Einstein Bros 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746903027186/a2116520z10-ka.htm[9/11/2014 10:14:22 AM]

10-K/A 1 a2116520z10-ka.htm 10-K/A

QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

ýANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2002

OR

oTRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

Commission File Number 0-27148

NEW WORLD RESTAURANT GROUP, INC.

(Name of Registrant as Specified in its Charter)

Delaware 13-3690261

(State or Other Jurisdiction

of Incorporation or Organization)

(I.R.S. Employer

Identification No.)

1687 Cole Blvd., Golden, Colorado 80401

(Address of Principal Executive Offices) (Zip Code)

(303) 568-8000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendments of this Form 10-K. o

Table of contents

-

Page 1

... ACT OF 1934 Commission File Number 0-27148 NEW WORLD RESTAURANT GROUP, INC. (Name of Registrant as Specified in its Charter) Delaware (State or Other Jurisdiction of Incorporation or Organization) 1687 Cole Blvd., Golden, Colorado 80401 (Address of Principal Executive Offices) (Zip Code) (303) 568... -

Page 2

... AND EXECUTIVE OFFICERS OF THE REGISTRANT EXECUTIVE COMPENSATION SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS CONTROLS AND PROCEDURES EXHIBITS, FINANCIAL STATEMENT SCHEDULES AND REPORTS ON FORM 8-K 35 37 41 44 46 47 SPECIAL NOTE... -

Page 3

...1. BUSINESS General We are a leader in the quick casual segment of the restaurant industry. With 747 locations in 32 states as of December 31, 2002, we operate and license locations primarily under the Einstein Bros. and Noah's New York Bagels ("Noah's") brand names and franchise locations primarily... -

Page 4

... and lunch, including fresh baked goods, made-to-order sandwiches on breads such as challah, hearty soups, innovative salads, desserts, five fresh-brewed premium coffees daily and other café beverages. The Einstein Bros. brand generated approximately 78% of our 2002 revenues. Noah's New York Bagels... -

Page 5

... generally target specific markets and regions, making extensive use of local promotional media. Local marketing efforts may include print advertising and radio and television promotions. In mid-2002, we conducted a marketing test utilizing television advertising in three Einstein Bros. markets... -

Page 6

... of the federal registration of the "Einstein Bros.," "Noah's New York Bagels," "Manhattan Bagel," "Chesapeake Bagel Bakery" and "New World Coffee" Marks. Some of our Marks are also registered in several foreign countries. We are aware of a number of companies that use various combinations of words... -

Page 7

... the franchise offering circular with state authorities. Employees As of December 31, 2002, we had 7,575 employees, of whom 7,276 were store personnel, 84 were plant and support services personnel, and 215 were corporate personnel. Most store personnel work part-time and are paid on an hourly basis... -

Page 8

... effect on our business, financial condition and results of operations. We face the risk of increasing labor costs that could adversely affect our continued profitability. We are dependent upon an available labor pool of unskilled employees, many of whom are hourly employees whose wages may be... -

Page 9

... our financial and management resources that would otherwise be used to benefit the future performance of our operations. We have been subject to claims from time to time, and although these claims have not historically had a material impact on our operations, a significant increase in the number of... -

Page 10

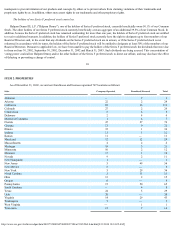

... locations as follows: State Company-Operated Franchised/Licensed Total Alabama Arizona California Colorado Connecticut Delaware District of Columbia Florida Georgia Illinois Indiana Kansas Maryland Massachusetts Michigan Minnesota Missouri Nevada New Hampshire New Jersey New Mexico New York North... -

Page 11

... action complaint against Einstein in the Superior Court for the State of California, County of San Francisco. The plaintiffs allege that Noah's failed to pay overtime wages to managers and assistant managers of its California stores, whom it is alleged were improperly designated as exempt employees... -

Page 12

... New Jersey, Monmouth County. As the founders of Manhattan Bagel Company, the plaintiffs claim to be reproducing the "original formula" Manhattan bagel dough and selling it to franchisees at a competitive price. Their complaint seeks a judgment declaring that their production and sale of this bagel... -

