FairPoint Communications 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(Mark One)

x

¨

Common Stock, par value $0.01 per share

The Nasdaq Stock Market LLC

(Nasdaq Capital Market)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulations S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer ¨ Accelerated filer x

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Table of contents

-

Page 1

... Degember 31, 2011. or TRTNSITION REPORT PURSUTNT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHTNGE TCT OF 1934. For the transition period from to Commission File Number 001-32408 ¨ FairPoint Communigations, Ing. (Exagt Name of Registrant as Spegified in Its Charter) Delaware (State or Other... -

Page 2

... company (as defined in Rule 12b-2 of the Act). Yes ¨ No x The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2011 (based on the closing price of $9.21 per share) was $237,682,166. Indicate by check mark whether the registrant has filed all... -

Page 3

... 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services PTRT IV... -

Page 4

... support payments; availability of net operating loss ("NOL") carryforwards to offset anticipated tax liabilities; the impact of changes in assumptions on our ability to meet obligations to our Company-sponsored pension plans and post-retirement healthcare plans; and changes in accounting... -

Page 5

... should not place undue reliance on such forward-looking statements, which are based on the information currently available to us and speak only as of the date on which this Annual Report was filed with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements... -

Page 6

...Verizon Group") related long distance and Internet service provider business in tpose states prior to tpe Merger. Our Business We are a leading provider of communications services in rural and small urban communities, offering an array of services, including high speed data ("HSD"), Internet access... -

Page 7

... to purchase shares of our new common stock to holders of certain claims in accordance with the Plan, (iii) the satisfaction of claims associated with the Credit Agreement, dated as of March 31, 2008, by and among FairPoint Communications, Spinco, Bank of America, N.A. as syndication agent, Morgan... -

Page 8

... carriers for origination and termination of interstate and intrastate long-distance phone calls; (iii) HSD services; (iv) Universal Service Fund high-cost loop and high-cost model payments; and (v) the provision of other services such as long-distance resale, other data and Internet and broadband... -

Page 9

... switched access charges relate to long-distance, or toll calls, that typically involve more than one company in the provision of telephone service as well as to the termination of interexchange private line services. Since toll calls and private line services are generally billed to the customer... -

Page 10

..., Internet dial-up, high speed cable modem and wireless broadband. Customers can utilize this access in combination with customer owned equipment and software to establish a presence on the World Wide Web. We offer enhanced Internet services, which include obtaining IP addresses, basic web site... -

Page 11

.... Our Northern New England operations carrier access billing and our Telecom Group billing operations are supported by fully outsourced third-party platforms. Our systems are supported by a combination of employees and contractors. Our internal IT group supports data center operations, data network... -

Page 12

... wireless and cable have formed and may continue to form strategic alliances to offer bundled services in our service areas. We estimate that, as of December 31, 2011, most of the customers that we serve have access to voice, network transport and Internet services through a cable television company... -

Page 13

...example, concerning interstate access, all of the Telecom Group regulated interstate services of FairPoint were regulated under a rate-of-return model, while all of the rate-regulated interstate services provided by the Verizon Northern New England business were regulated under a price cap model. On... -

Page 14

.../ICC Order. In this order, the FCC replaced all existing USF for price cap carriers with its CAF. The intent of the CAF is to bring high speed affordable broadband services to all Americans. The FCC CAF/ICC Order fundamentally reforms the ICC system that governs how communications companies bill one... -

Page 15

... operations in Maine, New Hampshire and Vermont and, effective July 1, 2010, our Telecom Group operations in Maine and Vermont, are subject to price cap regulation of access charges. Under price cap regulation, limits are imposed on a company's interstate rates without regard to its costs or revenue... -

Page 16

... their telephone numbers when changing carriers, referred to as local number portability; (iii) ensure that competitors' customers can use the same number of digits when dialing and receive nondiscriminatory access to telephone numbers, operator service, directory assistance and directory listing... -

Page 17

... Operating Companies, subject to certain conditions with which we comply. In addition, our operations have been obligated under the FCC's "equal access" scripting requirement to read new customers a list of all available long-distance carriers presented in random order. Not all of our competitors... -

Page 18

... broadband Internet access services through private carrier arrangements on negotiated commercial terms. The FCC order also allows rural rate-of-return carriers, including most of our Telecom Group operations, the option to continue providing DSL service as a common carrier (status quo) offering... -

