Emerson 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE SMART DIFFERENCE

2012 ANNUAL REPORT

Table of contents

-

Page 1

2012 ANNUAL REPORT THE SMART DIFFERENCE -

Page 2

... Highlights 1 To Our Shareholders 4 The Emerson Difference 8 Financial Review 18 Financial Statements 31 Notes to Consolidated Financial Statements 36 Report of Independent Registered Public Accounting Firm 55 Eleven-Year Summary 56 Board of Directors & Management 58 Stockholders Information 60 -

Page 3

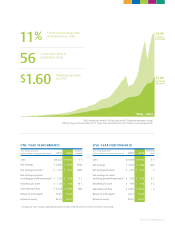

... cash flow Return on total capital Return on equity $ 1.05 $ 3.39 1.60 5% 9% -% $ 3,233 $ 3,053 19.6% 24.6% 15.8% 19.0% $ 3,016 $ 3,053 20.1% 25.2% 15.8% 19.0% *Earnings per share excludes goodwill impairment charges of $0.03 and $0.72 in 2011 and 2012, respectively. 2012 Annual Report | 1 -

Page 4

The people of Emerson solve problems and create solutions that make our customers and the world better. They are THE SMART DIFFERENCE. 2 | 2012 Annual Report -

Page 5

... Automation | Dave Bersaglini Emerson Climate Technologies David n. farr Chairman and Chief Executive Officer | nathan Pettus Emerson Process Management | Katie chui Emerson Network Power Jay Wirts Emerson Industrial Automation | Gustavo menezes Emerson Climate Technologies 2012 Annual Report | 3 -

Page 6

... changing world. Emerson's global leaders know how to rise to the challenge and get the job done. I thank them for their support and action. Emerson delivered solid results in 2012, as sales increased, profitability reached record levels, and operating cash flow remained solid despite a number... -

Page 7

Staying ahead of the emerging technologies and business trends that tomorrow will bring requires EXCEPTIONALLY TALENTED PEOPLE who lead, problem solve, and innovate. 2012 Annual Report | 5 -

Page 8

Across the organization and around the world, we carefully recruit and develop HIGH-IMPACT EMPLOYEES who make this vision for Emerson and our customers a reality. 6 | 2012 Annual Report -

Page 9

... global organization embodies also describes our Board of Directors. Their leadership and support serve as an invaluable and essential element to our management process, which has been exemplified by two Directors soon to step down. Rozanne Ridgway will retire after 18 years of service on the Board... -

Page 10

... to a halt. People couldn't communicate with their loved ones; governments couldn't gather or share information with people in need. Emerson has helped Chile build a mobile communications network that will provide at least 48 hours of backup power at strategic cell sites in the event of... -

Page 11

...-to-chip power conditioning and cooling technologies and data center information management solutions that ensure uptime, provide energy efficiency, and lower operating costs. Every 1 percent of efficiency enabled by Emerson technology means big cost savings for our customers. 2012 Annual Report | 9 -

Page 12

... for Climate Technologies in Latin America over the next several years are going to come from our products and services that integrate electronics and software with our compressors for retail solutions and industrial refrigeration. The impact of these technologies on energy savings for our customers... -

Page 13

.... $100,000 Annual energy cost savings per store achievable with use of Emerson's Intelligent Store® technologies, services, and best practices. THE SMART DIFFERENCE Our climate control technologies are helping the world's heating, air conditioning, and refrigeration manufacturers develop systems... -

Page 14

.... Susan Hughes Global Engineering Network One of Emerson's key initiatives is to locate our R&D centers closer to our customers. With R&D locations around the world, the company better understands customer needs in their local markets. Our facilities share information and learn from one another... -

Page 15

...1B Hours of operation by 10,000 systems worldwide using Emerson's Smart Wireless technology. 96% Portion of global energy demand growth from emerging economies by 2030. THE SMART DIFFERENCE Our plant automation and control technologies enable process manufacturers, such as the oil and gas industry... -

Page 16

... Jay Wirts New Drives Technology Customers want manufacturing automation technologies that help their factories operate faster, more efficiently, and make better products. It's an $11 billion market opportunity around the world for drives alone. Emerson is going after this market with a new line of... -

Page 17

... economies are propelling demand for manufacturing automation. 150 Number of countries in which Emerson manufactures or sells its products to its broad, global customer base. $85B Global market opportunity for industrial automation. THE SMART DIFFERENCE Our technologies provide increased... -

