FairPoint Communications 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

Report

www.FairPoint.com

Table of contents

-

Page 1

Annual Report www.FairPoint.com -

Page 2

-

Page 3

..., North Carolina (Address of principal executive offices) 28202 (Zip Code) Registrant's telephone number, including area code: (704) 344-8150 _____ Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered Common Stock, par value... -

Page 4

..., 2013 (based on the closing price of $8.35 per share) was $216,153,093. Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan... -

Page 5

... III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services PART IV... -

Page 6

... products or services; change in preference and use by customers of alternative technologies; the effects of competition on our business and market share; our ability to overcome changes to or pressure on pricing and their impact on our profitability; intellectual property infringement claims... -

Page 7

... local exchange business of Verizon New England Inc. in Maine, New Hampshire and Vermont and the customers of Verizon and its subsidiaries' (other than Cellco Partnership) related long distance and Internet service provider business in those states prior to the Merger. "Predecessor Company" refers... -

Page 8

... support. Hosted PBX service allows us to continue to expand the services we offer to business customers, while leveraging our Ethernet network. We offer broadband Internet access via digital subscriber line ("DSL") technology, fiber-to-the-home technology, dedicated T-1 connections, Internet... -

Page 9

...our local network to originate or terminate intrastate and interstate communications. Network switched access charges relate to long distance, or toll calls, that typically involve more than one company in the provision of telephone service as well as to the termination of interexchange private line... -

Page 10

...,000 miles of fiber optic cable and 87% of our central offices enabled for Ethernet services, FairPoint offers the largest such network in Northern New England. Combined with our copper network, our infrastructure reaches more than 95% of businesses in Maine, New Hampshire and Vermont. By investing... -

Page 11

...000 miles of fiber optic cable. This network is the largest IP/MPLS based network in Northern New England. We have made significant investments in our fiber optic network to expand our business service offerings to meet the growing needs of our customers and to increase broadband speeds and capacity... -

Page 12

...and mobile data services. A large portion of households in the United States are moving to a wireless only model. Wireless carriers, particularly those that provide unlimited wireless service plans with no additional fees for long distance, offer customers a substitution service for our access lines... -

Page 13

... in accordance with the Plan, (iii) the satisfaction of claims associated with (a) the credit agreement dated as of March 31, 2008, by and among FairPoint Communications, Spinco, Bank of America, N.A., as syndication agent, Morgan Stanley Senior Funding, Inc. and Deutsche Bank Securities Inc., as co... -

Page 14

... the Old Credit Agreement Loans on February 14, 2013. For more information about this refinancing, see "-February 2013 Refinancing" herein. In connection with the Chapter 11 Cases, we also negotiated with representatives of the state regulatory authorities in Maine, New Hampshire and Vermont and... -

Page 15

...speed broadband services to 697 customer locations in the state of Maine. This petition was withdrawn on August 27, 2013 in response to the FCC making the unused 2012 funding available in the second round of support offered in the 2013 CAF program. On May 22, 2013, the FCC filed the Report and Order... -

Page 16

... communications carriers including ILECs, CLECs, cable companies, wireless carriers and VoIP providers. The new rules, the majority of which were effective beginning July 1, 2012, established separate rules for price cap carriers and rate-of-return carriers. Although the FCC order treats our rate... -

Page 17

... and a download speed of 1.5 megabits per second" even if that line is served by the legacy ATM network we acquired from Verizon. On August 14, 2013 the MPUC issued an Order Approving a Stipulation between Northern New England Telephone Operations LLC and the Office of the Maine Public Advocate (the... -

Page 18

...access to telephone numbers, operator service, directory assistance and directory listing, (iv) ensure competitive access to telephone poles, ducts, conduits and rights of way and (v) compensate competitors for the cost of completing calls to competitors' customers from the other carrier's customers... -

