CompUSA 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYSTEMAX INC

FORM 10-K

(Annual Report)

Filed 03/14/13 for the Period Ending 12/31/12

Address 11 HARBOR PARK DR

PORT WASHINGTON, NY 11050

Telephone 5166087000

CIK 0000945114

Symbol SYX

SIC Code 5961 - Catalog and Mail-Order Houses

Industry Retail (Catalog & Mail Order)

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

SYSTEMAX INC FORM 10-K (Annual Report) Filed 03/14/13 for the Period Ending 12/31/12 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 11 HARBOR PARK DR PORT WASHINGTON, NY 11050 5166087000 0000945114 SYX 5961 - Catalog and Mail-Order Houses Retail (Catalog & Mail Order) Services ... -

Page 2

... Number: 1-13792 Systemax Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 11-3262067 (I.R.S. Employer Identification No.) 11 Harbor Park Drive Port Washington, New York 11050 (Address of principal executive offices... -

Page 3

...  Smaller reporting company 1 No  Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes 1 The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2012, which is the last business day of the... -

Page 4

... Part I Item 1. Business General Products Sales and Marketing Customer Service, Order Fulfillment and Support Suppliers Competition and Other Market Factors Employees Environmental Matters Financial Information About Foreign and Domestic Operations Available Information Item 1A. Risk Factors Item... -

Page 5

... inventory and/or the loss of product return rights and price protection from our vendors effective management of our retail stores in North America meeting credit card industry compliance standards in order to maintain our ability to accept credit cards significant changes in the computer products... -

Page 6

... events. Item 1. Business. General Systemax is primarily a direct marketer of brand name and private label products. Our operations are organized in two reportable business segments - Technology Products and Industrial Products. Our Technology Products segment sells computers, computer supplies and... -

Page 7

... such customers with electronic data interchange ("EDI") ordering and customized billing services, customer savings reports and stocking of specialty items specifically requested by these customers. Our relationship marketers' efforts are supported by frequent catalog mailings and e-mail campaigns... -

Page 8

...computer and office supply superstores. Timely introduction of new products or product features are critical elements to remaining competitive. Other competitive factors include product performance, quality and reliability, technical support and customer service, marketing and distribution and price... -

Page 9

... of product. Industrial Products The market for the sale of industrial products in North America is highly fragmented and is characterized by multiple distribution channels such as small dealerships, direct mail distribution, internet-based resellers, large warehouse stores and retail outlets. We... -

Page 10

... See Item 7, "Management's Discussions and Analysis of Financial Condition and Results of Operations", for further information with respect to our operations. Available Information We maintain an internet website at www.systemax.com. We file reports with the Securities and Exchange Commission... -

Page 11

... distribution, internet-based resellers, large warehouse stores and retail outlets. We also face competition from manufacturers' own sales representatives, who sell industrial equipment directly to customers, and from regional or local distributors. In addition, new competitors may enter our markets... -

Page 12

... us with co-operative advertising support in exchange for featuring their products in our catalogs and on our internet sites. Certain suppliers provide us with other incentives such as rebates, reimbursements, payment discounts, price protection and other similar arrangements. These incentives... -

Page 13

... to manage our inventory of older products we may have excess or obsolete inventory. We may have limited rights to return purchases to certain suppliers and we may not be able to obtain price protection on these items. The elimination of purchase return privileges and lack of availability of price... -

Page 14

... We operate retail stores in North America and we must effectively manage our cost structure, such as inventory needs, point of sales systems, personnel and lease expense. We currently have 41 retail stores operating in North America at December 31, 2012. The Company needs to effectively manage its... -

Page 15

... website sales depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. While we have taken significant steps to protect customer and confidential information, there can be no assurance that advances in computer capabilities, new... -

Page 16

... of certain New York Stock Exchange listing standards that, among other things, require listed companies to have a majority of independent directors on their board; the Company does however currently have an independent Audit, Compensation Committee and Corporate Governance and Nominating Committees... -

