Dell 1999 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1999 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

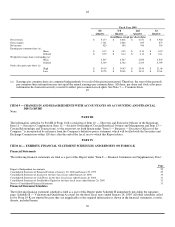

established the accounting standards for equity derivative contracts indexed to and potentially settled in a company's own stock. It did

not address embedded settlement features which are contingent on events which are unlikely to occur. EITF 00-7 addresses embedded

settlement features and states that contracts which could require cash payment cannot be accounted for as equity of the issuer.

EITF 00-7 is effective on March 17, 2000 for new contracts. For contracts executed prior to March 17, 2000, EITF-00-7 takes effect

on December 31, 2000. The Company is assessing the impact of EITF 00-7 on its consolidated financial statements.

Reclassifications — Certain prior year amounts have been reclassified to conform to the fiscal year 2000 presentation.

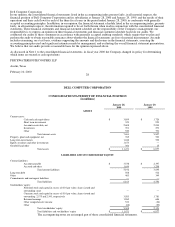

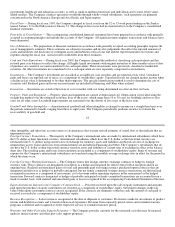

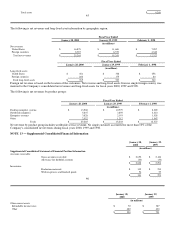

NOTE 2 — Business Combination

On October 20, 1999, the Company acquired all the outstanding shares of ConvergeNet Technologies, Inc. ("ConvergeNet") in

exchange for 6.9 million shares of the Company's common stock and $4.5 million cash for total purchase consideration of

$332 million. ConvergeNet is a developer of storage domain management technology for enterprise storage area networks. The

consolidated financial statements include the operating results of ConvergeNet from the date of acquisition. Pro forma results of

operations have not been presented because the effect of the acquisition was not material.

The ConvergeNet acquisition was recorded under the purchase method of accounting. Accordingly, the purchase price was allocated

to the net assets acquired based on their estimated fair values. The amount allocated to purchased research and development of

$194 million was determined based on an appraisal completed by an independent third party using established valuation techniques in

the storage management industry and expensed upon acquisition because technological feasibility had not been established and no

future alternative uses existed. Additionally, ConvergeNet had not begun shipment of its products as of the date of acquisition.

Research and development costs to bring ConvergeNet products to technological feasibility are not expected to have a material impact

on the Company's future results from operations or cash flows.

The excess of cost over net assets acquired of $132 million was recorded as goodwill and included in other assets. Goodwill and other

intangible assets arising from this combination are being amortized on a straight line basis over periods from three to eight years.

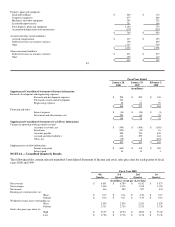

NOTE 3 — Financial Instruments

Disclosures About Fair Values of Financial Instruments

The fair value of investments, long-term debt and related interest rate derivative instruments has been estimated based upon market

quotes from brokers. The fair value of foreign currency forward contracts has been estimated using market quoted rates of foreign

currencies at the applicable balance sheet date. The estimated fair value of foreign currency purchased option contracts is based on

market quoted rates at the applicable balance sheet date and the Black-Scholes options pricing model. Considerable judgment is

necessary in interpreting market data to develop estimates of fair value. Accordingly, the estimates presented herein are not

necessarily indicative of the amounts that the Company could realize in a current market exchange. Changes in assumptions could

significantly affect the estimates.

Cash and cash equivalents, accounts receivable, accounts payable and accrued and other liabilities are reflected in the accompanying

consolidated financial statements at fair value because of the short-term maturity of these instruments.

36

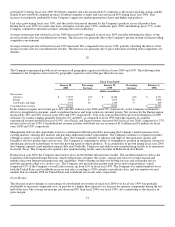

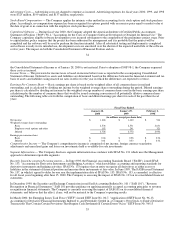

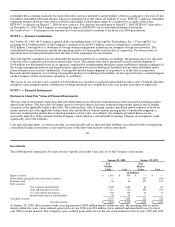

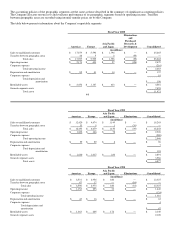

Investments

The following table summarizes by major security type the fair market value and cost of the Company's investments.

January 28, 2000 January 29, 1999

Fair Fair

Market Market

Value Cost Value Cost

(in millions)

Equity securities $ 1,451 $ 595 $ — $ —

Mutual funds, principally invested in debt securities — — 936 936

Preferred stock 56 56 107 107

Debt securities:

U.S. corporate and bank debt 1,200 1,186 84 84

State and municipal securities 115 117 295 293

U.S. government and agencies 192 195 33 33

International corporate and bank debt 30 30 — —

Total debt securities 1,537 1,528 412 410

Total investments $ 3,044 $ 2,179 $ 1,455 $ 1,453

At January 28, 2000, debt securities with a carrying amount of $309 million mature within one year; the remaining debt securities

mature within five years. Gross realized gains for fiscal year 2000 were $81 million. Gross realized and unrealized losses for fiscal

year 2000 were not material. The Company's gross realized gains and losses on the sale of investments for fiscal years 1999 and 1998