Page 19

... and (iii) acquire any services from their affiliated LEC at tariffed rates, terms and conditions. Our Northern New England operations, which are Bell Operating Companies, are subject to a different set of rules allowing them to offer both long distance and local exchange services in the regions... -

Page 20

...long distance rates are also subject to state regulation. States typically regulate local service quality, billing practices and other aspects of our business as well. As described above, intrastate access charges are subject to the transition plan established in the recent CAF/ICC Order. Most state... -

Page 21

... of equipment to an existing central office that will enable customers served by that central office with loop lengths of up to 22,000 feet from that central office and who purchase our internet service to have the ability to access our Ethernet-based internet service. Vermont Regulatory Settlement... -

Page 22

... could have a material adverse effect on our business, financial condition, results of operations, liquidity and/or the market price of our outstanding securities. In addition, our borrowings under our New Credit Agreement bear interest at a variable rate based on a British Bankers Association LIBOR... -

Page 23

... our ability to execute on our business plan. Our future operating performance, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors, such as any pension contributions required by the Employee Retirement Income Security Act of 1974... -

Page 24

... of the Internal Revenue Code of 1986, as amended (the "Code"). This followed previous ownership changes resulting from our initial public offering in February 2005, which resulted in an "ownership change" within the meaning of the United States federal income tax laws addressing NOL carryforwards... -

Page 25

...cable companies, the use of alternate technologies, including wireless, as well as challenging economic conditions and the offering of DSL services. We expect to continue to experience net access line losses. Our strategy of providing broadband and advanced data services, such as Ethernet over fiber... -

Page 26

...for local service, we will also lose them for all related services); reduced network usage by existing customers who may use alternative providers for voice and data services; reductions in the prices we charge to meet competition; and increases in marketing expenditures and discount and promotional... -

Page 27

... market price of our outstanding securities. Our service territory spans 17 states. As of December 31, 2013, we had approximately 1.2 million access line equivalents, of which approximately 85% are located in Maine, New Hampshire and Vermont (including certain of our Telecom Group service companies... -

Page 28

... use or disabling of our network, theft of customer data, unauthorized use or publication of our intellectual property and/or confidential business information and could harm our competitive position or otherwise adversely affect our business. Attempts by others to gain unauthorized access... -

Page 29

... could damage our network, network operations centers, call centers, data centers, central offices, corporate headquarters or other facilities. Such an event could interrupt our services, adversely affect service quality, overwhelm customer support and ultimately harm our business and reputation... -

Page 30

... business, financial condition, results of operations, liquidity and/or the market price of our outstanding securities. The amount we are required to contribute to our qualified pension plans and post-retirement healthcare plans is impacted by several factors that are beyond our control and changes... -

Page 31

...and the related rules and regulations of the SEC, including accelerated reporting requirements and expanded disclosures regarding evaluations of internal control systems. With respect to internal control over financial reporting, standards established by the Public Company Accounting Oversight Board... -

Page 32

... to Verizon in 2006 and transferred to FairPoint by the FCC in its order approving the Merger, we offer high-speed interstate services on a deregulated basis. The FCC has initiated a proceeding to investigate potential changes to the regulation of special access services. Several parties filed... -

Page 33

... customers to remote switch locations or to the central office and to points of presence or interconnection with the long distance carriers. These facilities are located on land pursuant to permits, easements or other agreements. Our rolling stock includes service vehicles, construction equipment... -

Page 34

... to January 24, 2011 and (ii) on the New York Stock Exchange under the symbol "FRP" from our initial public offering on February 4, 2005 until October 23, 2009. All of the common stock of the Predecessor Company was extinguished in accordance with the Plan on January 24, 2011. Our existing common... -

Page 35

...securities of FairPoint Communications were authorized for issuance. The Long Term Incentive Plan was approved by the Bankruptcy Court in connection with our emergence from bankruptcy. For a description of the material features of the Long Term Incentive Plan, see note (16) "Stock-Based Compensation... -

