Equifax 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28FEB200910255904

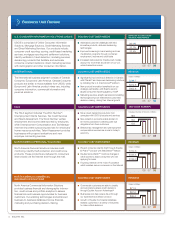

Segment Financial Results

U.S. Consumer Information Solutions

U.S. Consumer Information

Solutions Twelve Months Ended December 31, Change

2008 vs. 2007 2007 vs. 2006

(Dollars in millions) 2008 2007 2006 $ % $ %

Operating revenue:

Online Consumer Information

Solutions $ 594.5 $ 639.0 $ 619.2 $ (44.5) (7)% $ 19.8 3%

Mortgage Solutions 70.2 66.1 71.7 4.1 6% (5.6) (8)%

Credit Marketing Services 132.0 156.4 166.3 (24.4) (16)% (9.9) (6)%

Direct Marketing Services 94.1 108.2 110.9 (14.1) (13)% (2.7) (2)%

Total operating revenue $ 890.8 $ 969.7 $ 968.1 $ (78.9) (8)% $ 1.6 0%

% of consolidated revenue 46% 53% 63%

Total operating income $ 337.1 $ 383.5 $ 395.7 $ (46.4) (12)% $ (12.2) (3)%

Operating margin 37.9% 39.6% 40.9% (1.7) pts (1.3) pts

The decreases in revenue for 2008, as compared to 2007, Services, Inc. in February 2008. These increases were par-

were mainly due to effects of the continued weakness in tially offset by continued weakness in the U.S. housing

the U.S. credit and retail economy, offset by growth in the market, which led to reduced transaction volumes from our

Mortgage Solutions business primarily due to increased existing mortgage customer base. The 2007 decline in rev-

activity with our settlement services products. The slight enue, as compared to 2006, was primarily a result of

increase in revenue in 2007, as compared to 2006, was weakness in the U.S. mortgage markets, which led to

due to growth in Online Consumer Information Solutions reduced transaction volumes from our existing customer

(OCIS), largely offset by decreased revenues in the other base and caused several large mortgage brokerage cus-

three service lines due primarily to weakness in the U.S. tomers to cease operations during 2007. This decrease

consumer credit and mortgage markets. was partially offset by incremental revenue from our acqui-

sition of three mortgage affiliates in the first quarter of 2007

Revenues in our OCIS and Credit Marketing Services ser- and increased revenue related to new settlement services

vice lines and in our USCIS segment as a whole decreased products.

sequentially in each quarter during 2008, as a result of the

weakening U.S. economy. Based on current rates of eco- Credit Marketing Services. For 2008 and 2007, as com-

nomic and credit activity in the U.S., we currently expect pared to prior years, revenue declined due to volume

revenue in the OCIS and Credit Marketing Services service decreases from our existing customer base, primarily due

lines and in the overall USCIS segment in 2009 to be to lower revenue associated with new account acquisition

below levels achieved in 2008. services as financial institutions have scaled back signifi-

cantly on new marketing and extension of credit. These

OCIS. For 2008, as compared to 2007, revenue declined declines were partially offset by a continued increase in rev-

primarily due to a seven percent reduction of online credit enue related to customer portfolio management services

decision transaction volume resulting from the weakness of used by institutions to manage and sustain existing cus-

the U.S. economy. The 2007 increase in revenue, as com- tomers. Our financial services customers began increased

pared to 2006, was primarily due to volume increases from usage of our portfolio management services in 2007 and

our regional customers and both volume and price less usage of prescreen services, which reflects a continu-

increases from our smaller customers. Revenue from resel- ing trend towards the enhanced management of their

lers also rose during 2007 due to price increases that existing customer portfolios as opposed to new account

became effective near the end of 2006, and we recorded acquisitions.

higher revenue from our insurance, banking and regulatory

brokerage monitoring customers. These increases were Direct Marketing Services. For 2008, as compared to

partially offset by price and volume decreases from certain 2007, revenue declined primarily due to reduced mailing

large financial services institutions. volumes for existing customers reflecting the slowdown in

retail sales and the marketing campaigns of many retailers,

Mortgage Solutions. For 2008, as compared to 2007, as well as changes to a contract with a large marketing

revenue grew due to a four-fold increase in activity associ- services reseller. The 2007 decrease in revenue, as com-

ated with our settlement services products and incremental pared to 2006, was mainly due to reduced mailing volumes

revenue from our acquisition of certain assets of FIS Credit from our existing customer base, driven in part by the

2008 ANNUAL REPORT 17