Page 19

... companies to provide communications services. In some states, our intrastate long-distance rates are also subject to state regulation. States typically regulate local service quality, billing practices and other aspects of our business as well. As described above, intrastate access charges... -

Page 20

... NH 2008 Order, and the resold services are purchased through and serviced by us. • • Pricing restrictions regarding stand-alone DSL service terminated on April 1, 2011; provided, however, that we will continue to honor the "for life" pricing that Verizon had offered to certain customers. We... -

Page 21

...reimburse the State of New Hampshire for certain costs and expenses. We fulfilled this obligation in January 2011. During the first two years following the Effective Date of the Plan, we are barred from paying dividends if we are in material breach of the New Hampshire Regulatory Settlement until we... -

Page 22

...the terms of the ME 2008 Merger Order, as modified by the Maine Regulatory Settlement, and all other regulatory matters involving the States of Vermont, New Hampshire and Maine. We appointed a regulatory committee on the Effective Date. • • We agreed to seek to have a Chief Information Officer... -

Page 23

...% broadband availability in the VT 2008 Order (the "100% Exchanges") by June 30, 2011. We believe we met this obligation. With respect to the remaining 5% of lines in the 100% Exchanges, we will deploy broadband to any requesting customer using an extended service interval of 90 days from the date... -

Page 24

...upon consummation of the Merger. The AFOR provides for the capping of rates for basic local exchange services and allows pricing flexibility for other services, including intrastate long-distance, optional services and bundled packages. Under the terms of the ME 2008 Merger Order, among other things... -

Page 25

... to our competitors. In addition to our access tariff, we maintain two New Hampshire wholesale tariffs, one for interconnection, colocation and UNEs and another for services offered to carriers for resale. The order of the NHPUC approving the spin-off and the Merger includes conditions generally... -

Page 26

...operations are in substantial compliance with applicable environmental laws and regulations. Other Information We make available free of charge on our website, www.fairpoint.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to such... -

Page 27

...incur interest costs above market rates. While we may enter into agreements limiting our exposure to higher interest rates, these agreements may not offer complete protection from this risk. We are a holding gompany and rely on dividends, interest and other payments, advanges and transfers of funds... -

Page 28

... any of our indebtedness on commercially reasonable terms, or at all. If we are unable to make payments on or refinance our debt or obtain new financing under these circumstances, we would have to consider other options, including: • • • sales of assets; reduction or delay of capital... -

Page 29

...as amended (the "Code"). This followed previous ownership changes resulting from our initial public offering in February 2005 which resulted in an "ownership change" within the meaning of the U.S. federal income tax laws addressing NOL carryforwards, alternative minimum tax credits and other similar... -

Page 30

... of our Common Stock that may be held or acquired by our directors, executive officers, employee insiders and other affiliates, as that term is defined in the Securities Act, which will be restricted securities under the Securities Act. Restricted securities may not be sold in the public market... -

Page 31

...resulted mainly from competition, including competition from bundled offerings by cable companies, the use of alternate technologies as well as challenging economic conditions and the offering of DSL services, which prompts some customers to cancel second line service. We believe that the Chapter 11... -

Page 32

... wireless carriers has increased and is expected to further increase. We also face increasing competition from wireline and cable television companies for our voice and Internet services. We estimate that as of December 31, 2011, most of the customers that we serve had access to voice and Internet... -

Page 33

... for our services and resulting loss of access line equivalents which could have a material adverse effect on our business, financial condition, results of operations, liquidity and/or the market price of our Common Stock. In addition, if state regulators in Maine, New Hampshire or Vermont were to... -

Page 34

... team, due to retirement or otherwise, and the inability to attract and retain highly qualified technical and management personnel in the future, could have a material adverse effect on our business, financial condition, results of operations, liquidity and/or the market price of our Common Stock... -

Page 35

...adverse impact on our business, financial condition, results of operations, liquidity and/or the market price of our Common Stock. Our long-lived assets may begome impaired in the future. Upon our adoption of fresh start accounting, we recorded our property, plant and equipment at fair value and we... -

Page 36

of impairment exist. At September 30, 2011, an $18.8 million impairment charge was recorded which reduced the carrying value of our non-amortizable intangible asset to $39.2 million. Indicators of impairment could include, but are not limited ... -

Page 37

... by a carrier that utilizes our access services could negatively affect our business, financial condition, results of operations, liquidity and/or the market price of our Common Stock. The amount of access charge revenues that we receive is based on rates set by federal and state regulatory bodies... -