Page 36

... Per the Long Term Incentive Plan, if the consolidated enterprise value of the Company (as defined in the Long Term Incentive Plan) does not equal or exceed $2.3 billion on or prior to the expiration of the warrants, then the aggregate number of shares of common stock available for issuance pursuant... -

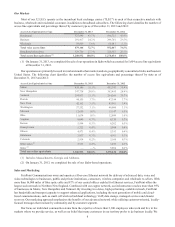

Page 37

... (4) Total assets Total long-term debt (5) Total stockholders' (deficit) equity Operating Data (at period end): Access line equivalents (6) Residential access lines Business access lines Wholesale access lines (7) Broadband subscribers Summary of Cash Flows: Net cash provided by (used in) operating... -

Page 38

..., wholesale and residential customers within our service territories. We offer our customers a suite of advanced data services such as Ethernet, high capacity data transport and other IP-based services over our Next Generation Network in addition to Internet access, HSD, and local and long distance... -

Page 39

... the states of Maine, New Hampshire and Vermont that will serve to promote fair competition among communication services providers in the region, we believe that there is a significant organic growth opportunity within the business and wholesale markets given our extensive fiber network and IP-based... -

Page 40

.... Basis of Presentation We view our business of providing data, voice and communications services to business, wholesale and residential customers as one reportable segment as defined in the Segment Reporting Topic of the Accounting Standards Codification ("ASC"). Beginning in the second quarter of... -

Page 41

... taxes Reorganization items (Loss) income before income taxes Income tax benefit (expense) (Loss) income before discontinued operations Gain on sale of discontinued operations, net of taxes Net (loss) income Access line equivalents: Residential Business Wholesale Total voice access lines Broadband... -

Page 42

... through the provision of local calling services to business and residential customers, generally for a fixed monthly charge and service charges for special calling features. We also generate revenue through long distance services within our service areas on our network and through resale agreements... -

Page 43

... backhaul connections. We also construct new fiber routes to cellular telecommunications towers when the business case presents itself. As described above, we adopted a separate PAP for certain services provided on a wholesale basis to CLECs in each of the states of Maine, New Hampshire and Vermont... -

Page 44

... of data and Internet services to residential and business customers through DSL technology, fiber-to-the-home technology, retail Ethernet, dedicated T-1 connections, Internet dial-up, high speed cable modem and wireless broadband. We have invested in our broadband network to extend the reach and... -

Page 45

...and benefits (including stock based compensation, pension and post-retirement healthcare) not directly attributable to a service or product, bad debt charges, taxes other than income, advertising and sales commission costs, customer billing, call center and information technology costs, professional... -

Page 46

8. Financial Statements and Supplementary Data" included elsewhere in this Annual Report for further information on our company-sponsored qualified pension plans. (2) Increases in 2013 and 2012 net periodic benefit costs for our post-retirement healthcare plans are primarily attributable to an ... -

Page 47

...issuance fees related to the New Credit Agreement Loans as a result of the Refinancing, partially offset by lower weighted average long-term debt outstanding during fiscal year 2013 as compared to fiscal year 2012. Interest on borrowings under the Old Credit Agreement Loans accrued at an annual rate... -

Page 48

... and Supplementary Data" included elsewhere in this Annual Report. Loss on Debt Refinancing On February 14, 2013, we completed the Refinancing and paid all amounts outstanding under the Old Credit Agreement. In connection with this Refinancing, we incurred $5.6 million in related fees and wrote... -

Page 49

... compensated absences accrual to eliminate the impact of changes in the accrual, c) the add-back of costs related to the reorganization, including professional fees for advisors and consultants. See note (4) "Reorganization Under Chapter 11-Financial Reporting in Reorganization-Reorganization Items... -

Page 50

...to support and grow our business; and contributions to our qualified pension plan and payments under our post-retirement healthcare plans. Based on our current and anticipated levels of operations and conditions in our markets, we believe that cash on hand (including amounts available under the New... -

