Eli Lilly 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Eli Lilly and Company

Answers for Shareholders 2005

2005 Annual Report, Notice of 2006 Annual Meeting, and Proxy Statement

Table of contents

-

Page 1

Eli Lilly and Company Answers for Shareholders 2005 2005 Annual Report, Notice of 2006 Annual Meeting, and Proxy Statement -

Page 2

... Report of Independent Registered Public Accounting Firm Proxy Statement 58 60 64 67 74 76 83 84 86 93 Notice of 2006 Annual Meeting and Proxy Statement General Information Board of Directors Highlights of the Company's Corporate Governance Guidelines Audit Committee Matters Executive Compensation... -

Page 3

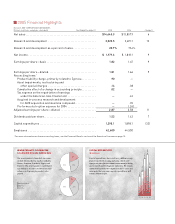

2005 Financial Highlights ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions, except per-share data) Year Ended December 31 2005 2004 Change % Net sales ...Research and development ...Research and development as a percent of sales ...Net income ...Earnings per share-basic ... $14,645.3 3,... -

Page 4

... costs of health care in general and drugs in particular. In the European Union and Japan, aging populations are straining health care budgets, and governments are pursuing policies that hold down prices of and access to innovative medicines. In the U.S., pressure on payers-whether employers, states... -

Page 5

... to customers and to society. Among our responses to public skepticism over pharmaceutical company drug data, for example, was the industry's ï¬rst online clinical trial registry-for which both The New York Times and In Vivo magazine singled out Lilly for our transparency and leadership. Actions... -

Page 6

... in both ï¬nancial and general management in the United States, Canada and the United Kingdom. With major uncertainties behind us, a proven strategy that remains right for our challenging business environment, strong leadership, and no patent expirations through this decade, Lilly is poised for... -

Page 7

... new tools. For example, the molecular engineering technologies we've acquired through Applied Molecular Evolution give us powerful new capabilities to customize antibodies and proteins to make better drugs. Q: How will the Medicare drug beneï¬t impact Lilly's business? When we launch our products... -

Page 8

...N D PI PE LI N E Innovation at Lilly: The Portfolio and the Pipeline Major Marketed Products 2005 Byetta® (Dates indicate the year of ï¬rst global launch) for type 2 diabetes (codeveloped with Amylin Pharmaceuticals, Inc., and copromoted with Amylin in the U.S.) for major depressive disorder for... -

Page 9

...) (developed by Centocor and promoted by Lilly, except in Japan) for...2003) for type 1 and type 2 diabetes PIPELINE 1987 Humatrope® 1983 Humulin® New Drug Application Submitted For Review to the U.S. Food and Drug Administration Arxxant™ (ruboxistaurin) for diabetic retinopathy Select Drug... -

Page 10

...F D I R EC T O R S Karen N. Horn, Ph.D. Retired President, Private Client Services, and Managing Director, Marsh, Inc. Sidney Taurel Chairman of the Board and Chief Executive Ofï¬cer Alfred G. Gilman, M.D., Ph.D. Dean, The University of Texas Southwestern Medical School and Regental Professor of... -

Page 11

... Guggenheim Professor Retired Executive Vice President, of Biochemistry and Molecular Biology, Kimberly-Clark Corporation Professor of Molecular Pharmacology and Experimental Therapeutics, Mayo Medical School, and Director, Mayo Clinic Cancer Center Ellen R. Marram President, The Barnegat Group LLC... -

Page 12

...Corporate Business Development Timothy R. Franson, M.D. Vice President, Global Regulatory Affairs Alan Breier, M.D. Vice President, Medical, and Chief Medical Ofï¬cer Lori V. Queisser†Frank M. Albertus J. Sharon Deane, Ph.D.†van den Bergh Sullivan Vice President, Global Customer Solutions... -

