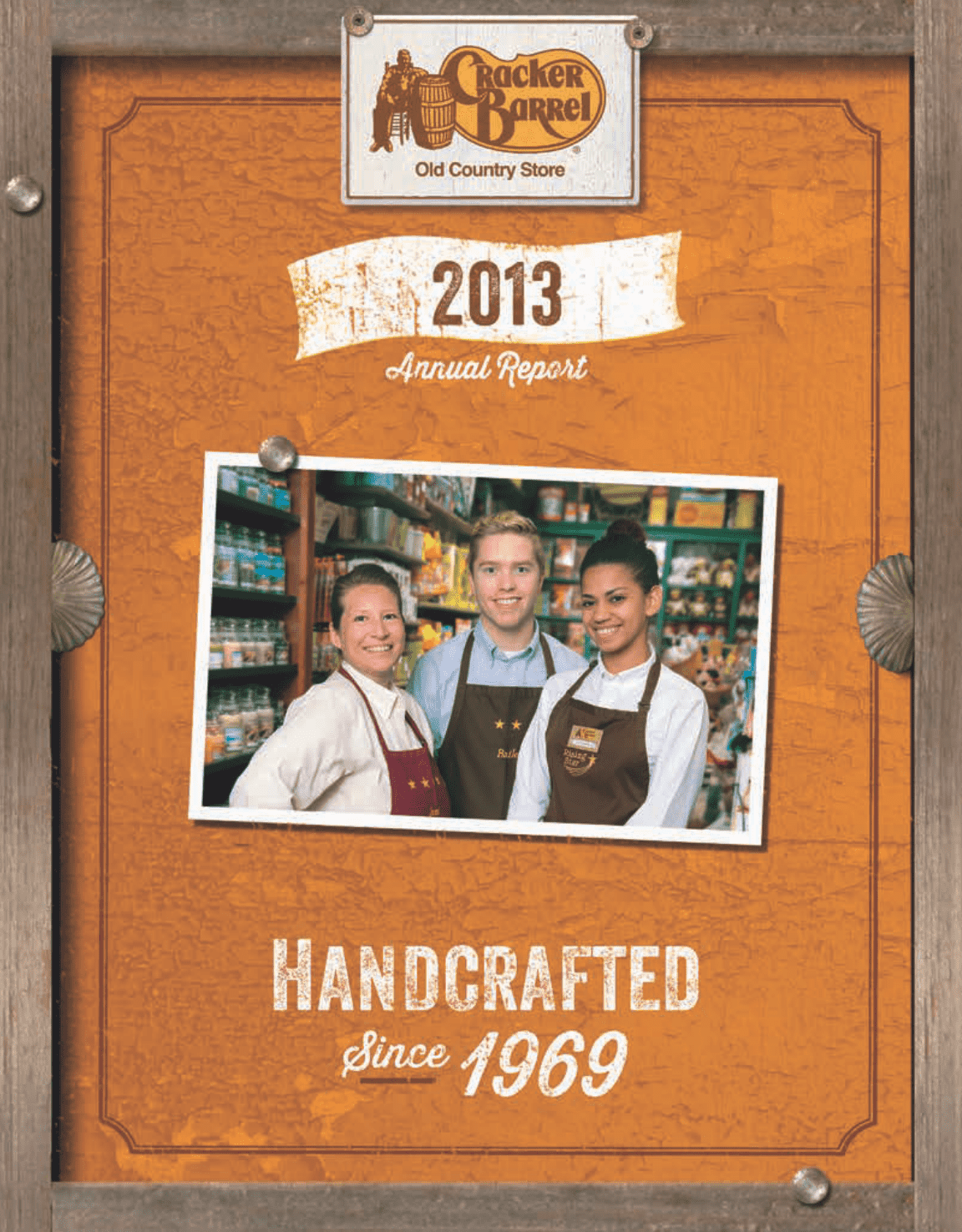

Cracker Barrel 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

Table of contents

-

Page 1

-

Page 2

-

Page 3

..., and retention rates improved among both store managers and hourly employees. increased our quarterly dividend by 50% for shareholders. Over the course of the ï¬scal year, we achieved total return for our shareholders, as calculated by the increase in our share price plus the dividends paid, of...

-

Page 4

... positive returns for you, our shareholders. The success of our sales began with an increase in trafï¬c to the stores. On a comparable 52-week basis, we grew revenues in ï¬scal 2013 by 4.6% to $2.6 billion, with comparable store restaurant sales increasing 3.1% and comparable store retail sales...

-

Page 5

...: Food Quality, Cleanliness, Service, Menu Variety, Craveability, Atmosphere, Reputation, Likely to Return, and Likely to Recommend. This direct positive feedback from consumers reafï¬rms the strong appeal of the Cracker Barrel brand.

