Dominion Power 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

more than 150 feet above the river. Four conductors crashed into the

water, damaging two others and blacking out a major portion of downtown

during rush hour. Under old ways of business, repairs to the line would

have halted traffic on the river for a week to ten days while the cable

was lowered and work performed from another barge.

Instead, three Bulk Power employees—Mark Allen, Don Koonce and

Danny Bowers—acted quickly and decisively. Our people chartered a

specialized helicopter and crew so that they could work on the damaged

cables from the air. Leaning out of that chopper, the aerial linemen spliced

lines together above the water, bringing the substation back into operation

in a matter of hours.

All in all, we had an excellent year.

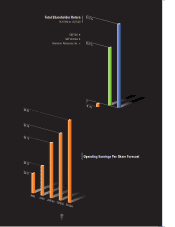

Our 2000 operating earnings rose to $3.33 per share, up 10.6 percent

over 1999 with an operating return on equity of about 12 percent. Our

earnings performance exceeded our growth target of 8 to 10 percent.

Recognizing the full potential of the combined company, we twice increased

projected operating earnings for 2001. We now project per-share operating

earnings of $4.10—a level that we originally believed we would reach

by 2004—with continued annual growth in the range of 8 to 10 percent in

coming years. We set this target expecting that gas and oil prices will decline

from historic highs, our electric production costs will remain low, and demand

for gas and electricity in our geographic market will continue to grow.

We’re committed to continuing our $2.58 annual dividend. Dividends are

an important, if neglected, component of total return. Maintaining the dividend

is important to many shareholders who depend on dividends for income.

Some Wall Street pundits say a company intent on share-price growth

can’t afford to reward its investors with cash. I disagree. Unless the laws

of gravity change, our share price should rise with rising earnings. And the

percentage of earnings we pay as dividends will go down—something

Wall Street will view favorably. At year’s end, our payout was about

77 percent of total earnings. Over time, we’ll work to have earnings growth

move that in the neighborhood of 50 to 55 percent.

17

Operating Earnings Rise

We’re committed to continuing our $2.58 annual dividend. Dividends

are an important, if neglected, component of total return.