Page 17

... currently available for sale. The following table summarizes the geographic location of our North America stores at the end of 2012: Location Delaware Florida Georgia Illinois North Carolina Puerto Rico Texas Ontario, Canada Stores Open - 12/31/11 2 18 1 5 2 1 7 6 42 Store Openings/ (Store Closings... -

Page 18

... to receive at his direction such removed product inventory, without payment to the Company and for his own personal gain; ii) Mr. Fiorentino caused substantial amounts of Company inventory purchases to be effected through Company credit cards in order to accrue and/or use "reward points" for his... -

Page 19

... Issuer Purchases of Equity Securities Systemax common stock is traded on the NYSE Euronext Exchange under the symbol "SYX." The following table sets forth the high and low closing sales price of our common stock as reported on the New York Stock Exchange for the periods indicated. High 2012 First... -

Page 20

... of brand name and private label products. Our operations are organized in two reportable business segments - Technology Products and Industrial Products. Our Technology Products segment sells computers, computer supplies and consumer electronics which are marketed in North America, Puerto Rico and... -

Page 21

... sales made direct to other businesses through managed business relationships, outbound call centers and extranets. Sales in the Industrial Products segment and Corporate and other are considered to be business to business sales. Consumer channel sales are sales from retail stores, consumer websites... -

Page 22

or a specific customer's inability to meet its financial obligations, a specific reserve for bad debts applicable to amounts due to reduce the net recognized receivable to the amount management reasonably believes will be collected is recorded. In those situations with ongoing discussions, the ... -

Page 23

... models include projected sales growth, same store sales growth, gross margin percentages, new business opportunities, working capital requirements, capital expenditures and growth in selling, general and administrative expense. We also use our company's market capitalization and comparable company... -

Page 24

...vendor agreements and using existing expenditures for which funding is available, determining products whose market price would indicate coverage for markdown or price protection is available and estimating the level of our performance under agreements that provide funds or allowances for purchasing... -

Page 25

... Accounting policy Income Taxes. We are subject to taxation from federal, state and foreign jurisdictions and the determination of our tax provision is complex and requires significant management judgment. We conduct operations in numerous U.S. states and foreign locations. Our effective tax rate... -

Page 26

... to 2011. Movements in exchange rates negatively impacted European sales by approximately $57.6 million and Canadian sales by approximately $7.1 million. Special one-time asset impairment charges of $35.3 million related to intangible assets and goodwill of CompUSA and Circuit City. Special one-time... -

Page 27

... and retail store sales which were only partially offset by our European business to business sales growth. We have made a number of investments in the European market to better capitalize on the opportunities we see in those existing markets and we have built out our European team to support... -

Page 28

... of a new distribution center in the Industrial Products segment and new sales and administrative offices in the United Kingdom, approximately $6.9 million of reduced vendor co-operative funding partially offset by savings in catalog and store advertising costs, and increased internet advertising of... -

Page 29

... due to additional sales personnel and additional retail stores operating for the full year of 2011 compared to 2010, additional rent and related costs of approximately $2.8 million and $10.1 million of increased internet, store space ads advertising and reduced cooperative advertising funding on... -

Page 30

...full year of interest on the Recovery Zone Bond entered into to finance the equipment for the second Technology Products distribution center opened in 2010. INCOME TAXES The Company's effective tax rate was an 80.8% benefit in 2012 as compared to a 30.9% provision in 2011. The tax benefit in 2012 is... -

Page 31

... discontinued operations in 2010 was $0.2 million. Net cash used in investing activities from continuing operations was $12.0 million for 2012 and were for warehouse racking systems for the new distribution center, network upgrades, fabrication equipment, expenditures for a new retail store opening... -

Page 32

...financial institution in France which was secured by WStore accounts receivable balances. This credit facility was terminated by the Company on June 9, 2012. Available amounts for borrowing under this facility included all accounts receivable balances not over 60 days past due reduced by the greater... -

