Dominion Power 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 2011 Summary Annual Report / Dominion Resources /

Outlook for 2012

Our guidance for 2012 anticipates operating

earnings in the range of $3.10 per share to $3.35

per share.* With rising energy demand, lower

interest expense, construction and operation of

new infrastructure in our regulated businesses

and continued control over operating expenses,

we expect 5 6 percent earnings per share

growth in 2012. That growth should continue

for the foreseeable future.

We expect that the dividend payout ratio will

again be near the top end of our target range

in 2012. In January 2012, the board increased

the annual dividend rate by 14 cents per share,

or 7.1 percent — to $2.11 per share, subject to

quarterly declaration. We expect our directors

to continue aligning dividend increases with

our expected earnings per share growth of

5–6 percent.**

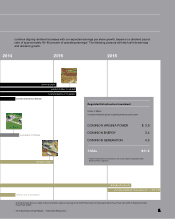

Strong Foundation Fuels Growth Plans

Over the past five years, your company sold

commodity-based businesses to reduce earnings

volatility and strengthen our balance sheet.

Since then, we have targeted billions of dollars

in investment in federally and state-regulated

projects to meet the growing demand of our

customers and maintain system reliability.

Investor confidence in our performance and

earnings outlook is based on the fundamentals

of our business model: investing in and

maintaining energy infrastructure designed to

last for generations. Our growth comes from

a strong foundation of concrete and steel,

reinforced by the values in our culture: working

safely and responsibly, and respectfully looking

out for one another.

The strength of this foundation was affirmed

when our employees rallied to respond to two

natural disasters in August. It was also affirmed

when Dominion Resources took advantage of its

strong credit metrics and balance sheet to raise

$850 million in two separate debt issuances with

terms of three and five years — selling at interest

rates below 2 percent, among the lowest ever

recorded for U.S. holding companies. These

offerings were part of nearly $2 billion in senior

notes that Dominion issued in 2011.

Dominion did not issue any net common

stock in 2011. And, with the exception of issuing

approximately $320 million in equity through our

employee savings plans, direct stock purchase

and dividend reinvestment plan, and other

employee and director benefit plans, we do not

anticipate issuing common stock in 2012.

Building for Virginia

In 2011, we completed three major projects

for our utility customers in Virginia and North

Carolina on time and on budget. These included

the $619 million, 590-megawatt gas-fired

Bear Garden Power Station in Central Virginia,

and two 500-kilovolt transmission lines in

Northern Virginia and Southeastern Virginia,

which cost $479 million combined. Bear

Garden is now online and generating electricity.

And the Meadow Brook-to-Loudoun and

Carson-to-Suffolk transmission lines are

transporting power that flows to consumers.

Since our utility growth program began in

2007, Dominion has added more than 1,500

megawatts of generating capacity and about

300 miles of transmission lines to serve Virginia

and North Carolina customers.

Despite sluggish growth in the overall

economy, weather-adjusted power usage at

Dominion Virginia Power rose 1.6 percent in 2011.

The utility set a new peak demand record of

20,061 megawatts on July 22, 2011, surpassing

the previous record of 19,688 megawatts, set in

August 2007. Load from data centers, each of

which consumes as much electricity as 9,000

typical homes, is expected to nearly double over

the next two years. To keep the Internet up and

running 24/7, we must provide reliable electric

service to data centers 24/7.

Since 2007,

we have

added more

than 1,500

megawatts

of generating

capacity

and about

300 miles of

transmission

lines.

* See page 22 for GAAP Reconciliation of 2012 Operating

Earnings Guidance.

** All dividend declarations are subject to Board of Directors approval.