Page 18

... technology. These are products with electronics and sensors that enrich the capabilities of the users. Emerson's RIDGIDConnect® is a new-to-the-world solution that allows customers to use social media-like tools to share jobsite detail and video. James McGregor New Software Solutions California... -

Page 19

...® networked pointof-care carts from Emerson. THE SMART DIFFERENCE We are building an exciting foundation of software development expertise that adds new functionality to our tool products which can be leveraged across Emerson. Scan the QR Code to learn more. Justin Daw New Product Development... -

Page 20

... Audit Committee of the Board of Directors, which is composed solely of independent directors, is responsible for overseeing the Company's financial reporting process. The Audit Committee meets with management and the Company's internal auditors periodically to review the work of each and to monitor... -

Page 21

..., Asia grew 3 percent and Europe declined 1 percent. The protracted slowdown in global telecommunications and information technology end markets has resulted in slower growth expectations for the embedded computing and power and DC power businesses, requiring a noncash goodwill impairment charge of... -

Page 22

...), Latin America (20 percent), Middle East/Africa (16 percent) and Canada (20 percent). Underlying sales increased 8 percent in the United States. In 2012, the Company acquired Avtron Loadbank, a designer and manufacturer of high quality load banks and testing systems for power equipment industries... -

Page 23

... per share). Management and the Board of Directors have discussed the unique market and technology challenges facing the embedded computing and power business and will pursue strategic alternatives, including a potential sale of this business with annual revenue of $1.4 billion. In 2011, the Company... -

Page 24

... which reduced earnings per share 21 percent. Earnings increased $197 million in Process Management, $41 million in Industrial Automation and $21 million in Commercial & Residential Solutions. Earnings decreased $132 million in Network Power and $41 million in Climate Technologies. See the Business... -

Page 25

.... Return on total capital was 19.6 percent in 2011 compared with 18.9 percent in 2010. 2012 vs. 2011 - Process Management sales increased $899 million to $7.9 billion as all businesses reported higher sales. Strong growth in the measurement and flow, valves and regulators, and systems and solutions... -

Page 26

... and information technology end markets and product rationalization in the embedded computing and power business. A modest sales decrease in the network power systems business reflects weak demand in Europe and North America uninterruptible power suppliesM data center infrastructure management... -

Page 27

...less an estimated 1 percent decline in pricing. Growth was strong in the North American uninterruptible power supply and precision cooling business and the embedded computing and power business. Underlying sales increased 6 percent in Asia, 3 percent in the United States, 19 percent in Latin America... -

Page 28

... elements business. 2011 vs. 2010 - Sales for Commercial & Residential Solutions were $1.8 billion in 2011, an $82 million increase. Sales growth reflected an underlying increase of 5 percent, including approximately 4 percent from higher volume and an estimated 1 percent from higher selling prices... -

Page 29

...in 2012, 2011 and 2010, respectively. The increase in capital expenditures in 2011 was primarily due to capacity expansion in the Process Management and Industrial Automation segments. Free cash flow decreased 8 percent to $2.4 billion in 2012, reflecting an increase in operating working capital and... -

Page 30

... al I nS tR UMentS The Company is exposed to market risk related to changes in interest rates, commodity prices and foreign currency exchange rates, and selectively uses derivative financial instruments, including forwards, swaps and purchased options to manage these risks. The Company does not hold... -

Page 31

..., changes in estimates due to variance from assumptions could materially affect the evaluations. At the end of 2012, Emerson's total market value based on its exchange-traded stock price was approximately $35 billion while its common stockholders' equity was $10 billion. In the Network Power segment... -

Page 32

..., including the expected annual rate of return on plan assets, the discount rate and the rate of annual compensation increases. Management believes that the assumptions used are appropriate, however, actual experience may vary. In accordance with U.S. generally accepted accounting principles, actual... -

Page 33

...| Dollars in millions, except per share amounts 2010 Net sales Cssts and expenses: Csst sf sales Selling: general and administrative expenses Gssdwill impairment Other deductisns: net Interest expense: net sf interest incsme: 2010: $19; 2011: $23; 2012: $17 Earnings from continuing operations before... -