Page 33

... and penalties being paid to taxing authorities. As of December 31, 2012, the Company had no material uncertain tax positions. In January 2013, the Company entered into a lease for the European Technology Products segment's shared services center. The facility, located in Budapest, Hungary, is... -

Page 34

... accordance with generally accepted accounting principles, and that the Company's receipts and expenditures are being made only in accordance with authorizations of the Company's management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized... -

Page 35

Table of Contents The Company's independent registered public accounting firm, Ernst & Young LLP, has issued an attestation report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2012, a copy of which is included in this report on Form 10-K. ... -

Page 36

... Schedules. (a) 1. Consolidated Financial Statements of Systemax Inc. Reports of Ernst & Young LLP Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2012 and 2011 Consolidated Statements of Operations for the years ended December 31, 2012, 2011 and 2010... -

Page 37

...) Form of 2005 Employee Stock Purchase Plan* (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2006) Lease Agreement dated September 20, 1988 between the Company and Addwin Realty Associates (Port Washington facility) (incorporated by reference... -

Page 38

... lenders from time to time party thereto (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2011) Lease Agreement, dated as of September 1, 2010, among Development Authority of Jefferson, Georgia, GE Government Finance Inc. and SYX Distribution Inc... -

Page 39

... Document XBRL Taxonomy Extension Calculation Linkbase Document XBRL Taxonomy Extension Definition Linkbase Document XBRL Taxonomy Extension Label Linkbase Document XBRL Taxonomy Extension Presentation Linkbase Document * Management contract or compensatory plan or arrangement 36 -

Page 40

...SYSTEMAX INC. By: /s/ RICHARD LEEDS Richard Leeds Chairman and Chief Executive Officer Date: March 14, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this Report... Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer)... -

Page 41

... for each of the three years in the period ended December 31, 2012. Our audits also included the financial statement schedule listed in the Index at Item 15 (a). These financial statements and financial statement schedule are the responsibility of the Company's management. Our responsibility is to... -

Page 42

... accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized... -

Page 43

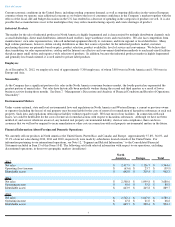

...Contents SYSTEMAX INC. CONSOLIDATED BALANCE SHEETS (in millions, except for share data) December 31, 2012 2011 ASSETS: Current assets: Cash Accounts receivable, net of allowances of $15.5 and $14.7 Inventories Assets available for sale Prepaid expenses and other current assets Deferred income taxes... -

Page 44

Table of Contents SYSTEMAX INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Year Ended December 31, 2012 2011 2010 3,544.6 $ 3,680.6 $ 3,589.1 3,056.5 3,150.1 3,099.6 488.1 530.5 489.5 481.7 455.3 416.4 46.3 (5.6) 4.3 (39.9) 80.8 68.8 0.3 1.0 1.7 (0.3) (1.4) (0.8) 1.7... -

Page 45

Table of Contents SYSTEMAX INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in millions) Year Ended December 31, 2011 2010 (8.3) $ 54.4 $ 42.6 5.0 (3.3) $ (2.8) 51.6 $ (2.6) 40.0 2012 Net income (loss) Other comprehensive income (loss): Foreign currency translation Total comprehensive ... -

Page 46

...Compensation expense related to equity compensation plans Return of common stock-special gain Excess tax benefit from exercises of stock options Loss on dispositions and abandonment Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets... -

Page 47

...stock withheld for employee taxes Exercise of stock options Income tax benefit on stock-based compensation Change in cumulative translation adjustment Net income Balances, December 31, 2010 Stock-based compensation expense Issuance of restricted stock Exercise of stock options Return of Common Stock... -

Page 48

... of trademarks, trade and domain names, technology, retail leases and customer lists (See Note 2). The Company conducted an evaluation of its Technology Products multi-brand United States consumer strategy and the intangible assets used in that strategy and concluded that the Company's future North... -

