Earthlink 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Earthlink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fewer gross subscriber additions for our satellite services. New satellite service subscriptions generate significant first month revenues

associated with the installation and sale of equipment. The decrease is also a result of lower average wholesale broadband revenues per

subscriber due to the restructuring of our relationship with Charter. However, the restructuring of our relationship with Charter also increased

the proportion of retail customers in our broadband subscriber base, which had the effect of increasing average monthly revenue per broadband

subscriber.

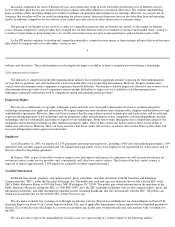

The following table summarizes broadband subscriber activity for the years ended December 31, 2002 and 2003:

(a)

Year Ended December 31,

2002

2003

(in thousands)

Subscribers at beginning of year

471

779

Gross organic subscriber additions

322

575

Acquired subscribers

7

—

Narrowband subscribers converted to our broadband services

98

54

Adjustment (a)

—

(

152

)

Churn

(119

)

(195

)

Subscribers at end of year

779

1,061

Due to the reduction in revenue per subscriber during the transition period under our arrangement with Charter, we

excluded approximately 152,000 Charter wholesale broadband subscribers from our total paying subscriber count as of

the third quarter of 2003. See discussion below for more information.

Our broadband subscriber base consists of both retail and wholesale customers. In a retail relationship, we market the service directly to

consumers under the EarthLink brand, have latitude in establishing price, and are responsible for most aspects of providing the service,

including first tier customer support. In a wholesale relationship, a telecommunications partner (including cable companies) markets the

service, has latitude in establishing price, provides the communications link to the consumer's

23

home, and pays EarthLink to provide underlying Internet services such as authentication, email, web space, news and varying degrees of

customer support. While retail services are generally priced above $40 per month per subscriber to cover all of the costs of the service,

wholesale relationships are priced between $4 and $10 per month recognizing the limited set of activities performed by EarthLink. In a retail

relationship, EarthLink recognizes the amount the subscriber is billed as revenue, but in a wholesale relationship, EarthLink recognizes the

amount due from the wholesale partner as revenue. As of December 31, 2003, our broadband subscriber base consisted of approximately 68%

retail customers and 32% wholesale customers, compared to 57% and 43%, respectively, at December 31, 2002. The number of customers

being added or served at any point in time through our wholesale efforts is subject to the business and marketing circumstances of our

telecommunications partners.

The pricing of our retail broadband access services is subject to competitive pressures that are beyond our control. Two ILECs, Verizon

Communications Inc. ("Verizon") and SBC Communications Inc. ("SBC") have reduced the retail prices of their broadband service offerings

over the past nine months. Verizon and SBC have also decreased, to a lesser degree, the wholesale prices of broadband services they provide us

and other high-speed service providers. Such competitive pressures may cause us to decrease the price of our retail broadband access services

resulting in a decrease in our average monthly revenue per broadband subscriber, and potentially a reduction in gross margin dollars per

subscriber, and/or may result in fewer new broadband subscribers from our sales and marketing programs. Any of these could have a materially

adverse effect on the profitability of our business.

We have agreements with varying terms with all of our significant broadband network providers. The following table summarizes the

expiration dates for these agreements:

Contract Expiration

Broadband Network Provider

Month

Year

Covad Communications Group, Inc.

July

2004

Comcast Corporation

July

2005

Subsidiaries of SBC January

September

2006

2006