DuPont 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

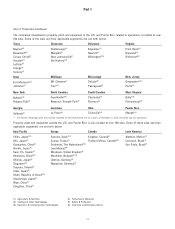

Item 6. SELECTED FINANCIAL DATA

(Dollars in millions, except per share) 2005 2004 2003 2002 2001

Summary of operations

Net sales $26,639 $27,340 $26,996 $24,006 $24,726

Income before income taxes and minority interests $ 3,558 $ 1,442 $ 143 $ 2,124 $ 6,844

Provision for (benefit from) income taxes $ 1,468 $ (329) $ (930) $ 185 $ 2,467

Income before cumulative effect of changes in accounting principles $ 2,053 $ 1,780 $ 1,002 $ 1,841 $ 4,328

Net income (loss) $ 2,053 $ 1,780 $ 9731$ (1,103) 2$ 4,339 3

Adjusted net income (loss) $ 2,053 $ 1,780 $ 9731$ (1,103) 2$ 4,505 3, 4

Basic earnings (loss) per share of common stock

Income before cumulative effect of changes in accounting principles $ 2.08 $ 1.78 $ 1.00 $ 1.84 $ 4.17

Net income (loss) $ 2.08 $ 1.78 $ 0.97 1$ (1.12) 2$ 4.18 3

Adjusted net income (loss) $ 2.08 $ 1.78 $ 0.97 1$ (1.12) 2$ 4.34 3, 4

Diluted earnings (loss) per share of common stock

Income before cumulative effect of changes in accounting principles $ 2.07 $ 1.77 $ 0.99 $ 1.84 $ 4.15

Net income (loss) $ 2.07 $ 1.77 $ 0.96 1$ (1.11) 2$ 4.16 3

Adjusted net income (loss) $ 2.07 $ 1.77 $ 0.96 1$ (1.11) 2$ 4.32 3, 4

Financial position at year-end

Working capital $ 4,959 $ 7,272 $ 5,419 $ 6,363 $ 6,734

Total assets $33,250 $35,632 $37,039 $34,621 $40,319

Borrowings and capital lease obligations

Short-term $ 1,397 $ 937 5$ 6,017 5$ 1,185 $ 1,464

Long-term $ 6,783 $ 5,548 $ 4,462 5$ 5,647 $ 5,350

Stockholders’ equity $ 8,907 $11,377 $ 9,781 $ 9,063 $14,452

General

For the year

Purchases of property, plant & equipment and investments in affiliates $ 1,406 $ 1,298 $ 1,784 $ 1,416 $ 1,634

Depreciation $ 1,128 $ 1,124 $ 1,355 $ 1,297 $ 1,320

Research and development (R&D) expense $ 1,336 $ 1,333 $ 1,349 $ 1,264 $ 1,588

Average number of common shares outstanding (millions)

Basic 982 998 997 994 1,036

Diluted 989 1,003 1,000 999 1,041

Dividends per common share $ 1.46 $ 1.40 $ 1.40 $ 1.40 $ 1.40

At year-end

Employees (thousands) 60 60 81 79 79

Closing stock price $ 42.50 $ 49.05 $ 45.89 $ 42.40 $ 42.51

Common stockholders of record (thousands) 101 106 111 116 127

1Includes a cumulative effect of a change in accounting principle charge of $29 and $0.03 per share, basic and diluted, relating to the adoption of Statement of

Financial Accounting Standards (SFAS) No. 143 ‘‘Accounting for Asset Retirement Obligations’’. See Note 9 to the Consolidated Financial Statements.

2Includes a cumulative effect of a change in accounting principle charge of $2,944 and $2.96 (basic) and $2.95 (diluted) per share, relating to the adoption of SFAS

No. 142 ‘‘Goodwill and Other Intangible Assets’’ (SFAS No. 142).

3Includes a cumulative effect of a change in accounting principle benefit of $11 and $0.01 per share, basic and diluted, relating to the adoption of SFAS No. 133

‘‘Accounting for Derivative Instruments and Hedging Activities’’.

4Reflects pro forma effects relating to the adoption of SFAS No. 142 in 2002 and the resulting nonamortization of goodwill and indefinite-lived intangible assets.

5Includes borrowings and capital lease obligations classified as liabilities held for sale.

17