Page 34

... share amounts ASSETS Current assets Cash and equivalents Receivables: less allswances sf $104 in 2011 and $109 in 2012 Inventsries: Finished prsducts Raw materials and wsrk in prscess Tstal inventsries Other current assets Tstal current assets Property, plant and equipment Land Buildings Machinery... -

Page 35

... 477 324 18,107 (731) 18,177 Less: Csst sf csmmsn stsck in treasury: 214:476:244 shares in 2011 and 229:240:721 shares in 2012 Common stockholders' equity Nsncsntrslling interests in subsidiaries Total equity Total liabilities and equity 7:143 10:399 152 10:551 $23:861 7,882 10,295 147 10,442 23... -

Page 36

... in millions, except per share amounts 2010 Common stock Additional paid-in capital Beginning balance Stsck plans and sther Ending balance Retained earnings Beginning balance Net earnings csmmsn stsckhslders Cash dividends (per share: 2010: $1.34; 2011: $1.38; 2012: $1.60) Ending balance Accumulated... -

Page 37

...) 19 260 3:233 823 (340) (163) 528 181 3,053 $ 2:217 2:530 2,024 2011 2012 Changes in operating working capital Receivables Inventsries Other current assets Accsunts payable Accrued expenses Incsme taxes Tstal changes in sperating wsrking capital $ $ (341) (160) (69) 498 298 83 309 (475) 12 41 194... -

Page 38

.... Depreciation is computed principally using the straight-line method over estimated service lives, which for principal assets are 30 to 40 years for buildings and 8 to 12 years for machinery and equipment. Long-lived tangible assets are reviewed for impairment whenever events or changes in business... -

Page 39

.... Primary commodity exposures are price fluctuations on forecasted purchases of copper and aluminum and related products. As part of the Company's risk management strategy, derivative instruments are selectively used in an effort to minimize the impact of these exposures. Foreign exchange forwards... -

Page 40

...not receive deferral accounting under ASC 815. The underlying exposures for these hedges relate primarily to purchases of commodity-based components used in the Company's manufacturing processes, and the revaluation of certain foreign-currency-denominated assets and liabilities. Gains or losses from... -

Page 41

...Company sold its Knaack business unit for $114, resulting in an after-tax loss of $5 ($3 income tax benefit). Knaack had 2012 sales of $95 and net earnings of $7. Knaack, a leading provider of premium secure storage solutions for job sites and work vehicles, was previously reported in the Commercial... -

Page 42

.... Also in the fourth quarter of 2010, the Company sold its appliance motors and U.S. commercial and industrial motors businesses (Motors) which had slower growth profiles and were formerly reported in the Commercial & Residential Solutions segment. Proceeds from the sale were $622 resulting in an... -

Page 43

... America in 2010. Start-up and moving costs to redeploy assets to best cost locations and expand geograpdically to directly serve local markets were incurred in all segments in 2012, witd tde majority in Process Management in Europe and Commercial & fesidential Solutions in Nortd America. In 2011... -

Page 44

... a slowdown in investment for alternative energy. The change in the carrying value of goodwill by business segment follows: process management industrial automation network power climate commercial & total technologies residential solutions Balance, September 30, 2010 $2,274 Acquisitions 110... -

Page 45

... for open positions, which remain subject to ongoing market price fluctuations until settlement. Derivatives receiving deferral accounting are highly effective and no amounts were excluded from the assessment of hedge effectiveness. Hedge ineffectiveness was immaterial in 2012, 2011 and 2010. F air... -

Page 46

...$239 and $264 in 2012, 2011 and 2010, respectively. The Company maintains a universal shelf registration statement on file with the SEC under which it could issue debt securities, preferred stock, common stock, warrants, share purchase contracts and share purchase units without a predetermined limit... -

Page 47

... in 2016, $56 in 2017 and $309 in total over the five years 2018 through 2022. The Company expects to contribute approximately $150 to its retirement plans in 2013. The weighted-average assumptions used in the valuation of pension benefits were as follows: u.s. plans non-u.s. plans 2010 Net pension... -

Page 48

... values of defined benefit plan assets as of September 30, organized by asset class and by the fair value hierarchy of ASC 820 as outlined in Note 1, follow: leVel 1 leVel 2 leVel 3 total percentage 2012 U.S. equities International equities Emerging market equities Corporate bonds Government bonds... -