Page 51

... payments of $3.7 million under our post-retirement healthcare plans. Contributions to our qualified defined benefit pension plans in 2013 met the minimum funding requirements under the Pension Protection Act of 2006. Legislation enacted in 2012 changed the method for determining the discount rate... -

Page 52

... first-priority lien on substantially all personal property of FairPoint Communications and the Subsidiary Guarantors, subject to certain exclusions set forth in the related security documents, pari passu with the lien securing the obligations under the New Credit Agreement. The Notes will mature on... -

Page 53

... in Maine, New Hampshire and Vermont and approved by the Bankruptcy Court as part of the Plan. For further information on these capital expenditure requirements, see "Item 1. Business-Regulatory Environment-State Regulation-Regulatory Conditions to the Merger, as Modified in Connection with the Plan... -

Page 54

... and equipment; Stock-based compensation; and Valuation of long-lived assets and indefinite-lived intangible assets. Revenue Recognition. We recognize service revenues based upon usage of our local exchange network and facilities and contract fees. Fixed fees for voice services, Internet services... -

Page 55

... in expense. Significant qualified pension and other post-retirement healthcare plan assumptions, including the discount rate used, the long-term rate-of-return on plan assets, and medical cost trend rates are periodically updated and impact the amount of benefit plan income, expense, assets and... -

Page 56

... rates when appropriate. The Company utilizes straight-line depreciation for its non-telephone property, plant and equipment. Periodically, the Company reviews the estimated remaining useful lives of its group asset categories to address continuing changes in technology, competition and the Company... -

Page 57

...(8) "Long-Term Debt" and note (9) "Interest Rate Swap Agreements" to our consolidated financial statements in "Item 8. Financial Statements and Supplementary Data" included elsewhere in this Annual Report. Interest Rate and Investment Risk - Pension Plans. We are exposed to risks related to the fair... -

Page 58

... AND SUPPLEMENTARY DATA INDEX TO FINANCIAL STATEMENTS Page FAIRPOINT COMMUNICATIONS, INC. AND SUBSIDIARIES: Report of Management on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting Report of Independent... -

Page 59

...Based on such evaluation, management determined that the Company's internal control over financial reporting was effective as of December 31, 2013. Ernst & Young, LLP, our independent registered public accounting firm who audited the financial statements included in this Annual Report, has issued an... -

Page 60

...respects, effective internal control over financial reporting as of December 31, 2013, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of FairPoint Communications, Inc... -

Page 61

... with the standards of the Public Company Accounting Oversight Board (United States), FairPoint Communications, Inc. and subsidiaries' internal control over financial reporting as of December 31, 2013, based on criteria established in Internal Control-Integrated Framework issued by the Committee... -

Page 62

... claims accrual Accrued interest payable Accrued payroll and related expenses Other accrued liabilities Liabilities held for sale Total current liabilities Capital lease obligations Accrued pension obligations Accrued post-retirement healthcare obligations Deferred income taxes Other long-term... -

Page 63

...2011 (in thousands, except per share data) Predecessor Company Three Hundred Forty-One Days Ended December 31, 2011 Twenty-Four Days Ended January 24, 2011 Year Ended December 31, 2013 Year Ended December 31, 2012 Revenues Operating expenses: Cost of services and sales, excluding depreciation and... -

Page 64

... Year Ended December 31, 2013 Year Ended December 31, 2012 Twenty-Four Days Ended January 24, 2011 Net (loss) income Other comprehensive (loss) income, net of taxes: Interest rate swaps (net of $0.4 million tax benefit) Qualified pension and post-retirement healthcare plans (net of $45.6 million... -

Page 65

... restricted stock Exercise of stock options Stock-based compensation expense Interest rate swaps other comprehensive loss Employee benefit other comprehensive income before reclassifications Employee benefit amounts reclassified from accumulated other comprehensive loss Balance at December 31, 2013... -