Page 13

..., Engineering, and Environmental Health and Safety J. Carmel Egan, Ph.D. Vice President, Project Management Anne Nobles Vice President, Corporate Affairs Newton F. Crenshaw President and General Manager, Lilly Japan Steven M. Paul, M.D.*†Executive Vice President, Science and Technology... -

Page 14

...rst online clinical trial registry (www.lillytrials.com); working to improve the industry's good promotional practices and code of ethics; respecting the environment; partnering with world health leaders to combat MDR-TB with the goal of treating 20,000 patients annually by 2010 (www.lillymdr-tb.com... -

Page 15

...than sales. During 2005, we began to expense stock options, which had the effect of increasing our research and development and marketing and administrative expenses. We also beneï¬ted from an increase in net other income due primarily to increased proï¬tability of the Lilly ICOS joint venture and... -

Page 16

...â„¢ for diabetic retinopathy, Cymbalta for generalized anxiety disorder, and Evista for breast cancer risk reduction in postmenopausal women. Legal and Governmental Matters Certain generic manufacturers have challenged our U.S. compound patent for Zyprexa and are seeking permission to market generic... -

Page 17

... we market Cialis exclusively. The remaining sales relate to the joint-venture territories of Lilly ICOS LLC (North America, excluding Puerto Rico, and Europe). Our share of the joint-venture territory sales, net of expenses, is reported in net other income in our consolidated income statement. 15 -

Page 18

...($ in millions of growth; percentages represent changes from 2004) Five of our products-Cymbalta, Alimta, Forteo, Gemzar, and Humalog-generated $4.1 billion in net sales during 2005, an increase of $1.3 billion over 2004. In addition, global sales of Cialis, promoted with our partner ICOS, increased... -

Page 19

...to the outlicense of legacy products and partnered products in development. We report our 50 percent share of the operating results of the Lilly ICOS joint venture in our net other income. For 2005, our net income from the joint venture was $11.1 million, compared with a net loss of $79.0 million in... -

Page 20

... we market Cialis exclusively. The remaining sales relate to the joint-venture territories of Lilly ICOS LLC (North America, excluding Puerto Rico, and Europe). Our share of the joint-venture territory sales, net of expenses, is reported in net other income in our consolidated income statement. 18 -

Page 21

Consolidated Statements of Income ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions, except per-share data) Year Ended December 31 2005 2004 2003 Net sales ...Cost of sales ...Research and development ...Marketing and administrative ...Acquired in-process research and development (Note 3)... -

Page 22

... miscellaneous income. This was offset partially by an increase in the net loss of the Lilly ICOS LLC joint venture, due primarily to increased marketing costs of Cialis in joint-venture territories, and the 2003 sale of dapoxetine patent rights. For 2004, our net loss from the joint venture was... -

Page 23

... borrowings and current maturities of long-term debt (Note 6)...Accounts payable ...Employee compensation ...Sales rebates and discounts...Dividends payable ...Income taxes payable (Note 11) ...Other current liabilities (Note 8) ...Total current liabilities ...Other Liabilities Long-term debt (Note... -

Page 24

... and development ...Cash paid for acquisition of Applied Molecular Evolution, net of cash acquired ...Other, net ...Net Cash Used in Investing Activities ...Cash Flows From Financing Activities Dividends paid ...Purchase of common stock ...Issuances of common stock under stock plans ...Net change in... -

Page 25

... purchase obligations. • Contractual payment obligations with each of our signiï¬cant vendors, which are noncancelable and are not contingent. 3 We have included our long-term liabilities consisting primarily of our nonqualiï¬ed supplemental pension funding requirements and deferred compensation... -

Page 26

...can be expected to change materially over time as new contracts are initiated and existing contracts are completed, terminated, or modiï¬ed. APPLICATION OF CRITICAL ACCOUNTING POLICIES In preparing our ï¬nancial statements in accordance with generally accepted accounting principles (GAAP), we must... -

Page 27

... effect on our income before income taxes and cumulative effect of change in accounting principle. As of December 31, 2005, our Medicaid rebate liability was $272.5 million. Approximately 90 percent and 86 percent of our global rebate and discount liability results from sales of our products in the... -

