CompUSA 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

KL2 2600873.8

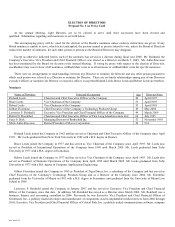

Stock Plan for Non-Employee Directors

(6)

Includes options to acquire a total of 11,000 shares that are exercisable immediately pursuant to the terms of the Company’ s 1995

Stock Plan for Non-Employee Directors.

(7)

Includes options to acquire a total of 13,000 shares that are exercisable immediately pursuant to the terms of the Company’ s 1995

Stock Plan for Non-Employee Directors.

(8) Includes options to acquire 62,500 shares that are currently exercisable pursuant to the terms of the Company’ s 1999 Long-

Term

Stock Incentive Plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’ s executive officers and Directors and persons who own more than ten

percent of a registered class of the Company’ s equity securities to file reports of ownership and changes in ownership with the

Securities and Exchange Commission. Executive officers, Directors and ten-percent stockholders are required by SEC regulation to

furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of Section 16(a) forms

received by it, or written representations from certain reporting persons, the Company believes its executive officers, Directors and ten-

percent stockholders complied with all such filing requirements for fiscal year 2008, except for the inadvertent failure to timely file a

Form 4 for each of our independent directors in connection with their annual grant of restricted stock.

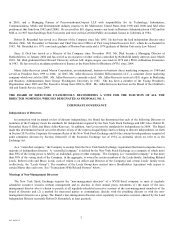

TRANSACTIONS WITH RELATED PERSONS

Under the Company’ s Corporate Ethics Policy, all officers, Directors and employees (collectively the “Company Representatives”)

are required to avoid conflicts of interest, appearances of conflicts of interest and potential conflicts of interest. A “conflict of interest”

occurs when a Company Representative’ s private interest interferes in any way with the interests of the Company. A conflict can arise

when a Company Representative takes actions or has interests that may make it difficult to perform his or her Company work

objectively and effectively. Conflicts of interest also arise when a Company Representative, or a member of his or her family, receives

improper personal benefits as a result of his or her position in the Company. Company Representatives cannot allow any consideration

such as the receipt of gifts or financial interests in other businesses or personal or family relationships to interfere with the independent

exercise of his or her business judgment and work activities to the benefit of the Company. Loans to, or guarantees of obligations of,

Company Representatives are prohibited unless permitted by law and authorized by the Board or a Committee designated by the

Board. If a Company Representative becomes aware of a potential conflict of interest he or she must communicate such potential

conflict of interest to the Company.

The Company’ s corporate approval policy requires related party transactions (specifically Company agreements, including leases,

with “related parties” and sales or purchases of inventory or other Company assets by “related parties”) to be approved by the

Company’ s Audit Committee as well as the Company’ s CEO, CFO and General Counsel.

Leases

The Company has leased its facility in Port Washington, NY since 1988 from Addwin Realty Associates, an entity owned by

Richard Leeds, Bruce Leeds and Robert Leeds, Directors of the Company and the Company’ s three senior officers and principal

stockholders. Rent expense under this lease totaled $860,000 for fiscal year 2008. The Company believes that these payments were no

higher than would be paid to an unrelated lessor for comparable space.

Stockholders Agreement

Certain members of the Leeds family (including Richard Leeds, Bruce Leeds and Robert Leeds) and family trusts of Messrs. Leeds

entered into a stockholders agreement pursuant to which the parties agreed to vote in favor of the nominees for the Board designated by

the holders of a majority of the Shares held by such stockholders at the time of the Company’ s initial public offering of the Shares. In

addition, the agreement prohibits the sale of the Shares without the consent of the holders of a majority of the Shares held by all parties

to the agreement, subject to certain exceptions, including sales pursuant to an effective registration statement and sales made in