Page 66

... of business Distributions from investments and proceeds from the sale of property Net cash used in investing activities Cash flows from financing activities: Proceeds from issuance of long-term debt Financing costs Repayments of long-term debt Restricted cash Proceeds from exercise of stock options... -

Page 67

...disclosure of cash flow information: Interest paid, net of capitalized interest Income tax paid, net of refunds Capital additions included in accounts payable, claims payable and estimated claims accrual or liabilities subject to compromise at period-end Reorganization costs paid Non-cash settlement... -

Page 68

...-generation fiber network with more than 16,000 miles of fiber optic cable in addition to Internet access, high-speed data ("HSD") and local and long distance voice services. As of December 31, 2013, FairPoint's service territory spanned 17 states where it is the incumbent communications provider... -

Page 69

... Connect America Fund ("CAF") receipts, Internet and broadband services and other miscellaneous services. Local access charges are billed to local end users under tariffs approved by each state's Public Utilities Commission ("PUC") or by rates, terms and conditions determined by the Company. Access... -

Page 70

... of credit risk with respect to accounts receivable are principally related to trade receivables from other interexchange carriers and are otherwise limited to the Company's large number of customers in several states. The Company sponsors qualified pension plans for certain employees. Plan assets... -

Page 71

...in order to meet funding requirements under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). For additional information regarding the plan assets of the Company's qualified pension plans, including the December 31, 2013 balance at risk, see note (11) "Employee Benefit Plans... -

Page 72

... the Company's internal use software is developed or obtained in accordance with the Interest Topic of the ASC. The Company did not capitalize interest costs incurred during the pendency of the Chapter 11 Cases (as defined hereinafter in note (4) "Reorganization Under Chapter 11"), as payments on... -

Page 73

... net periodic benefit cost. (n) Operating Segments Management views its business of providing data, video and voice communication services to residential, wholesale and business customers as one operating segment as defined in the Segment Reporting Topic of the ASC. The Company's services consist of... -

Page 74

...in accordance with the Plan, (iii) the satisfaction of claims associated with (a) the credit agreement, dated as of March 31, 2008, by and among FairPoint Communications, Spinco, Bank of America, N.A., as syndication agent, Morgan Stanley Senior Funding, Inc. and Deutsche Bank Securities Inc., as co... -

Page 75

... with the Long Term Incentive Plan (as defined hereinafter in note (16) "Stock-Based Compensation") adopted as part of the Plan, the FairPoint Litigation Trust entered into as part of the Plan and the writeoff of the Predecessor Company's long term incentive plans and director and officer policy... -

Page 76

... for the post-emergence company using a number of estimates and assumptions and prepared a calculation of the present value of the future cash flows. The projections were based on information available to the Company at the time of preparation of such projections in connection with the Plan and its... -

Page 77

...2011. (7) Property, Plant and Equipment A summary of property, plant and equipment is shown below (in thousands): Estimated Life (in years) December 31, 2013 December 31, 2012 Land Buildings Central office equipment Outside communications plant Furniture, vehicles and other work equipment (1) Plant... -

Page 78

..., the ''New Credit Agreement Loans"). On the Refinancing Closing Date, FairPoint Communications used the proceeds of the Notes offering, together with $640.0 million of borrowings under the New Term Loan and cash on hand to (i) repay principal of $946.5 million outstanding on the Old Term Loan (as... -

Page 79

... in the related security documents, pari passu with the lien securing the obligations under the Notes. Mandatory Repayments. FairPoint Communications is required to make quarterly repayments of the New Term Loan in a principal amount equal to $1.6 million during the term of the New Credit Agreement... -

Page 80

..., 2011. During 2012 and in the first quarter of 2013, prior to the Old Credit Agreement being retired, the Company made $43.0 million and $10.5 million, respectively, of principal payments on the Old Term Loan. The Old Credit Agreement contained customary representations, warranties and affirmative... -