Since a positive employee experience drives a successful...

-

Page 6

... year, we tested a new category for our menu, Wholesome Fixin's®. The category provides ï¬,avorful and fresh meals for under 600 calories. We added Wholesome Fixin's to our core menu in the ï¬rst quarter of ï¬scal 2014.

Having analyzed our marketplace, guests' feedback and brand positioning, we...

-

Page 7

... cases, Cracker Barrel's and spot radio to deliver product news. We updated partnership went beyond releasing exclusive the radio spots with current menu and retail albums and CD recordings and led to new ways for product offerings and ran new TV commercials highlighting our Country Dinner Plates...

-

Page 8

... the administrative menu expansion with Wholesome Fixin's. work of the management teams and allowing them more time for guest interaction. As a result, we saw labor and other related expenses decrease as a percentage of total revenue compared with the prior While improving sales and operations...

-

Page 9

... of our leadership, home ofï¬ce to continued growth. I believe our long-term strategy team, and, most importantly, our employees in to enhance the core operations, expand the footthe ï¬eld for successfully executing on our business print and extend the brand will drive our success. initiatives...

-

Page 10

...Starbucks Corporation

James W. Bradford

Chairman of the Board; Retired; former Dean and Professor for the Practice of Management at Vanderbilt University's Owen Graduate School of Management

Sandra B. Cochran

President and CEO of Cracker Barrel Old Country Store, Inc.

Glenn A. Davenport

President...

-

Page 11

... Data Shareholder Return Performance Graph Management's Discussion and Analysis of Financial Condition and Results of Operations Management's Report on Internal Control Over Financial Reporting Report Of Independent Registered Public Accounting Firm Report Of Independent Registered Public Accounting...

-

Page 12

... to review that Annual Report on Form 10-K and all our SEC filings. Risks Related to Our Business • General economic, business and societal conditions as well as those specific to the restaurant or retail industries that are largely out of our control may adversely affect our business, financial...

-

Page 13

... locations and open new stores that are profitable, our business could suffer. • Individual store locations are affected by local conditions that could change and adversely affect the carrying value of those locations. • Health concerns, government regulation relating to the consumption of food...

-

Page 14

... 61,232 89,670 135,622 67,842 -

Cost of goods sold Labor and related expenses Other store operating expenses Store operating income General and administrative expenses Impairment and store dispositions, net Operating income Income before income taxes

SeLeCTeD BaLanCe SheeT DaTa:

32.3% 36.5 18.2 13...

-

Page 15

... the value of $100 invested in Cracker Barrel Old Country Store, Inc. Common Stock, the Standard & Poor's Small Cap Index, and the Standard & Poor's 600 Restaurant Index which we believe is an adequate peer composite for the Company. The plotted points represent the closing price on the last day of...

-

Page 16

... with a gift shop. The restaurants serve breakfast, lunch and dinner. The gift shop area offers a variety of decorative and functional items specializing in rocking chairs, holiday gifts, toys, apparel and foods. As of September 20, 2013, the Company operated 624 Cracker Barrel stores located in 42...

-

Page 17

...99 Daily Lunch Specials or $7.69 Country Dinner Plates. In addition, we continued with our Handcrafted by Cracker Barrel media advertising and maintained the approach that we adopted in 2012, using national cable to drive brand awareness and spot radio to deliver product news during our busy holiday...

-

Page 18

...improved hourly labor scheduling that not only reduced costs but we believe allowed our store managers to spend more time interacting with guests. During the second quarter of 2013, we implemented a new merchandise planning system that provides greater visibility to manage the products in our retail...

-

Page 19

...years:

2013 2012 2011

Restaurant Cost of Goods Sold

27.2%

26.9%

26.5%

Restaurant Retail Restaurant & Retail

3.1% 2.9 3.0

2.2% 1.6 2.1

* Comparable store sales consist of sales of stores open at least six full quarters at the beginning of the year and are measured on comparable calendar weeks...

-

Page 20

...from improved productivity due to our enhanced labor management system and menu price increases being higher than wage inflation. The decrease in our health care costs from 2011 to 2012 resulted from a change in our group policy. Employee health

The increase in advertising expense from 2012 to 2013...

-

Page 21

... Manager conference expense

(0.2%) (0.1%)

In 2013 and 2012, we did not incur any impairment charges, gains on disposition of stores or store closing costs. In 2011, we recorded impairment charges of $1,044 and $2,175, respectively, for office space classified as property held for sale and a leased...

-

Page 22

... expansion plans, our share repurchase plans and our expected dividend payments for 2014. Cash generated from Operations The decrease in net cash flow provided by operating activities from 2012 to 2013 reflected higher annual and long-term incentive bonus payments and related taxes made in 2013...