Page 13

...New York, County of New York, against us and our franchisee, captioned General Electric Capital Corp. v. New World Coffee/Manhattan Bagels, Inc. et al. In its complaint... former Chief Financial Officer, and Greenlight Capital, another holder of our Series F preferred stock. Special Situations sought,... -

Page 14

...high and low closing sale prices (as quoted on the Nasdaq National Market, the OTC Bulletin Board or the "pink sheets," as applicable) for our Common Stock for each fiscal quarter during the periods indicated. Fiscal 2002 High Low First Quarter (From January 1, 2002 to April 2, 2002) Second Quarter... -

Page 15

...Revenues Cost of sales General and administrative expenses Depreciation and amortization Provision for integration and reorganization costs...(0.63) 16 Other Financial Data: Depreciation and amortization Capital expenditures Balance Sheet Data (at end...discount, notes paid-in-kind, debt issuance costs... -

Page 16

... the Einstein Bros. and Noah's brand names and franchise locations primarily under the Manhattan and Chesapeake brand names. Our locations specialize in high-quality foods for breakfast and lunch, including fresh baked goods, made-to-order sandwiches on a variety of breads and bagels, soups, salads... -

Page 17

... that were incorrectly established in years prior to fiscal 2000 related to our acquisition of Manhattan Bagel Company and Chesapeake Bagel Franchise Corp. were inappropriately reversed into income and ongoing period costs were charged against such liabilities in error. The restated results... -

Page 18

... related asset and liability amounts. Revenue Recognition. Manufacturing revenues are recognized upon shipment to customers. Retail sales are recognized when payment is tendered at the point of sale. Pursuant to our franchise agreements, franchisees are generally required to pay an initial franchise... -

Page 19

... securities includes the 7.25% Convertible Debentures due 2004 of Einstein/Noah Bagel Corp., which are classified as available for sale securities and are recorded at fair value. Fair value is based on the most recent quoted market prices or, beginning in 2001 due to developments in the bankruptcy... -

Page 20

... decrease primarily resulted from a shift in sales mix towards retail store revenues and the implementation of supply chain cost reduction initiatives related to the integration of Einstein. General and administrative expenses increased to $42.6 million for fiscal 2002 from $28.6 million for fiscal... -

Page 21

...to outsource our distribution business related to the New World brands, which had been included in manufacturing revenues in fiscal 2000. Manufacturing revenue related to the Einstein Bros. and Noah's brands partially offset this decrease. Franchise related revenues decreased 9.5% to $5.7 million or... -

Page 22

... financial statements included in this Form 10-K, this represents the change in the fair value of warrants classified as liabilities as determined periodically based on quoted market prices of the underlying common stock, among other factors. As of January 1, 2002 and December 31, 2000, the closing... -

Page 23

... to the Consolidated Financial Statements included in this Form 10-K. Fiscal Year Ended December 31, 2002 January 1, 2002(1) (Dollars in millions) December 31, 2000(2) Income Statement Data: Revenues: Einstein Bros. and Noah's New World(3) Total revenues Cost of sales General and administrative... -

Page 24

... related retail and manufacturing sales, decreased to 81.8% in fiscal 2002 from 83.7% in fiscal 2001. The percentage decrease was primarily attributable to the cost savings, operating leverage at Einstein Bros. and Noah's and the closing of less-profitable company-operated New World stores. General... -

Page 25

... decrease was primarily related to costs associated with underperforming company-operated Einstein Bros. and Noah's stores that were closed in fiscal 2000 and fiscal 2001 as well as the differences in the fiscal calendar between fiscal 2000 and fiscal 2001. Cost of sales, expressed as a percentage... -

Page 26

... net of related offering expenses, were $22.7 million. The proceeds from this stock sale were utilized to fund, in part, the purchase price for the Einstein Acquisition. On June 19, 2001, we consummated a private placement of 140,000 units consisting of $140.0 million of Senior Increasing Rate Notes... -

Page 27

... relates primarily to the issuance of Series F preferred stock, proceeds from the sale ...2002. We currently have no intention to change to the fair value method to account for employee stock-based compensation; however, the disclosure provisions have been implemented within our consolidated financial... -

Page 28

... factors, including increases in the commodity prices of green coffee and/or flour, acquisitions by us of existing stores, existing and additional competition, marketing programs, weather and variations in the number of location openings. Although few, if any, employees are paid at the minimum wage... -