Page 38

... with the Plan." Our business also may be affected by legislation and regulation imposing new or greater obligations related to open Internet access, assisting law enforcement, bolstering homeland security, minimizing environmental impacts, protecting customer privacy or addressing other issues that... -

Page 39

... power failure. Transport and distribution network facilities include fiber optic backbone and copper wire distribution facilities, which connect customers to remote switch locations or to the central office and to points of presence or interconnection with the long-distance carriers. These... -

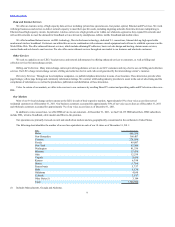

Page 40

... sales prices per share of our New Common Stock as reported on the NASDAQ, from January 25, 2011 to December 31, 2011. The stock price information is based on published financial sources. Year Ended Degember 31, 2011 High Low First quarter (January 25, 2011 through March 31, 2011) Second quarter... -

Page 41

... 31, 2011, the FairPoint Communications, Inc. 2010 Long Term Incentive Plan (the "Long Term Incentive Plan") was the only equity compensation plan under which securities of the Company were authorized for issuance. The Long Term Incentive Plan was approved by the Bankruptcy Court in connection with... -

Page 42

... exchange businesses of Verizon New England in Maine, New Hampshire and Vermont and the customers of the related voice and Internet service provider businesses in those states to subsidiaries of Spinco. The Merger was accounted for as a "reverse acquisition" of FairPoint by Spinco under the purchase... -

Page 43

... members of the board of directors received restricted shares of Common Stock and options to purchase Common Stock pursuant to the terms of the Long Term Incentive Plan. As of March 2, 2012, we had 26,194,442 shares of Common Stock outstanding. All periods after the Effective Date are referred to as... -

Page 44

Reorganization items for the year ended December 31, 2009. 41 -

Page 45

... includes voice access lines and HSD lines, which include DSL, wireless broadband, cable modem and fiber-to-thepremises. Wholesale access lines include residential and business resale lines and unbundled network element platform ("UNEP") lines. The balance sheet data reflected at January 24, 2011 is... -

Page 46

... back-office functions in the Maine, New Hampshire and Vermont operations acquired from Verizon. These services were provided by Verizon under the Transition Services Agreement, dated as of January 15, 2007, which we entered into with certain subsidiaries of Verizon in connection with the Merger, as... -

Page 47

.../ICC Order. In this order, the FCC replaced all existing USF for price cap carriers with its CAF. The intent of the CAF is to bring high speed affordable broadband services to all Americans. The FCC CAF/ICC Order fundamentally reforms the ICC system that governs how communications companies bill one... -

Page 48

... paid by long-distance companies and other customers for access to our networks in connection with the origination and termination of intrastate telephone calls both to and from our customers. Intrastate access charges to longdistance carriers and other customers are based on access rates filed with... -

Page 49

...include DSL, wireless broadband, cable modem and fiber-to-the-premises) as of December 31, 2011, 2010 and 2009: Suggessor Company Degember 31, Predegessor Company Degember 31, Degember 31, 2010 2009 2011 Tggess Line Equivalents: Residential access lines Business access lines Wholesale access lines... -

Page 50

Table of Contents Because the Verizon Northern New England business had been operating as the LEC of Verizon in Maine, New Hampshire and Vermont, and not as a standalone telecommunications provider, we operated under the Transition Services Agreement for the one month ended January 2009, under ... -

Page 51

...is attributable to local calling services revenues and $3.3 million of the decrease is attributable to long distance service revenues. This decrease in voice services revenues is primarily due to the impact of an 8.4% decline in total switched access lines in service at December 31, 2011 compared to... -

Page 52

...secured or unsecured claim. We continued to accrue interest expense on the Pre-Petition Credit Facility, as such interest was considered an allowed claim pursuant to the Plan. Upon the Effective Date, we entered into the Credit Agreement and began accruing interest on the Revolving Facility and Term... -

Page 53

... reduction of an accrual for forgiveness of fiscal 2008 and 2009 SQI penalties in New Hampshire and Vermont. SQI penalties are settled by crediting customer accounts and are recorded as a reduction to revenue. The decrease in the number of voice access lines is due to an increase in competition from... -

Page 54

... losses recognized on the change in fair market value of interest rate swap derivatives. During the year ended December 31, 2009 we recognized a net non-cash gain of $12.3 million related to our derivative financial instruments. In connection with the filing of the Chapter 11 Cases, the Swaps were... -