Page 81

... below (in thousands): As of December 31, 2013 Derivatives designated as hedging instruments: Interest rate swaps Balance Sheet Location Fair Value Other long-term liabilities $ 1,005 The effect of the Company's interest rate swap agreements on the consolidated statements of comprehensive... -

Page 82

...the New Term Loan is net of the unamortized discount of $17.1 million. For a discussion of the fair value measurement of the Company's pension plan assets, see note (11) "Employee Benefit Plans-Plan Assets, Obligations and Funded Status-Qualified Pension Plan Assets". (11) Employee Benefit Plans The... -

Page 83

... obligation: Beginning projected benefit obligation Service cost Interest cost Plan settlements Benefits paid Actuarial loss (gain) Ending projected benefit obligation Funded status Accumulated benefit obligation Amounts recognized in the consolidated balance sheet: Long-term liabilities Net amount... -

Page 84

... Ending fair value of plan assets Projected benefit obligation: Beginning projected benefit obligation Service cost Interest cost Benefits paid Actuarial loss (gain) Ending projected benefit obligation Funded status Amounts recognized in the consolidated balance sheet: Current liabilities Long-term... -

Page 85

...diversification benefits, in terms of asset volatility and pension funding volatility, in the portfolio and a stable source of income. Units held in publicly traded mutual funds that invest in fixed income securities are valued using quoted market prices and are classified within Level 1 of the fair... -

Page 86

... valued using quoted market prices and thus classified within Level 1 of the fair value hierarchy. Net Periodic Benefit Cost. Components of the net periodic benefit cost related to the Company's qualified pension plans and post-retirement healthcare plans for the year ended December 31, 2013, the... -

Page 87

... the net liability and the net periodic benefit cost recognized for the qualified pension plans and postretirement healthcare plans by the Company are, in part, based on assumptions made by management. These assumptions include, among others, the discount rate applied to estimated future cash flows... -

Page 88

...weighted average assumptions used in determining projected benefit obligations are as follows: December 31, 2013 December 31, 2012 Qualified Pension Plans: Discount rate Rate of compensation increase (a) Post-retirement Healthcare Plans: Discount rate Rate of compensation increase (a) 4.92% 3.00... -

Page 89

... the Company elected to defer use of the higher segment rates under the act until the plan year beginning on January 1, 2013 solely for determination of the adjusted funding target attainment percentage ("AFTAP") used to determine benefit restrictions under Internal Revenue Code (the "Code") Section... -

Page 90

..., cover all eligible Telecom Group employees and Northern New England management employees, and one voluntary 401(k) savings plan that covers all eligible Northern New England represented employees (collectively, "the 401(k) Plans"). Each 401(k) Plan year, the Company contributes an amount of... -

Page 91

... initial public offering on February 8, 2005, which resulted in an "ownership change" within the meaning of the United States federal income tax laws addressing NOL carryforwards, alternative minimum tax credits and other similar tax attributes. The Merger and the Company's emergence from Chapter 11... -

Page 92

... to accumulated other comprehensive loss in the consolidated balance sheets. During 2013, as a result of the Company's change in the estimated useful lives for certain fixed assets and change in realizability of certain state credits, the Company recognized a $14.8 million reduction in the beginning... -

Page 93

... note (9) "Interest Rate Swap Agreements" herein. For further detail of amounts recognized in other comprehensive (loss) income related to the qualified pension and post-retirement healthcare plans, see note (11) "Employee Benefit Plans-Plan Assets, Obligations and Funded Status-Other Comprehensive... -

Page 94

... from the above reconciliation include warrants, nonvested restricted stock and stock options issued under the Long Term Incentive Plan (as defined hereinafter in note (16) "Stock-Based Compensation"). (15) Stockholders' Deficit On the Effective Date, the Company issued 25,659,877 shares of common... -

