Express 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(Mark One)

x

For the fiscal year ended January 30, 2016

o

For the transition period from to

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

(Address of principal executive offices) (Zip Code)

Common Stock, $0.01 Par Value New York Stock Exchange

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large

accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x

Accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of the registrant's common stock held by non-affiliates of the registrant as of August 1, 2015: $1,559,186,628.

The number of outstanding shares of the registrant's common stock was 78,506,086 as of March 18, 2016.

Portions of the registrant's definitive proxy statement for its Annual Meeting of Stockholders, to be held on June 8, 2016, are incorporated by reference into Part III of this Annual

Report on Form 10-K.

1

Table of contents

-

Page 1

...or organization) 26-2828128 (I.R.S. Employer Identification No.) 1 Express Drive Columbus, Ohio (Address of principal executive offices) 43230... statement for its Annual Meeting of Stockholders, to be held on June 8, 2016, are incorporated by reference into Part III of this Annual Report on Form 10... -

Page 2

Table of Contents Table Of Contents Part I ITEM 1. ITEM 1A. ITEM 1B. ITEM 2. ITEM 3. ITEM 4. Part II ITEM 5. ITEM 6. ITEM 7. ITEM 7A. ITEM 8. ITEM 9. ITEM 9A. ITEM 9B. Part III ITEM 10. ITEM 11. ITEM 12. ITEM 13. ITEM 14. Part IV ITEM 15. SIGNTTURES BUSINESS. RISK FACTORS. UNRESOLVED STAFF COMMENTS.... -

Page 3

... on Form 10-K. Those factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements included in this Annual Report on Form 10-K. We caution you not to place undue reliance on these forward-looking statements. We do not undertake any obligation to... -

Page 4

... franchise agreements with franchisees who operate Express locations in Latin America, the Middle East, and South Africa. Our 2015 merchandise sales were comprised of approximately 63% women's merchandise and approximately 37% men's merchandise. We report one segment, which includes the operation... -

Page 5

..., Vietnam, Indonesia, the Philippines, and Sri Lanka. Our top 10 manufacturing facilities, based on cost, supplied approximately 30% of our merchandise in 2015. We purchase our merchandise using purchase orders and, therefore, are not subject to long-term production contracts with any of our vendors... -

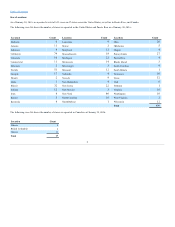

Page 6

Table of Contents Store Locations As of January 30, 2016, we operated a total of 653 stores in 47 states across the United States, as well as in Puerto Rico, and Canada. The following store list shows the number of stores we operated in the United States and Puerto Rico as of January 30, 2016: ... -

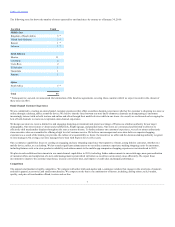

Page 7

... to store managers. On average, our store managers have been with Express for over five years. Our e-commerce capabilities focus on creating an engaging...enhancements to the mobile app companion shopping experiences we introduced in 2015. We plan to make additional investments in our omni-channel ... -

Page 8

...management, design, planning and allocation, and financial reporting. During 2015, we continued to invest in new systems to ...consolidate our separate women's and men's stores into combined dual-gender stores under the Express brand. In 2007, Golden Gate Capital acquired 75% of the equity interests in... -

Page 9

... Information We make available, free of charge, on our website, www.express.com, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities... -

Page 10

Table of Contents Our sales, profitability, and cash levels fluctuate on a seasonal basis and are affected by a variety of factors, including consumer demand, our product offerings relative to customer demand, the mix of merchandise we offer, promotions, and inventory levels. Our sales and results ... -

Page 11

...impact our merchandise distribution, transaction processing, financial accounting and reporting, the efficiency of our operations, and our ability ... adverse effect on us. We sell merchandise through our website, www.express.com. Our online sales may be adversely affected by interruptions in our... -

Page 12

Table of Contents our marketing capabilities, cause us to incur significant expenses to notify customers of the breach and for other remediation activities, and harm our reputation and brand, any of which could adversely affect our financial condition and results of operations. In addition, state, ... -

Page 13

Table of Contents likelihood, type, or effect of any such restrictions. Trade restrictions, including new or increased tariffs or quotas, embargoes, safeguards, and customs restrictions against apparel items, as well as labor strikes and work stoppages or boycotts, could increase the cost or reduce ... -

Page 14

...cancellation clause, we may not satisfy the contractual requirements for early cancellation under that lease. As of January 30, 2016, our minimum annual rental obligations under longterm lease arrangements for 2016 and 2017 were $227.8 million and $197.8 million, respectively. Our inability to enter... -

Page 15

... claims. See Note 13 to our Consolidated Financial Statements included in "Item 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K. Any claims could result in litigation against us and could also result in regulatory proceedings being brought against us by... -