Page 55

... prior to accounting for the effects of the reorganization. Our short-term and long-term liquidity needs arise primarily from: (i) interest and principal payments on our indebtedness; (ii) capital expenditures; (iii) working capital requirements as may be needed to support and grow our business; and... -

Page 56

...of up to $30.0 million of letters of credit, and the Term Loan. On the Effective Date, we paid to the lenders providing the Revolving Facility an aggregate fee equal to $1.5 million. Interest on the Credit Agreement Loans accrues at an annual rate equal to either (a) LIBOR plus 4.50%, with a minimum... -

Page 57

... million of the DIP Financing, subject to the terms and conditions of the DIP Credit Agreement and related orders of the Bankruptcy Court, of which up to $30.0 million was available in the form of one or more letters of credit that could be issued to third parties for our account. As of December 31... -

Page 58

... us to make payments totaling approximately $45.4 million to Verizon in the first quarter of 2009, including a one-time fee of $34.0 million due at Cutover, with the balance related to the purchase of certain Internet access hardware. The settlement set forth in the Transition Agreement resulted in... -

Page 59

... Allowance for doubtful accounts; Accounting for pension and other post-retirement benefits; Accounting for income taxes; Depreciation of property, plant and equipment; Stock-based compensation; Valuation of long-lived assets, including goodwill; and Accounting for software development costs. 56 -

Page 60

... reorganization accounting rules. With the exception of deferred taxes and assets and liabilities associated with pension and post-retirement health plans, all Successor Company assets and non-interest bearing liabilities are recorded at their estimated fair values upon the Effective Date. The fair... -

Page 61

... dividend rate, the risk-free interest rate and expected volatility. The expected life of the stock options granted represents the period of time that the options are expected to be outstanding. The risk-free interest rates are based on United States Treasury yields in effect at the date of grant... -

Page 62

... decline in our stock price since the Effective Date and the September 30, 2011 impairment of goodwill and the FairPoint trade name, as further described below, we determined that a possible impairment of our long-lived assets - the property, plant and equipment, customer relationships and favorable... -

Page 63

... with internal use software, including direct labor costs and external costs of materials and services. Costs incurred during the preliminary project stage, as well as maintenance and training costs, are expensed as incurred. New Tggounting Standards In June 2011, the FASB issued ASU 2011-05... -

Page 64

... in the fair value of our pension plan assets and from changes to rates at which benefit payments are discounted. For the year ended December 31, 2011, the actual gain on the pension plan assets was approximately 1.6%. Net periodic benefit cost for 2011 assumes a weighted average annualized expected... -

Page 65

... DTTT INDEX TO FINTNCITL STTTEMENTS Page FAIRPOINT COMMUNICATIONS, INC. AND SUBSIDIARIES: Report of Management on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting Report of Independent Registered Public... -

Page 66

... that the Company's internal control over financial reporting was not effective as of December 31, 2011 because the following material weakness in internal control over financial reporting existed during 2011: • Procedures for the review of our income tax provision and supporting schedules were... -

Page 67

... Management has identified a material weakness in controls related to the Company's review of its income tax provision. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of FairPoint Communications... -

Page 68

...the standards of the Public Company Accounting Oversight Board (United States), FairPoint Communications, Inc.'s internal control over financial reporting as of December 31, 2011 (Successor), based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring... -

Page 69

...payable Claims payable and estimated claims accrual Accrued interest payable Other accrued liabilities Total gurrent liabilities Capital lease obligations Accrued pension obligation Employee benefit obligations Deferred income taxes Unamortized investment tax credits Other long-term liabilities Long... -

Page 70

-

Page 71

... Other income (expense): Interest expense Gain on derivative instruments Gain on early retirement of debt Other Total other expense 262,019 1,369,317 (406,205) Loss before reorganization items and ingome taxes Reorganization items (Loss) ingome before ingome taxes Income tax benefit (expense) Net... -

Page 72

... Company Three Hundred FortyOne Days Ended Degember 31, 2011 Twenty-Four Days Ended Year Ended Degember 31, January 24, 2011 2010 2009 Net (loss) ingome Other comprehensive (loss) income, net of taxes: Defined benefit pension and post-retirement plans (net of $39.1 million tax benefit... -

Page 73

... 31, 2008 (Predegessor Company) Net loss Issuance of 2008 Interim Awards Issuance of restricted shares Restricted stock cancelled for withholding tax Restricted units cancelled for withholding tax Stock based compensation expense Net assets contributed back to Verizon Employee benefit adjustment to... -