-

Page 23

... costs for store locations to be opened in 2015. We also expect to increase capital expenditures for maintenance programs, technology and operational improvements. We intend to fund our capital expenditures with cash generated by operations and borrowings under our revolving credit facility...

-

Page 24

... inventories purchased locally are generally financed through trade credit at terms of 30 days or less. Because of our gift shop, which has a lower product turnover than the restaurant, we carry larger inventories than many other companies in the restaurant industry. Retail inventories are generally...

-

Page 25

... our long-term incentive plans ($8,777). Our standby letters of credit relate to securing reserved claims under workers' compensation insurance and reduce our borrowing availability under the Revolving Credit Facility. Consists solely of guarantees associated with lease payments for two properties...

-

Page 26

... Provision for Asset Dispositions • Insurance Reserves • Retail Inventory Valuation • Tax Provision • Share-Based Compensation Management has reviewed these critical accounting estimates and related disclosures with the Audit Committee of our Board of Directors. Impairment of Long-Lived...

-

Page 27

...and/or modify our reserves. A significant portion of our health insurance program is currently self-insured. Benefits for any individual (employee or dependents) in the self-insured group health program are

limited to not more than $20 in any given plan year, and, in certain cases, to not more than...

-

Page 28

... tax rates, employer tax credits for items such as FICA taxes paid on employee tip income, Work Opportunity and Welfare to Work credits, as well as estimates related to certain depreciation and capitalization policies. Our estimates are made based on current tax laws, the best available information...

-

Page 29

discounted using an appropriate risk-free interest rate. Other nonvested stock awards accrue dividends and their fair value is equal to the market price of our stock at the date of grant. In 2011, we adopted annual long-term incentive plans that award MSU Grants to our executives instead of stock ...

-

Page 30

..., which are the weighted average fixed rates of our interest rate swaps plus our current credit spread. See Note 6 to our Consolidated Financial Statements for further discussion of our interest rate swaps. Commodity Price Risk. Many of the food products that we purchase are affected by commodity...

-

Page 31

... viewed on our website. They set the tone for our organization and include factors such as integrity and ethical values. Our internal control over financial reporting is supported by formal policies and procedures, which are reviewed, modified and improved as changes occur in business conditions and...

-

Page 32

... Registered Public accounting Firm

To the Board of Directors and Shareholders of Cracker Barrel Old Country Store, Inc. Lebanon, Tennessee We have audited the accompanying consolidated balance sheets of Cracker Barrel Old Country Store, Inc. and its subsidiaries (the "Company") as of August 2, 2013...

-

Page 33

... Registered Public accounting Firm

To the Board of Directors and Shareholders of Cracker Barrel Old Country Store, Inc. Lebanon, Tennessee We have audited the internal control over financial reporting of Cracker Barrel Old Country Store, Inc. and its subsidiaries (the "Company") as of August 2, 2013...

-

Page 34

... share data)

August 2, 2013 August 3, 2012

aSSeTS

Current Assets: Cash and cash equivalents Property held for sale Accounts receivable Inventories Prepaid expenses and other current assets Deferred income taxes Total current assets Property and Equipment: Land Buildings and improvements Buildings...

-

Page 35

... of Income

(In thousands except share data)

August 2, 2013 Fiscal years ended August 3, 2012 July 29, 2011

Total revenue Cost of goods sold Gross profit Labor and other related expenses Other store operating expenses Store operating income General and administrative expenses Impairment and...

-

Page 36

... income Cash dividends declared - $2.25 per share Share-based compensation Exercise of share-based compensation awards Tax benefit realized upon exercise of share-based compensation awards Purchases and retirement of common stock Balances at August 2, 2013

See Notes to Consolidated Financial...

-

Page 37

... Other assets Accounts payable Taxes withheld and accrued Accrued employee compensation Accrued employee benefits Deferred revenues Other current liabilities Other long-term obligations Deferred income taxes Net cash provided by operating activities Cash flows from investing activities: Purchase of...

-

Page 38

...investments purchased with an original maturity of three months or less to be cash equivalents. Property held for sale - Property held for sale consists of real estate properties that the Company expects to sell within one year and is reported at the lower of carrying amount or fair value less costs...

-

Page 39

... prime rate or LIBOR plus a percentage point spread based on certain specified financial ratios under its credit facility (see Note 5). The Company's policy has been to manage interest cost using a mix of fixed and variable rate debt. To manage this risk in a cost efficient manner, the Company uses...

-

Page 40

... quarterly basis to verify and/or modify the Company's reserves. For the Company's health insurance plans, benefits for any individual (employee or dependents) in the self-insured program are limited to not more than $20 in any given year, and, in certain cases, to not more than $8 in any given year...

-

Page 41

..., the Company's policy is to issue shares of common stock to satisfy exercises of share-based compensation awards. Income taxes - The Company's provision for income taxes includes employer tax credits for FICA taxes paid on employee tip income and other employer tax credits are accounted for by...