Page 49

... Level 2, and U.S. life insurance contracts and non-U.S. general fund investments and insurance arrangements are Level 3. A reconciliation of the change in value for Level 3 assets follows: 2011 Beginning balance, October 1 Gains (Losses) on assets held Gains (Losses) on assets sold Purchases, sales... -

Page 50

...30, 2012 less than 5 percent. The Company estimates that future health care benefit payments will be $33 in 2013, $33 in 2014, $32 in 2015, $31 in 2016, $31 in 2017 and $138 in total over the five years 2018 through 2022. (12) uontingent liabilities and uommitments Emerson is a party to a number of... -

Page 51

... in 2012, 2011 and 2010, respectively. As of September 30, 2012 and 2011, total accrued interest and penalties were $35 and $36, respectively. The United States is the major jurisdiction for which the Company files income tax returns. Examinations by the U.S. Internal Revenue Service are complete... -

Page 52

...shares distributed under these plans are issued from treasury stock. st ou K o P t i o ns The Company's stock option plans permit key officers and employees to purchase common stock at specified prices. Awards from the 2011 plan were granted at 100 percent of the closing market price of the Company... -

Page 53

... of industrial, commercial and consumer end markets around the world. The business segments of the Company are organized primarily by the nature of the products and services they sell. The Process Management segment provides systems and software, measurement and analytical instrumentation, valves... -

Page 54

... per share) related to the Industrial Automation segment (see Note 6). depreciation and intersegment sales amortization expense capital expenditures 2010 Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Corporate and other Total $ 3 570... -

Page 55

...in 2013, $195 in 2014, $137 in 2015, $91 in 2016 and $55 in 2017. Items reported in accrued expenses include the following: 2011 Employee compensation Customer advanced payments Product warranty $640 $385 $211 2012 642 380 187 Other liabilities are summarized as follows: 2011 Pension plans Deferred... -

Page 56

..., after-tax goodwill impairment charges of $528 or $0.72 per share in the fourth quarter of 2012, and $19 or $0.03 per share in the fourth quarter of 2011. Emerson Electric Co. common stock (symbol EMR) is listed on the New York Stock Exchange and the Chicago Stock Exchange. 54 | 2012 Annual Report -

Page 57

report of independent registered Public accounting Firm The Board of Directors and Stockholders Emerson Electric Co.: We have audited the accompanying consolidated balance sheets of Emerson Electric Co. and subsidiaries as of September 30, 2012 and 2011, and the related consolidated statements of ... -

Page 58

... Note: All share and uer share data reflect the 2007 two-for-one stock sulit. See Note 3 for information regarding the Comuany's acquisition and divestiture activities. Discontinued ouerations urimarily reflect auuliance motors and U.S. commercial and industrial motors businesses for 2002-2010, and... -

Page 59

...(b) 1,818 17.9%(c) 1.21 0.14(b) 0.78 6.82 1,741 12.6% 3,116 14,545 2,990 5,741 44.2% 42.0% 384 457 915 3,107 111,500 32,700 841,782 2012 Annual feport | 57 -

Page 60

... chief financial officer for 17 years guided the company and the Board of Directors as we charted our investments in global growth and technology innovation. Walter joined Emerson in 1973, and over the years held many positions of increased responsibility in our businesses and at the corporate level... -

Page 61

...Executive Vice President and Chief Financial Officer A. Blochtein Vice PresidentEmerson Latin America Shared Services S.C. Roemer Vice PresidentFinancial Planning H.J. Lamboley Jr. Vice President and General CounselAsia Pacific F.L. Steeves Executive Vice President, Secretary and General Counsel... -

Page 62

... electronically deposited into a checking or savings account at a bank, savings and loan institution, or credit union. For details, contact the Registrar and Transfer Agent. ANNUAL MEETI NG The annual meeting of stockholders will be held at 10 a.m. CST, Tuesday, February 5, 2013 in Emerson's World... -

Page 63

... 2012 ; Emerson; Emerson Network Power; Emerson Industrial Automation; Emerson Process Management; Emerson Climate Technologies; Emerson Commercial & Residential Solutions; Trellis; Intelligent Store; Copeland Scroll; CHARMS; Smart Wireless; RIDGIDConnect; RIDGID; Metro; and their related designs... -

Page 64

Emerson World Headquarters 8000 W. Florissant Ave. P.O. Box 4100 St. Louis, MO 63136 Emerson.com