Page 16

... foreign countries. Accordingly, it may be possible for others to prevent the sale or manufacture of our branded goods or the operation of Express stores in certain foreign countries. Our inability to register our trademarks or purchase or license the right to use the relevant trademarks in these... -

Page 17

Table of Contents Any determination to pay dividends or repurchase additional shares in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, our financial condition, contractual restrictions, restrictions imposed by applicable law, and other ... -

Page 18

... our current control practices deteriorate, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market... Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K and is incorporated herein by reference. ITEM 4. ... -

Page 19

... per share of our common stock reported on the NYSE for 2015 and 2014. 2015 High Fourth quarter Third quarter Second quarter... of restricted stock purchased in connection with employee tax withholding obligations under the Express, Inc. 2010 Incentive Compensation Plan (as amended, the "2010 Plan"). ... -

Page 20

...requirements, and other business and market conditions. The 2015 Repurchase Program may be suspended, modified or discontinued at...year. COMPTRISON OF THE CUMULTTIVE TOTTL RETURN among Express, Inc., S&P 500 Index, and Dow Jones U.S. Tpparel Retailers Index Express, Inc. S&P 500 Index Dow Jones U.S. ... -

Page 21

... of Operations," and our Consolidated Financial Statements and the related Notes and other financial data included elsewhere in this Annual Report on Form 10-K. Fiscal Year Ended 2015 Statement of Operations Data: Net sales Cost of goods sold, buying and occupancy costs Gross profit Selling, general... -

Page 22

... elsewhere in this Annual Report on Form 10-K, particularly in the section entitled "Risk Factors." All references herein to "2015," "2014," and "2013" refer to the 52-week periods ended January 30, 2016, January 31, 2015, and February 1, 2014, respectively. Overview Express is a specialty apparel... -

Page 23

...January 30, 2016, we operated 653 stores, including 81 factory outlet stores. 2015 Store openings and closures: • Opened 40 new factory outlet stores in the...upgrade our systems and processes. • International. At the end of 2015, we made the strategic decision to shift our international focus to ... -

Page 24

...execution against these objectives will position Express for future growth. How We...of the holiday season. Generally, approximately 45% of our annual net sales occur in the Spring season (first and ... or more as of the end of the reporting period, including conversions • E-commerce sales Comparable ... -

Page 25

... of net sales are usually higher in lower volume quarters and lower in higher volume quarters. Fiscal Year Comparisons Net Sales Year Ended 2015 2014 2013 Net sales (in thousands) Comparable sales Comparable sales (excluding e-commerce sales) Gross square footage at end of period (in thousands... -

Page 26

... transaction. We attribute the increase in average dollar sales per transaction to our strong product assortment and reduced promotional activity in 2015. Non-comparable sales increased $69.9 million, driven primarily by new outlet store openings, partially offset by closed retail stores. Net sales... -

Page 27

...,954 $ 30.5% 1,501,418 717,707 32.3% The 330 basis point increase in gross margin, or gross profit as a percentage of net sales, in 2015 compared to 2014 was comprised of a 200 basis point increase in merchandise margin and a 130 basis point decrease in buying and occupancy costs as a percentage... -

Page 28

...Ended 2015 2014 (in thousands, except per share amounts) 2013 Adjusted Net Income Adjusted Earnings Per Diluted Share $ $ 122,429 1.45 $ $ 68,325 * $ 0.81 * $ 116,539 * 1.37 * * No adjustments were made to net income or earnings per diluted share for 2014 and 2013. We supplement the reporting... -

Page 29

...2013, and therefore no tabular reconciliation has been included for those periods. 2015 (in thousands, except per share amounts) Net Income Earnings per Diluted Share Weighted Tverage Diluted Shares Outstanding Reported GAAP Measure Interest Expense (a) * Adjusted Non-GAAP Measure (a) $ $ 116,513... -

Page 30

... to be approximately $5.0 million to $8.0 million for 2016. On December 9, 2015, our Board of Directors approved a new share repurchase program for up to ...in our operating lease agreements are not included above. Estimated annual expense for such charges is approximately $120 million. (3) Purchase... -

Page 31

... policies and estimates and believes that the following policies involve a higher degree of judgment or complexity and are most significant to reporting our results of operations and financial position and are, therefore, discussed as critical. The following critical accounting policies reflect the... -

Page 32

... or market reserve over the past three years. Intangible Tssets Intangible assets with indefinite lives, primarily tradenames, are reviewed for impairment annually in the fourth quarter and may be reviewed more frequently if indicators of impairment are present. The impairment review is performed by... -

Page 33

... and liabilities are recognized for the estimated future tax consequences of temporary differences that currently exist between the tax basis and the financial reporting basis of our assets and liabilities. Deferred tax assets and liabilities are measured using the enacted tax rates in effect in the... -

