Dollar General 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

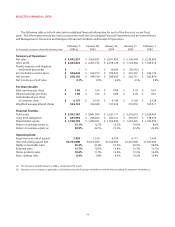

Accounting Periods. The following text contains refer-

ences to years 2006, 2005, 2004 and 2003, which represent

fiscal years ending or ended February 2, 2007, February 3,

2006, January 28, 2005, and January 30, 2004, respectively.

Fiscal year 2006 will be, and each of 2004 and 2003 was,

a 52-week accounting period, while fiscal 2005 was a

53-week accounting period, which affects the comparabili-

ty of certain amounts in the Consolidated Financial

Statements and financial ratios between 2005 and the

other fiscal years reflected herein.The Company’s fiscal

year ends on the Friday closest to January 31. This discus-

sion and analysis should be read with, and is qualified in

its entirety by, the Consolidated Financial Statements and

the notes thereto. It also should be read in conjunction

with the Forward-Looking Statements/Risk Factors disclo-

sure set forth above.

Purpose of Discussion. We intend for this discussion to

provide the reader with information that will assist in

understanding our Company and the critical economic

factors that affect our Company. In addition, we hope to

help the reader understand our financial statements, the

changes in certain key items in those financial statements

from year to year, and the primary factors that accounted

for those changes,as well as how certain accounting

principles affect our financial statements.

Executive Overview

Dollar General Corporation (“Dollar General” or the

“Company”) is the largest dollar store discount retailer of

consumable basics in the United States, with over 8,000

stores.We are committed to serving the needs of low-,

middle- and fixed-income customers. However, the

Company sells quality private label and national brand

products that appeal to a wide range of customers. Our

merchandise is priced at competitive everyday low prices

that do not change frequently as a result of promotional

activity. We believe many of our customers shop at Dollar

General because they trust us to consistently stock quality

merchandise at low prices. We also believe convenience,

or the ability to complete a shopping trip in a limited

amount of time, is critical to many of our customers and is

a key factor that differentiates us from large-box retailers.

We operate in the highly competitive retail industry.

We face strong sales competition from other retailers that

sell general merchandise and food. Because of Dollar

General’s low-price strategy, we must strive to keep our

operating costs as low as possible. This effort affects all

expenses, but is particularly critical as we compete for

retail site locations and for qualified talent to manage and

operate our stores. The fact that many of our stores are

located in towns that many retailers may find too small to

support their business model, however, has allowed Dollar

General to continue to increase its store count faster than

most retailers.

Management of the Company continues to focus on

making good investment decisions for the long-term

growth and profitability of the Company. In order to better

support sales efforts in our stores and to enable the

Company to continue its rapid growth, the Company has

attempted to strengthen the senior leadership team over

the last several years. In 2005, changes were made to the

organization structure in order to increase synergies

between store operations and new store development

and among merchandising, marketing and the supply

chain. Executives were added to support our efforts in

human resources, real estate, store operations, supply

chain and the Dollar General Market concept. Going

forward, the Company expects these new leaders to

have a positive impact on the overall performance and

profitability of the Company.

Along with other retail companies,we are impacted

by a number of factors including, but not limited to: cost

of product, consumer debt levels, economic conditions,

customer preferences, unemployment, labor costs,

inflation, fuel prices, weather patterns, insurance costs

and accident costs.

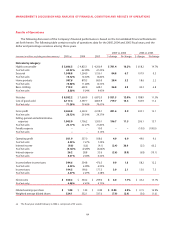

Key Items in Fiscal 2005. Despite a difficult economic

environment for our customers in 2005, the Company

successfully implemented many of the important operat-

ing initiatives outlined in last year’s Form 10-K, while also

increasing sales and earnings per share. The following

are some of the more significant accomplishments during

the year:

• Total sales increased by 12.0 percent, including sales

during the 53rd week, and same-store sales increased

by 2.0 percent;

• We opened 734 new stores, including 29 Dollar

General Market stores;

• We implemented “EZstore”, the Company’s initiative

designed to improve inventory flow from distribution

centers to consumers as well as improve other areas

of store operations, including labor scheduling, hiring

and training and product presentation, in 3,825 stores

as of year-end;

• We completed construction of and opened the

Company’s eighth DC in South Carolina and began

construction of a ninth DC in Indiana to increase over-