Page 28

... service cost and interest cost by approximately $22 million. If the discount rate for 2005 were to be changed by a quarter percentage point, income before income taxes and cumulative effect of change in accounting principle would change by approximately $27 million. If the expected return on plan... -

Page 29

... the ofï¬ce of the Attorney General, Medicaid Fraud Control Unit, of the State of Florida, seeking production of documents relating to sales of Zyprexa and our marketing and promotional practices with respect to Zyprexa. It is possible that other Lilly products could become subject to investigation... -

Page 30

..., remuneration of health care professionals, managed care arrangements, and Medicaid best price reporting comply with applicable laws and regulations. We have been named as a defendant in a large number of Zyprexa product liability lawsuits in the United States and have been notiï¬ed of several... -

Page 31

...and our historical product liability defense cost experience. The $1.07 billion net charge took into account our estimated recoveries from our insurance coverage related to these matters. The after-tax impact of this net charge was $.90 per share. The $700 million for the Zyprexa settlement was paid... -

Page 32

... Statements of Comprehensive Income ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions) Year Ended December 31 2005 2004 2003 Net income ...Other comprehensive income (loss) Foreign currency translation gains (losses) ...Net unrealized gains (losses) on securities...Minimum pension... -

Page 33

... 2005 2004 2003 Net sales-to unafï¬liated customers Neurosciences ...Endocrinology ...Oncology ...Animal health...Cardiovascular ...Anti-infectives ...Other pharmaceutical ...Net sales ...Geographic Information Net sales-to unafï¬liated customers1 United States ...Europe, Middle East, and Africa... -

Page 34

...76.26 67.60 74.70 65.00 Our common stock is listed on the New York, London, and other stock exchanges. In the second quarter of 2005, we incurred a tax expense of $111.9 million despite reporting a net loss before income taxes for the quarter. The product liability charge of $1.07 billion (Note 13... -

Page 35

...) ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions, except per-share data) 2005 2004 2003 2002 2001 Operations Net sales ...Cost of sales ...Research and development ...Marketing and administration ...Other ...Income before income taxes and cumulative effect of a change in accounting... -

Page 36

... and losses, net of tax, reported in other comprehensive income. Unrealized losses considered to be other-than-temporary are recognized in earnings. Factors we consider in making this evaluation include company-speciï¬c drivers of the decrease in stock price, status of projects in development, near... -

Page 37

... Impairment is determined by comparing projected undiscounted cash ï¬,ows to be generated by the asset to its carrying value. If an impairment is identiï¬ed, a loss is recorded equal to the excess of the asset's net book value over the asset's fair value, and the cost basis is adjusted. At December... -

Page 38

... the recognition of the fair value of stock-based compensation in net income. Stock-based compensation primarily consists of stock options and performance awards. Stock options are granted to employees at exercise prices equal to the fair market value of our stock at the dates of grant. Generally... -

Page 39

...standard required recognition of the fair value of stock-based compensation in net income. Note 3: Acquisitions Applied Molecular Evolution, Inc. Acquisition On February 12, 2004, we acquired all the outstanding common stock of Applied Molecular Evolution, Inc. (AME) in a tax-free merger. Under the... -

Page 40

... from projected sales revenues and estimated costs. These projections were based on factors such as relevant market size, patent protection, historical pricing of similar products, and expected industry trends. The estimated future net cash ï¬,ows were then discounted to the present value using... -

Page 41

... performed in existing facilities in Indianapolis. The site has been written down to fair value less cost to sell and is currently held for sale. • We closed all district and regional sales ofï¬ces throughout the United States, and these operations are now managed from home-based ofï¬ces. In... -

Page 42

... carrying value to zero, and have disposed of or destroyed substantially all of the assets. The asset impairment charges incurred in the second quarter of 2004 aggregated $108.9 million. Similar to 2004, during 2003, management approved global manufacturing strategies across our product portfolio... -