Page 74

...flow information: Interest paid, net of capitalized interest Income tax paid, net of refunds Non-cash issuance of Senior Notes Capital additions included in accounts payable, claims payable and estimated claims accrual or liabilities subject to compromise at period-end Reorganization costs paid 854... -

Page 75

-

Page 76

... an array of services, including high speed data ("HSD"), Internet access, voice, television and broadband product offerings, to residential, business and wholesale customers. FairPoint operates in 18 states with approximately 1.3 million access line equivalents (including voice access lines and HSD... -

Page 77

... (the "Old Common Stock"), options and contractual or other rights to acquire any equity interests. The Plan provided for: • (i) The lenders under the Credit Agreement, dated as of March 31, 2008, by and among FairPoint Communications, Spinco, Bank of America, N.A. as syndication agent, Morgan... -

Page 78

... the terms of the FairPoint Communications, Inc. 2010 Long Term Incentive Plan (the "Long Term Incentive Plan"); and Members of the Company's board appointed on the Effective Date (the "New Board") to receive options to purchase New Common Stock pursuant to the terms of the Long Term Incentive Plan... -

Page 79

... Company to incur indebtedness, create liens, engage in mergers, consolidations and other fundamental changes, make investments or loans, engage in transactions with affiliates, pay dividends, make capital expenditures and repurchase capital stock. The Credit Agreement also contains minimum interest... -

Page 80

... of all liens, charges, claims, encumbrances and interests except for the return to FairPoint Communications of any funds deposited in the Litigation Trust bank account. In addition, pursuant to the Plan, the Company transferred funds to the Litigation Trust to pay the reasonable costs and expenses... -

Page 81

.... On October 25, 2011, the Litigation Trust filed suit in the State of North Carolina Business Court against Verizon Communications and certain of its subsidiaries. Long Term Incentive Plan and Success Bonus Plan As contemplated by the Plan, on the Effective Date, the Company was deemed to have... -

Page 82

... to the Company's stock prior to the ownership change by the amount of creditor claims surrendered or canceled during the reorganization. Specifically, the amount of the annual limitation would equal the "long-term tax-exempt rate" (published monthly by the Internal Revenue Service (the "IRS... -

Page 83

... January 24, 2011 2010 2009 Professional fees (a) $ Success bonus (b) Non-cash allowed claim adjustments (c) Cancellation of debt income (d) Goodwill adjustment (e) Intangible assets adjustment (e) Property, plant and equipment adjustment (e) Pension and post-retirement healthcare adjustment... -

Page 84

..., 2010 consisted of the following (amounts in thousands): Predegessor Company Degember 31, 2010 Senior secured credit facility Senior Notes Interest rate swap Accrued interest Accounts payable Other accrued liabilities Other long-term liabilities Liabilities subject to compromise $ 1,970,963 549... -

Page 85

... or file an objection to the remaining claims. Because of the duplicative claims, the amount of disallowed and settled claims may increase significantly in the future. On the Effective Date, the Company distributed cash, entered into the Credit Agreement, and issued shares of New Common Stock and... -

Page 86

... Accounts payable Claims payable and estimated claims accrual Other accrued liabilities Total gurrent liabilities Capital lease obligations Accrued pension obligation Employee benefit obligations Deferred income taxes Unamortized investment tax credits Other long-term liabilities Long-term... -

Page 87

of obligations pursuant to the Plan and the related tax effects. The following reflects the calculation of the pre-tax gain (in thousands, unaudited): 81 -

Page 88

... subject to compromise Less: Transfer to claims reserve Remaining liabilities subject to compromise Less: Issuance of debt and equity New long-term debt Successor common stock (at par value) Successor additional paid-in capital Successor warrants Pre-tax gain from gangellation and satisfagtion... -

Page 89

... Effective Date) related to the Credit Agreement Loans were recorded in Debt issue costs, net and will be amortized over the terms of the respective agreements. Reflects the cumulative impact of the reorganization adjustments (in thousands, unaudited): Pre-tax gain from cancellation and satisfaction... -

Page 90

...the FairPoint Communications trade name and a $0.4 million favorable leasehold agreement intangible asset. • • (h) The customer list asset was valued based on a cost method which utilized average cost to acquire a new line multiplied by the number of existing lines within the FairPoint network... -

