Dominion Power 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dominion 2007 Annual Report 11

of the expected benefits of competi-

tion would not materialize. In short,

lawmakers reregulated the state’s

electric utilities, employing a

modified cost-of-service model to

set base electricity rates.

Deregulation provided an environ-

ment in which it was too risky to

build significant baseload generation.

The new law, on the other hand,

establishes a constructive framework

that provides investors the opportu-

nity to earn competitive returns on

equity. The new system allows your

company to apply to recover these

costs as they are incurred—a critical

consideration for investors—and

helps protect customers from rate

spikes.

The new rules establish environ-

mental-based incentives for con-

structing nuclear, advanced-technolo-

gy coal and natural gas facilities, and

for meeting or exceeding renewable

generation goals. They also reward

efficient operations that reduce costs

and emissions, enable cost-effective

power production and provide

excellent customer service.

REGULATORY HEARINGS TO

DETERMINE AUTHORIZED RETURNS

IN LINE WITH PEERS

As part of reregulation, Virginia

Power in 2009 will file for a review of

its base rates for the first time in a

decade. As in the past, the Virginia

State Corporation Commission will

set future rates that balance share-

holder and consumer interests. The

commission ultimately will make rul-

ings that will authorize the company

to earn rates of return no lower than

an average of those of a group

of our peer utilities in the Southeast.

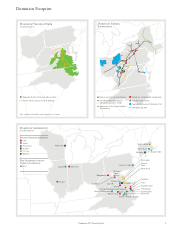

Turning to the Midwest, our

Dominion East Ohio natural gas

utility serves more than 1.2 million

homes and businesses. Last year

we asked the Public Utilities

Commission of Ohio for an increase

in base rates of $73 million to recover

increased costs. This request—the

first proposed increase since 1994—

would support a 12 percent return

on equity.

WELL POSITIONED IN FAVORABLE

NORTHEAST, MIDWEST MARKETS

Our merchant fleet operates in the

Northeast and Midwest. It comprises

about 35 percent of our total electric

generation. These facilities occupy

excellent geographic locations near

high-demand centers with transmis-

sion infrastructure in place. We

began acquiring such facilities nearly

a decade ago. Since then wholesale

power prices have risen substantially.

These businesses manage their

price risks by entering into power

sales with creditworthy buyers.

We also maintain available power for

sale into spot wholesale markets as

opportunities arise.

With little new generation con-

struction anticipated in New England,

our fleet there will become all the

more valuable and all the more

necessary to serve the region’s energy

needs.

While helping to meet the energy

needs of the region, we must comply

with stringent emissions-reduction

standards adopted there, strive to

operate these units safely and efficient-

ly and seek to increase their capacity.

Unlike in New England, much

of our electric output in the Midwest

is being sold to utilities under below-

market price contracts scheduled

to expire by 2013. To begin realizing

some of this trapped value for

shareholders, last year we paid about

$230 million to buy out a contract

for our 515-megawatt State Line

Power Station in Hammond, Ind.,

near Chicago.

WITH LITTLE NEW

GENERATION CONSTRUCTION

ANTICIPATED IN NEW

ENGLAND, OUR FLEET THERE

WILL BECOME ALL THE MORE

VALUABLE AND ALL THE MORE

NECESSARY TO SERVE

THE REGION’S ENERGY NEEDS.