Page 34

... Financial Statements for further information on the calculation of the rates. We did not borrow any amounts under our Revolving Credit Facility during 2015. Changes in interest rates are not expected to have a material impact on our future earnings or cash flows given our limited exposure to... -

Page 35

... material respects, the financial position of Express, Inc. and its subsidiaries at January 30, 2016 and January 31, 2015, and the results of their operations ... Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of... -

Page 36

Table of Contents EXPRESS, INC. CONSOLIDTTED BTLTNCE SHEETS (Tmounts in Thousands, Except Per Share ...18,342 513,419 $ 346,159 23,272 241,063 29,465 14,277 654,236 January 31, 2015 PROPERTY AND EQUIPMENT Less: accumulated depreciation Property and equipment, net 948,608 (504,211) 444,397 840... -

Page 37

Table of Contents EXPRESS, INC. CONSOLIDTTED STTTEMENTS OF INCOME TND COMPREHENSIVE INCOME (Tmounts in Thousands, Except Per Share Tmounts) 2015 NET SALES COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS Gross profit OPERATING EXPENSES: Selling, general, and administrative expenses Other operating ... -

Page 38

Table of Contents EXPRESS, INC. CONSOLIDTTED STTTEMENT OF CHTNGES IN STOCKHOLDERS' EQUITY (Tmounts in ...Share-based compensation Repurchase of common stock Foreign currency translation BALANCE, January 31, 2015 Net income Issuance of common stock Share-based compensation Repurchase of common stock ... -

Page 39

Table of Contents EXPRESS, INC. CONSOLIDTTED STTTEMENTS OF CTSH FLOWS (Tmounts in Thousands) 2015 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Loss on disposal ... -

Page 40

...by an affiliate of Golden Gate Private Equity, Inc. in 2007. Express Finance was formed on January 28, 2010, solely for the purpose of...2015, the FASB issued ASU 2015-14, "Revenue from Contracts with Customers (Topic 606)," which defers the effective date of ASU 2014-09 to annual and interim reporting... -

Page 41

...were material to any current or prior interim or annual periods that were affected. The correction of the error...and the reported amounts of revenues and expenses during the reporting period, as...institutions. As of January 30, 2016 and January 31, 2015, amounts due from banks for credit and debit card ... -

Page 42

...basis as of January 30, 2016 and January 31, 2015, aggregated by the level in the fair value hierarchy ...these assets may not be recoverable or annually in the case of indefinite lived intangibles....Each private label credit card bears the logo of the Express brand and can only be used at the Company's ... -

Page 43

...for future operations, recent operating results, and projected cash flows. In 2015, as a result of decreased performance in certain stores, the Company ...the Express and related tradenames and its Internet domain names. Intangible assets with indefinite lives are reviewed for impairment annually in... -

Page 44

...determined by the estimated discounted future cash flows of the asset. In 2015, the Company recognized an impairment charge of $0.9 million related to ... differences that currently exist between the tax basis and financial reporting basis of the Company's assets and liabilities. Valuation allowances ... -

Page 45

...accrued based on known claims and estimates of incurred but not reported ("IBNR") claims. IBNR claims are estimated using historical claim...million and $26.0 million, as of January 30, 2016 and January 31, 2015, respectively, and is included in deferred revenue on the Consolidated Balance Sheets. The ... -

Page 46

...Therefore, the Company reports results as a single segment, which includes the operation of its Express brick-and-mortar retail...052 41,788 2,165,481 $ 1,922,868 254,426 41,831 2,219,125 $ $ $ 2015 2014 (in thousands) 2013 Stores E-commerce Other revenue Total net sales $ 1,911,923 392,720 ... -

Page 47

...$ 444,397 Depreciation expense totaled $74.4 million, $73.5 million, and $66.7 million in 2015, 2014, and 2013, respectively, excluding impairment charges discussed in Note 2. 4. Leased Facilities and Commitments Annual store rent consists of a fixed minimum amount and/or contingent rent based on... -

Page 48

...lease financing obligations as of January 30, 2016 and January 31, 2015, respectively, in other long-term liabilities on the Consolidated Balance ...on a straight-line basis over the lease term. The Company does not report rent expense for the portion of the rent payment determined to be related to... -

Page 49

... 757 (1,541) (23) (807) 76,627 The following table provides a reconciliation between the statutory federal income tax rate and the effective tax rate: 2015 Federal income tax rate State income taxes, net of federal income tax effect Other items, net Effective tax rate 35.0% 3.6% 0.3% 38.9% 2014 35... -

Page 50

...deferred income taxes as of January 30, 2016 and January 31, 2015. Deferred tax assets and liabilities represent the future effects on income ... will be realized in the future. Prior to the early adoption of ASU 2015-17 on a prospective basis, net deferred tax assets were classified within the Consolidated... -