Page 91

... other communications carriers. Revenues are primarily derived from: access, pooling, voice services, Universal Service Fund receipts, Internet and broadband services and other miscellaneous services. Local access charges are billed to local end users under tariffs approved by each state's Public... -

Page 92

... the consolidated balance sheets. PAP penalties for Maine and New Hampshire are recorded as a reduction to accounts receivable since these penalties are paid by the Company in the form of credits applied to the Competitive Local Exchange Carrier ("CLEC") bills. PAP penalties in Vermont are recorded... -

Page 93

... interexchange carriers and are otherwise limited to the Company's large number of customers in several states. The Company sponsors pension and post-retirement healthcare plans for certain employees. Plan assets are held by third party trustees. The Company's plans hold debt and equity securities... -

Page 94

Table of Contents In connection with the Company's adoption of fresh start accounting on the Effective Date, property, plant and equipment assets were revalued to their fair value, generally their appraised value after considering economic obsolescence, and new remaining useful lives were ... -

Page 95

... (FairPoint Communications, Inc. exclusive of the local exchange business acquired from Verizon and its subsidiaries after giving effect to the Merger (the "Northern New England operations")), using the purchase method of accounting and the fair value of net assets acquired. Upon the Effective Date... -

Page 96

.... On the Effective Date, the Company recorded $256.0 million of goodwill in connection with the Company's adoption of fresh start accounting. During the second quarter of 2011, the Company made a $12.8 million reclassification adjustment to Property, Plant and Equipment based on fresh start... -

Page 97

... Benefit Plans The Company accounts for pensions and other post-retirement benefit plans in accordance with the Compensation-Retirement Benefits Topic of the ASC. This Topic requires the recognition of a post-retirement benefit plan's funded status as either an asset or liability on the balance... -

Page 98

...-Retirement Benefits Topic of the ASC. Additionally, a company must determine the fair value of plan assets as of the company's year end. (r) Business Segments Management views its business of providing data, video and voice communication services to residential, wholesale and business customers... -

Page 99

.... On the Effective Date, the Company recorded $256.0 million of goodwill in connection with the Company's adoption of fresh start accounting. During the second quarter of 2011, the Company made a $12.8 million reclassification adjustment to Property, Plant and Equipment based on fresh start... -

Page 100

...Predegessor Company Degember 31, Estimated life 2011 2010 (in years) Land Buildings and leasehold improvements Central office equipment Outside communications plant Furniture, vehicles and other work equipment Plant under construction Other - 2 - 45 5 - 11 15 - 50 3 - 15 - - $ Total property... -

Page 101

... of the Company's debt securities at the respective balance sheet dates. As of December 31, 2011, the Company had $62.6 million, net of $12.4 million outstanding letters of credit, available for additional borrowing under the Revolving Facility. As a result of the filing of the Chapter 11 Cases... -

Page 102

... of the Term Loan being due and payable on the Maturity Date. The Credit Agreement Loans are guaranteed by all of the Financing Loan Parties. The Credit Agreement Loans as a whole are secured by liens upon substantially all existing and after-acquired assets of the Financing Loan Parties, with... -

Page 103

...on the Effective Date. All letters of credit outstanding under the DIP Credit Agreement were transferred to the Credit Agreement on the Effective Date. (10) Employee Benefit Plans The Company sponsors noncontributory qualified pension plans and post-retirement healthcare plans which provide certain... -

Page 104

... with fresh start accounting, the Company remeasured the net liabilities of its pension and other post-retirement healthcare benefits as of the Effective Date using a weighted average discount rate of approximately 5.80%. See note 2. Obligations and funded status A summary of plan assets, projected... -

Page 105

... the net liability and the net periodic benefit cost recognized for the qualified pension plans and post-retirement healthcare plans by the Company are, in part, based on assumptions made by management. These assumptions include, among others, the discount rate applied to estimated future cash flows... -

Page 106

... Matters Agreement, dated January 15, 2007 between Verizon and the Company (the "Employee Matters Agreement"). The disputed amount was not included in the Company's pension plan assets at December 31, 2009. By letter dated July 29, 2010, the third-party actuary appointed to perform the review and... -

Page 107

... December 31, 2011 is as follows (in thousands): Funds Hedge Regeivable Funds from Verizon Other Tssets Total Balange at Degember 31, 2009 (Predegessor Company) Actual gain (loss) on plan assets held Actual gain (loss) on plan assets sold during the period Purchases and sales Transfers in and... -