Page 29

... Hut, Inc. in real estate and construction management. Mr. Gibson received his undergraduate degree in Accounting from Eastern Kentucky University and has an M.B.A. from the University of North Texas. Richard R. Lovely. Mr. Lovely joined us as Chief Personnel Officer in June 2002. From July 1995... -

Page 30

...held senior human resources positions for First USA in Dallas, TX, Wilmington, DE, and the United Kingdom. Mr. Lovely has a J.D. degree from Georgetown University and a B.S. degree in Industrial and Labor Relations from Cornell University. Edward McPherson. Mr. McPherson joined us as Chief Marketing... -

Page 31

...GRANTS IN FISCAL 2002 Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term(1) Expiration Date 5%(2) 10%(3) Number of Securities Underlying Option Granted Percentage of Total Options Granted to Employees in Fiscal Year Exercise Price ($ per Share) Anthony... -

Page 32

...term. Assumes 10% compounded rate of appreciation in the market price per share from the date of grant to the end of the option term. 38 (2) (3) Fiscal Year End Option Values During the fiscal year ended December 31, 2002, none of the Named Executive Officers exercised any stock options. Set forth... -

Page 33

...the fiscal year ended December 31, 2002, except for each of our executive officers and non-employee directors who failed to file a report on Form 5 to report exempt grants of stock and options. 40 ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth... -

Page 34

... one percent (1%). Address for each officer and director is our office located at 1687 Cole Blvd., Golden, Colorado 80401. 5,374,026(4) 10.5% 4,995,825(5) 1,683,769(6) 0 202,729(7) 82,729(8) 44,661(9) 2,013,888(10) 9.8% 3.2% * * * * 3.8% Based upon an amendment to a Schedule 13D filed with the... -

Page 35

...Price of Outstanding Options, Warrants and Rights Number...of Common Stock, which are due to the directors who were in office as of October 1, 2002, but...coffee roasting facility in Connecticut. The options vested immediately upon grant. Represents warrants granted to Mr. Tannenbaum in 2000 for financial... -

Page 36

...of our Common Stock at its closing price on August 18, 2000. In addition, Mr. Tannenbaum was designated by BET as a director to serve for the period specified in the Stockholders Agreement. Eve Trkla, a director of our company, is the Chief Financial Officer of Brookwood Financial Partners, L.P., an... -

Page 37

...parents are officers of NW Coffee, Inc. In periods prior to April 2001, we purchased goods for the franchise and paid for all of the expenses of the franchise other than payroll (other than the salary of the general manager), which generated receivables for us. From time to time, NW Coffee, Inc. and... -

Page 38

...years ended December 31, 2000 and January 1, 2002. Current Report on Form 8-K filed with the SEC on October 17, 2002, announcing that the Company had engaged CIBC World Markets Corp. as its financial advisor in connection with its review of strategic alternatives to rationalize its capital structure... -

Page 39

...(4) Form of Store Franchise Sale Agreement(4) Manhattan Bagel Company, Inc.-DIP Amended Acquisition Agreement and Exhibits(5) Manhattan Bagel Company, Inc.-Debtor in Possession First Amended Joint Plan of Reorganization(5) Manhattan Bagel Company, Inc.-Debtor in Possession Confirmation Order... -

Page 40

...and Halpern Denny(13) List of Subsidiaries(13) Consent of Grant Thornton* Certification of Principal Executive Officer and Principal Financial Officer of the Registrant pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, with respect to the Registrant's Annual Report on Form 10-K for the year... -

Page 41

... and Director (Principal Executive, Financial and Accounting Officer) August 12, 2003 Director August 12, 2003 Director 51 August 12, 2003 CERTIFICATIONS I, Anthony D. Wedo, certify that: 1. I have reviewed this annual report on Form 10-K of New World Restaurant Group, Inc.; 2. Based on my... -

Page 42

...Principal Executive Officer and Principal Accounting Officer) 52 NEW WORLD RESTAURANT GROUP, INC. AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS FINANCIAL STATEMENTS: Consolidated Balance Sheets as of December 31, 2002, January 1, 2002 and... -

