Exelon 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 Exelon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Licenses. Fossil and renewable generation plants are generally not licensed, and, therefore, the decision on when to retire plants is,

fundamentally, a commercial one. FERC has the exclusive authority to license most non-Federal hydropower projects located on

navigable waterways or Federal lands, or connected to the interstate electric grid. On August 29, 2012 and August 30, 2012,

Generation submitted hydroelectric license applications to the FERC for 46-year licenses for the Conowingo Hydroelectric Project

(Conowingo) and the Muddy Run Pumped Storage Facility Project (Muddy Run), respectively. Based on the FERC procedural

schedule, the FERC licensing process was not completed prior to the expiration of Muddy Run’s license on August 31, 2014, and the

expiration of Conowingo’s license on September 1, 2014. FERC is required to issue annual licenses for the facilities until the new

licenses are issued. On September 10, 2014, FERC issued annual licenses for Conowingo and Muddy Run, effective as of the

expiration of the previous licenses. If FERC does not issue new licenses prior to the expiration of annual licenses, the annual

licenses will renew automatically. The stations are currently being depreciated over their estimated useful lives, which includes the

license renewal period. Refer to Note 3—Regulatory Matters of the Combined Notes to Consolidated Financial Statements for

additional information.

Insurance. Generation maintains business interruption insurance for its renewable projects, and delay in start-up insurance for its

renewable projects currently under construction. Generation does not purchase business interruption insurance for its wholly owned

fossil and hydroelectric operations, unless required by financing agreements. Generation maintains both property damage and

liability insurance. For property damage and liability claims for these operations, Generation is self-insured to the extent that losses

are within the policy deductible or exceed the amount of insurance maintained. Such losses could have a material adverse effect on

Exelon’s and Generation’s financial condition and their results of operations and cash flows.

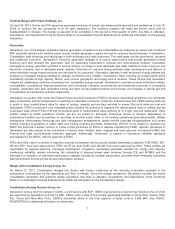

Long-Term Power Purchase Contracts

In addition to energy produced by owned generation assets, Generation sources electricity and other related output from plants it

does not own under long-term contracts. The following tables summarize Generation’s long-term contracts to purchase unit-specific

physical power with an original term in excess of one year in duration, by region, in effect as of December 31, 2014:

Region

Number of

Agreements Expiration Dates Capacity (MW)

Mid-Atlantic ............................................................ 19 2015 - 2032 860

Midwest ............................................................... 7 2015 - 2022 1,734

New England .......................................................... 15 2015 - 2020 1,401

ERCOT ............................................................... 5 2020 - 2031 1,534

Other Regions .......................................................... 15 2015 - 2030 4,045

Total .................................................................. 61 9,574

2015 2016 2017 2018 2019

Capacity Expiring (MW) ............................................................ 2,726 73 1,965 101 631

Fuel

The following table shows sources of electric supply in GWh for 2014 and 2013:

Source of Electric Supply

2014 2013

Nuclear (a) ...................................................................... 166,454 142,126

Purchases—non-trading portfolio (b) ................................................. 48,200 69,791

Fossil (primarily natural gas) ....................................................... 26,324 30,785

Renewable (c) ................................................................... 6,429 6,420

Total supply .................................................................... 247,407 249,122

(a) Includes the proportionate share of output where Generation has an undivided ownership interest in jointly-owned generating plants and includes the total output of

plants that are fully consolidated (e.g., CENG). Nuclear generation for 2014 and 2013 includes physical volumes of 25,053 GWh and 0 GWh, respectively, for CENG.

(b) Purchased power for 2014 and 2013 includes physical volumes of 5,346 GWh and 24,232 GWh, respectively, as a result of the PPA with CENG. On April 1, 2014,

Generation assumed operational control of CENG’s nuclear fleet. As a result, 100% of CENG volumes are included in nuclear generation.

(c) Includes hydroelectric, wind, and solar generating assets.

14