Einstein Bros 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000110465906016136/a06-3178_110k.htm[9/11/2014 10:13:03 AM]

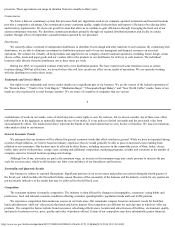

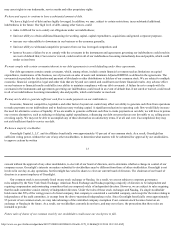

Other expense (income)

(312)

(284)

(172)

(322)

131

Loss before income taxes

(14,018)

(17,454)

(72,709)

(44,528)

(21,586)

Provision (benefit) for state income taxes

—

(49)

812

366

167

Net loss

(14,018)

(17,405)

(73,521)

(44,894)

(21,753)

Dividends and accretion on Preferred Stock

—

—

(14,423)

(27,594)

(58,520)

Net loss available to common stockholders

$ (14,018)

$ (17,405)

$ (87,944)

$ (72,488)

$ (80,273)

Net loss per share—basic and diluted

$ (1.42)

$ (1.77)

$ (22.71)

$ (55.18)

$ (133.43)

19

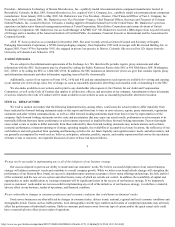

As of:

Jan 3, 2006 Dec 28, 2004 Dec 30, 2003 Dec 31, 2002 Jan 1, 2002

(in thousands of dollars, except per share amounts)

Balance Sheet

Cash and cash equivalents

$ 1,556

$ 9,752

$ 9,575

$ 10,705

$ 15,478

Property, plant and equipment, net

33,359

41,855

54,513

73,780

98,064

Total assets

130,924

158,456

181,738

203,174

280,203

Short-term debt and current portion of

long-term debt

280

295

2,105

150,872

168,394

Mandatorily redeemable Series Z preferred

stock, $.001 par value, $1,000 per share

liquidation value(3)

57,000

57,000

57,000

—

—

Long-term debt

160,560

160,840

161,120

11,011

12,119

Mandatorily redeemable Series F preferred

stock, $.001 par value, $1,000 per share

liquidation value (temporary equity)(3)

—

—

—

84,932

57,338

Total stockholders’ equity (deficit)

(126,211)

(112,483)

(95,153)

(96,146)

(30,096)

Other Financial Data:

Depreciation and amortization

$ 26,316

$ 27,848

$ 34,013

$ 35,047

$ 18,260

Capital expenditures

10,264

9,393

6,921

5,172

3,757

Number of locations at end of period

626

690

736

747

770

Franchised and licensed

191

237

272

287

287

Company-owned and operated

435

453

464

460

483

Increase (decrease) in comp store sales(4)

5.2%

(1.9)%

(3.5)%

1.9%

2.5%

(1) We have a 52/53-week fiscal year ending on the Tuesday closest to December 31. Fiscal years 2004, 2003, 2002 and 2001 which ended on December 28,

2004, December 30, 2003, December 31, 2002 and January 1, 2002, respectively, contained 52 weeks, while fiscal year 2005, which ended on January 3,

2006, contained 53 weeks.

(2) Interest expense is comprised of interest paid or payable in cash and non-cash interest expense resulting from the amortization of debt discount, notes

paid-in-kind, debt issuance costs and the amortization of warrants issued in connection with debt financings.

(3) As more fully described in the notes to the consolidated financial statements, the adoption of Statement of Financial Accounting Standard (SFAS)

No. 150 resulted in the Series Z Preferred Stock being presented as a liability rather than the historical mezzanine presentation of the Series F.

(4) Comparable store sales represent sales at restaurants that were open for one full year and have not been relocated or closed during the current year.

Comparable store sales are also referred to as “same-store” sales and as “comp sales” within the restaurant industry.

20

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Quickservice Industry Overview

According to the Restaurant Industry Operations Report 2004, published in 2005 by the National Restaurant Association and Deloitte,

quickservice sales growth continues to strengthen fueled by an improving economy. Growth in quickservice restaurant sales outpaced full service

restaurants. Part of the reason for the stronger growth of quickservice restaurants was lessened competition from grocery and convenience stores, as