Page 43

... schedule, when considered in relation to the basic financial statements taken as a whole, presents fairly, in all material respects, the information therein. /s/ Grant Thornton LLP Denver, Colorado March 26, 2003 (except for Note 19, as to which the date is July 8, 2003) F-2 NEW WORLD RESTAURANT... -

Page 44

...,220 The accompanying notes are an integral part of these consolidated financial statements. F-3 NEW WORLD RESTAURANT GROUP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2002, JANUARY 1, 2002 AND DECEMBER 31, 2000 (in thousands, except share and per... -

Page 45

December 31, 2002 January 1, 2002 December 31, 2000 Revenues: Retail sales Manufacturing revenues Franchise related revenues Total revenues Cost of sales General and administrative expenses Depreciation and amortization Provision for integration and reorganization costs. Impairment charge in ... -

Page 46

... Dividends and accretion Balance, December 31, 2000 (Restated) Net loss Net unrealized gain on available-for-sale securities Comprehensive loss Issuance of common stock Issuance of warrants in connection with Series F preferred stock Issuance of warrants in connection with Senior Notes Issuance of... -

Page 47

...) The accompanying notes are an integral part of these consolidated financial statements. F-6 NEW WORLD RESTAURANT GROUP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2002, JANUARY 1, 2002 AND DECEMBER 31, 2000 (in thousands) As Restated December 31... -

Page 48

...sale of assets held for resale Net cash paid for acquisitions Deferred acquisition costs Investment in debt securities Proceeds from the sale... notes are an integral part of these consolidated financial statements. F-7 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION...stock to Series F preferred stock... -

Page 49

... Einstein Bros. and Noah's brand names and franchises locations primarily under the Manhattan and Chesapeake brand names. The Company's locations specialize in high-quality foods for breakfast and lunch, including fresh baked goods, made-to-order sandwiches on a variety of breads and bagels, soups... -

Page 50

... Debt Securities Investment in debt securities includes 7.25% Convertible Debentures due 2004 of Einstein/Noah Bagel Corp., which are classified as available for sale securities. Accordingly, as of January 1, 2002, these securities are recorded at fair value with temporary fluctuations in fair value... -

Page 51

...is based on the most recent traded market price. Due to the developments in the bankruptcy of Einstein in 2001, including the auction pursuant...annual impairment analyses of goodwill indicated that the fair value of the Manhattan Bagel Company reporting unit as of December 31, 2002 and January 2, 2002... -

Page 52

...911) 372 471 (7,068) $ F-12 Long-Lived Assets The Company's policy is to record long-lived assets at cost, amortizing these costs over the expected useful lives of the related assets. In accordance with Statement of Financial Accounting Standards (SFAS) No. 144, Accounting for the Impairment or... -

Page 53

...lease term, over cash rentals paid. Shipping and Handling Costs The Company classifies shipping and handling expenses related to product sales as a cost of goods sold. Fair Value of Financial Instruments The fair value of franchise notes receivable (Note 6) is estimated to approximate their carrying... -

Page 54

... Segment Disclosure The Company follows the provisions of SFAS No. 131, Disclosure about Segments of an Enterprise and Related Information. SFAS 131 requires the reporting of certain information about operating segments in annual financial statements. The Company operates and manages its business as... -

Page 55

... for fiscal years ending after December 15, 2002. The Company currently has no intention to change to the fair value method to account for employee stock-based compensation; however, the disclosure provisions have been implemented within these financial statements. http://www.sec.gov/Archives/edgar... -

Page 56

...stockholders' equity based on the application of the criteria in EITF Issue 00-19, Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company's Own Stock, and accordingly has classified those warrants as a liability in the balance sheet. Further, those warrants... -

Page 57

... proper application of generally accepted accounting principles ("GAAP"). Accordingly, the Company has restated its financial statements for fiscal 2000, fiscal 2001 and the opening balances of certain accounts in 2000. A. Beginning Balance for Fiscal 2000 In the process of reviewing the accounting... -

Page 58

...Assets Held For Resale. The Company identified and expensed $569,794 of general and administrative costs originally capitalized in assets held for resale relating to the acquisition of Lots 'A Bagels, Inc. (LAB), New York Bagel Enterprises (NYBE), and the Western New York stores http://www.sec.gov... -

