Comerica 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Comerica annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT 03

shown broad-based economic improvement in the state, with the

exception of employment. With the national economy now in a

modest expansion, it is expected that employment in California

will start trending higher over the course of 2010.

As in Texas, we are seeing more middle market and small

businesses taking steps to position their companies for the

recovery ahead. We are assisting them in preparing for the future,

as we have the resources and capacity in place to help them grow.

We are appropriately positioned to increase our market share in

California as the state economy continues to improve.

Michigan’s economy has been battling erce headwinds for

many years due to the deep cyclical decline in auto sales and,

more recently, the restructuring of the domestic automobile

industry. We have worked closely with our Michigan customers

to help them through these difcult times.

There are strong indications that auto sales may be

recovering. Stabilization of the Michigan economy may come

gradually, but we are well positioned for the turnaround. Our

160-year presence in the state serves as a constant reminder

to customers that we are a bank they can count on through all

economic cycles. We also are the deposit market share leader

in Michigan, based on Federal Deposit Insurance Corporation

(FDIC) data as of June 30, 2009. The ranking is a reection of

the hard work of our dedicated colleagues and the trust we have

earned from our customers in the state.

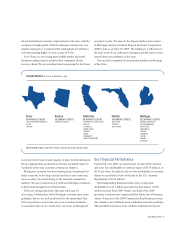

You can nd a snapshot of our primary markets on this page

of the letter.

Our Financial Performance

For the full-year 2009, we reported net income of $17 million

and a net loss attributable to common shares of $118 million, or

$0.79 per share. Included in the net loss attributable to common

shares were preferred stock dividends to the U.S. Treasury

Department of $134 million.

The disappointing nancial results were, in large part,

attributable to a $1.1 billion provision for loan losses, a $396

million increase from 2008. Nearly one-third of the 2009

provision was from our Commercial Real Estate line of business.

About 15 percent of the 2009 Commercial Real Estate provision

was related to our California local residential real estate portfolio.

This portfolio focused on local, smaller residential developers,

PRIMARY MARKETS (ALL DATA AS OF DECEMBER 31, 2009)

OFFICES OUTSIDE OF THE U.S.: MONTERREY, MEXICO; & WINDSOR AND TORONTO, ONTARIO, CANADA

Texas

90 BANKING CENTERS

DALLAS/FORT WORTH METROPLEX

AUSTIN

HOUSTON

Arizona

16 BANKING CENTERS

PHOENIX/SCOTTSDALE

California

98 BANKING CENTERS

SAN FRANCISCO & THE EAST BAY

SAN JOSE

LOS ANGELES

ORANGE COUNTY

SAN DIEGO

FRESNO

SACRAMENTO

SANTA CRUZ/MONTEREY

Florida

10 BANKING CENTERS

BOCA RATON

SOUTHEAST

WEST/CENTRAL

Michigan

232 BANKING CENTERS

METROPOLITAN DETROIT

GREATER ANN ARBOR

BATTLE CREEK

GRAND RAPIDS

JACKSON

KALAMAZOO

LANSING

MIDLAND

MUSKEGON