DSW 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 DSW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

As of January 31, 2015, approximately 23 million members were enrolled in our DSW Rewards program and have made at least one purchase over the course

of the last two years as compared to approximately 22 million members as of February 1, 2014. In both fiscal 2014 and fiscal 2013, shoppers in the loyalty

program generated approximately 90% of DSW segment sales.

Our growth strategy is to continue to strengthen our position as a leading footwear and accessories retailer by: expanding our business and omni-channel

strategy to address changing consumer expectations, driving sales through enhanced merchandising, investing in our infrastructure, and utilizing our

financial strength to invest in key initiatives.

Expanding Our Business and Investing in our Omni-Channel Strategy

We opened 37 DSW stores in fiscal 2014, five of which were small format stores. Our small format stores average approximately 12,000 square feet and, if

successful, could pave the way for more small format stores. We plan to open approximately 35 DSW stores in fiscal 2015, and plan to open 15 to 20 DSW

stores in each of the following two to five years. We believe that we have the potential to operate 500 to 550 stores, which excludes small format stores. Our

plan is to open stores in both new and existing markets, with the primary focus on power strip centers and to reposition existing stores as opportunities arise.

Depending on the market, we also consider regional malls, lifestyle centers and urban street locations. In general, our evaluation of potential new stores

integrates information on demographics, co-tenancy, retail traffic patterns, site visibility and accessibility, store size and configuration and lease terms. Our

real estate decision-making entails an analysis of underlying demand for our products through brick and mortar and online channels. Our analysis also looks

at current penetration levels in markets we serve and our ability to deepen our share of the market and acquire new customers.

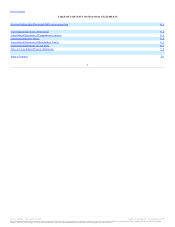

As of January 31, 2015, we operated 431 DSW stores in 42 states, the District of Columbia and Puerto Rico. The following table shows the number of our

DSW stores by state and territory:

Alabama 5

Louisiana 4

Ohio 18

Arizona 10

Maine 1

Oklahoma 3

Arkansas 1

Maryland 18

Oregon 4

California 41

Massachusetts 16

Pennsylvania 21

Colorado 11

Michigan 17

Puerto Rico 2

Connecticut 8

Minnesota 11

Rhode Island 2

Delaware 1

Mississippi 1

South Carolina 2

Florida 27

Missouri 5

Tennessee 6

Georgia 15

Nebraska 2

Texas 37

Idaho 1

Nevada 3

Utah 2

Illinois 22

New Hampshire 2

Virginia 15

Indiana 11

New Jersey 17

Washington 8

Iowa 2

New York 33

District of Columbia 3

Kansas 2

North Carolina 9

Wisconsin 7

Kentucky 4

North Dakota 1

Total 431

In addition to store growth, we are enhancing our omni-channel capabilities. We are expanding our drop ship program, making previously store-only product

available online and increasing availability of our accessories online. Our ship from store program allows customers to purchase shoes from a location other

than from where the customer originally demanded the item. Our mobile application provides another manner for customers to interact with us. In fiscal 2015,

we plan to launch buy online, pick up in store.

In our Affiliated Business Group, we leverage our sourcing network to produce a merchandise assortment that meets the needs of our affiliated business

customers. We actively pursue opportunities for new affiliated business partners.

Through our investment in Town Shoes, we serve Canadian customers with great values on branded footwear and accessories within a variety of concepts,

including DSW Designer Shoe Warehouse stores.

4

Source: DSW Inc., 10-K, March 26, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.