FairPoint Communications 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

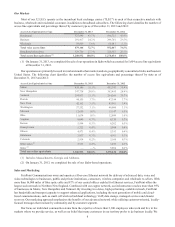

entered into a $1,075.0 million senior secured credit facility with a syndicate of lenders and Bank of America, N.A., as the

administrative agent for the lenders, arranged by Banc of America Securities LLC (the "Old Credit Agreement"), comprised of a

$75.0 million revolving facility (the "Old Revolving Facility") and a $1.0 billion term loan facility (the "Old Term Loan", and

together with the Old Revolving Facility, the "Old Credit Agreement Loans"). As discussed below, we refinanced the Old Credit

Agreement Loans on February 14, 2013. For more information about this refinancing, see "—February 2013 Refinancing" herein.

In connection with the Chapter 11 Cases, we also negotiated with representatives of the state regulatory authorities in Maine,

New Hampshire and Vermont and agreed to regulatory settlements with respect to (i) certain regulatory approvals relating to the

Chapter 11 Cases and the Plan and (ii) certain modifications to the requirements imposed by state regulatory authorities as a

condition to approval of the Merger (each a "Merger Order", and collectively, the "Merger Orders"). For more information regarding

these regulatory settlements, see "—Regulatory Environment—State Regulation—Regulatory Conditions to the Merger, as

Modified in Connection with the Plan" herein.

On June 30, 2011 and on November 7, 2012, the Bankruptcy Court entered final decrees closing certain of

the Company's bankruptcy cases due to such cases being fully administered. Of the 80 original bankruptcy cases, only the Chapter

11 Case of Northern New England Telephone Operations LLC (Case No. 09-16365) remains open.

Fresh Start Accounting

Upon our emergence from the Chapter 11 bankruptcy proceedings, we adopted fresh start accounting in accordance with

guidance under the applicable reorganization accounting rules, pursuant to which our reorganization value was allocated to our

assets in conformity with guidance under the applicable accounting rules for business combinations, using the purchase method

of accounting for business combinations. In addition to fresh start accounting, our consolidated financial statements reflect all

effects of the transactions contemplated by the Plan. Therefore, our consolidated statements of financial position and consolidated

statements of operations subsequent to the Effective Date are not comparable in many respects to our consolidated statements of

financial position and consolidated statements of operations for periods prior to the Effective Date. For more information regarding

fresh start accounting, see note (4) "Reorganization Under Chapter 11" to our consolidated financial statements in "Item 8. Financial

Statements and Supplementary Data" included elsewhere in this Annual Report.

February 2013 Refinancing

On February 14, 2013 (the "Refinancing Closing Date"), we completed the refinancing of the Old Credit Agreement Loans

(the "Refinancing"). In connection with the Refinancing, we (i) issued $300.0 million aggregate principal amount of 8.75% senior

secured notes due in 2019 (the "Notes") in a private offering exempt from registration under the Securities Act pursuant to an

indenture that we entered into on the Refinancing Closing Date (the "Indenture") and (ii) entered into a new credit agreement (the

"New Credit Agreement"), dated as of the Refinancing Closing Date. The New Credit Agreement provides for a $75.0 million

revolving credit facility, including a sub-facility for the issuance of up to $40.0 million in letters of credit (the "New Revolving

Facility"), and a $640.0 million term loan facility (the "New Term Loan" and, together with the New Revolving Facility, the "New

Credit Agreement Loans"). On the Refinancing Closing Date, we used the proceeds of the Notes offering, together with $640.0

million of borrowings under the New Term Loan and cash on hand to (i) repay principal of $946.5 million outstanding on the Old

Term Loan, plus approximately $7.7 million of accrued interest and (ii) pay approximately $32.6 million of fees, expenses and

other costs related to the Refinancing. For further information regarding the New Credit Agreement, the Notes and our repayment

of the Old Credit Agreement Loans, see "Item 7. Management's Discussion and Analysis of Financial Condition and Results of

Operations —Liquidity and Capital Resources" included elsewhere in this Annual Report.

Regulatory Environment

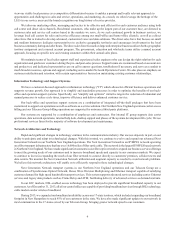

We are generally subject to common carrier regulation primarily by federal and state governmental agencies. At the federal

level, the FCC generally exercises jurisdiction over communications common carriers, such as FairPoint, to the extent those carriers

provide, originate or terminate interstate or international telecommunications. State regulatory commissions generally exercise

jurisdiction over common carriers to the extent those carriers provide, originate or terminate intrastate telecommunications. In

addition, pursuant to the 1996 Act, which amended the Communications Act of 1934 (as amended, the "Communications Act"),

state and federal regulators share responsibility for implementing and enforcing the domestic pro-competitive policies introduced

by that legislation.

We are required to comply with the Communications Act which requires, among other things, that telecommunications

carriers offer telecommunications services at just and reasonable rates and on terms and conditions that are not unreasonably

discriminatory. The Communications Act contains requirements intended to promote competition in the provision of local services

and lead to deregulation as markets become more competitive.