Page 43

...Unrealized gross gains ...Unrealized gross losses ... $52.0 15.9 $43.7 7.9 The net adjustment to unrealized gains and losses (net of tax) on available-for-sale securities increased (decreased) other comprehensive income by ($4.6) million, ($18.2) million, and $45.4 million in 2005, 2004, and 2003... -

Page 44

.... The 6.55 percent Employee Stock Ownership Plan (ESOP) debentures are obligations of the ESOP but are shown on the consolidated balance sheet because we guarantee them. The principal and interest on the debt are funded by contributions from us and by dividends received on certain shares held by the... -

Page 45

... the recognition of the fair value of stock-based compensation in net income. Stock-based compensation primarily consists of stock options and performance awards. Stock options are granted to employees at exercise prices equal to the fair market value of our stock at the dates of grant. Generally... -

Page 46

..., the total remaining unrecognized compensation cost related to nonvested stock options amounted to $216.2 million, which will be amortized over the weighted-average remaining requisite service period of 16 months. The number of shares ultimately issued for the performance award program is dependent... -

Page 47

... Earnings Deferred Costs-ESOP Common Stock in Treasury Shares (in thousands) Amount Balance at January 1, 2003...Net income ...Cash dividends declared per share: $1.36 ...Retirement of treasury shares ...Purchase for treasury ...Issuance of stock under employee stock plans ...ESOP transactions... -

Page 48

... used to purchase shares of our common stock on the open market. Shares of common stock held by the ESOP will be allocated to participating employees annually through 2017 as part of our savings plan contribution. The fair value of shares allocated each period is recognized as compensation expense... -

Page 49

...the composition of income taxes attributable to income before cumulative effect of a change in accounting principle: 2005 2004 2003 Current Federal ...Foreign ...State ...Deferred Federal ...Foreign ...State ...Unremitted earnings to be repatriated due to change in tax law ...Income taxes ... $ 517... -

Page 50

... 2004 2003 United States federal statutory tax rate ...Add (deduct) International operations, including Puerto Rico ...Additional repatriation due to change in tax law ...Non-deductible acquired in-process research and development ...General business credits ...Sundry ...Effective income tax rate... -

Page 51

... 12: Retirement Beneï¬ts We used a measurement date of December 31 to develop the change in beneï¬t obligation, change in plan assets, funded status, and amounts recognized in the consolidated balance sheets at December 31 for our deï¬ned beneï¬t pension and retiree health beneï¬t plans, which... -

Page 52

...ï¬ned Beneï¬t Pension Plans 2005 2004 2003 Retiree Health Beneï¬t Plans 2005 2004 2003 Components of net periodic beneï¬t cost Service cost ...Interest cost...Expected return on plan assets ...Amortization of prior service cost ...Recognized actuarial loss ...Net periodic beneï¬t cost ... $297... -

Page 53

... Laboratories, Ltd. (Reddy), and Teva Pharmaceuticals (Teva), submitted abbreviated new drug applications (ANDAs) seeking permission to market generic versions of Zyprexa in various dosage forms several years prior to the expiration of our U.S. patents for the product. The generic companies alleged... -

Page 54

..., remuneration of health care professionals, managed care arrangements, and Medicaid best price reporting comply with applicable laws and regulations. We have been named as a defendant in a large number of Zyprexa product liability lawsuits in the United States and have been notiï¬ed of several... -

Page 55

... the drug. These cases have been removed to federal court and are now part of the MDL proceedings in the Eastern District of New York. In these actions, the Department of Health and Hospitals seeks to recover the costs it paid for Zyprexa through Medicaid and other drug-beneï¬t programs, as well as... -

Page 56

..., as income taxes were generally not provided for foreign currency translation. The unrealized gains (losses) on securities is net of reclassiï¬cation adjustments of $9.1 million, $9.8 million, and $37.4 million, net of tax, in 2005, 2004, and 2003, respectively, for net realized gains on sales of... -

