, monitor and report delinquencies, and perform other required activities. A servicing contract breach could result in credit losses for Fannie Mae, or Fannie Mae... -

Page 39

... the new effective yield been applied since acquisition of the mortgages or MBS. Fannie Mae's premium, discount, and deferred price adjustment prepayment sensitivity analysis at December 31, 2001 indicates that a 100 basis point increase in interest rates would result in a decrease in projected net... -

Page 40

...31, 2001, from $55 billion at December 31, 2000. The Liquid Investment Portfolio accounts for the majority of Fannie Mae's investments and consists primarily of high-quality short-term investments in nonmortgage assets, such as asset-backed securities, commercial paper, and federal funds. The Liquid... -

Page 41

... callable structures that are brought to market in a scheduled manner. As part of its voluntary safety and soundness initiatives, Fannie Mae began issuing Subordinated Benchmark Notes in the first quarter of 2001 on a periodic basis to create a new, liquid class of fixed income assets for investors... -

Page 42

...Mae to maintain an orderly and cost-effective debt issuance schedule so it can fund daily loan purchase commitments without significantly increasing its interest rate risk or exposure to changes in the spread of its funding costs versus benchmark interest rates. { 40 } Fannie Mae 2001 Annual Report -

Page 43

... are of very high credit quality. 2) Fannie Mae has a conservative collateral management policy with provisions for requiring collateral on its derivative contracts in gain positions. Fannie Mae has never experienced a loss on a derivative transaction due to credit default by a counterparty... -

Page 44

... credit loss on derivative instruments can be estimated by calculating the cost, on a present value basis, to replace at current market rates all outstanding derivative contracts in a gain position. Fannie Mae's exposure on derivative contracts (taking into account master settlement agreements that... -

Page 45

...Fannie Mae's ratio of liquid assets to total assets was 9.5 percent, compared with 8.2 percent at December 31, 2000. Fannie Mae's primary sources of cash are issuances of debt obligations, mortgage repayments, interest income, and MBS guaranty fees. Fannie Mae had cash and cash equivalents and short... -

Page 46

... in 2001. At December 31, 2000, Fannie Mae had $16 billion in outstanding mandatory commitments and $2 billion in outstanding optional commitments for the purchase and delivery of mortgages in 2001. Fannie Mae's core capital (defined by its regulator, Office of Federal Housing Enterprise Oversight... -

Page 47

... the Chief Financial Officer, determines interest rate risk and credit risk pricing thresholds, formulates corporate hedging strategies, and ensures compliance with economic and regulatory risk-based capital requirements. Fannie Mae assesses capital adequacy using an internally developed stress test... -

Page 48

... at securitization. Fannie Mae applies the interest method to amortize the guaranty fee adjustment over the estimated life of the loans underlying the MBS. Calculating the constant effective yield method necessary to apply the interest method is a critical accounting policy that requires estimating... -

Page 49

...-related expenses and Fannie Mae's credit loss ratio. Fannie Mae believes its current book of business is better positioned to withstand the effects of an economic slowdown than in prior slowdowns because of improved loan underwriting through the automated Desktop Underwriter, lower loan-to-value... -

Page 50

...-related losses fell as a percentage of the average book of business to .7 basis points in 2000 from 1.1 basis points in 1999. The provision for losses remained stable at negative $120 million in conjunction with Fannie Mae's current policy of recording a negative loss provision in line with net... -

Page 51

... item-(loss) gain on early extinguishment of debt (net of tax benefit of $183 million in 2001, tax expense of $17 million in 2000, and tax benefit of $5 million in 1999) ...Cumulative effect of change in accounting principle, net of tax effect ...Net income ...Preferred stock dividends ...Net income... -

Page 52

...Total assets ...Liabilities and Stockholders' Equity Liabilities: Debentures, notes and bonds, net: Due within one year ...Due after one year ...Total ...Accrued interest payable ...Derivatives in loss positions ...Other ...Total liabilities ...Stockholders' Equity: Preferred stock, $50 stated value... -

Page 53

... losses on available-for-sale securities ...Total comprehensive income ...Dividends ...Shares repurchased ...Preferred stock issued ...Treasury stock issued for stock options and benefit plans ...Balance, December 31, 2000 ...Comprehensive income: Net income ...Other comprehensive income, net of tax... -

Page 54

... income ...$ Adjustments to reconcile net income to net cash provided by (used in) operating activities: Amortization of discount/premium ...Negative provision for losses ...Gain (loss) on early extinguishment of debt ...Cumulative effect of change in accounting principle (net of tax) ...Purchased... -

