Eli Lilly 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FI NA NCI A L S

14

Humatrope®, and Zyprexa.

•

We launched Cymbalta for the treatment of major de-

pressive disorder in the U.S. in August 2004. In Septem-

ber 2004, Cymbalta received its second U.S. approval

and became the first FDA-approved treatment for

diabetic peripheral neuropathic pain (DPNP). Cymbalta

was launched in the United Kingdom and Germany

in the first quarter of 2005 for the treatment of major

depressive episodes. Other launches in the European

Union are expected to occur throughout 2006. The Eu-

ropean Commission also granted marketing authoriza-

tion of Cymbalta for the treatment of DPNP in adults in

July 2005. Cymbalta has achieved $728.9 million in U.S.

sales since its launch.

• In June 2005, Lilly and Amylin Pharmaceuticals, Inc.,

launched Byetta (exenatide), the first in a new class of

medicines known as incretin mimetics, in the U.S. for

the treatment of type 2 diabetes. In the fourth quarter

of 2005, we submitted Byetta for the treatment of type

2 diabetes in Europe.

• We expect to advance our pipeline during 2006 with

three significant submissions anticipated, including

Arxxant™ for diabetic retinopathy, Cymbalta for gen-

eralized anxiety disorder, and Evista for breast cancer

risk reduction in postmenopausal women.

Legal and Governmental Matters

Certain generic manufacturers have challenged our U.S.

compound patent for Zyprexa and are seeking permission

to market generic versions of Zyprexa prior to its pat-

ent expiration in 2011. On April 14, 2005, the U.S. District

Court in Indianapolis ruled in our favor on all counts,

upholding our patents. The decision has been appealed.

In 2005, we entered into an agreement with plain-

tiffs’ attorneys involved in certain U.S. Zyprexa prod-

uct liability litigation to settle a majority of the claims

against us relating to the medication. We established

a fund of $690 million for the claimants who agree to

settle their claims. Additionally, we paid $10 million to

cover administration of the settlement. As a result of our

product liability exposures, the substantial majority of

which were related to Zyprexa, we recorded a net pretax

charge of $1.07 billion in the second quarter of 2005.

In March 2004, we were notified by the U.S. Attor-

ney’s office for the Eastern District of Pennsylvania that

it has commenced a civil investigation relating to our

U.S. sales, marketing, and promotional practices.

In the United States, implementation of the Medicare

Prescription Drug, Improvement and Modernization Act

of 2003 (MMA), which provides a prescription drug ben-

efit under the Medicare program, took effect January 1,

2006. While it is difficult to predict the business impact of

this legislation, we currently anticipate a modest short-

term increase in sales. However, in the long term there

is additional risk of increased pricing pressures. While

the MMA prohibits the Secretary of Health and Human

Services (HHS) from directly negotiating prescription

drug prices with manufacturers, we expect continued

challenges to that prohibition over the next several years.

Also, the MMA retains the authority of the Secretary of

HHS to prohibit the importation of prescription drugs, but

we expect Congress to consider several measures that

could remove that authority and allow for the importation

of products into the U.S. regardless of their safety or cost.

If adopted, such legislation would likely have a negative

effect on our U.S. sales. We believe there is some chance

that the new and expanded prescription drug coverage for

seniors under the MMA will alleviate the need for a federal

importation scheme.

As a result of the passage of the MMA, aged and

disabled patients jointly eligible for Medicare and Medicaid

began receiving their prescription drug benefits through

the Medicare program, instead of Medicaid, on January 1,

2006. This may relieve some state budget pressures but

is unlikely to result in reduced pricing pressures at the

state level. A majority of states have begun to implement

supplemental rebates and restricted formularies in their

Medicaid programs, and these programs are expected to

continue in the post-MMA environment. Several states are

also attempting to extend discounted Medicaid prices to

non-Medicaid patients. Additionally, notwithstanding the

federal law prohibiting drug importation, approximately

a dozen states have implemented importation schemes

for their citizens, usually involving a website that links

patients to selected Canadian pharmacies. One state has

such a program for its state employees. As a result, we

expect pressures on pharmaceutical pricing to continue.

International operations are also generally subject

to extensive price and market regulations, and there

are many proposals for additional cost-containment

measures, including proposals that would directly or

indirectly impose additional price controls or reduce the

value of our intellectual property protection.

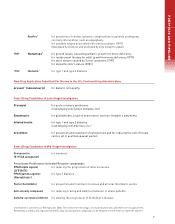

OPERATING RESULTS—2005

Sales

Our worldwide sales for 2005 increased 6 percent,

to $14.65 billion, driven primarily by sales growth of

Cymbalta, Alimta, Forteo, and Gemzar. As a result of

restructuring our arrangements with our U.S. wholesalers

in early 2005, reductions occurred in wholesaler inventory

levels for certain products (primarily Strattera, Prozac®,

and Gemzar) that reduced our sales by approximately

$170 million. Sales growth in 2005 was also affected

by decreased U.S. demand for Zyprexa, Strattera, and

Prozac. Despite this wholesaler destocking and decreased

demand, sales in the U.S. increased 2 percent, to $7.80

billion, driven primarily by increased sales of Cymbalta

and Alimta. Sales outside the U.S. increased 11 percent,

to $6.85 billion, driven by growth of Zyprexa, Alimta, and

Gemzar. Worldwide sales reflected a volume increase of 3

percent, with global selling prices contributing 1 percent

and an increase due to favorable changes in exchange

rates contributing 1 percent. (Numbers do not add due to

rounding.)