Page 49

...million during 2012, 2011 and 2010, respectively, and are included in the accompanying consolidated statements of operations. The Company utilizes advertising programs to support vendors, including catalogs, internet and magazine advertising, and receives payments and credits from vendors, including... -

Page 50

... number of stock options outstanding excluded from the computation of diluted earnings per share was 1.1 million for the year ended December 31, 2012 and 0.8 million and 0.7 million for the years ended December 31, 2011 and 2010, respectively, due to their antidilutive effect. Employee Benefit Plans... -

Page 51

... American consumer business would be optimized by consolidating its United States consumer operations under TigerDirect, its leading and largest brand. As a result an impairment charge of approximately $35.3 million related to the trademarks, domain names and goodwill of CompUSA and Circuit City was... -

Page 52

... Retail store leases Client lists Technology Total For the year ended December 31, 2012, the Company incurred one-time impairment charges related to definite-lived intangible assets of approximately $1.0 million. This impairment charge was recorded in the Consolidated Statements of Operations as... -

Page 53

...the following (in millions): December 31, 2012 2011 29.7 $ 32.5 4.0 3.1 9.0 7.6 9.7 5.3 5.1 4.7 26.0 19.2 83.5 $ 72.4 Payroll and employee benefits Freight Advertising Sales and VAT tax payable Income taxes payable Other $ $ 6. LONG-TERM DEBT The Company (through a subsidiary) has an outstanding... -

Page 54

...other exit costs related to the planned closing and relocation of one of our smaller distribution centers to a new, significantly larger distribution and call center in the second quarter of 2012. These costs were recorded as special charges within the Industrial Products segment. The balance of the... -

Page 55

... to receive at his direction such removed product inventory, without payment to the Company and for his own personal gain; ii) Mr. Fiorentino caused substantial amounts of Company inventory purchases to be effected through Company credit cards in order to accrue and/or use "reward points" for his... -

Page 56

... Company who are not employees of the Company or of any entity in which the Company has more than a 50% equity interest ("independent directors") an opportunity to participate in the ownership of the Company by receiving options to purchase shares of common stock at a price equal to the fair market... -

Page 57

...assumptions used to estimate the fair value of options granted in 2012, 2011 and 2010: 2012 Expected annual dividend yield Risk-free interest rate Expected volatility Expected life in years 0% 1.10% 57.3% 6.3 2011 0% 2.02% 59.8% 8.0 2010 0% 1.37% 61.1% 4.8 The following table summarizes information... -

Page 58

... the market price of the Company's stock at the date of the award. Compensation expense related to the restricted stock award was approximately $0.4 million for the year ended December 31, 2012. In October 2011 and November 2011, the Company granted 100,000 restricted stock units under the 2010 Plan... -

Page 59

... with applicable local regulations. The Company recorded tax (benefit) expense of $(0.2) million, $0.1 million and $0.0 million in 2012, 2011 and 2010, respectively, related to discontinued operations. A reconciliation of the difference between the income tax expense and the computed income tax... -

Page 60

... of accruals, our effective tax rate in a given financial statement period could be affected. As of December 31, 2012 the Company had no uncertain tax positions. There were no accrued interest or penalty charges related to unrecognized tax benefits recorded in income tax expense in 2012 or 2011. 57 -

Page 61

... AND OTHER MATTERS Leases - The Company is obligated under operating lease agreements for the rental of certain office and warehouse facilities and equipment which expire at various dates through July 2030. The Company currently leases its headquarters office/warehouse facility in New York from an... -

Page 62

... Note 1. Financial information relating to the Company's operations by reportable segment was as follows (in millions): Year Ended December 31, 2011 2010 $ 3,357.4 319.9 3.3 3,680.6 $ 3,336.9 250.0 2.2 3,589.1 2012 Net Sales: Technology Products Industrial Products Corporate and other Consolidated... -