Page 55

... and stockholder-owned corporation operating in the residential mortgage finance industry. The accounting and reporting policies of Fannie Mae conform with accounting principles generally accepted in the United States of America. Certain amounts in prior years' financial statements have been... -

Page 56

...-for-sale upon the adoption of FAS 133. At the time of this non-cash transfer, these securities had gross unrealized gains and losses of $164 million and $32 million, respectively. Derivative Instruments and Hedging Activities Effective January 1, 2001, Fannie Mae adopted Financial Accounting... -

Page 57

... will not be collected as scheduled in the loan agreement. All of Fannie Mae's impaired loans are multifamily loans as single-family loans are exempt from Financial Accounting Standard No. 114, Accounting by Creditors for Impairment of a Loan. Nonperforming loans outstanding totaled $3.7 billion at... -

Page 58

... of their expected life because borrowers generally have the right to repay their obligations at any time. Presented below are the amortized cost and fair value of the Liquid Investment Portfolio and other investments classified as available-for-sale at December 31, 2001 and 2000. 2001 Amortized... -

Page 59

...Short-Term Notes and Debenture Programs and applies to debt settling after January 3, 2000. Debentures, notes, and bonds at December 31, 2001 included $140 billion of callable debt, which generally is redeemable, in whole or in part, at the option of Fannie Mae any time on or after a specified date... -

Page 60

...-for-sale securities ...Other items, net ...Deferred tax assets ...Deferred tax liabilities: Debt-related expenses ...Purchase discount and deferred fees ...Benefits from tax-advantaged investments ...Other items, net ...Deferred tax liabilities ...Net deferred tax asset (liability) ... Fannie Mae... -

Page 61

... Fannie Mae elected to apply APB Opinion 25 and related interpretations in accounting for its plans. Thus, no compensation expense has been recognized for the nonqualified stock options and Employee Stock Purchase Plan. Fannie Mae's reported net income and reported diluted earnings per common share... -

Page 62

...shares, respectively. 1 The closing yield on the comparable average life U.S. Treasury on the day prior to grant. 2 Dividend rate on common stock at date of grant. Dividend rate assumed to remain constant over the option life. Employee Stock Purchase Plan Fannie Mae has an Employee Stock Purchase... -

Page 63

.... Corporate plan assets consist primarily of listed stocks, fixed-income securities, and other liquid assets. Plan assets do not directly include any shares of Fannie Mae stock. 9. Employee Retirement Benefits Retirement Savings Plan All regular employees of Fannie Mae scheduled to work 1,000 hours... -

Page 64

... business includes the management of asset purchases and funding activities for Fannie Mae's mortgage portfolio and investment portfolio. Income is derived primarily from the difference, or spread, between the yield on mortgage loans and investments and the borrowing costs related to those loans... -

Page 65

... 3,489 Net interest income ...Guaranty fee income ...Fee and other income (expense) ...Credit-related expenses ...Administrative expenses ...Special contribution ...Purchased options expense ...Federal income taxes ...Extraordinary item - (loss) gain on early extinguishment of debt ...Operating net... -

Page 66

... and Context Fannie Mae employs cash flow hedges to lock in the interest spread on purchased assets by hedging existing variable-rate debt and forecasted issuances of debt through its Benchmark Program. The issuance of short-term Discount Notes and variable-rate long-term debt during periods... -

Page 67

... value of pay-fixed swaptions and interest rate caps in its assessment of hedge effectiveness. Therefore, Fannie Mae excludes changes in the time value of these contracts from the assessment of hedge effectiveness and recognizes them as purchased options expense on the income statement. For the year... -

Page 68

... pre-tax purchased options expense of $3 million in the income statement for the change in time value of these contracts. master agreements that provide for netting of certain amounts payable by each party, requiring that counterparties post collateral if the value of Fannie Mae's gain positions... -

Page 69

... Fannie Mae enters into master delivery commitments with lenders on either a mandatory or an optional basis. Under a mandatory master commitment, a lender must either deliver loans under an MBS contract at a specified guaranty fee rate or enter into a mandatory portfolio commitment with the yield... -

Page 70

... to similar changes in economic conditions that could affect their ability to meet contractual obligations. Many servicers employ Risk ProfilerSM, a default prediction model created by Fannie Mae, to enhance their loss mitigation efforts on loans serviced for Fannie Mae. Risk Profiler uses credit... -