Page 57

...of the Public Company Accounting Oversight Board (United States). Ernst & Young's opinion with respect to the fairness of the presentation of the statements (see opinion on page 56) is included in our annual report. Ernst & Young reports directly to the audit committee of the board of directors. Our... -

Page 58

... 2006 expressed an unqualiï¬ed opinion thereon. As discussed in Notes 2 and 7 to the ï¬nancial statements, in 2005 Eli Lilly and Company adopted new accounting pronouncements for asset retirement obligations and stock-based compensation. FI N A N C I A L S Indianapolis, Indiana February 13, 2006... -

Page 59

... standards of the Public Company Accounting Oversight Board (United States), the 2005 consolidated ï¬nancial statements of Eli Lilly and Company and subsidiaries and our report dated February 13, 2006 expressed an unqualiï¬ed opinion thereon. FI N A N C I A L S Indianapolis, Indiana February 13... -

Page 60

... to attend our annual meeting of shareholders on Monday, April 24, 2006, at the Lilly Center Auditorium, Lilly Corporate Center, Indianapolis, Indiana, at 11:00 a.m. EDT. If you are unable to attend in person, please join us via live webcast on the company's website at www.lilly.com. The webcast... -

Page 61

... 24, 2006 The annual meeting of shareholders of Eli Lilly and Company will be held at the Lilly Center Auditorium, Lilly Corporate Center, Indianapolis, Indiana, on Monday, April 24, 2006, at 11:00 a.m. EDT for the following purposes: • to elect four directors of the company to serve three-year... -

Page 62

... the Lilly Employee 401(k) Plan (the 401(k) plan). PROX Y S TATE M E NT What constitutes a quorum? A majority of the outstanding shares, present or represented by proxy, constitutes a quorum for the annual meeting. As of the record date, 1,129,982,580 shares of company common stock were issued and... -

Page 63

... the directions of the participants to whose accounts the shares are credited) • shares held in the plan that are not yet credited to individual participants' accounts. All participants are named ï¬duciaries under the terms of the 401(k) plan and under the Employee Retirement Income Security Act... -

Page 64

... Lilly website until May 24, 2006. How do I contact the board of directors? You can send written communications to one or more members of the board, addressed to: Presiding Director, Board of Directors Eli Lilly and Company c/o Corporate Secretary Lilly Corporate Center Indianapolis, Indiana 46285... -

Page 65

... a separate copy of the 2005 annual report and 2006 proxy statement, or if you wish to receive separate copies of future annual reports and proxy statements, please call us at 317-433-5112 or write to: Householding Department, 51 Mercedes Way, Edgewood, New York 11717. We will deliver the requested... -

Page 66

... and The New York Times Company as well as several private companies. She serves on the boards of The New York-Presbyterian Hospital, Lincoln Center Theater, Families and Work Institute, and Citymeals-on-Wheels. Sidney Taurel Age 57 Director since 1991 Chairman of the Board and Chief Executive Of... -

Page 67

... Mayo Medical School since 1975. Dr. Prendergast serves on the board of trustees of the Mayo Foundation and the Mayo Clinic Board of Governors. Kathi P. Seifert Age 56 Director since 1995 Retired Executive Vice President, Kimberly-Clark Corporation Ms. Seifert served as executive vice president for... -

Page 68

... products and corporate development in 2001. He was named executive vice president, pharmaceutical operations in 2004. He is a member of the American Chemical Society. In 2004, Dr. Lechleiter was appointed to the Visiting Committee of Harvard Business School and to the Health Policy and Management... -

Page 69

... per year in direct compensation from Lilly other than for service as a non-executive employee. • a director who is employed (or whose immediate family member is employed as an executive ofï¬cer) by another company where any Lilly executive ofï¬cer serves on that company's compensation committee... -