Page 108

Table of Contents Net periodic benefit cost Components of the net periodic benefit cost related to the Company's pension and post-retirement healthcare plans for the 341 days ended December 31, 2011, the 24 days ended January 24, 2011 and the years ended December 31, 2010 and 2009 are presented ... -

Page 109

... settlement with the New Hampshire Public Utilities Commission ("NHPUC"). During the years ended December 31, 2010 and 2009, the Company did not make a contribution to the qualified pension plans, but did incur $1.5 million and $0.4 million, respectively, in post-retirement healthcare plan... -

Page 110

... the expected long-term rate-of-return assumption, the Company evaluated historical investment performance and input from its investment advisors. Projected returns by such advisors were based on broad equity and bond indices. The expected long-term rate-of-return on qualified pension plan assets is... -

Page 111

... assumption, the net periodic benefit cost may increase in future periods and the Company may be required to contribute additional funds to its pension plans. A 1% change in the medical trend rate assumed for post-retirement healthcare benefits at December 31, 2011 (Successor Company) would have the... -

Page 112

... Degember 31, 2011 Predegessor Company Year Ended Twenty-Four Degember 31, Days Ended January 24, 2011 2010 2009 Current: Federal State and local Total current income tax (expense) benefit Investment tax credits Deferred: Federal State and local Total deferred income tax benefit (expense) Total... -

Page 113

... Suggessor Company Predegessor Company 2011 2010 Deferred tax assets: Federal and state tax loss carryforwards Employee benefits Allowance for doubtful accounts Investment tax credits Alternative minimum tax and other state credits Basis in interest rate swaps Bond issuance costs Service quality... -

Page 114

... Group completed an initial public offering on February 8, 2005, which resulted in an "ownership change" within the meaning of the U.S. Federal income tax laws addressing NOL carryforwards, alternative minimum tax credits, and other similar tax attributes. The Merger and the Company's emergence... -

Page 115

... balance sheet for the payment of interest and penalties at December 31, 2011 as the remaining unrecognized tax benefits would only serve to reduce the Company's current federal and state NOL carryforwards, if ultimately recognized. The Company or one of its subsidiaries files income tax... -

Page 116

... Date, the Company issued 25,659,877 shares of Common Stock and 3,458,390 Warrants to purchase Common Stock and reserved 610,309 shares and 124,012 Warrants for satisfaction of certain pending claims related to the Chapter 11 Cases. During the 341 days ended December 31, 2011 the Company issued... -

Page 117

... expense, the grant date fair value per share of the stock options under the Long Term Incentive Plan was estimated using the Black-Scholes option pricing model which requires the use of various assumptions including the expected life of the option, expected dividend rate, expected volatility... -

Page 118

... to acquire any equity interests, were cancelled and extinguished on the Effective Date. (a) 1998 Stock Incentive Plan In August 1998, the Company adopted the FairPoint Communications, Inc. (formerly MJD Communications, Inc.) Stock Incentive Plan (the "1998 Plan"). The 1998 Plan provided for grants... -

Page 119

... Employee Stock Incentive Plan In May 2000, the Company adopted the FairPoint Communications, Inc. 2000 Employee Stock Incentive Plan (the "2000 Employee Stock Incentive Plan"). The 2000 Employee Stock Incentive Plan provided for grants to members of management of up to 1,898,521 options to purchase... -

Page 120

... shares pay current dividends. In 2008, the Company's board of directors approved an annual award to each of the Company's non-employee directors in the form of non-vested stock or stock units, at the recipient's option, issued under the 2008 Long Term Incentive Plan. The non-vested stock and stock... -

Page 121

... Stock were cancelled upon his resignation, effective August 24, 2010. (16) Transagtions with Tffiliates The Company hired Gilbane Building Company to construct a new data center in Manchester, New Hampshire and to perform restoration services on a flooded building in Raymond, New Hampshire... -

Page 122

... post-retirement healthcare plans, all assets and liabilities were remeasured at fair value under fresh start accounting. See note 2. (19) Business Congentrations Geographic As of December 31, 2011, approximately 85% of the Company's access line equivalents were located in Maine, New Hampshire and... -

Page 123

... Maine, New Hampshire or Vermont were to take an action that is adverse to the Company's operations in those states, the Company could suffer greater harm from that action by state regulators than it would from action in other states because of the concentration of operations in those states. Labor... -