Page 71

... of total ...2000 ...Percent of total ...1 Excludes housing revenue bonds and non-Fannie Mae securities. 16. Disclosures of Fair Value of Financial Instruments The basic assumptions used and the estimates disclosed in the Fair Value Balance Sheets represent management's best judgment of appropriate... -

Page 72

...pool of loans with similar characteristics was subtracted from the weightedaverage coupon rate less servicing fees. The method for estimating this guaranty fee and the credit risk associated with the mortgage portfolio is described under "Guaranty Fee Income, Net." Fannie Mae then employed an option... -

Page 73

... income taxes for the difference between net assets at fair value and at cost at the statutory corporate tax rate of 35 percent. Derivatives Fannie Mae enters into interest rate swaps, including callable swaps that, in general, extend or adjust the effective maturity of certain debt obligations... -

Page 74

... of December 31, 2001 and 2000, and the related statements of income, changes in stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2001. These financial statements are the responsibility of Fannie Mae's management. Our responsibility is to express... -

Page 75

... for the assets of the corporation. Internal control over financial reporting includes controls for the execution, documentation, and recording of transactions, and an organizational structure that provides an effective segregation of duties and responsibilities. Fannie Mae has an internal Office of... -

Page 76

... federal income taxes ...Income before extraordinary item and cumulative effect of change in accounting principle ...Extraordinary item-loss on early extinguishment of debt, net of tax effect ...Cumulative effect of change in accounting principle, net of tax effect ...Net income ...Preferred stock... -

Page 77

...or repricing date, taking into consideration the effect of derivative financial instruments. The cost of debt includes expense for the amortization of purchased options in 2000 and 1999. 2 Reflects pro forma adjustments to permit comparison of yields on tax-advantaged and taxable assets. 3 Includes... -

Page 78

... to Changes in1 Volume Rate Dollars in millions Increase (Decrease) 2001 vs. 2000 Interest income: Mortgage portfolio ...Investments and cash equivalents ...Total interest income ...Interest expense 2: Short-term debt ...Long-term debt ...Total interest expense ...Net interest income ...2000 vs... -

Page 79

...-family ...Multifamily ...Total mortgages purchased ...Average net yield on mortgages purchased ...Debt issued: Short-term debt ...Long-term debt ...Total ...Average cost of debt issued ...MBS issues acquired by others ...Financial ratios: Return on average assets ...Operating return on average... -

Page 80

...-rate ...Adjustable-rate ...Total single-family ...Multifamily ...Total unpaid principal balance ...Less unamortized discount (premium), price adjustments, and allowance for losses ...Net mortgage portfolio ...Other assets ...Total assets ...Debentures, notes, and bonds, net: Due within one year... -

Page 81

... of the corporation suffering financial losses on a loan or the final dollar value of those losses in the event of a borrower default. Mandatory delivery commitment: An agreement that a lender will deliver loans or securities by a certain date at agreedupon terms. Mortgage: A legal document that... -

Page 82

... Beggs & Simpson A commercial real estate company Portland, Oregon Daniel H. Mudd Vice Chairman and Chief Operating Officer Fannie Mae Kenneth M. Duberstein Chairman and Chief Executive Officer The Duberstein Group, Inc. An independent strategic planning and consulting company Washington, DC Jamie... -

Page 83

... Institute A nonprofit organization Washington, DC Joe K. Pickett Former Chairman and Chief Executive Officer HomeSide International Inc. A mortgage banking company Jacksonville, Florida Vincent A. Mai Chairman AEA Investors Inc. A private investment company New York, New York Taylor C. Segue, III... -

Page 84

... 600 Miami, FL 33131 St. Louis Partnership Office Gateway One 701 Market Street, Suite 1210 St. Louis, MO 63101 Tennessee Partnership Office 214 Second Avenue N., Suite 205 Nashville, TN 37201 Utah Partnership Office 15 West South Temple, Suite 870 Salt Lake City, UT 84101 Washington, DC Partnership... -

Page 85

..., contact Jayne Shontell, Senior Vice President, Corporate Development and Investor Relations, Fannie Mae, 3900 Wisconsin Avenue, NW, Washington, DC 20016. You also may call 202-752-7000 for more information. Fannie Mae will provide, without charge, copies of its most recent Information Statement... -

Page 86

3900 Wisconsin Avenue, NW Washington, DC 20016-2892 CA290U 04/02 ©2002, Fannie Mae All rights reserved This Annual Report was printed in the U.S.A on recycled paper and is recyclable.