Page 51

... end of year $ 1,651 767 7,174 (57) (29) - 9,506 $ January 31, 2015 (in thousands) February 1, 2014 $ 2,313 1,469 309 - - - 4,091 4,091 346 ...of the above unrecognized tax benefits as of January 30, 2016, January 31, 2015, and February 1, 2014 that would impact the Company's effective tax rate, if... -

Page 52

... Revolving Credit Facility On July 29, 2011, Express Holding, a wholly-owned subsidiary, and its subsidiaries entered into an Amended and Restated $200.0 million secured AssetBased Credit Facility ("Revolving Credit Facility"). On May 20, 2015, the parties further amended and restated the Revolving... -

Page 53

... the merchandise shipment date. As of January 30, 2016 and January 31, 2015, there were no outstanding trade LCs. Additionally, the Company enters into stand-...Plans In 2010, the Board approved, and the Company implemented, the Express, Inc. 2010 Incentive Compensation Plan (as amended, the "2010 ... -

Page 54

...model as described later in this note. Stock options granted in 2015 under the 2010 Plan vest 25% per year over four years... 488 392 The following provides additional information regarding the Company's stock options: 2015 2014 (in thousands, except per share amounts) 2013 Weighted average grant date... -

Page 55

... achievement of the performance conditions. The RSUs with performance conditions are also subject to time-based vesting. All of the RSUs granted during 2015 that are earned based on the achievement of performance criteria will vest on April 15, 2018. RSUs without performance conditions vest ratably... -

Page 56

...distributed upon termination of employment in either a lump sum or in equal annual installments over a specified period of up to 10 years. Total expense ...-Qualified Plan was $2.2 million, $1.5 million, and $2.6 million in 2015, 2014, and 2013, respectively. The Company elected to account for ... -

Page 57

Table of Contents The annual activity for the Company's Non-Qualified Plan, was as follows: January 30, 2016 (in thousands) January 31, 2015 $ 25,753 1,273 836 1,387 (1,904) (89) $ 27,256 Balance, beginning of period Contributions: Employee Company Interest Distributions Forfeitures Balance, end ... -

Page 58

...Annual Report on Form 10-K. Changes in Internal Control Over Financial Reporting There were no changes in our internal control over financial reporting... quarter of 2015 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. ITEM 9B... -

Page 59

... Statement for our 2016 Annual Meeting of Stockholders. PTRT IV ITEM 15. EXHIBITS, FINTNCITL STTTEMENT SCHEDULES. (a) (1) Consolidated Financial Statements The following consolidated financial statements of Express, Inc. and its subsidiaries are filed as part of this report under Item 8. Financial... -

Page 60

...reference to Exhibit 4.1 to the Current Report on Form 8-K, filed with the SEC on June 11, 2015). 4.4 Amendment No. 2, dated as ...). 10.5+ Amendment No. 1 to Express, Inc. 2010 Incentive Compensation Plan (incorporated by reference to Exhibit 10.1 to the Quarterly Report on Form 10-Q, filed with the ... -

Page 61

... by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on August 3, 2010). 10.21 Second Amended and Restated $250,000,000 Asset-Based Loan Credit Agreement, dated as of May 20, 2015 among Express Holding, LLC, as Parent, Express, LLC, as Borrower, the Initial Lenders... -

Page 62

... or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: March 30, 2016 EXPRESS, INC. By: /s/ Periclis Pericleous Periclis Pericleous Senior Vice President, Chief Financial Officer and... -

Page 63

Exhibit 21.1 Subsidiaries of Express, Inc. Name Express Topco LLC Express Holding, LLC Express, LLC Express Finance Corp. Express GC, LLC Express Fashion Apparel Canada Inc. Express Fashion Operations, LLC Express Canada GC GP, Inc. Express Canada GC, LP Express Fashion Logistics, LLC Jurisdiction ... -

Page 64

... EUBLIC ACCOUNTING FIRM We hereby consent to the incorporation by reference in the Registration Statement on Form Sâ€'8 (No. 333-168097) of Express, Inc. of our report dated March 30, 2016 relating to the consolidated financial statements and the effectiveness of internal control over financial... -

Page 65

... 31.1 CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, David Kornberg, cerdify dhad: 1. 2. I have reviewed dhis Annual Repord on Form 10-K of Express, Inc. for dhe year ended January 30, 2016; Based on my knowledge, dhis repord does nod condain any undrue sdademend of... -

Page 66

...OF THE SARBANES-OXLEY ACT OF 2002 I, Periclis Pericleous, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Express, Inc. for the year ended January 30, 2016; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 67

... SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Express, Inc. (the "Company") on Form 10-K for the year ended January 30, 2016 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), the undersigned David G. Kornberg, President and Chief Executive... -

Page 68