-

Page 42

... weighted average number of common and common equivalent shares outstanding during the year. Common equivalent shares related to stock options, nonvested stock awards and MSU Grants issued by the Company are calculated using the treasury stock method. Outstanding employee and director stock options...

-

Page 43

...-

The Company's assets and liabilities measured at fair value on a recurring basis at August 3, 2012 were as follows:

Level 1 Level 2 Fair Value as of August 3, Level 3 2012

Cash equivalents* Interest rate swap asset (see Note 6) Deferred compensation plan assets** Total assets at fair value

$104...

-

Page 44

...point spread based on certain specified financial ratios. At August 2, 2013 and August 3, 2012, the Company's outstanding borrowings were swapped at weighted average interest rates of 3.73% and 7.57%, respectively (see Note 6 for information on the Company's interest rate swaps). The Credit Facility...

-

Page 45

... the amended Credit Facility, if there is no default existing and the liquidity requirements are met, the Company may declare and pay cash dividends on shares of its common stock if the aggregate amount of dividends paid in any fiscal year is less than the sum of (1) the 20% limitation and (2) $100...

-

Page 46

...the restaurant and retail product lines of a Cracker Barrel store are shared and are indistinguishable in many respects. Accordingly, the Company manages its business on the basis of one reportable operating segment. All of the Company's operations are located within the United States. Total revenue...

-

Page 47

... land, a retail distribution center and advertising billboards. Rent expense under operating leases, including the sale-leaseback transactions discussed below, for each of the three years was:

Year Minimum Contingent Total

11 ShaRe-BaSeD COmPenSaTIOn

Stock Compensation Plans The Company's employee...

-

Page 48

...the applicable three-year performance period for each annual plan is based on total shareholder return, which is defined as the change in the Company's stock price plus dividends paid during the performance period. The number of shares awarded at

2012 LTPP 2013 LTPP

2012 - 2013 2013 - 2014

2 2 or...

-

Page 49

... the 2013 MSU Grants at August 2, 2013:

Shares

2011 MSU Grants 2012 MSU Grants 2013 MSU Grants

41,963 56,301 20,849

Stock Options Prior to 2012, stock options were granted with an exercise price equal to the market price of the Company's stock on the grant date; those option awards generally vest...

-

Page 50

... Transfer & Trust Company, LLC, as rights agent (the "Rights Agreement"). Pursuant to the terms of the Rights Agreement, the Board of Directors declared a dividend of one preferred share purchase right (a "Right") for each outstanding share of common stock, par value $0.01 per share. The dividend...

-

Page 51

... Preferred Shares) having a market value equal to twice the Right's then-current exercise price. In addition, if the Company is later acquired in a merger or similar transaction after the Distribution Date, each Right will generally entitle the holder, except the Acquiring Person or any associate or...

-

Page 52

... The Board of Directors may adjust the purchase price of the Preferred Shares, the number of Preferred Shares issuable and the number of outstanding Rights to prevent dilution that may occur from a stock dividend, a stock split, a reclassification of the Preferred Shares or common stock. amendments...

-

Page 53

...components of the Company's net deferred tax liability consisted of the following at:

August 2, 2013 August 3, 2012

Deferred tax assets: Compensation and employee benefits Deferred rent Accrued liabilities Insurance reserves Inventory Other Deferred tax assets Deferred tax liabilities: Property and...

-

Page 54

... credit related to securing reserved claims under workers' compensation insurance. All standby letters of credit are renewable annually and reduce the Company's borrowing availability under its Revolving Credit facility (see Note 5). As of August 2, 2013, the Company is secondarily liable for lease...

-

Page 55

...,304 Net income 23,192 35,168 24,602 34,303 Net income per share - basic $ 0.98 $ 1.48 $ 1.04 $ 1.44 Net income per share - diluted $ 0.97 $ 1.47 $ 1.02 $ 1.43 2012 Total revenue $598,437 $673,234 $608,514 $700,010 Gross profit 412,130 437,843 418,899 483,839 Income before income taxes 33,489 36,312...

-

Page 56

..., Restaurant Operations Michael J. Chissler Vice President, Restaurant and Retail Operations Support Brenda L. Cool Regional Vice President, Retail Operations P. Doug Couvillion Vice President, Corporate Controller and Principal Accounting Officer Leon De Wet Vice President, Information Services and...

-

Page 57

...-K Annual Report are available for a reasonable fee.

Annual Meeting

The annual meeting of shareholders will be held at 10:00 a.m. Wednesday, November 13, 2013, at the Cracker Barrel Old Country Store home office on Hartmann Drive, Lebanon, Tennessee.

Dividend Reinvestment and Direct Stock Purchase...

-

Page 58