Page 59

... relating to the Einstein Acquisition. Of the $1,085,721 of such costs expensed, $946,470 represented payments in stock and cash to consultants providing capital raising and financial advisory services that were not direct and incremental to the acquisition of the assets of Einstein/Noah Bagel Corp... -

Page 60

effective dividend rate will be applied prospectively as of the beginning of such reporting period. As of December 31, 2000, the components of Series D preferred stock were included in the accompanying balance sheet as originally recorded and as restated as follows: As Reported As Restated (amounts... -

Page 61

... and (3) reduce the balance of accrued liabilities by $4,132,979. In addition, in reviewing costs originally capitalized into the purchase price of Einstein, the Company has identified and adjusted $2,702,888 of such capitalized F-24 costs as follows: $1,706,642 of costs not directly related to the... -

Page 62

... a fixed period of time. As a result, cost of goods sold and other long-term liabilities were increased in 2001 by $793,783. In addition, the Company reclassified $1,420,784 of the liability related to this contract from shortterm to long-term liabilities. The restated financials also include $114... -

Page 63

..., issuance costs, the estimated fair value of additional warrants (if not classified as derivative liabilities), the amortization of any related discount, and the estimated outstanding term of the instrument based on management's intent to refinance a portion of the original Series F preferred stock... -

Page 64

...the underlying Common Stock price. The components of the Bridge Loan were included in the accompanying balance sheet as follows: As Restated December 31, 2002 January 1, 2002 (amounts in thousands) Original face value of Bridge Loan Issuance discount from face value Discount attributable to future... -

Page 65

... F preferred stock Common stock Additional paid-in capital Retained earnings Total stockholders' equity (deficit) Statement of Operations: Total revenues Cost of sales General and administrative expense Depreciation and amortization Provision for store closing and reorganization cost Impairment... -

Page 66

..., LAB and the Western New York stores was not material to the financial statements. On June 19, 2001, the Company purchased substantially all of the assets (the "Einstein Acquisition") of Einstein/Noah Bagel Corp. and its majority-owned subsidiary, Einstein/Noah Bagel Partners, L.P. (collectively... -

Page 67

... the Company is entitled to a reduction in purchase price to the extent that assumed current liabilities (as defined) exceed $30,000,000 as of the acquisition date. The accompanying balance sheet as of January 1, 2002 reflects approximately $3,918,000 as due from the Einstein bankruptcy estate. This... -

Page 68

... franchisees to facilitate their construction of stores and provide other initial and ongoing operating cash flows. The notes are payable with interest thereon at rates ranging from 6-10% per annum and are generally to be paid in full simultaneously upon the closing of a subsequent financing by the... -

Page 69

... initial annual rate of 13%, increasing by 100 basis points each quarter commencing September 15, 2001 to a maximum rate of 18%. The Company commenced quarterly interest payments on September 15, 2001. The Company may redeem all or a portion of the notes at any time for their face value plus accrued... -

Page 70

... of the notes upon a change of control of EnbcDeb Corp., which F-36 requires the Company to pay 101% of the principal amount thereof plus accrued and unpaid interest thereon. EnbcDeb Corp. is required to apply all proceeds relating to the Einstein Bonds as a repayment of the $35 million notes. The... -

Page 71

... by the related assets of Chesapeake Bagel Bakery. h. In December 1998, Manhattan Bagel Company entered into a note payable of $2,800,000 with the New Jersey Economic Development Authority at an interest rate of 9% per annum. The note has a 10-year maturity. Principal is paid annually and interest... -

Page 72

... of $208,000 on its plant in South Carolina. The mortgage bears interest at prime plus 1.25% and matures in March 2010. The mortgage is secured by the associated real estate. Scheduled maturities of long-term debt are as follows: December 31, 2002 2003 2004 2005 2006 2007 Thereafter $ 150,872... -

Page 73

... rights except as provided under the General Corporation Law of the State of Delaware. The stock is convertible into shares of Common Stock in accordance with the Certificate of Designation of Series B convertible preferred stock. On June 7, 1999, the Company's board of directors authorized the... -

Page 74

... "Third Purchase Agreement") by and among the Company, Halpern Denny, Greenlight and Special Situations. In connection with the sale of the June 2001 Series F preferred stock, the Company sold warrants to purchase 17,769,305 shares of Common Stock at a price per share of $0.01 (subject to adjustment... -

