Einstein Bros 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746903027186/a2116520z10-ka.htm[9/11/2014 10:14:22 AM]

As previously reported $ 45,723 $ 5,210 $ 3,883 $ 26,733

Adjustments:

Beginning balance — — — 215

Reorganization accruals (484) (3,131) (3,131) (3,131)

Manufacturing revenue and COGS (1,236) — — —

Assets held for resale — (1,691) (1,691) (1,691)

Deferred tax asset — (260) (3,360) (3,360)

Purchase accounting — (1,086) (1,086) (1,086)

Other (925) (2,165) (2,281) (6,006)

Equity — — (245) (707)

Total adjustments (2,645) (8,333) (11,794) (15,766)

As restated $ 43,078 $ (3,123) $ (7,911) $ 10,967

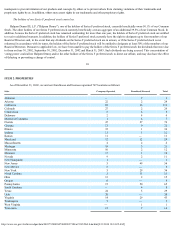

C. Restatement of Fiscal 2001 Financial Statements

The primary effects of the restatement of the fiscal 2001 financial statements are summarized below:

Fiscal 2001

(amounts in thousands)

Revenue

Loss From

Operations

Net Loss

Available To

Common

Stockholders'

Equity/(Deficit)

As previously reported $ 236,020 $ (529) $ (54,809) $ 26,934

Adjustments:

Beginning balance — — — (15,766)

Reorganization accruals — (1,167) (1,167) (1,167)

Manufacturing revenue and COGS (1,690) — —

Assets held for resale — 250 119 119

Purchase accounting — (3,981) (3,981) (3,981)

Other (155) (1,346) (1,484) 3,186

Equity — — (15,898) (36,368)

Total adjustments (1,845) (6,244) (22,411) (53,977)

As restated $ 234,175 $ (6,773) $ (77,220) $ (27,043)

Critical Accounting Policies and Estimates

Our Consolidated Financial Statements and Notes to the Consolidated Financial Statements included in this Form 10-K contain information

that is pertinent to management's discussion and analysis. The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosures of contingent assets and liabilities.

20

We believe the following critical accounting policies involve additional management judgment due to the sensitivity of the methods,

assumptions, and estimates necessary in determining the related asset and liability amounts.

Revenue Recognition. Manufacturing revenues are recognized upon shipment to customers. Retail sales are recognized when payment is

tendered at the point of sale. Pursuant to our franchise agreements, franchisees are generally required to pay an initial franchise fee and a monthly

royalty payment equal to a percentage of the franchisees' gross sales. Initial franchise fees are recognized as revenue when we perform

substantially all of our initial services as required by the franchise agreement. Royalty fees from franchisees are accrued each month pursuant to the

franchise agreements. Royalty income and initial franchise fees are included in franchise revenues.

Accounts Receivable. The majority of our accounts receivable are due from our franchisees. Accounts receivable are due within 15 to

30 days and are stated at amounts due from customers net of an allowance for doubtful accounts. Accounts outstanding longer than the contractual