Famous Footwear 2013 Annual Report Download - page 19

Download and view the complete annual report

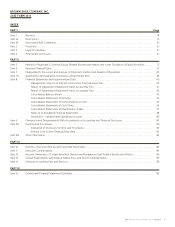

Please find page 19 of the 2013 Famous Footwear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2013 BROWN SHOE COMPANY, INC. FORM 10-K 17

In addition, with the growing trend toward retail trade consolidation, we and our wholesale customers increasingly

depend upon a reduced number of key retailers whose bargaining strength is growing. This consolidation may result

in the following adverse consequences:

• Our wholesale customers may seek more favorable terms for their purchases of our products, which could limit

our ability to raise prices, recoup cost increases, or achieve our profit goals.

• The number of stores that carry our products could decline, thereby exposing us to a greater concentration of

accounts receivable risk and negatively impacting our brand visibility.

We also face the following risks with respect to our customers:

• Our customers could develop in-house brands or utilize a higher mix of private-label footwear products,

which would negatively impact our sales.

• As we sell our products to customers and extend credit based on an evaluation of each customer’s financial

condition, the financial diculties of a customer could cause us to stop doing business with that customer,

reduce our business with that customer, or be unable to collect from that customer.

• If any of our major wholesale customers experiences a significant downturn in its business or fails to remain

committed to our products or brands, then these customers may reduce or discontinue purchases from us.

• Retailers are directly sourcing more of their products directly from manufacturers overseas and reducing their

reliance on wholesalers, which could have a material adverse eect on our business and results of operations.

A disruption in the eective functioning of our distribution centers could adversely aect our ability to deliver inventory

on a timely basis.

We currently utilize several distribution centers, which are leased or third-party managed. These distribution centers serve

as the source of replenishment of inventory for our footwear stores operated by our Famous Footwear and Specialty

Retail segments and serve our Wholesale Operations segment. We may be unable to successfully manage, negotiate, or

renew our third-party distribution center agreements, or we may experience complications with respect to our distribution

centers, such as substantial damage to, or destruction of, such facilities due to natural disasters or ineective information

technology systems. In such an event, our other distribution centers may not be able to support the resulting additional

distribution demands and we may be unable to locate alternative persons or entities capable of fulfilling our distribution

needs, resulting in an adverse eect on our ability to deliver inventory on a timely basis.

Foreign currency fluctuations may result in higher costs and decreased gross profits.

Although we purchase most of our products from foreign manufacturers in United States dollars and otherwise engage

in foreign currency hedging transactions, we cannot ensure that we will not experience cost variations with respect to

exchange rate changes. Currency exchange rate fluctuations may also adversely impact third parties who manufacture

the Company’s products by making their purchases of raw materials or other production costs more expensive and

more dicult to finance, resulting in higher prices and lower margins for the Company, its distributors, and licensees.

Additional duties, quotas, taris and other trade restrictions may be imposed on our foreign sourced products,

adversely aecting our sales and profitability.

Our foreign sourced products are subject to duties collected by customs authorities when imported to the United States

or other countries. We cannot predict whether additional customs duties, quotas, taris, anti-dumping duties, safeguard

measures, cargo restrictions or other trade restrictions may be imposed on the importation of our products in the future.

Such additional charges may result in increases in the cost of our products and may adversely aect our sales and profitability.

Our business, sales and brand value could be harmed by violations of labor, trade or other laws.

We focus on doing business with those suppliers who share our commitment to responsible business practices and

the principles set forth in our Production Code of Conduct (the “PCOC”). By requiring our suppliers to comply with the

PCOC, we encourage our suppliers to promote best practices and work toward continual improvement throughout their

production operations. The PCOC sets forth standards for working conditions and other matters, including compliance

with applicable labor practices, workplace environment, and compliance with laws. Although we promote ethical business

practices, we do not control our suppliers or their labor practices. A failure by any of our suppliers to adhere to these

standards or laws could cause us to incur additional costs for our products, could cause negative publicity, and harm our

business and reputation. We also require our suppliers to meet our standards for product safety, including compliance

with applicable laws and standards with respect to safety issues, including lead content in paint. Failure by any of

our suppliers to adhere to product safety standards could lead to a product recall, which could result in critical media

coverage, harm our business and reputation, and cause us to incur additional costs.

In addition, if we, or our suppliers or foreign manufacturers, violate United States or foreign trade laws or regulations, we may

be subject to additional duties, significant monetary penalties, the seizure and forfeiture of the products we are attempting