Page 75

... number of Original Warrant Shares. If the Company redeems all issued and outstanding shares of Series F preferred stock on or prior to June 19, 2002, the number of Original ... with Halpern Denny to reflect the new form of Senior Notes. In addition, the Company, BET, Brookwood and Halpern Denny ... -

Page 76

... entitle its holder to purchase, at the Right's then-current exercise price, a number of the acquiring company's common shares having a market value at that time of twice the Right's exercise price. Warrants As of December 31, 2002, the Company has 41,244,218 warrants outstanding all of which were... -

Page 77

... information about the Company's stock options at December 31, 2002: Number Outstanding at December 31, 2002 Weighted Average Remaining Contractual Life Number Exercisable at December 31, 2002 Exercise Price Weighted Average Exercise Price Weighted Average Exercise Price $0.14 - $1.00 $1.01... -

Page 78

...focus given the Einstein Acquisition (Note 4). During 2001, the Company sold four stores in New York and closed ten locations classified as assets held for resale. During 2002, the Company F-47 sold seven stores for an aggregate sales price of $1.4 million, and closed 15 stores classified as assets... -

Page 79

... amounts listed in the above table are affected by the market price of the underlying Common Stock and other factors described in Note 1 -Derivative Instruments. As of December 31, 2000, the closing price of the Common Stock was $1.125, which price had decreased to $0.26 by January 1, 2002 and was... -

Page 80

... terminate certain lease obligations inclusive of several company-operated locations. When initiated, the restructuring plan was ...Company. The following tables display the 2001 and 2002 activity and balances of the 2001 restructuring accrual account: Balance as of January 1, 2002 Application of costs... -

Page 81

... Operating Leases The Company leases office and retail space under various non-cancelable operating leases. Property leases normally require payment of a minimum annual rental plus a pro rata share of certain landlord operating expenses. As of December 31, 2002, approximate future minimum... -

Page 82

... complaint against Einstein in the Superior Court for the F-52 State of California, County of San Francisco. The plaintiffs allege that Noah's failed to pay overtime wages to managers and assistant managers of its California stores, whom it is alleged were improperly designated as exempt employees... -

Page 83

... amended complaint to refile the demurrer. In July 2002, the New Jersey Division of Taxation entered judgment in the amount of $5,744,902, plus costs, against Manhattan Bagel Construction Company, a wholly owned subsidiary of Manhattan Bagel Company. This judgment represents amounts for corporate... -

Page 84

... to its Company-operated and franchised locations. Investment Banking Agreement In October of 2002, the Company engaged CIBC World Markets Corp. as its financial advisor in connection with its review of strategic alternatives to rationalize its capital structure. 17. Related Party Transactions... -

Page 85

... owned by GNW to secure the EnbcDeb Corp. notes. The Company is required to apply all proceeds received with respect to the Einstein bonds to repay the EnbcDeb Corp. F-56 notes. To the extent that there are any excess proceeds, the Company is required to pay them to Greenlight. If Greenlight does... -

Page 86

... officers of NW Coffee, Inc. In periods prior to April 2001, the Company purchased goods for the franchisee and paid for all of the expenses of the franchisee other than payroll (other than the salary of the general manager), which generated receivables for the Company. From time to time, NW Coffee... -

Page 87

...an action in the Supreme Court for the State of New York, County of New York, against the Company and its franchisee, captioned General Electric Capital Corp. v. New World Coffee/Manhattan Bagels, Inc. et al. In its complaint, plaintiff asserts that it entered into certain equipment lease agreements... -

Page 88

... A Notice of Voluntary Withdrawal was filed by Special Situations with the United States District Court for the Southern District of New York on May 5, 2003. F-60 Schedule II-Valuation of Qualifying Accounts Balance at Beginning of Period Balance at End of Period Additions Deductions (amounts in... -

Page 89

...CERTAIN BENEFICIAL OWNERS AND MANAGEMENT EQUITY COMPENSATION PLAN INFORMATION ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS ITEM 14. CONTROLS AND PROCEDURES PART IV ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES AND REPORTS ON FORM 8-K SIGNATURES CERTIFICATIONS NEW WORLD RESTAURANT GROUP...