Page 70

... the audit, compensation, and directors and corporate governance committees must meet all applicable independence tests of the New York Stock Exchange, Securities and Exchange Commission, and Internal Revenue Service. The board has determined that all 10 of the nonemployee directors listed on pages... -

Page 71

... New York Stock Exchange and Securities and Exchange Commission. This code is set forth in: • The Red Book, a comprehensive code of ethical and legal business conduct applicable to all employees worldwide and to our board of directors • the company's Code of Ethical Conduct for Lilly Financial... -

Page 72

... online at http://investor.lilly.com/board-committees.cfm or in paper form upon request to the company's corporate secretary. Committees of the Board of Directors Audit Committee The duties of the audit committee are described in the audit committee report found on page 74 of this proxy statement... -

Page 73

... in 2005. Current committee membership and the number of meetings of the full board and each committee in 2005 are shown in the table below. Directors and Corporate Governance Public Policy and Compliance Science and Technology Board Audit Compensation Finance Sir Winfried Bischoff Mr. Cook Dr... -

Page 74

... cash compensation in Lilly stock. In addition, the annual award of shares to each director noted above (1,500 shares in 2005) is credited to this account. Funds in this account are credited as hypothetical shares of Lilly stock based on the market price of the stock at the time the compensation... -

Page 75

..., director compensation, and board performance. The committee's charter is available online at http://investor.lilly. com/board-committees.cfm or in paper form upon request to the company's corporate secretary. All committee members are independent as deï¬ned in the New York Stock Exchange listing... -

Page 76

... of the audit committee are independent as deï¬ned in both the New York Stock Exchange listing standards and the Securities and Exchange Commission standards applicable to audit committee members. The board of directors has determined that Sir Winfried Bischoff and Mr. J. Michael Cook are audit... -

Page 77

... related to employee beneï¬t plan and other ancillary audits, and accounting consultations Tax Fees • 2005 and 2004: primarily related to tax planning and various compliance services All Other Fees • 2005 and 2004: primarily related to upgrading and maintaining on-line training programs Total... -

Page 78

...its objectives. The Committee's Processes We consider various measures of company and industry performance, including sales, earnings per share, return on assets, return on equity, and total shareholder return. These data assist us in exercising judgment in establishing total compensation ranges. We... -

Page 79

...compensation programs for full corporate deductibility to the extent feasible and consistent with our overall compensation goals. The company has taken steps to qualify compensation under the Eli Lilly and Company Bonus Plan, as well as stock options and performance awards under its management stock... -

Page 80

... example, in 2004 the company strengthened its compliance activities and adopted the industry's most progressive principles of medical research and clinical trial registry. In recognition of his continued strong leadership in 2004, we increased Mr. Taurel's annual salary by 4 percent effective March... -

Page 81

... Under board policy, for security reasons the company-owned aircraft is made available to Mr. Taurel for both business and personal travel. Mr. Taurel did not use the corporate aircraft for any personal ï¬,ights in 2005. We report the incremental cost to the company of any such personal travel based... -

Page 82

... using a Black-Scholes valuation model that we used for determining pro forma stock compensation expense under the prior Statement of Financial Accounting Standards (SFAS) No. 123. (6) Company contribution to the named individual's account in the Lilly Employee 401(k) Plan. Option Shares Granted in... -

Page 83

... We maintain two programs to provide retirement income to all eligible U.S. employees, including executive ofï¬cers: • The Lilly Employee 401(k) Plan, a deï¬ned contribution plan qualiï¬ed under sections 401(a) and 401(k) of the Internal Revenue Code. Eligible employees may elect to contribute... -

Page 84

... of the Internal Revenue Code as a result of the aggregate compensation payments and beneï¬ts made to the individual, under the program or otherwise, the company would cover the cost of the excise tax. Related Transaction As noted above, under board policy, for security reasons the company aircraft... -

Page 85

...a person invested $100 each in Lilly stock, the S&P 500 Stock Index, and the peer group's common stock. The graph measures total shareholder return, which takes into account both stock price and dividends. It assumes that dividends paid by a company are reinvested in that company's stock. Comparison... -

