Famous Footwear 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Famous Footwear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BROWN SHOE COMPANY, INC. 2003 FORM 10-K

ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS AND FINANCIAL CONDITION

OVERVIEW

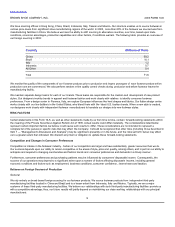

Overall, fiscal 2003 was a good year for Brown Shoe Company, Inc. in a difficult retail environment. Net earnings and diluted earnings per

share in both fiscal 2003 and 2002 were affected by special charges and recoveries.

In the following table, our fiscal 2003 and 2002 net earnings and net earnings per diluted share are provided both in accordance with

generally accepted accounting principles (GAAP) and using certain non-GAAP financial measures by excluding certain charges and

recoveries. These results are included as a complement to results provided in accordance with GAAP because management believes these

non-GAAP financial measures help indicate underlying trends in our business and provide useful information to both management and

investors by excluding certain items that are not indicative of our core operating results. Management utilizes these measures in various

ways, including performance evaluations and for compensation purposes. These non-GAAP measures should be considered in addition to

results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results.

2003 2002

Net Diluted Net Diluted

($ millions, except EPS) Earnings EPS Earnings EPS

Total — GAAP basis $46.9 $2.52 $45.2 $2.52

Special charges and (recoveries):

Canada factory closure 2.7 0.14

Environmental litigation 2.0 0.11

Naturalizer Retail excess store closing

reserve (0.5) (0.03)

Excess severance reserve (0.7) (0.04)

4.7 0.25 (1.2) (0.07)

Total excluding special items $51.6 $2.77 $44.0 $2.45

We are pleased with the 17% and 13% increase in net earnings and diluted earnings per share, respectively, excluding special items. The

improved results reflect increased operating earnings at our two largest segments, Famous Footwear and Wholesale, and lower interest

costs from a well-controlled balance sheet. At the same time, we invested in our future by improving our talent base, particularly in our

merchandising and product development areas, embarking on a major new initiative to improve and streamline our supply chain systems,

focusing on target customer marketing at Famous Footwear and beginning a remodeling program at the Famous Footwear stores. In

addition, we are pleased to have Diane Sullivan join us as President. She brings to the Company a great deal of executive management

experience in all aspects of the footwear business as well as a strong marketing background.

Following is a summary of the more significant factors affecting our results in 2003:

• Famous Footwear achieved a 14.4% increase in its operating earnings to $53.0 million, as a result of higher gross profits and operating

improvements in a number of areas. The improved gross profit reflects a fresher product mix, as inventories were clean throughout the

year. Operating improvements included more focused marketing programs, a better product mix with more exclusive product from key

vendors, reduced shrinkage costs and more efficient warehousing and distribution processes. Same-store sales, however, declined for

the fourth consecutive year, and traffic into the stores declined. While retail competition in footwear remains intense, we are focused on

reversing this trend and believe the new marketing programs and enhanced product mix provide the opportunity to do so.

• The Wholesale segment’s operating earnings improved $1.2 million to $55.6 million, as a result of overall improved gross profit rates

and strong operating earnings from the Naturalizer, LifeStride, and Men’s & Athletic businesses. These operating earnings include a

special charge of $4.3 million taken to close our last remaining footwear manufacturing facility in Canada. Closing the facility and

converting to totally imported footwear are expected to improve the operating results of the Canadian Wholesale operations in 2004. Our

Naturalizer and LifeStride brands improved their department store market share positions. The Women’s private label and Children’s

business had a down year due to difficulties at certain of their mass merchandiser customers.

16