Express 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

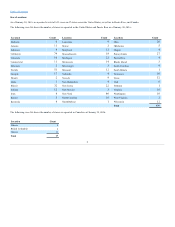

Table of Contents

We rely on certain trademark registrations and common law trademark rights to protect the distinctiveness of our brand. However, there can be no assurance

that the actions we have taken to establish and protect our trademarks will be adequate to prevent imitation of our trademarks by others or to prevent others

from claiming that sales of our products infringe, dilute, or otherwise violate third-party trademarks or other proprietary rights that could block sales of our

products.

The laws of certain foreign countries may not protect the use of unregistered trademarks to the same extent as do the laws of the United States. As a result,

international protection of our brand may be limited, and our right to use our trademarks outside the United States could be impaired. Other persons or

entities may have rights to trademarks that contain portions of our marks or may have registered similar or competing marks for apparel and/or accessories in

foreign countries. There may also be other prior registrations of trademarks identical or similar to our trademarks in other foreign countries. Accordingly, it

may be possible for others to prevent the sale or manufacture of our branded goods or the operation of Express stores in certain foreign countries. Our

inability to register our trademarks or purchase or license the right to use the relevant trademarks in these jurisdictions could limit our ability to penetrate

new markets in jurisdictions outside the United States.

Litigation may be necessary to protect and enforce our trademarks and other intellectual property rights, or to defend against claims by third parties alleging

that we infringe, dilute, or otherwise violate third-party trademarks or other intellectual property rights. Any litigation or claims brought by or against us,

whether with or without merit, and whether successful or not, could result in substantial costs and diversion of our resources, which could have a material

adverse effect on our business, financial condition, results of operations, or cash flows. Any intellectual property litigation or claims against us could result in

the loss or compromise of our intellectual property rights, could subject us to significant liabilities, require us to seek licenses on unfavorable terms, if

available at all, prevent us from manufacturing or selling certain products, limit our ability to market or sell to our customers using certain methods or

technologies, and/or require us to redesign or re-label our products or rename our brand, any of which could have a material adverse effect on our business,

financial condition, results of operations, or cash flows.

The terms of our Revolving Credit Facility may restrict our current and future operations, which could adversely affect our ability to respond to changes in

our business and to manage our operations.

We are party to an Asset Based Loan Credit Agreement ("Revolving Credit Facility") that allows us to borrow up to $250 million, subject to certain terms and

conditions contained in the agreement. The terms of the Revolving Credit Facility contain, and any agreements governing any future indebtedness may

contain, financial restrictions on us and our ability to, among other things:

• place liens on our assets;

• make investments other than permitted investments;

• incur additional indebtedness;

• prepay certain indebtedness;

• merge, consolidate or dissolve;

• sell assets;

• engage in transactions with affiliates;

• change the nature of our business;

• change our fiscal year or organizational documents; and

• make other restricted payments, including share repurchases and dividends.

In addition, the Revolving Credit Facility requires us to maintain a fixed charge coverage ratio of 1.00 to 1.00, if excess availability plus eligible cash

collateral is less than 10% of the borrowing base for 15 consecutive days.

A failure by us to comply with the covenants or to maintain the required financial ratios contained in the Revolving Credit Facility could result in an event

of default under such indebtedness, which could adversely affect our ability to respond to changes in our business and manage our operations. Upon the

occurrence of an event of default, the lenders under our Revolving Credit Facility could elect to declare all amounts outstanding to be due and payable and

exercise other remedies as set forth in the agreement and there can be no assurance that our assets would be sufficient to repay any indebtedness in full, which

could have a material adverse effect on our ability to continue to operate as a going concern. See Note 8 to our Consolidated Financial Statements for further

information relating to our indebtedness.

Our ability to pay dividends and repurchase shares is subject to restrictions in our Revolving Credit Facility, results of operations, and capital

requirements.

16