Page 124

... be paid by the Company in the form of credits applied to retail customer bills. During February 2010, the Company entered into the Regulatory Settlements with the representatives for each of Maine, New Hampshire and Vermont regarding modification of each state's Merger Order, which have since been... -

Page 125

... subject to compromise, respectively. (d) Performance Assurance Plan Credits As part of the Merger Orders, the Company adopted a PAP for certain services provided on a wholesale basis to CLECs in the states of Maine, New Hampshire and Vermont. Failure to meet specified performance standards in any... -

Page 126

... the Vermont Public Service Board, respectively. (e) Capital Expenditure Obligations Under regulatory settlements in each of Maine, New Hampshire and Vermont, the Company is required to make certain capital expenditures in each of these states. Beginning from the date of the Merger, the Company is... -

Page 127

..., tax and general ledger accounting. (d) Remediation of Material Weaknesses in Internal Control Over Financial Reporting During the year ended December 31, 2011, our management completed corrective actions to remediate certain of the material weaknesses identified in our 2010 Annual Report on... -

Page 128

... to shared administrator accounts to individuals with a valid business need for accessing those accounts; and Revised access to human resource, general ledger, accounts receivable, accounts payable, enterprise asset management, fixed assets, inventory, purchase order and payroll functions within... -

Page 129

... Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities-Securities Authorized for Issuance under Equity Compensation Plans" of this Annual Report. ITEM 13. CERTTIN RELTTIONSHIPS TND RELTTED TRTNSTCTIONS, TND DIRECTOR INDEPENDENCE The information... -

Page 130

..., thereunto duly authorized. FAIRPOINT COMMUNICATIONS, INC. Date: March 9, 2012 By: Name: Title: /s/ Paul H. Sunu Paul H. Sunu Chief Executive Officer and Director Pursuant to the requirements of the Securities Exchange Act of 1934, this Annual Report has been signed below by the following... -

Page 131

... agent, for the benefit of certain secured parties.(3) Registration Rights Agreement, dated as of January 24, 2011, by and between FairPoint Communications, Inc. and Angelo, Gordon & Co., L.P.(3) FairPoint Litigation Trust Agreement, dated as of January 24, 2011.(3) Form of Director Indemnity... -

Page 132

... Amended Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code, dated as of December 29, 2010.(1) Order of the Maine Public Utilities Commission, dated February 1, 2008.(14) Order of the Vermont Public Service Board, dated February 15, 2008.(15) Order of the New Hampshire Public... -

Page 133

...by reference to the Current Report on Form 8-K of FairPoint filed on February 25, 2008. Incorporated by reference to the Quarterly Report on Form 10-Q of FairPoint for the period ended June 30, 2011. Incorporated by reference to the Annual Report on Form 10-K of FairPoint for the year ended December... -

Page 134

... C-R Long Distance, Inc. Community Service Telephone Co. Sidney Telephone Company Utilities, Inc. China Telephone Company Maine Telephone Company Standish Telephone Company UI Long Distance, Inc. Berkshire Telephone Corporation Berkshire Cable Corp. Berkshire Cellular, Inc. Berkshire New York Access... -

Page 135

... f/k/a FairPoint Communications Corp.) FairPoint Broadband, Inc. Northern New England Telephone Operations LLC Telephone Operating Company of Vermont LLC Enhanced Communications of Northern New England Inc. FairPoint Logistics, Inc. (f/k/a MJD Capital Corp.) FairPoint Business Services LLC Delaware... -

Page 136

... to the 2010 Long Term Incentive Plan of our reeort dated March 9, 2012, with reseect to the consolidated financial statements and schedules of FairPoint Communications, Inc. (the Comeany), and the effectiveness of internal control over financial reeorting of FairPoint Communications, Inc. in this... -

Page 137

..., summarize and report financial information; and (ii) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. Date: March 9, 2012 /s/ Paul H. Sunu Paul H. Sunu Chief Executive Officer -

Page 138

...summarize and report financial information; and (ii) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. Date: March 9, 2012 /s/ Ajay Sabherwal Ajay Sabherwal Chief Financial Officer -

Page 139

... OF 2002 In connection with the Annual Report on Form 10-K of FairPoint Communications, Inc. (the "Company") for the year ended December 31, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Paul H. Sunu, Chief Executive Officer of the Company, certify... -

Page 140

... OF 2002 In connection with the Annual Report on Form 10-K of FairPoint Communications, Inc. (the "Company") for the year ended December 31, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Ajay Sabherwal, Chief Financial Officer of the Company, certify... -

Page 141