Page 95

... 31, 2013, the Company had $1.6 million of stock-based compensation cost related to non-vested awards that will be recognized over a weighted average period of 1.60 years, all of which is related to awards granted under the FairPoint Communications, Inc. 2010 Long Term Incentive Plan (the "Long Term... -

Page 96

Stock Options. Stock options have a term of 10 years from the date of grant; however, vested stock options will generally expire 90 days after an employee's termination with the Company, unless the Company is in a blackout period. Stock option activity under the Long Term Incentive Plan is ... -

Page 97

... and 2013, no dividends are expected to be paid over the contractual term of the stock options resulting in the use of a zero expected dividend rate. (3) The expected volatility rate is based on the observed historical and implied volatilities of comparable companies, which were adjusted to account... -

Page 98

... loss of access line equivalents which could have a material adverse effect on the Company's business, financial condition, results of operations, liquidity and/or the market price of the Company's outstanding securities. In addition, if state regulators in Maine, New Hampshire or Vermont were to... -

Page 99

..., 2013. (20) Commitments and Contingencies (a) Leases The Company currently leases real estate and fleet vehicles under capital and operating leases expiring through the year ending 2023. The Company accounts for leases using the straight-line method, which amortizes contracted total payments evenly... -

Page 100

... Date, FairPoint Communications and substantially all of its direct and indirect subsidiaries filed voluntary petitions for relief under the Chapter 11 Cases. On January 13, 2011, the Bankruptcy Court entered the Confirmation Order, which confirmed the Plan. On the Effective Date, the Company... -

Page 101

... 31, 2013. (b) Changes in Internal Control Over Financial Reporting We are committed to continuing to improve our internal control processes and will continue to review our financial reporting controls and procedures. As we continue to evaluate and work to improve our internal control over financial... -

Page 102

... Financial Statements and Supplementary Data" included elsewhere in this Annual Report for the Report of Management on Internal Control over Financial Reporting and the Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting, each of which is incorporated... -

Page 103

... reference to "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities-Securities Authorized for Issuance under Equity Compensation Plans" included elsewhere in this Annual Report. The information required by Item 403 of Regulation S-K is... -

Page 104

... SCHEDULES (a) Financial Statements The financial statements filed as part of this Annual Report are listed in the index to the financial statements under "Item 8. Financial Statements and Supplementary Data" included elsewhere in this Annual Report, which index to the financial statements is... -

Page 105

...the undersigned, thereunto duly authorized. FAIRPOINT COMMUNICATIONS, INC. By: /s/ Paul H. Sunu Paul H. Sunu, Chief Executive Officer and Director Date: March 5, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on... -

Page 106

... Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code.(1) Ninth Amended and Restated Certificate of Incorporation of FairPoint.(2) Second Amended and Restated By Laws of FairPoint.(2) Warrant Agreement, dated as of January 24, 2011, by and between FairPoint and The Bank of New York... -

Page 107

... Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code, dated as of December 29, 2010.(1) Order of the Maine Public Utilities Commission, dated February 1, 2008.(11) Order of the Vermont Public Service Board, dated February 15, 2008.(12) Order of the New Hampshire Public Utilities... -

Page 108

... the Current Report on Form 8-K of FairPoint filed on January 25, 2011, Film Number 11544980. Incorporated by reference to the Current Report on Form 8-K of FairPoint filed on January 25, 2011, Film Number 11544991. Incorporated by reference to the Quarterly Report on Form 10-Q of FairPoint for the... -

Page 109

[This page intentionally left blank.] -

Page 110

[This page intentionally left blank.] -

Page 111

... Vice President and Chief Technology Officer Shareholder Information Corporate Headquarters FairPoint Communications, Inc. 521 East Morehead Street Suite 500 Charlotte, NC 28202 Common Stock Symbol: FRP Listed on Nasdaq Transfer Agent For inquiries regarding registered shareholder accounts, please... -

Page 112