Page 86

... the number of shares of company common stock beneï¬cially owned by the directors, the named executive ofï¬cers, and all directors and executive ofï¬cers as a group, as of February 3, 2006. The table shows shares held by named executives in the Lilly Employee 401(k) Plan, shares credited to the... -

Page 87

... this ownership: Name and Address Number of Shares Beneï¬cially Owned Percent of Class Lilly Endowment, Inc. 2801 North Meridian Street Indianapolis, Indiana 46208 Capital Research and Management Company 333 South Hope Street Los Angeles, California 90071 Wellington Management Company, LLP 75... -

Page 88

.... Statement of Support: A number of pharmaceutical companies have adopted and prominently published animal welfare policies on their websites relating to the care of animals used in product research and development. Eli Lilly as an industry leader is commended for its recognition of an "ethical and... -

Page 89

... part of our Company's corporate stewardship. We urge shareholders to support this Resolution. Statement in Opposition to Animal Care and Use Proposal Lilly's public policy and compliance committee of the board has reviewed this proposal and believes that the additional reporting is an unnecessary... -

Page 90

... ultimately change the way in which directors interact with management." An independent board structure will also help the board address complex policy issues facing our company, foremost among them the crisis in access to pharmaceutical products. Millions of Americans and others around the world... -

Page 91

... research companies, health care providers, patient advocacy organizations, and community groups to help patients who lack prescription coverage in the United States get the medicines they need at the best prices available. In addition, Lilly has its own programs intended to supplement both industry... -

Page 92

... progressive policy further enhances board accountability and keeps Lilly a leader in corporate governance. The classiï¬ed board serves the company and its shareholders well by fostering a strong, stable, independent board of directors to guide the company in implementing its long-term strategy of... -

Page 93

... accepted system among U.S. public companies and is the default system under Indiana corporate law. The rules governing plurality voting are well understood. In addition, it is important to note that Lilly directors have consistently received broad shareholder support-typically well over 90 percent... -

Page 94

... legal scholars, practicing attorneys, corporations, and investors are actively studying these and other issues with majority voting under current laws to determine if there are workable, practical solutions that appropriately balance the interests of the shareholders, corporations, and their board... -

Page 95

... rules, our directors and executive ofï¬cers are required to ï¬le with the Securities and Exchange Commission reports of holdings and changes in beneï¬cial ownership of company stock. We have reviewed copies of reports provided to the company, as well as other records and information. Based... -

Page 96

...: Eli Lilly and Company P.O. Box 88665 Indianapolis, Indiana 46208-0665 To access these reports more quickly, you can ï¬nd all of our SEC ï¬lings online at: http://investor.lilly.com/edgar.cfm Stock listings Wells Fargo Shareowner Services Mailing address: Shareowner Relations Department P.O. Box... -

Page 97

...10:45 a.m. in the Lilly Center. Name Address City, State, and Zip Code Detach here Detach here Directions and Parking From I-70 take Exit 79B; follow signs to McCarty Street. Turn right (east) on McCarty Street; go straight into Lilly Corporate Center. You will be directed to parking. Be sure to... -

Page 98

...Detach here Detach here Eli Lilly and Company Annual Meeting of Shareholders April 24, 2006 Complimentary Parking Lilly Corporate Center Please place this identiï¬er on the dashboard of your car as you enter Lilly Corporate Center so it can be clearly seen by security and parking personnel. 96 -

Page 99

... trials registry ...www.lillytrials.com Multi-drug resistant tuberculosis initiative ...www.lillymdr-tb.com Medicare prescription drug coverage ...www.lillymedicareanswers.com Pharmaceutical industry patient assistance programs ...www.pparx.org Lilly Cares...www.lillycares.com or call toll-free... -

Page 100

Eli Lilly and Company Lilly Corporate Center Indianapolis, Indiana 46285 USA www.lilly.com