CompUSA 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Current economic conditions in the United States, including eroding consumer demand, as well as ongoing difficulties in the various European

countries where we operate, raise additional concerns as we believe the loss of consumer confidence in the Company’

s markets together with the

effects of the fiscal cliff and budget discussions in the U.S. has resulted in a decrease of spending in the categories of products we sell. It is also

possible that as manufacturers react to the marketplace they may reduce manufacturing capacity and create shortages of product.

Industrial Products

The market for the sale of industrial products in North America is highly fragmented and is characterized by multiple distribution channels such

as small dealerships, direct mail distribution, internet-based resellers, large warehouse stores and retail outlets. We also face competition from

manufacturers’ own sales representatives, who sell industrial equipment directly to customers, and from regional or local distributors. Many

high volume purchasers, however, utilize catalog distributors as their first source of product. In the industrial products market, customer

purchasing decisions are primarily based on price, product selection, product availability, level of service and convenience. We believe that

direct marketing via sales representatives, catalog and the Internet are effective and convenient distribution methods to reach mid-sized facilities

that place many small orders and require a wide selection of products. In addition, because the industrial products market is highly fragmented

and generally less brand oriented, it is well suited to private label products.

Employees

As of December 31, 2012, we employed a total of approximately 5,300 employees, of whom 3,800 were in North America and 1,500 were in

Europe and Asia.

Seasonality

As the Company has a significant portion of its sales in the North America consumer business market, the fourth quarter has represented the

greatest portion of annual sales. Net sales have historically been modestly weaker during the second and third quarters as a result of lower

business activity during those months. See Item 7, “Management’s Discussions and Analysis of Financial Condition and Results of Operations;

Seasonality”.

Environmental Matters

Under various national, state and local environmental laws and regulations in North America and Western Europe, a current or previous owner

or operator (including the lessee) of real property may become liable for the costs of removal or remediation of hazardous substances at such real

property. Such laws and regulations often impose liability without regard to fault. We lease most of our facilities. In connection with such

leases, we could be held liable for the costs of removal or remedial actions with respect to hazardous substances. Although we have not been

notified of, and are not otherwise aware of, any material real property environmental liability, claim or non-compliance, there can be no

assurance that we will not be required to incur remediation or other costs in connection with real property environmental matters in the future.

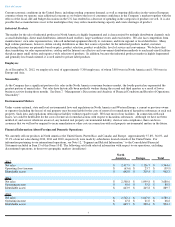

Financial Information About Foreign and Domestic Operations

We currently sell our products in North America (the United States, Puerto Rico and Canada) and Europe. Approximately 37.8%, 36.0%, and

35.1% of our net sales during 2012, 2011 and 2010, respectively were made by subsidiaries located outside of the United States. For

information pertaining to our international operations, see Note 12, “Segment and Related Information,” to the Consolidated Financial

Statements included in Item 15 of this Form 10-K. The following sets forth selected information with respect to our operations, excluding

discontinued operations, in those two geographic markets (in millions):

Table of Contents

North

America

Europe

Total

2012

Net sales

$

2,417.9

$

1,126.7

$

3,544.6

Operating (loss) income

$

(63.6

)

$

23.7

$

(39.9

)

Identifiable assets

$

642.9

$

319.4

$

962.3

2011

Net sales

$

2,580.8

$

1,099.8

$

3,680.6

Operating income

$

45.0

$

35.8

$

80.8

Identifiable assets

$

643.9

$

245.8

$

889.7

2010

Net sales

$

2,542.1

$

1,047.0

$

3,589.1

Operating income

$

47.8

$

21.0

$

68.8

Identifiable assets

$

665.7

$

228.4

$

894.1

7