Page 63

... information relating to the Company's entity-wide product category sales was as follows (in millions): Year Ended December 31, 2011 % 29.6% 27.4% 17.5% 11.5% 11.3% 2.7% 100% $ 1,047.6 1,025.0 746.5 453.8 319.9 87.8 3,680.6 28.5% 27.8% 20.3% 12.3% 8.7% 2.4% 100% 2012 Product Category Computers... -

Page 64

...years ended December: (in millions) Balance at Beginning of Period $ $ $ 14.7 17.9 22.5 Charged to Expenses $ $ $ 5.0 3.2 3.3 $ $ $ Balance at End of Period (1.1) $ $ $ 15.5 14.7 17.9 Description Allowance for sales returns and doubtful accounts 2012 2011 2010 Allowance for deferred tax assets 2012... -

Page 65

... stock trading, employment discrimination, bribery and other foreign corrupt practices, workplace safety laws and export/customs laws. Disclose and record accurately any use of Company funds. Do not falsify, inflate or disguise any accounting record or other business records of the Company. Report... -

Page 66

... to any purchasing agent or other employee of any corporate or government customer (a "Purchasing Agent") without the knowledge of such customer's management. A "gift" includes any tangible and intangible payment or gratuity such as cash, products, meals, tickets to events, services, etc. A gift... -

Page 67

... the Company or with any customer or supplier of the Company (such as employment or an employment agreement, a business venture, a consulting or service agreement, or an investment other than the ownership of the stock of a publicly traded company) without prior written disclosure to the Company and... -

Page 68

...comply with all applicable laws and regulations, including securities laws (which require fair disclosure of the Company's business and financial information to the public and prohibit any use of inside information about the Company in deciding to buy or sell stock of the Company, among other things... -

Page 69

... fair, accurate, timely, and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission, the New York Stock Exchange or any other applicable regulatory body or in other public communications made by the Company. Company Representatives shall... -

Page 70

... and other business practices. Examples of improper accounting practices include improper recording of sales transactions, inventory, accounts receivable, accounts payable or other revenue, expense or asset items. The Company's Audit Committee of the Board of Directors oversees the investigation of... -

Page 71

...persons identified in Section 11 above for further consideration by the Corporate Governance Committee as to whether such activity should be permitted. In the event that such waiver is requested by a director or executive officer of the Company, such waiver may be granted only by the Board, and must... -

Page 72

... Computer Supplies Inc. (a New York corporation) Global Equipment Company Inc. (a New York corporation) TigerDirect Inc. (a Florida corporation) Nexel Industries Inc. (a New York corporation) Systemax Manufacturing Inc. (a Delaware corporation) Profitcenter Software Inc. (a New York corporation... -

Page 73

... Inc. (a Delaware corporation) Target Advertising Inc. (a Delaware corporation) Software Licensing Center Inc. (a Florida corporation) SYX North American Tech Holdings LLC (a Delaware limited liability company) Rebate Holdings LLC (a Delaware limited liability company) Global Industrial Holdings LLC... -

Page 74

... corporation) Systemax Europe Sarl (a Luxembourg corporation) Systemax EMEA Technology Group Limited (a UK corporation) SYX Services Private Limited (an Indian corporation) Misco OY (a Finnish corporation) Systemax Polska Sp Zoo (a Polish corporation) Systemax Business Services K.F.T. (a Hungarian... -

Page 75

...schedule of Systemax Inc., and subsidiaries and the effectiveness of internal control over financial reporting of Systemax Inc. and subsidiaries included in this Annual Report (Form 10-K) of Systemax Inc. and subsidiaries for the year ended December 31, 2012. /s/ Ernst & Young LLP New York, New York... -

Page 76

... which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over... -

Page 77

... which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over... -

Page 78

...Chief Executive Officer of Systemax Inc., hereby certifies that Systemax Inc.'s Form 10-K for the Year Ended December 31, 2012 fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained... -

Page 79

...Chief Financial Officer of Systemax Inc., hereby certifies that Systemax Inc.'s Form 10-K for the Year Ended December 31, 2012 fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained...